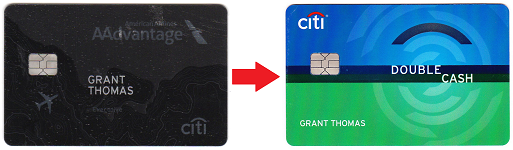

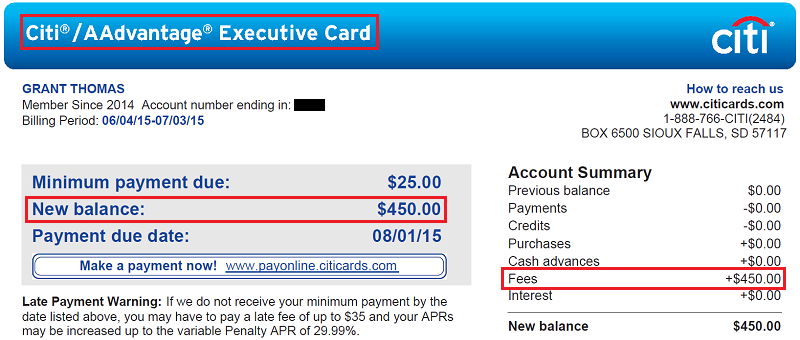

Good afternoon everyone, I hope your weekend is off to a great start. I have some credit card news I want to share with you. Earlier this month, my $450 annual fee posted on my Citi American Airlines Executive Credit Card. Since I didn’t want to pay the $450 annual fee to keep the card, I called Citi to see if I could convert that credit card into a Citi Double Cash Credit Card.

I’ve called Citi a few times regarding the Citi American Airlines Executive Credit Card. I called a few months before the annual fee posted and was told that Citi could not do anything accept close the credit card until the annual fee posted. After patiently waiting (extremely hard for me), I called Citi as soon as the annual fee posted and asked to convert the Citi American Airlines Executive Credit Card into the Citi Double Cash Credit Card. The rep was very helpful and processed the conversion request right away. After reading off 5 paragraphs of disclosures, the rep told me the conversion process would take about 50 days to complete, but I should receive my new Citi Double Cash Credit Card in about a month. I hate that Citi takes so long to complete the conversion, I wish it were faster like American Express and Chase.

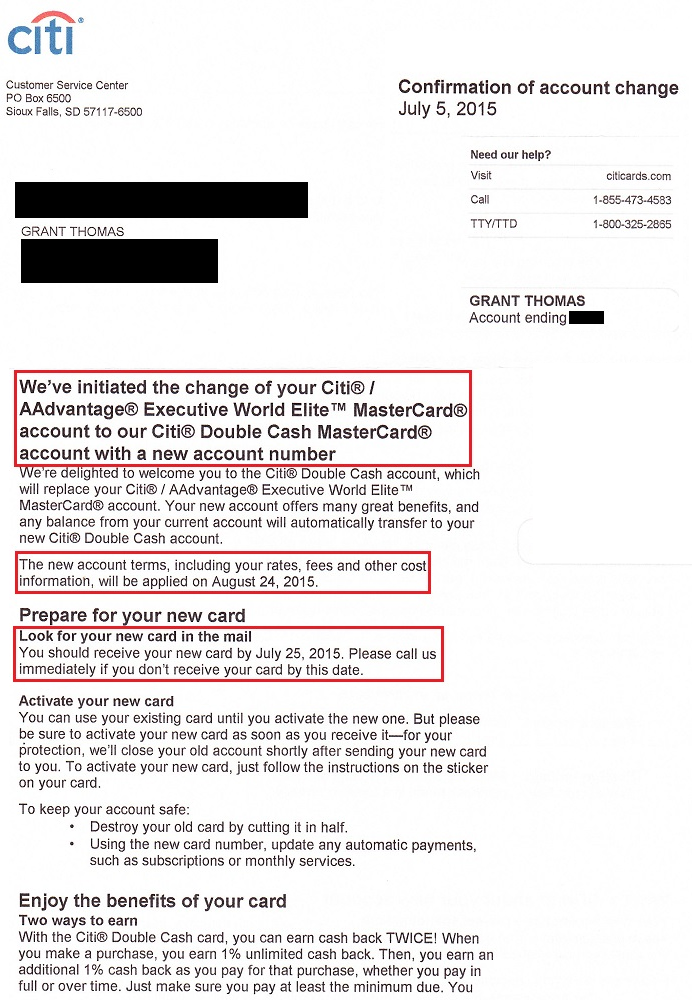

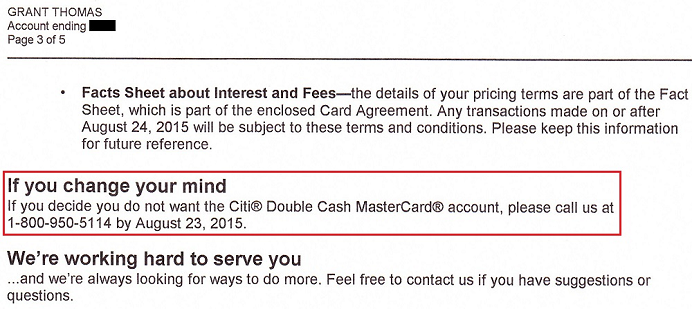

Here is the letter from Citi detailing the change from my Citi American Airlines Executive Credit Card into a new Citi Double Cash Credit Card. It is funny that they have text that says if you change your mind before the conversion is complete, you can call Citi and cancel the conversion. I was pretty sure I wanted to convert the credit card when I originally called, I am not having second thoughts now.

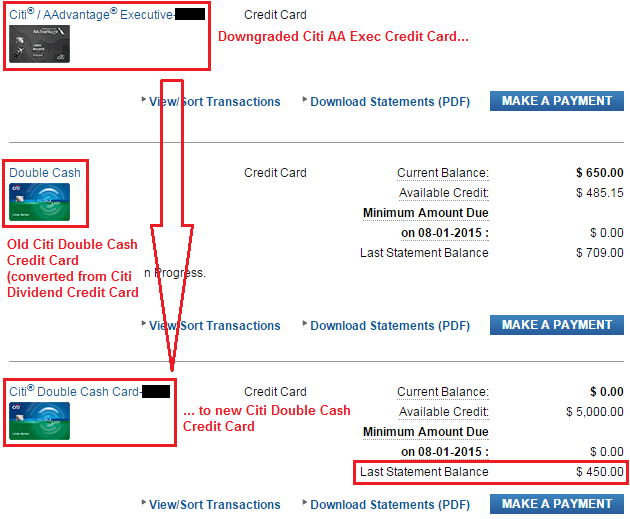

The rep advised me to pay the $450 annual fee before the due date since the conversion would not be complete until after the payment due date has passed. After the conversion is complete, the $450 annual fee will be refunded to my new Citi Double Cash Credit Card. Here is what my Citi online account looks like at the moment. I had an existing Citi Double Cash Credit Card that I converted earlier this year from a Citi Dividend Credit Card (I was not getting any use out of it this year). When the conversion process is complete, I will have 2 Citi Double Cash Credit Cards, one with a $2,000 credit line and another with a $5,000 credit line. I’ll see if Citi is able to combine the 2 credit lines, but that will be another post.

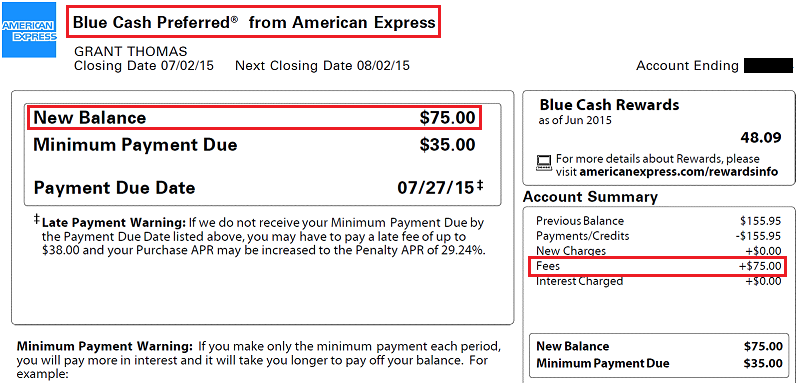

In other news, my American Express Blue Cash Preferred Credit Card’s $75 annual fee just posted too and I didn’t want to pay the $75 to keep a card I barely use (other than for AMEX Offers). I use my American Express Old Blue Cash Credit Card for all my grocery store and pharmacy purchases. I called American Express and asked them to downgrade my American Express Blue Cash Preferred Credit Card into an American Express Blue Cash Everyday Credit Card. This would allow me to keep the few dollars of cash back that has accrued in my account and allow me another credit card to use for AMEX Offers.

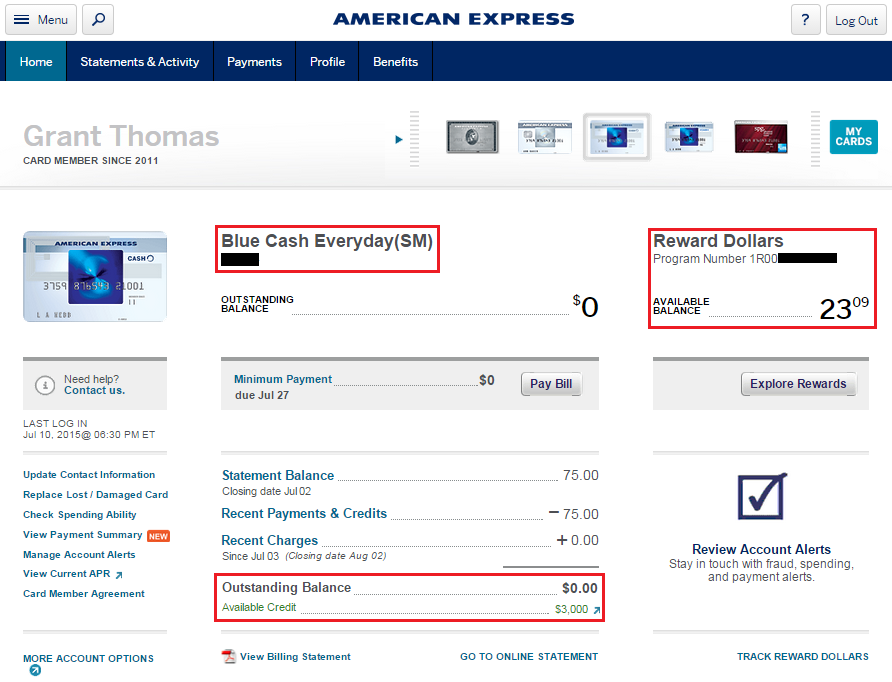

When I spoke to the rep from American Express, he said that the account would start acting like an American Express Blue Cash Everyday Credit Card right away, earning 3% at grocery stores and department stores, 2% at gas stations, and 1% everywhere else. The new American Express Blue Cash Everyday Credit Card should be arriving soon, but my online account is already updated with the new name.

If you have any questions, please leave a comment below. Have a great weekend everyone!

If I do this, are you certain I would still get all those months reflected in my credit history or would I get a new account?

When I did that with my US Airways card (to Barclays rewards) it looked like I got a brand new account. I have had my AAdvantage Citi card for more than 3 years and I would not like to lose my history.

I’m not 100% sure, but I think when you convert your card, you keep the same account age. There could be exceptions, but I think for the most part the account age stays the same.

I’m 100% sure (s)he’ll keep the credit history.

Thank you for clarifying, I was hoping that would be true.

Another interesting note, with AMEX, they “backdate” accounts to the first time someone opened an account with them *ever*. For example, I first had a Green card with them back in 2008 and closed it at some point. When I got a Blue Cash Preferred in 2014, my account got an open date of 2008. I looked into this across the web and it’s a pretty consistent thing they do. I guess their justification is basing on when the customer first established a relationship with them…or something like that. Anyway, the net effect is that this is almost always good for the consumer (I do work for one of the three credit bureaus, but my comments are my own).

I think Amex recently stopped backdating accounts, this changed in the last 2 months or so.

Just converted my Citi Exec to the Double Cash card this past week and the rep confirmed I would not lose the account even though the card would change. I made the conversion before the $450 fee posted but after I had the account for 12 months as I believe that’s the restriction in terms of converting down to a no annual fee card. The obvious benefit is I don’t have to wait to be credited back the $450 fee.

That’s a good call, I don’t mind paying the $450 AF, it shows up pretty quickly when the conversion is complete.

Your account age carries over. I prefer the dividend card to the double cash. I can usually max out the $300 cash rewards buying $200 gift cards at best buy during Q4 at 5%. Sometimes citi offers an additional 2-4x as a retention offer, so its possibly to get 9x on those best buy purchases.

The Best Buy stores in the Bay Area do not usually have $200 VGCs. I still probably wouldn’t bother since I can just buy $200 VGCs at office supply stores with Ink Bold/Plus. The Double Cash is a good 2% card year round.

Yeah, love the doublecash.

Me too :)

My wife and I both converted from aa exec to citi dbl cash this month and the fee refund showed up immediately for both of us.

Great, thanks for sharing Tyler. Do you both like the Citi Double Cash?

If you hold out to speak to the second rep (retentions transfer) Citi is offering a $50 statement credit each billing cycle for the next 7 in which you spend at least $1500 on the card. Makes the annual fee essentially $100.

I’ve heard about that retention offer, but that doesn’t interest me. I have Citi Prestige so I can use Admirals Club lounges if I’m flying AA/US. I fly out of SFO often, so the Centurion Lounge works great for me. Do you think that retention offer is worth the effort?

Im waiting on my GE credit to post. Do you know if the credit will show up still if I convert before the AF is due? Im flirting with the timing and may have to pay a little interest on the AF in order to get the GE credit and close my account all together

I think you can call Citi within 30 days of when your AF posts and get a full refund. I’m not sure what the time is for your GE credit.

I’m more interested in converting my blue cash to the everyday that earns MR. Haven’t called Amex about it but was wondering if that’s even possible

Should be possible, but you will probably lose any rewards that you have earned on your Blue Cash.

What is the reason for keeping two Dbl Cash card or each spouse to have one bec You or your spouse can be authorized user (can’t u not xfer the CL to your old Dbl Cash?).

I believe Citi does a hard credit pull whenever you move credit lines around.

Was literally on the with Citi to close this AA Exec card when I read this. Converted to a Citi Double Cash card. Rep said she will put in a request to immediately refund the $450 membership fee (which posted a week ago). She said the refund should show up in 1-2 business days.

Thanks for blogging about this!! :)

Great timing Will, glad you were able to convert the card to a Citi Double Cash CC.