Disclosure: if you are just starting out with credit cards, do not follow in my footsteps. I have years of experience with credit card applications, reconsideration calls, and managing my finances. You are responsible for your credit score and finances. You have been warned.

Good evening everyone, I hope you had a great weekend. I got sunburned Saturday sitting at Faction Brewery in Alameda and got another sunburn Sunday on a hike. After doing my Sunday chores, I decided to plan my upcoming App-O-Rama. Here is my current App-O-Rama plan. Please let me know if you have any thoughts on the credit cards I am applying for.

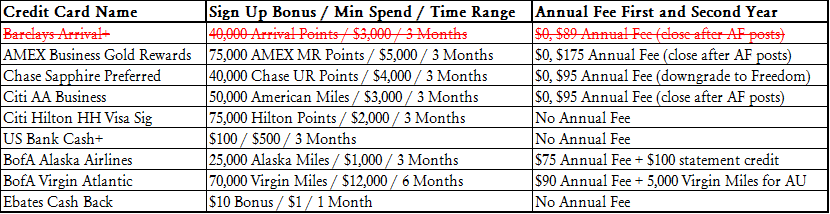

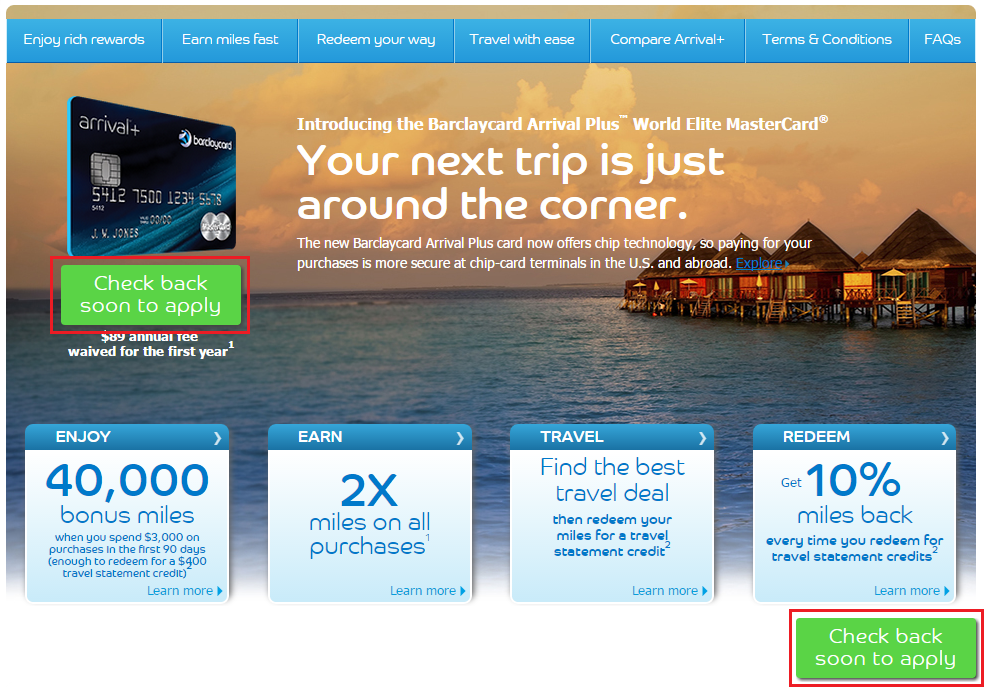

As some of you know, Barclays hates me. I have never been approved for a single credit card from Barclays, yet I continue applying every few months. I wanted to apply for the Barclays Arrival Plus (for probably the 3rd or 4th time), but the website is not accepting any applications at the moment. I will have to try back in a few months.

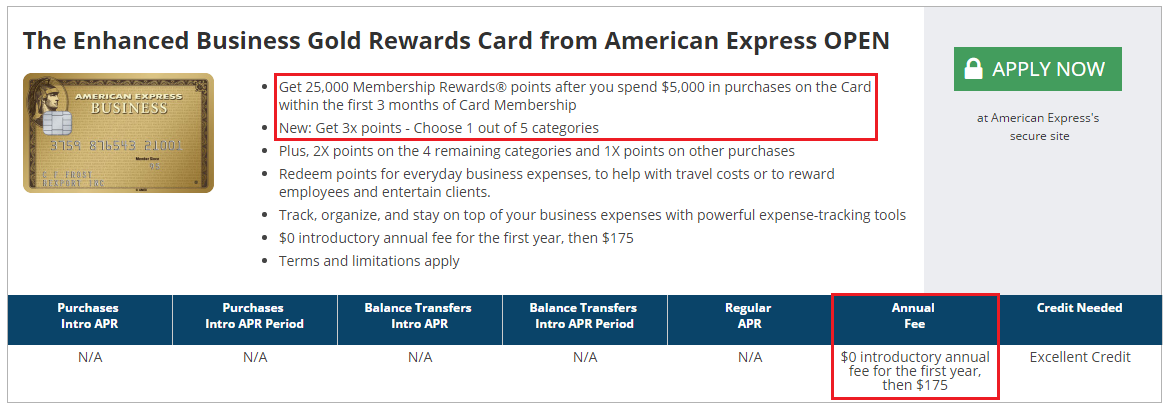

I have had just about every personal credit card out there, so I want to get more involved with business credit and charges cards (besides, Travel with Grant qualifies as a business). The publicly available American Express Business Gold Rewards Card has a 25,000 Membership Reward Points sign up bonus after spending $5,000 in 3 months. The annual fee is waived the first year, then $175 thereafter.

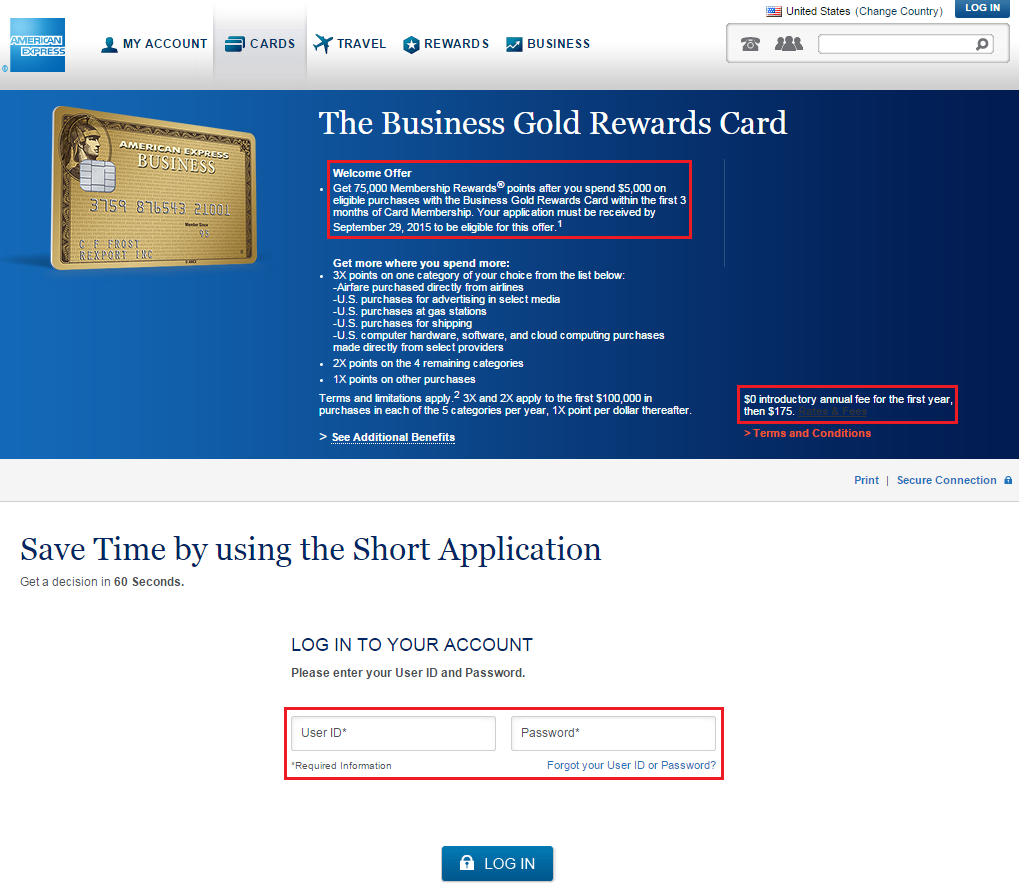

There is a private/targeted offer that I found on FlyerTalk for the same card that offers 75,000 Membership Rewards Points after spending $5,000 in 3 months. The annual fee is waived the first year, then $175 thereafter. You need to log into your American Express account to apply for the credit card.

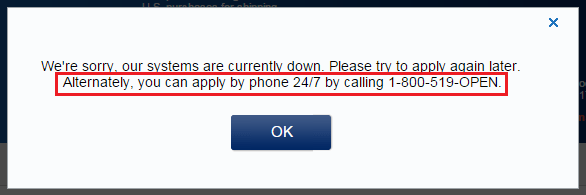

Unfortunately, when I try to log in, I get the following error message. I plan on calling American Express and seeing if I can apply for that offer over the phone.

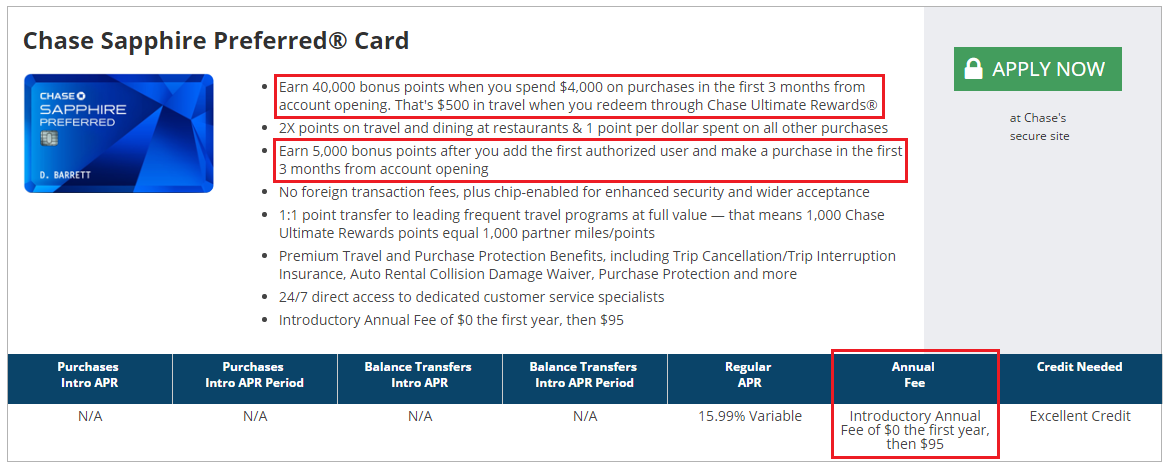

My Chase Southwest Airlines Plus Credit Card’s $69 annual fee just posted and I am looking to move the credit line to another Chase credit card. I had the Chase Sapphire Preferred Credit Card from August 2012 to August 2013, before I downgraded to the Chase Sapphire Credit Card, which I then converted to the Chase Freedom Credit Card. Since it has been more than 2 years since I got the sign up bonus, I can get the sign up bonus again. I have heard about the recent troubles with Chase credit cards, but I am not concerned.

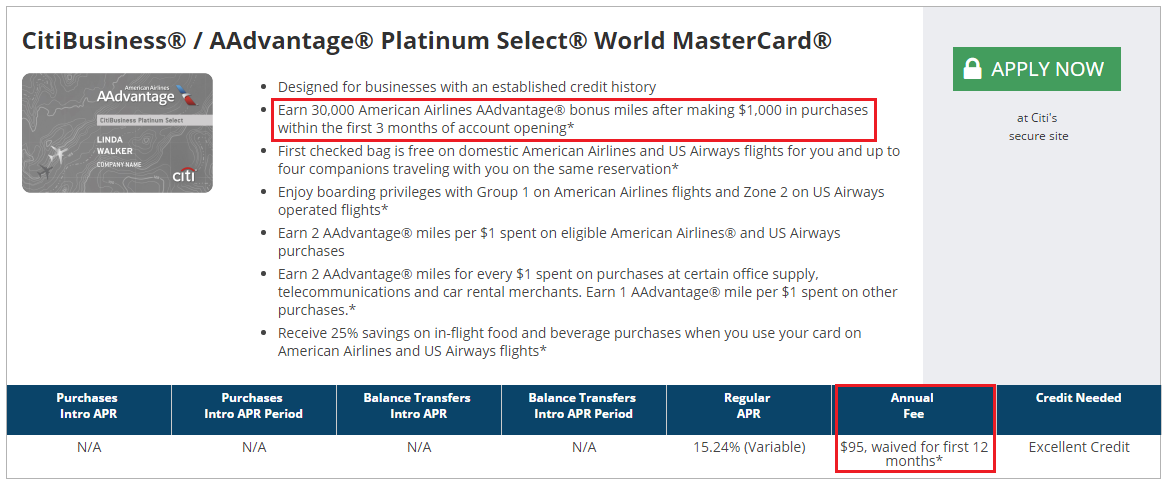

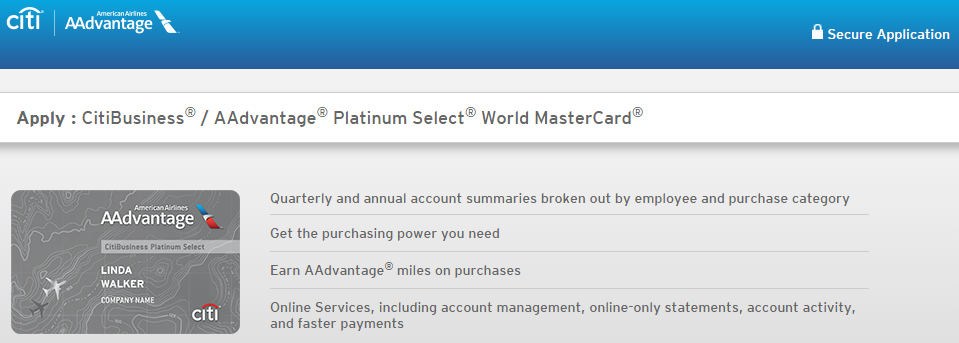

Since I have pretty much all of the Citi personal credit cards (Forward, 2 Double Cash, AA Platinum, Premier, Prestige, and Hilton Reserve), I want to apply for the Citi American Airlines Business Platinum Credit Card. The public offer has a 30,000 AA mile sign up bonus after spending $1,000 in 3 months. The annual fee is waived the first year, then $95 thereafter.

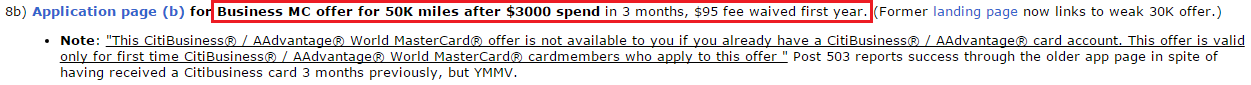

There is a private/target/zombie link on FlyerTalk that has a 50,000 AA mile sign up bonus after spending $3,000 in 3 months. The annual fee is also waived the first year, then $95 thereafter. There is no landing page for the 50,000 AA mile offer, but people on FlyerTalk have confirmed the offer is still working.

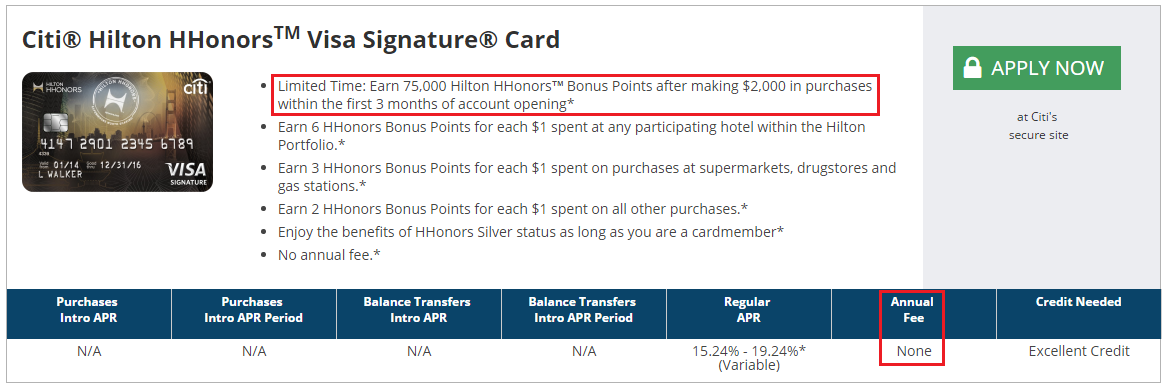

I have never had the Citi Hilton HHonors Visa Signature Credit Card (not Cit Hilton HHonors Reserve Credit Card), so I thought I would go for the no annual fee Hilton credit card that is offering 75,000 Hilton HHonors points after spending $2,000 in 3 months.

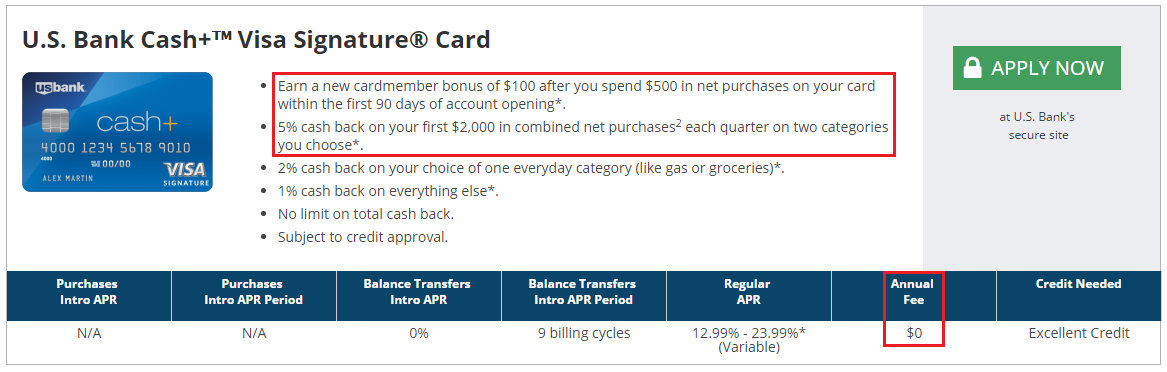

I currently have 4 US Bank credit cards (FlexPerks Visa, FlexPerks AMEX, Club Carlson Personal, and Club Carlson Business), but hopefully US Bank will approve me for the US Bank Cash Plus Credit Card. This is US Bank’s version of the Chase Freedom Credit Card, which allows you to pick two 5% cash back categories each quarter, with a quarterly limit of $2,000 of spend. The current sign up bonus is $100 cash back after spending $500 in 3 months. I am hopeful that I will get instantly approved, otherwise I will need to move credit from some of my existing US Bank credit cards.

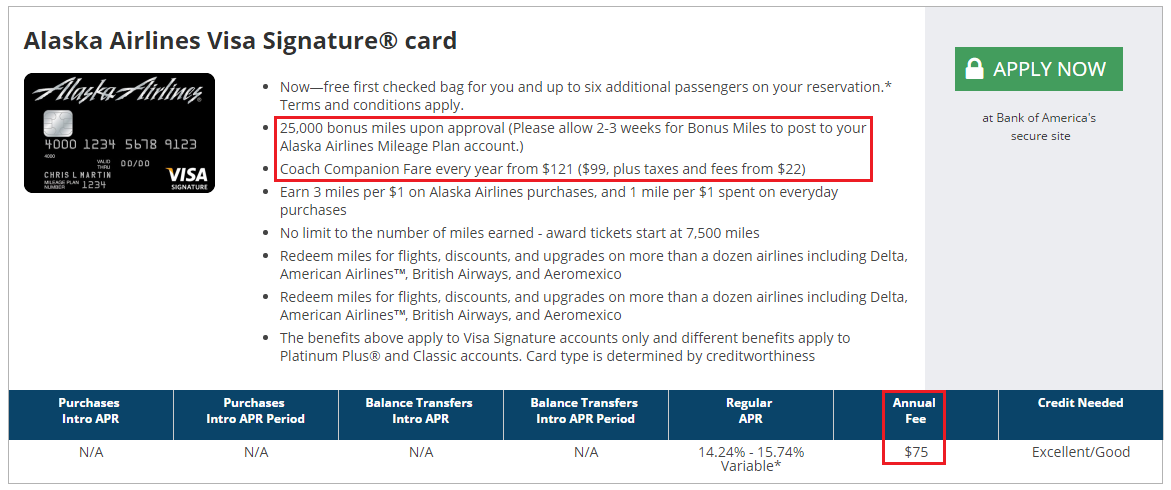

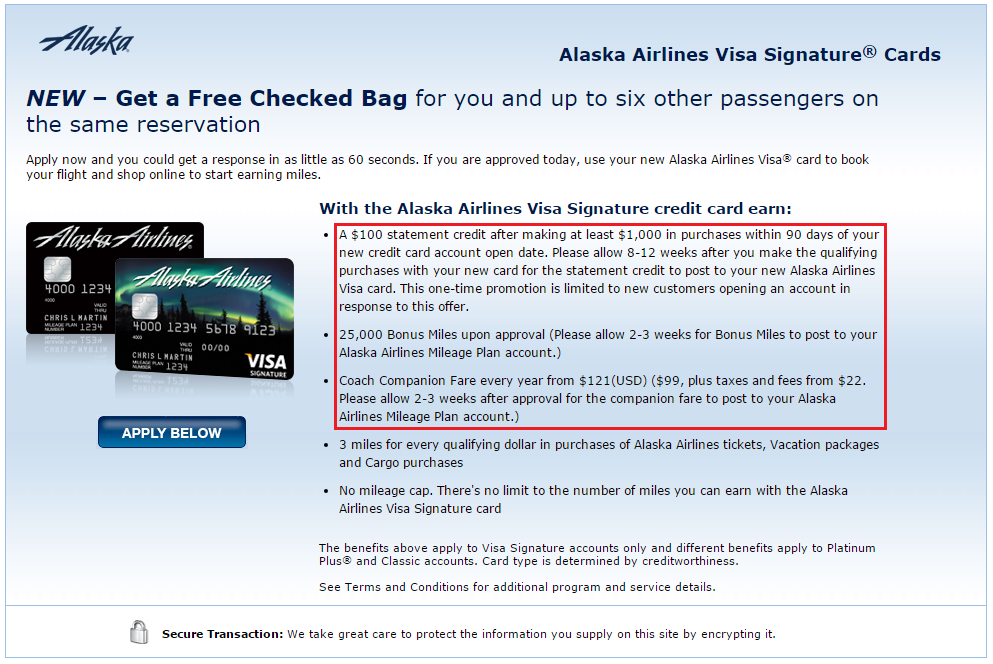

Frequent Miler and Doctor of Credit recently wrote about approval issues from Bank of America. I recently converted my Bank of America Alaska Airlines Credit Card to a Bank of America Better Balance Rewards Credit Card and I still have a Bank of America Virgin Atlantic Credit Card open. I will try for another Bank of America Alaska Airlines Credit Card and hopefully I will get automatically approved for the Visa Signature version offering 25,000 Alaska Airlines miles on approval, with a $75 annual fee. The public offer does not have any spending requirements.

Again, FlyerTalk has a private offer for the same card that offers a $100 statement credit after spending $1,000 in 3 months. This wipes out the $75 annual fee and leaves you with a $25 credit left on your credit card.

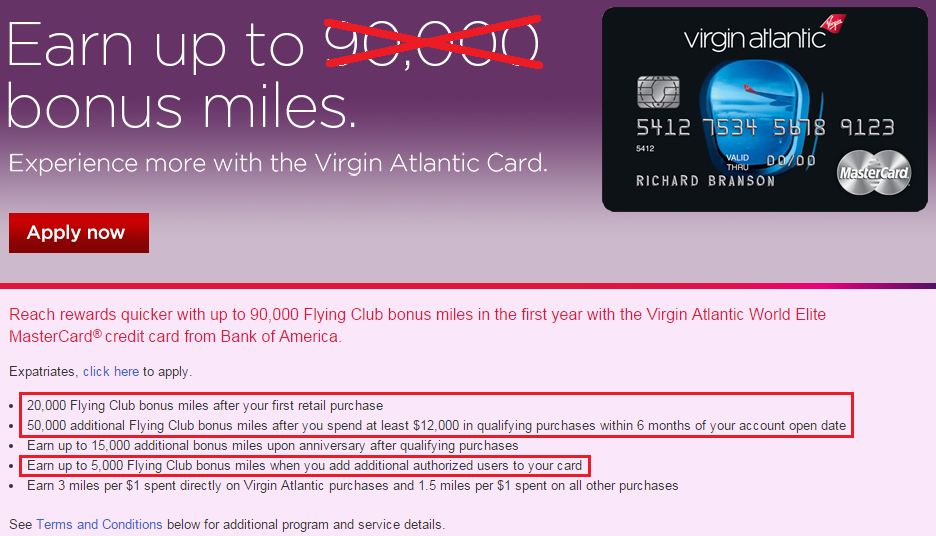

If I get instantly approved for the above credit card, I will apply for another Bank of America Virgin Atlantic Credit Card. The card offers a 70,000 mile bonus after spending $12,000 in 6 months. You can get another 5,000 miles when you add an authorized user. If this credit card does not get instantly approved, I will call Bank of America and see if they can move the credit from my other Bank of America credit cards.

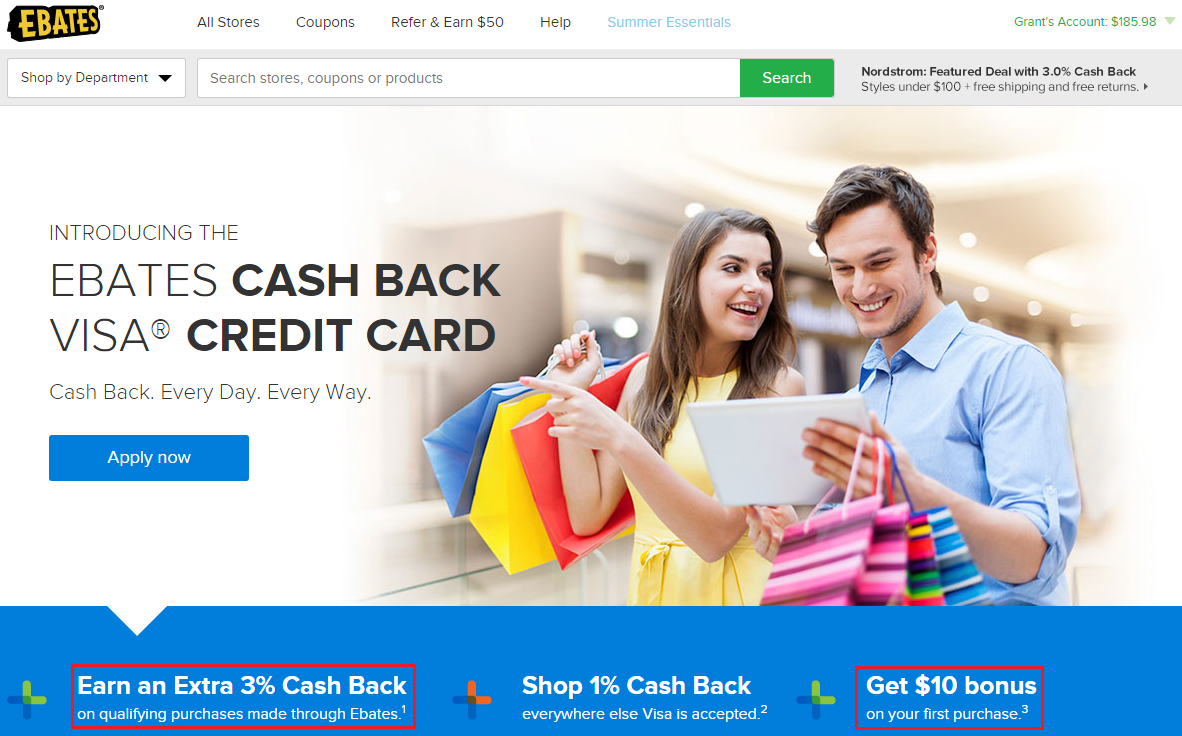

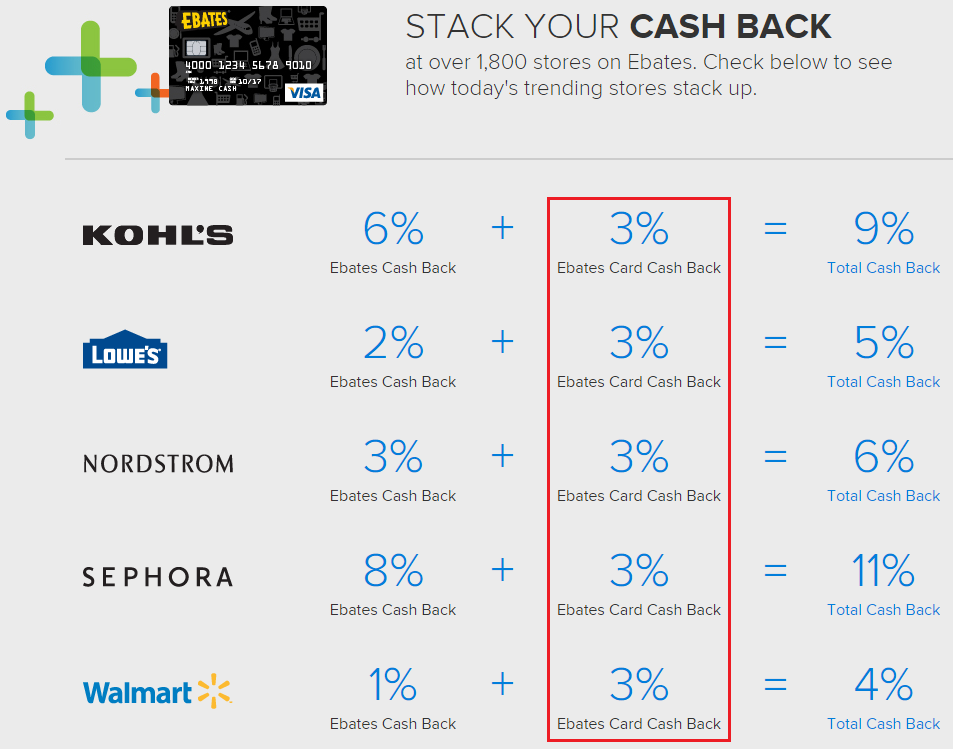

Last but not least, I will apply for the Ebates Cash Back Credit Card. The sign up bonus is only $10, but when you can get an extra 3% cash back bonus on all Ebates shopping, the rewards will start to add up. This will be perfect for Back to School specials and holiday shopping.

The 3% cash back bonus is independent from Ebates’ base cash back rate. If you are new to Ebates, check out this post. To sign up for your free Ebates account and start earning cash back for all most your online shopping, click here.

If you have any questions or credit card suggestions, please leave a comment below. Have a great evening everyone!

Nice plan! Just curious why you aren’t concerned about Chase approvals? Will you be going in branch to apply for Chase?

I don’t churn Chase UR cards, so I think I will be fine applying online. I will let you know how that goes. :)

If you have applied for more than 5 cc -including non Chase – in the last two years you’re likely to be denied. Goes for AU cards too (or so it seems). I have to assume you already know this, so what am I missing here that would lead you to trying anyways?

I’m betting on my reconsideration call skills to hopefully be the deal breaker. I will keep you posted on what the rep says.

Yeah Grant – have to agree with the above. Your Sapphire “I’m not worried” rationale lacks detail but more importantly, logic. Without explaining further why you “aren’t worried” you leave us no other option but to question your hubris …

I may be overconfident on this one, but I’m up for the challenge. I’ll report back with the results.

Grant,

For Chase CSP cards, you will have to be very lucky bec during they are recording the recon conv and subsequent calls fall on deaf ears. I will probably wait for few months to see Chase changes the requirements…

BTW, are u planning to do any MS from this list and where?

If my recon call fails, I will just close my Chase Southwest Plus CC to avoid paying the $69 AF. Chase has been pretty generous to me in the past, so I am hopeful the trend continues. I will do my usual MS of GCs and Redbirds to meet the minimum spends.

I noticed that you plan to close most of the cards (or move, downgrade) after the AF is posted after the 1st year. Any reason for doing so?

Will you still need to pay for the AF if closing the card after the AF posts?

Most of those cards do not provide much value to keep the card after the first year, which is why closing the cards makes the most financial sense. If I close the card after the first year, I do not need to pay the annual fee.

Grant,

I’m sure you read all the negative changes to the barclays: http://travelcodex.com/2015/07/confirmed-negative-changes-coming-to-barclaycard-arrival-plus/

Worst change is the 10,000-mile redemption minimum. (Used to be 2,500 mile redemption). Also changing the bonus miles from 10% down to 5%.

Essentially these changes turn this to a less than 2.1% cashback card that’s only redeemable for travel, and you have to redeem it in 10,000 mile minimum increments . Horrible if you ask me. Basically makes 9,000 points sitting in your account pointless until you spend $1k extra.

So a typical sign-up scenario would be this — you sign up and get 40,000 miles. You spend all 40,000 and now you get a 5% bonus which is 2,000 miles. Those 2,000 miles are now worthless until you spend $8k extra to finally get to 10,000 miles. Those 10,000 miles, when spent will get a bonus of 500 miles (which is basically useless until you spend 9,500 miles more, etc. etc.)

So, in my opinion, even if Barclays becomes available again, don’t waste a hard pull on them. Citi Double cash, Amex Fidelity, Capital one Venture Visa, BofA travel rewards (if you are able to get an additional bonus in gold or higher) are better. BofA doesn’t have Foreign transaction fees and NO annual fee! so that has become my go-to card now.

Btw on a personal note, screw Barclays. I had Arrival plus, used it as my primary card on a daily basis for the last year, spent more than $60k on it, and called 4 times to try to waive the annual $89 fee. No go on any of the calls. So I downgraded to basic Arrival card, and will basically keep it open by using Amazon allowance (which I learned of from you! Thanks!) Barclays has pretty much lost my business (except for the few bucks a year I will charge through them to fund my amazon account haha).

Anyway … you’re not able to apply for it anyway, which is a good thing in my opinion. Best of luck on your app-o-rama!!!!!!!!!!!!!

Thanks for sharing your frustration regarding the Barclays Arrival Plus. I know many people feel the same way as you do. If I recall correctly, the changes are not effective for everyone right away, so there was hope of still being able to earn and burn at the current rate. I really only want the ~$400 sign up bonus value, I would not spend much on the card after that.

Hey Grant. Good luck with your App o Rama. Do you have any idea how long that 75,000 bonus on the Citi Hilton card will be around for? I was just approved for the Citi Hilton Reserve card and was wondering if the 75,000 offer will be around when I apply for another Citi card. Not sure if there is any historical data on that.

Thanks for the post looking forward to the results.

I have no idea, but with Citi CCs, you can wait at least 8 days between applications and apply for the 75k offer. If you want to get it soon, it is technically possible, you will just need to call the reconsideration department.

Does this offer have the standard 18-month language? If so, have you not applied for the Hilton card within that time period?

I’ve never applied for the basic no annual fee version. I believe it does follow the 18 month rule.

Missing LH 50k offer

Hmm, I tried for the card in the past, but was not approved. It’s tempting but I think I will pass on Barclays this round.

Barclay Told me they only allow one card per customer. I have the Visa Black Card. Was the rep wrong?

hmm I have 4 Barclaycards (Arrivals+, Sallie Mae, Aviator Red, and Lufthansa)

Very nice. Can I have one?

For you? Of course! I just cancelled my LH card, leaving a spot open for you. Go ahead and get it now. ;)

I don’t know anything about Barclays, other than they won’t approve me for any cards.

Why do I have to visit the website to get the whole article instead of just reading it from my RSS feed app? Can you please fix this to save us time?

Good morning Jorge, I understand your frustration but I cannot change the truncated RSS feed. You will have to visit my blog to read the entire post. I hope you understand. Have a great day.

Gary managed to get it right, perhaps ask him.

That Amex 75,000 point link isn’t a valid offer. I’ve tried a couple times to call in, and have gotten the same story: that was a targeted link for one specific person, and it’s not available to the public. The Amex CSR will offer you the same deal you can find when you log into your Open account.

I hope you get better results than I did!

Bummer, that’s no good. Well then, I will call and see if they have any offer higher than 25k. I don’t need another Plat card since my personal card just renewed a few months ago. Maybe go for SPG biz or Amex Everyday CC.

With the Citi Business card, do you need to wait 18 months for approval? Got mine in May 2015 and closed in June 2015.

Thanks

I’m not sure what the rules are for Citi biz cards, this is my first Citi biz application. Does anyone else know the answer?

You must be racking up lots of inquiries. Have you found a way to remove those from your reports?

I don’t do anything to bump inquiries off my credit reports. I just let them fall off automatically.

IMO, the wyndham card from barclay is more valuable than arrival plus. Signup bonus gives you three nights at any wyndham. The 89$ annual fee gives you 15k points which is good for a night.

Interesting, I’ll do some research into the Wyndham credit card.

1) “I have heard about the recent troubles with Chase credit cards, but I am not concerned.”

I really dont think you will be approved for CSP if you were to apply online. I really dont recommend you try it… If you really dont care about the extra hard pull, it’s up to you…

2) “I have no idea, but with Citi CCs, you can wait at least 8 days between applications and apply for the 75k offer. If you want to get it soon, it is technically possible, you will just need to call the reconsideration department.”

I really think that the 8 day rule is pretty strict even with reconsideration. I doubt you will be an exception but you can also prove me wrong…

Good luck!!

Btw, what’s your spending pattern like on old blue cash? Mix of groceries/drug or only one store? $500 many times, or $2000 but fewer transactions? I just wonder if there’s any safe pattern for it. What I only know is to keep total spend in a year below 50k or monthly below 4-5k or so.

Does the Citi 8 day rule apply for personal and business apps or just for personal apps?

I have several ~$500+ transactions on my AMEX OBC.

http://www.flyertalk.com/forum/citi-thankyou-rewards/1475783-citi-aa-credit-cards-except-executive-2013-2014-a-23.html

Kind of old thread but I think it’s still valid. It’s “Only 1 Citi application of any kind per week (8 days to be safe).”

My concerns would be two-fold:

1) Chase – they have tightened up. I predict a denial and then I give you 65% chance of approval on the reconsideration line. If you are a good negotiator like you say, you may just get it!

2) Bofa – My advice would be only to apply for 1, not 2. They have also tightened up and word on the street is that they will not approve 2 apps. Period.

The rest I bet you will get without problem. Good luck, Grant.

You are exactly right. Chase was not willing to help move credit lines around to approve CSP. I applied for the Citi AA Business, due to 8 day rule. BofA would only approve the first card, not the second card. Things have certainly changed for the worst.

Agree. But this just means that we all have to be more clever, paying close attention to TRENDS, and adjust strategy some. As for me, I’m going to do no more than 1 major Chase app and 1 major AMX app per year. In between that, I will fill in with Citi, Bars of Clay, BofA, and whatever else I can think of. I will also increase my MS to make up for less apps per year. I have close to the highest credit score that one can achieve, and BofA really made me jump through hoops on my last one (was approved, thank God).

I’m going to lay off applying for credit cards throughout the rest of this year. I’ll play your games, credit card companies.

I just don’t see how you get approved. I either get too many inquiries (card applications) or too much total credit is sought.

I’ve both of the lines a few times. I will do a follow up post in a few days when the pending applications go through.

Looking forward to hearing your summary of how everything turned out.

Will do, I am still waiting to see which cards I get approved for, getting some denial letters, and seeing if I can call in to get an approval. There are still a few cards up in the air…

Anu updates on app o rama?

Almost, any particular card you have questions about?

Pingback: App-O-Rama Update: Overturning Bank of America's Spirit Airlines Credit Card Denial Letter | Travel with Grant

Pingback: My Unsuccessful Chase Sapphire Preferred Reconsideration Call, Visit, and Tweets

Pingback: 1 Month Approval Process for US Bank Cash Plus Credit Card