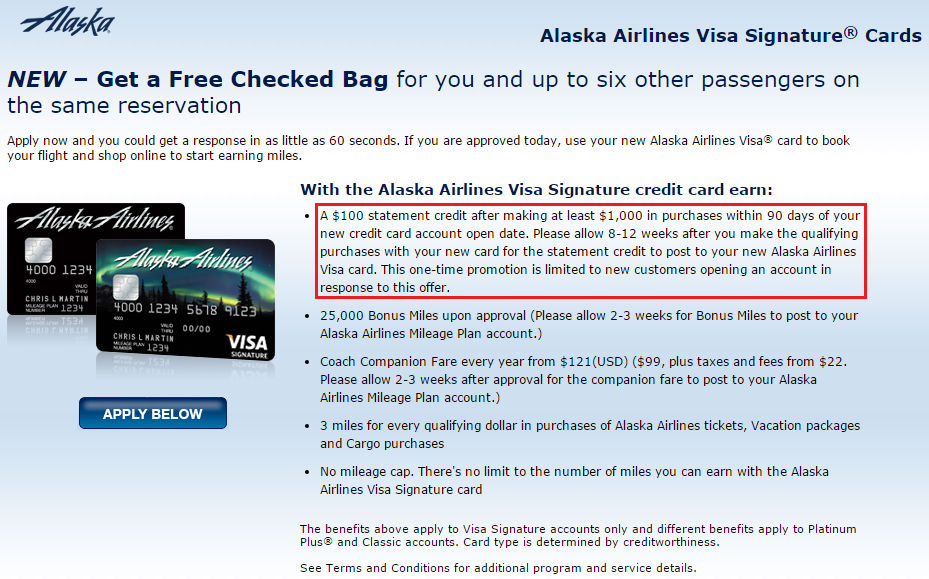

Good morning everyone. During my July 2015: My 8 Credit Card App-O-Rama Game Plan, I applied for the Bank of America Alaska Airlines Credit Card (I applied through the special link from FlyerTalk, not the publicly available offer). This credit card is great because it offers 25,000 Alaska Airlines miles on approval (no spend required), has a $75 annual fee (not waived), and also offers a $100 statement credit after spending $1,000 in 3 months. So after spending $1,000, my total gain from the credit card approval should be 26,000 Alaska Airlines miles (25,000 miles from sign up bonus + 1,000 miles from spend) plus $25. Pretty good deal, right?

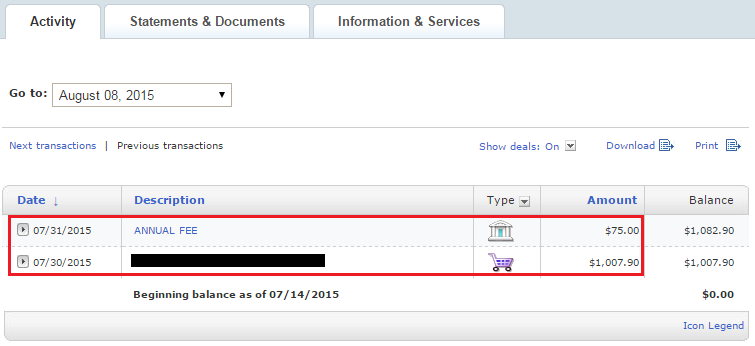

After my first statement closed, I was charged the $75 annual fee, but I did not see the $100 statement credit. I called Bank of America to find out what was going on. The reps were very confused by my request and thought I was asking about the companion pass ticket ($99 + taxes for a companion ticket). Then they conference called in a rep from Alaska Airlines who was as confused as I was about the whole situation. Clearly, I was the only one on the call that knew what I was talking about. I politely hung up and hoped the statement credit would show up on my next statement.

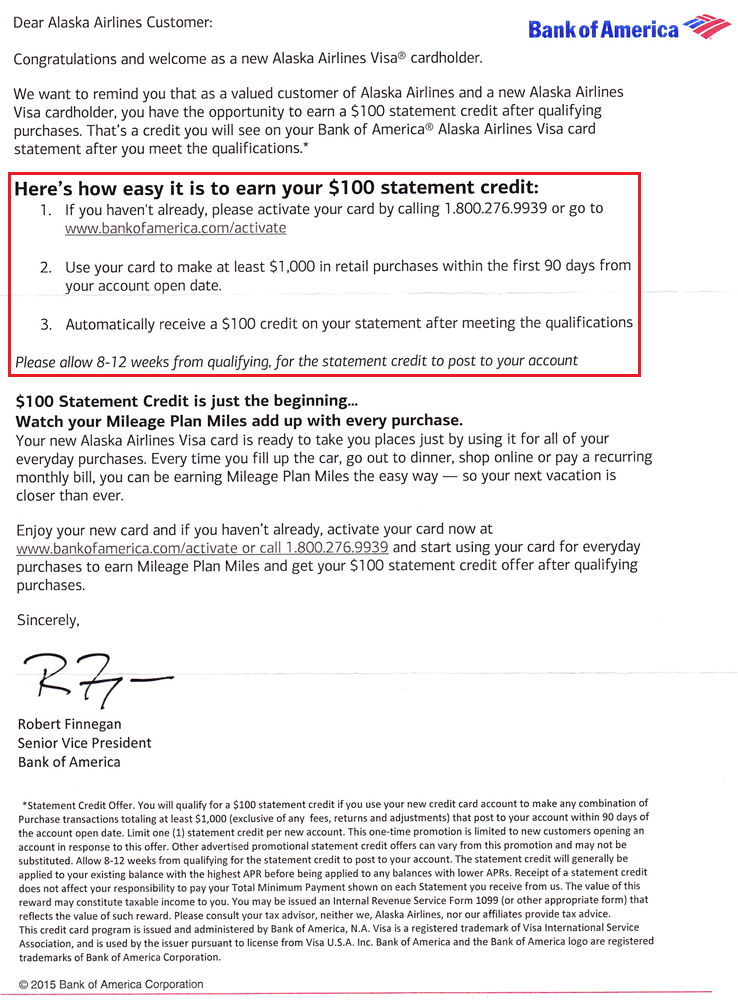

That same day, waiting for me in my mailbox was a letter from Bank of America specifically mentioning the $100 statement credit. Since I got the letter, I was assured the $100 statement credit would show up (hopefully sooner than 8-12 weeks).

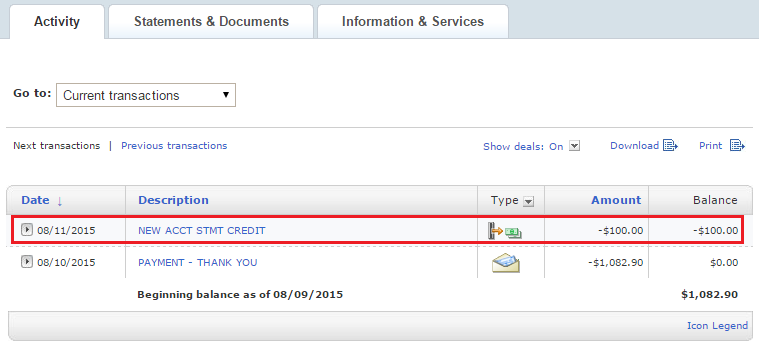

A day after paying off my July statement balance, I logged into my Bank of America online account and I see the $100 statement credit. Dang it, Bank of America, please post the $100 statement credit on the first statement. I wonder if the $100 statement credit automatically posts as soon as you pay off your previous month’s statement. The timing would indicate yes, but it could also be a coincidence.

If you have run into a similar situation or have other data points to share regarding the Bank of America Alaska Airlines credit card, please share below. If you have any questions, please leave a comment below. Have a great day everyone!

do you know what the churning rules are for this card? i.e. can you have multiple boa alaska air credit cards open at the same time or do you need to close the previous one first before applying for the new one? time frame in between apps matter?

You can have many BofA AS cards open at the same time. You can apply for a new card every month. As long as you keep getting approved, keep going. You might need to call in for recon approval after a while.

just to confirm, when you say every month, are you saying once every 30 days or is it used loosely? also i got approved yesterday with a whopping 21k credit line. would you recommend i decrease the CL immediately (say…. to $3,000) to increase my chances of instant approval on my next app or would you save it as bargaining chip when i need to call the recon line?

Technically you can apply as often as you want, there is no set time limit. You will probably want to lower your credit line to increase your chances of an instant approval on your next application.

Exact same thing happened to me. Paid the balance and then the credit showed up the next day on my first batch of AS cards 8 months ago. So this last batch I paid off everything but $100, and during that second statement period I saw the $100 credits posts.

Gotcha, thanks for sharing your experience, Shane. Previously I believe the $100 statement credit would always post on the first statement, as long as you met the minimum spending requirement, regardless if you paid off the balance or not.

shane how many boa alaska cards have you applied for within the past 8 months?

Back in the good ole days, you could get 3-4 AS cards on the same day.

You seem generally pleased with this latest app-o-rama, Grant, which tells me you’re either a Zen enthusiast or properly medicated. Plus as the serialized story unfolds, it gives the reader useful, near realtime data on how various banks use credit profiles. To fill in that picture, how many hard pulls are you charged with?

I am quite zen most of the time. I don’t track hard pulls or which credit bureaus are used by each bank. I don’t freeze any of the big 3 credit bureaus (only ARS and IDA). I’m not sure if that helps, but that is my philosophy and mindset.

Hey Grant, I do think that is the usual time line–that the credit posts after you have paid your Annual Fee/1st statement. However, you can also transfer that credit to any other BofA cards you might have a balance on if desired by simply calling their customer service :)

That’s my plan. I have a $500 balance on my BofA Spirit Airlines CC :)

My bonus points came quick. The $100 took about two statements.

Gotcha, thank you for the data point. I wish they would come at the same time.

You can also transfer the credit to your b of a checking account.

The credit only applies to accounts opened directly with the $100 credit. If you tried to backdoor it through the process of setting up a fake ticket for which you get a $100 credit for applying for and getting the credit card in the process of buying a ticket, they won’t apply the credit.

Thanks for the info. I’ve never tried the backdoor ticket trick, I always go directly to the special application page.

Do you mind to share what did you purchase in the amount of $1007.90. Looks like you bought 2x $500 gift card with 3.95 fee each.

That’s exactly what I bought :)

What kind of gift card is that? I usually buy vanilla gift card with 4.95 fee.

Back in August you could buy VGCs from AgFed for a $3.95 fee. That option is no longer available.

ok. Thanks for sharing!