(Hat Tip to Noah @ Money Metagame for the idea)

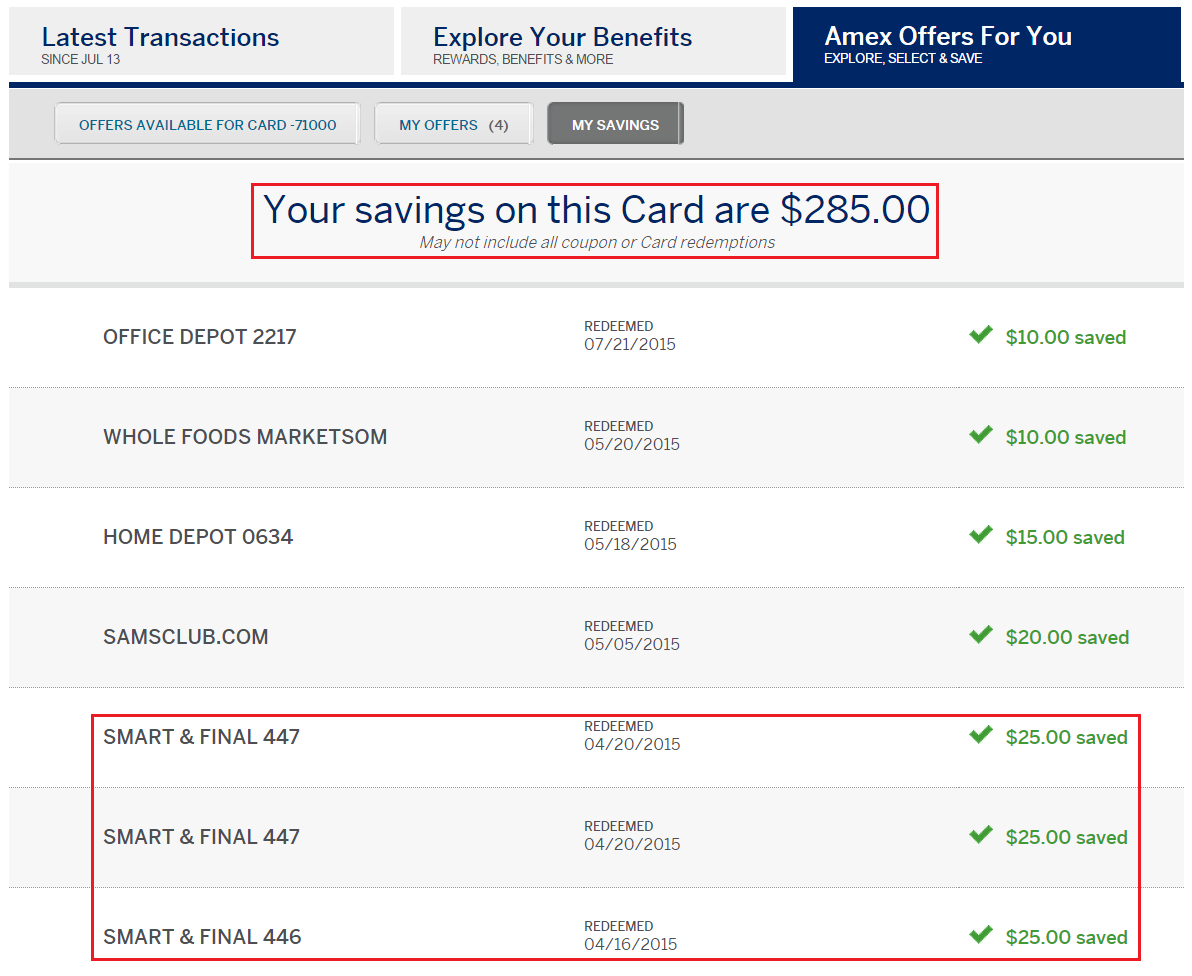

Good morning from beautiful Scottsdale, Arizona. I am staying at the $80/night Hyatt Place in Scottsdale after an exciting day at the Phoenician Hotel and Resort for the First2Board PHX Sessions. This morning, I was reading Money Metagame’s article and it got me thinking… how much money have I made/saved using AMEX Offers on 1 AMEX card over the last 12 months? If you log into your American Express account, click AMEX Offers For You, and click My Savings, you will see all the enrolled offers that you participated in. I think this list may exclude AMEX Sync Offers, so take that into consideration if you don’t see all your offers. Here is what I bought and the profit ($/%) per AMEX Offer:

- Office Depot: $50 Amazon Gift Card = $10 savings (20% free)

- Whole Foods: $75 loaded to my Clipper Card = $10 savings (13.3% free)

- Home Depot: $75 Panera Bread Gift Card = $15 savings (20% free)

- SamsClub.com: $20 Sams Club Gift Card = $20 savings (100% free)

- Smart & Final: 3 x $50 Southwest Airlines Gift Card = $75 savings (50% free)

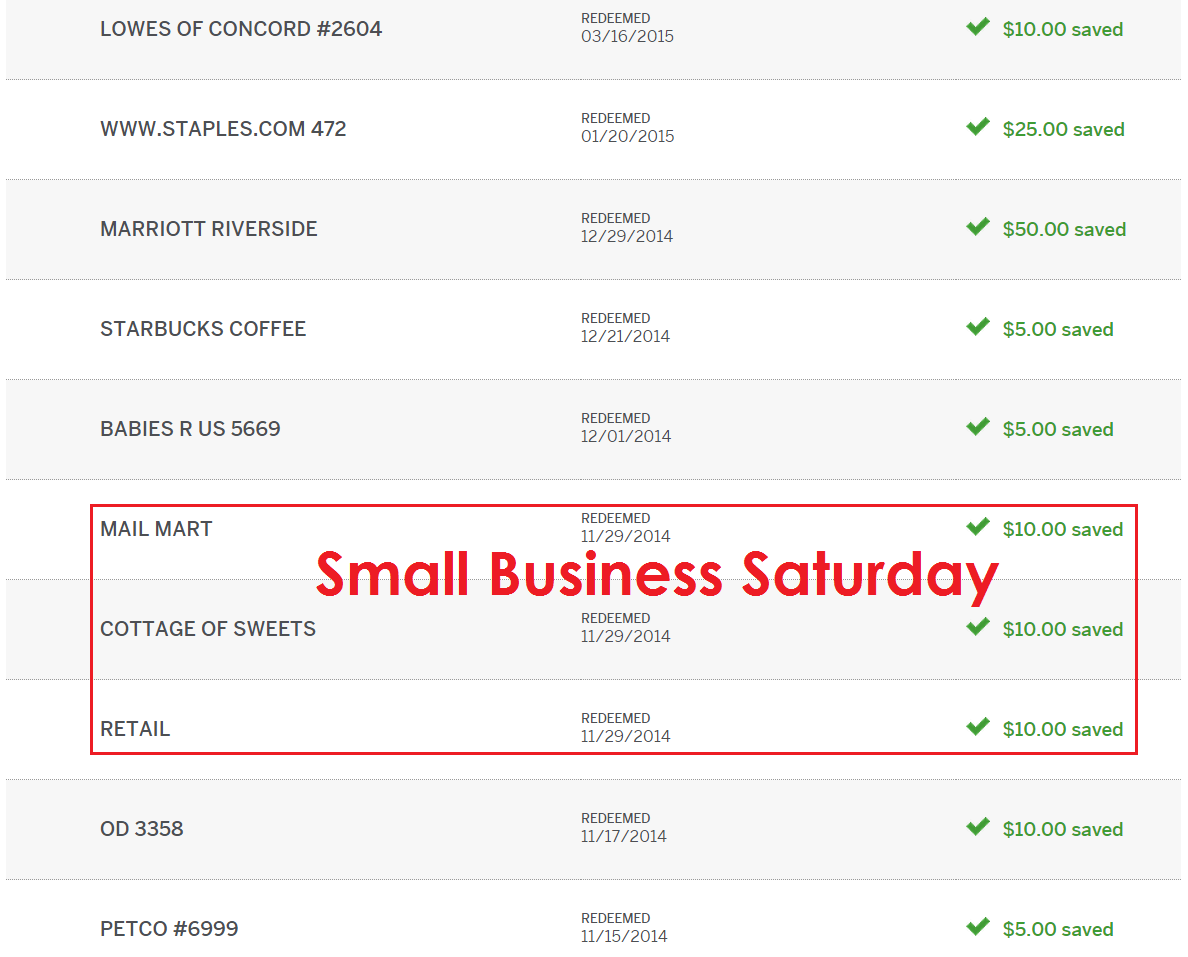

Continuing down the list with AMEX Offers:

- Lowe’s: $50 Amazon Gift Card = $10 savings (20% off)

- Staples: $100 Amazon Gift Card = $25 savings (25% off)

- Marriott: $200 Marriott Gift Card = $50 savings (25% off)

- Starbucks: $10 Starbucks eGift Card = $5 savings (50% off)

- Toys R Us / Babies R Us: $25 Subway Gift Card = $5 savings (20% off)

- Small Business Saturday: $30 in First Class Stamps, delicious candy, and souvenirs for friends = $25 savings (83.3% off)

- Office Depot: $50 Amazon Gift Card = $10 savings (20% free)

- Petco: $25 Petco Gift Card = $5 savings (20% off)

And finishing off the list of AMEX Offers:

- Walmart.com: $15 Walmart eGift Card = $5 savings (33.3% off)

- Uber: $25 Uber eGift Card = $10 savings (40% off)

- Bed, Bath & Beyond: $25 Subway Gift Card = $5 savings (20% off)

- AT&T Service: 2x $75 AT&T bill payment = $20 savings (13.3% off)

- Costco: $25 Costco Gift Card = $25 savings (100% off)

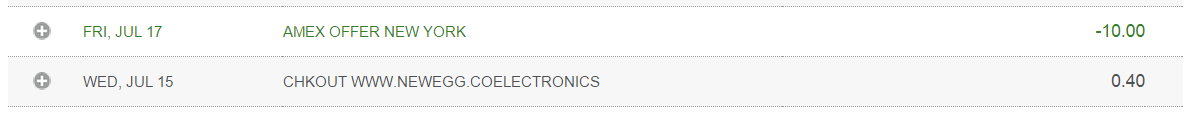

Last but not least, thanks to AMEX Checkout, I was able to make $9.60 buying a 40 cent game code from Newegg. Doctor of Credit has all the details.

If I add AMEX Checkout and all the AMEX Offers from above (I might be missing some from AMEX Sync), the total comes out to $339.60. All the gift cards that were bought above were used by myself or my parents, I did not sell any to any gift card exchanges. All these charges came from my no annual fee American Express Old Blue Cash Credit Card and several of my other AMEX cards received almost identical offers. In the above calculations, I am not including the ~1% cash back I earned on all the original purchases either.

As you can see, having a no annual fee AMEX card can be incredibly rewarding if used in AMEX Offers. You can scale this up incredibly by having multiple AMEX cards and by adding several authorized users to each card. How much have you made/saved on 1 American Express card over 1 year?

If you have any questions, please leave a comment below. Have a great weekend everyone!

This is a great article, Grant. I’ve been considering the AMEX SPG and while I’m not happy to see the AF rising $30, it’s still a great deal when you consider how quickly AMEX offers can wipe out the fee (and then some). I hope AMEX brings back the yearly 30K bonus this year!

SPG should have a 30,000 point sign up bonus soon, but no dates have been announced yet.

Great, but how much did you spend that you normally would not have spent?

Last SBS I ended up buying a lot of things I normally wouldn’t buy nor needed. I wouldn’t call that “saving”. My candy was “free” but I’m one step closer to diabetes.

For the average reader, getting in on lucrative Sync deals have been very, very challenging lately.

Exactly!!

True – sometimes we buy bad or useless things because of the “free” signs. It takes some time to plan a strategy on what to buy and what to use it for. I`ve been very selective lately, and only buy what I would need anyways – most of the time.

90% of my purchases for AMEX Offers are for gift cards that I can either use right away or in the near future. I try not to buy random stuff just to “save” a few dollars. I think my explanation for each AMEX Offer shows that I am pretty conservative with my purchases.

Great question, ABC. Most of the gift cards I purchased were for places I normally shop (Amazon) or for places I normally eat at (Panera Bread or Subway), so I did not go out of my way to spend money there. For SBS, I bought a bunch of USPS First Class Forever Stamps, which I don’t use often, but will definitely be used sometime in the future. As for the limited quantity of AMEX Sync Offers, I did not really take those into consideration. All the offers listed in the post were in my AMEX Offers for You tab. Most of the really good AMEX Offers (Sams Club and Smart & Final) were pretty much available to everyone via AMEX Offers or AMEX Sync Offers.

I am glad to see that AmEx has found it`s unique way to be attractive in the years of harsh battles among the credit cards/banks.

In the old good days, AmEx was my preferred card, but when Chase stepped up, AmEx was used less frequently because of their aggressive marketing strategies. Nowadays, because of the offers, AmEx cards have to busy again.

I was surprised to find out how much I made/saved from AMEX Offers. It doesn’t seem like much when you earn $5-$25 every few weeks, but when you step back, the dollars sure add up. Then multiple that by a few more AMEX cards and you see there is a lot of money out there with AMEX Offers. Do you still use your Chase credit cards more often than your AMEX cards?

Thanks for the nod :)

The blog’s name is Money Metagame for future reference, not the “Meta Money Game” you listed.

Sorry about that, Noah. I fixed both typos. Great article you wrote :)

When you get an AMEX offer for $30 off a $100 purchase at Target or Walmart, which can be used up to 5 times, at the very least you can net $24 each time by purchasing $100 AMEX gift cards there. That’s an easy $120.

Yes, that is an amazing offer. Unfortunately those amazing offers do not come around all that often.

I agree w Grant. This above post is the exact reason why I decided to keep/ downgrade my Amex Gold Biz down to a Green Biz card ($95 annual fee still). I have added 5 authorized users at no additional fee, which makes it essentially very very very useful still and well worth the $95 AF. I literally don’t use the card for anything but Amex offers.

And I basically get gc’s just like Grant for everything. And to places that I definitely would spend anyway (e.g. Amazon). This helps a lot

Thanks Alex, I am glad you are able to use your AMEX cards for the lucrative AMEX Offers. Hopefully the great AMEX Offers continue to show up.

AMEX is the most generous card company out there, for users! I made well over $1300 net on the Smart and Final offer!

Awesome, how many Amex cards are you managing? Probably 10+, correct?

How was the First2Board PHX Sessions? I was considering going. I was even in phx that weekend at the Hyatt Scottsdale Gainey Ranch. Maybe I’ll attend next year :)

Have you been to any other travel conferences? The meeting was prett small, only 30-40 people (including speakers/bloggers). I enjoyed talking with the other bloggers and the attendees. It might be in PHX next year, but I have no idea.

Yeah, some FTU’s and others. I’ll see you in Chicago.

I think the Chicago Seminar is one of the best travel conferences out there. I’ll cya there.

Just to prove your point, my biggest score in less than one year has been my SPG Business card with Amex sync savings of $620. No I did not spend any frivolous $$ to get the deals but I completely understand those points. Like Grant who understands the power of gift card loads and BB, Serve, Redbird, etc, my only cost was gift card fees and some time at Walmart and gas, ok so not free but still well worth it!

I scored on this card due to the rare Staples/Home Depot deal of $75 back on $250 x 5 and of course the Smart and Final deal. I didn’t even get the Target/WM deal of $30 on this card.

With 22 cards (including AU cards we had our biggest score with the Smart and Final deal. Spent $1,650, GC fees of $65.45, netting $1584.55 in profit. The $1,650 was not spent on any groceries so we failed to abide by the spirit of the promo, sorry S&F. Did spend about $200 on Shell gas cards but the remainder of spend was on Visa/MC which were liquidated at a WM Kiosk and bills paid, etc, through Serve.

I’m not trying to show off. Sorry if it sounds like that. I want other people to know they can make good on these deals too. Takes a bit of organization, desire and a number of Amex cards. Takes time to get the cards, but is worth it. The sync deals are real nice.

Thanks for sharing KC. It’s pretty awesome how profitable some of these Amex Offers can be. Obviously, the targeted offers are the best, but even some of the more widely available offers can be worth the time.