(Hat Tip to Travel Codex for the inspiration)

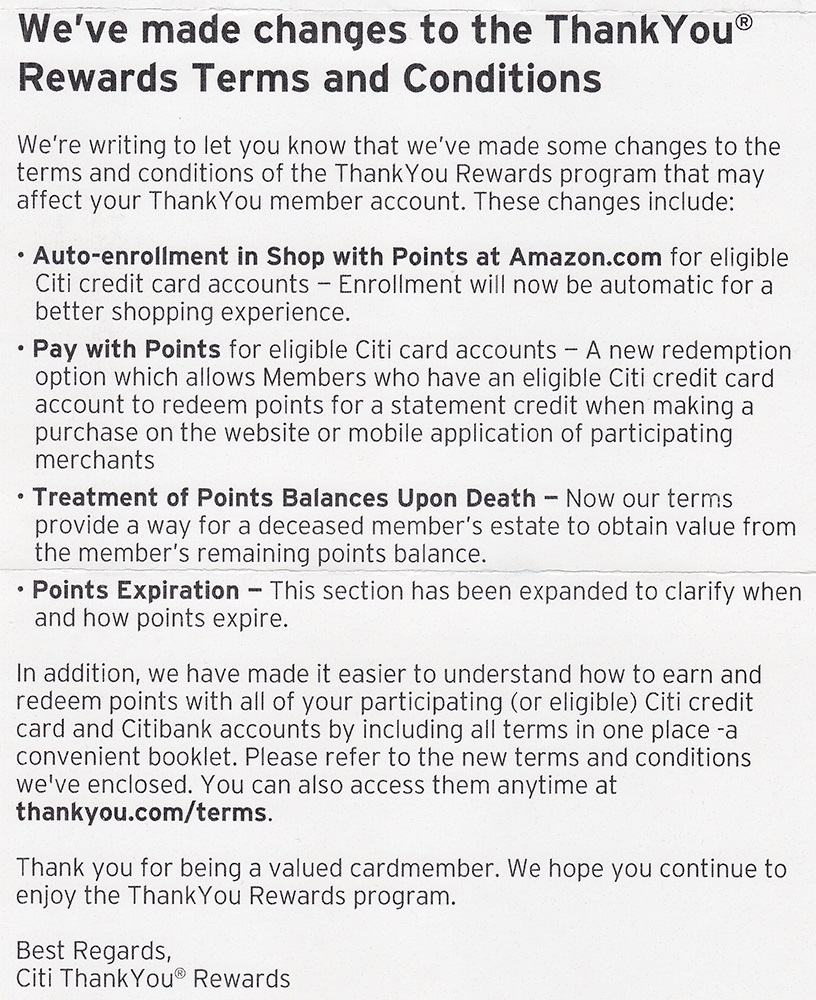

Good morning everyone, happy Super Bowl Sunday. Before the Big Game kicks off, let’s examine the recent changes to the Citi Thank You Points program terms and conditions. If you like long, boring posts about Citi credit cards, this post is for you. I know Travel Codex covered this topic on February 2, but my letter arrived late (a recent change of address is causing all my mail to arrive late). Anyway, in the letter, Citi announced 4 changes:

- Auto-enrollment in Shop with Points at Amazon.com

- Pay with Points

- Treatment of Points Balances Upon Death

- Points Expiration

I will go super in-depth to cover each of these topics and share some interesting findings regarding the Citi Prestige, Citi Premier, Citi Forward, and Citi Business Thank You Card.

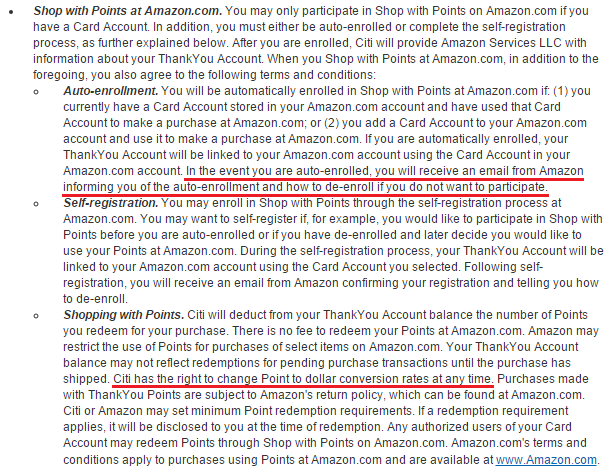

First things first, all the information in this post can be found in the terms & conditions page for the Citi Thank You Points Program. The first announcement from Citi was that if you add a Thank You Point earning Citi credit card to your Amazon account, you will be auto-enrolled in Amazon’s Shop with Points program. If you want to un-enroll at a later point, you can do that easily online. I’m not a big fan of programs auto-enrolling me into not-so-great deals, so I think this is a bad idea for people who value Citi Thank You Points at more than 0.8 cents per point (CPP).

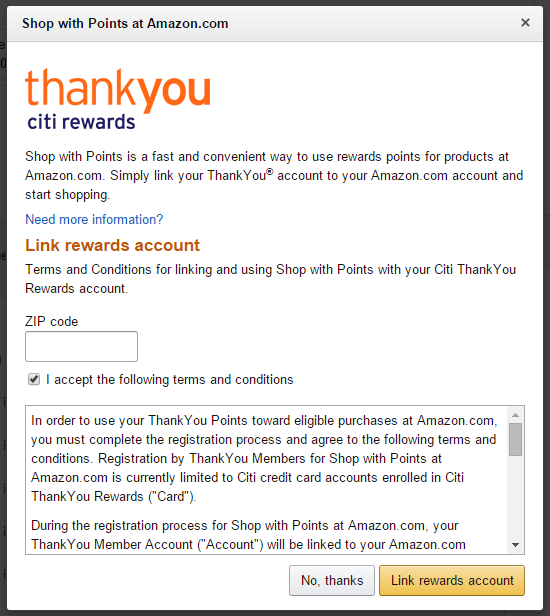

You also have the option to manually enroll in the Shop with Points program on Amazon. During the checkout process, go to the payment page and add a Thank You Point earning Citi credit card. There will be a link below the card to join the Shop with Points program. On the popup screen, enter your zipcode and accept the terms and conditions.

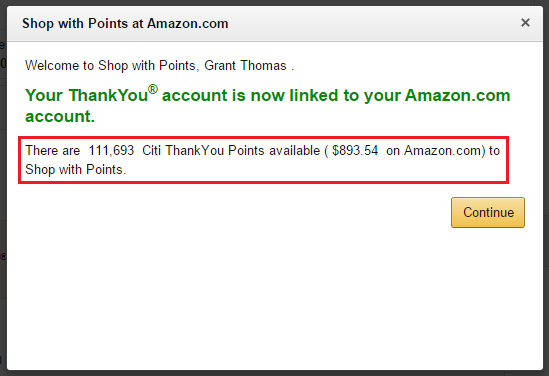

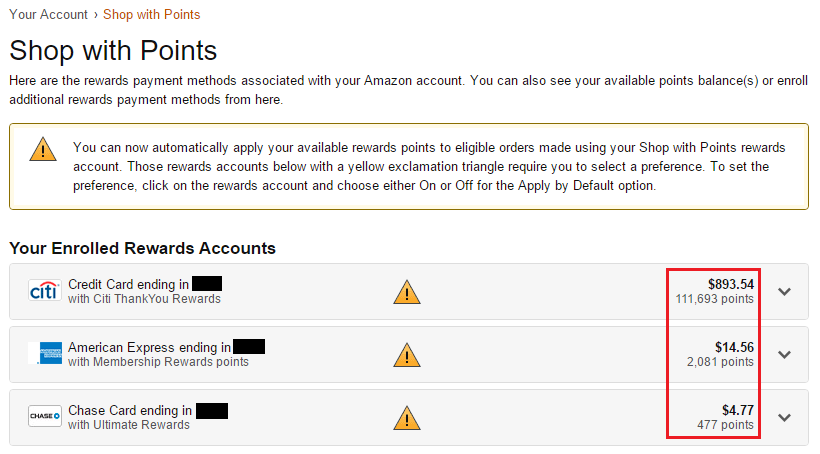

I am now enrolled in the Shop with Points program. Unfortunately, Citi Thank You Points are only worth 0.8 CPP ($893.54 / 111,693). My current stash of Citi Thank You Points is only worth $893.54 on Amazon. By comparison, if I used my Citi Thank You Points to book paid American Airlines flights, I would get $1787.09 in value (read How to Book American Airlines Flights with Citi Thank You Points (1.6 Cents Per Point Value)).

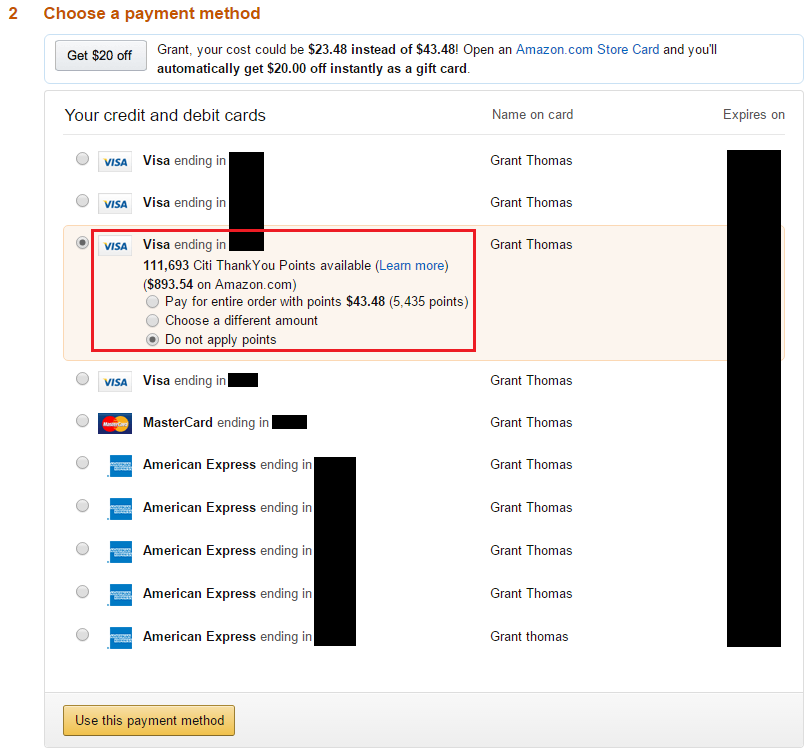

During the checkout process, the default payment method is set to “Do not apply points”, but you can change that selection to use all points or some points and charge the rest. Now, let me un-enroll in the program before I mistakenly spend all my Citi Thank You Points at Amazon.

Fortunately, Amazon makes it very easy to un-enroll in Shop with Points. You can manage all your Shop with Points accounts here. Time to remove Citi, Chase, and American Express from Amazon.

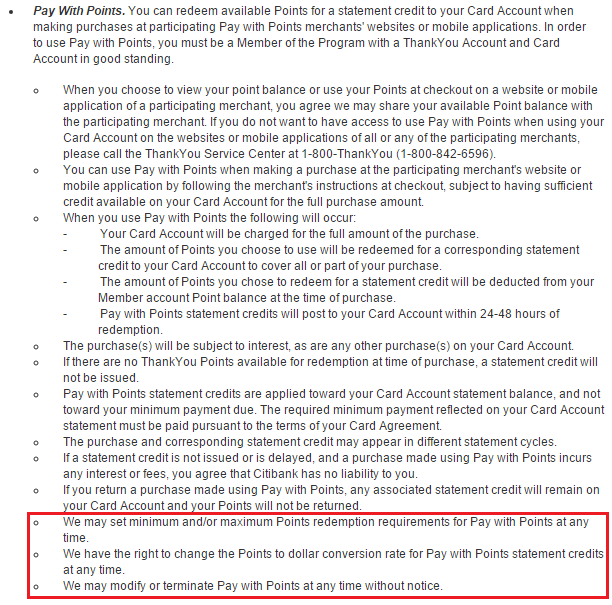

Up next is Pay with Points (not to be confused with “Shop with Points”). I don’t know much about this feature, but I am pretty sure the value of Citi Thank You Points will be around 0.8 CPP too. As the last 3 bullets indicate, anything can happen with this feature.

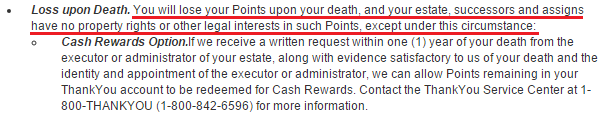

Up next, Citi says that if/when you die, you will lose all your Citi Thank You Points and the only way to get them back is to jump through a bunch of hoops. He who dies with the most Citi Thank You Points is not travelling enough. Lesson learned: spend all your Citi Thank You Points before you die.

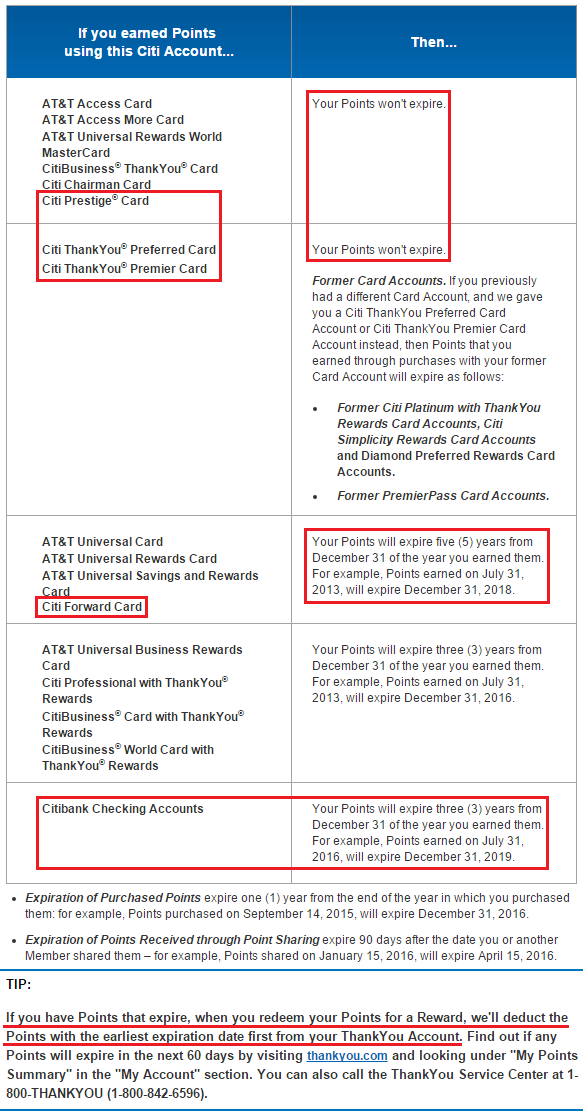

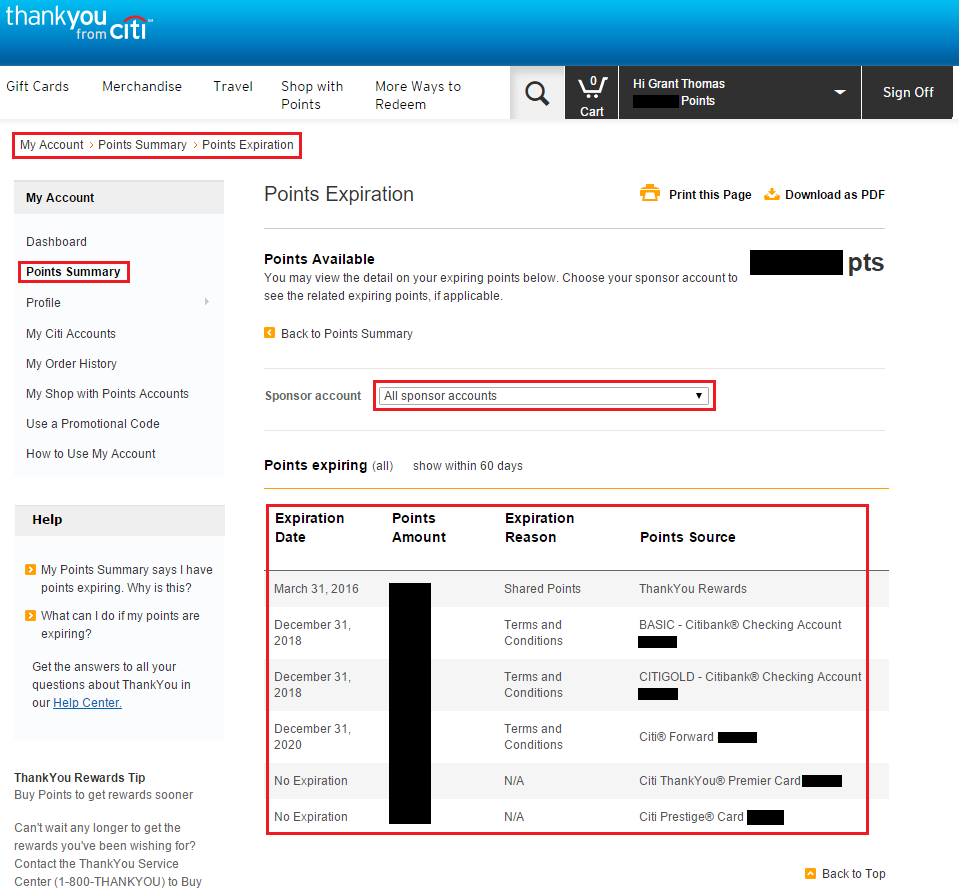

That’s it for the all the announced changes from Citi. While I was browsing the terms and condition pages (makes for great weekend reading), I found some interesting charts that I thought were worth sharing. Here is a very detailed breakdown of when your Citi Thank You Points expire, based on the credit card or account that was used to earn them. Basically, if you have a Citi Prestige, Citi Premier, or Citi Preferred, your Citi Thank You Points never expire… except if you product changed from one of the below mentioned Citi credit cards. Citi Thank You Points earned on my Citi Forward expire 5 years after December 31 of the year I earned the points. Any Citi Thank You Points earned with a Citi checking account (Citi Gold) expire 3 years after December 31 of the year I earned the points.

If you purchase Citi Thank You Points (don’t do it!), those points expire on December 31 of the following year. If you received Citi Thank You Points from someone (possibly a secret admirer for Valentine’s day – try to figure out how they got your Citi Thank You Points account number, since you might have an identity thief secret admirer), those points expire within 90 days from the date you received them.

Luckily, Citi says that they will use the Citi Thank You Points with the earliest expiration date first for all points redemption. That is good to hear. To see the expiration dates for your Citi Thank You Points, log into your Thank You account, go to Points Summary, and click the Points Expiration link. If you have several different Citi Thank You Point earning accounts, you will probably have several different expiration dates.

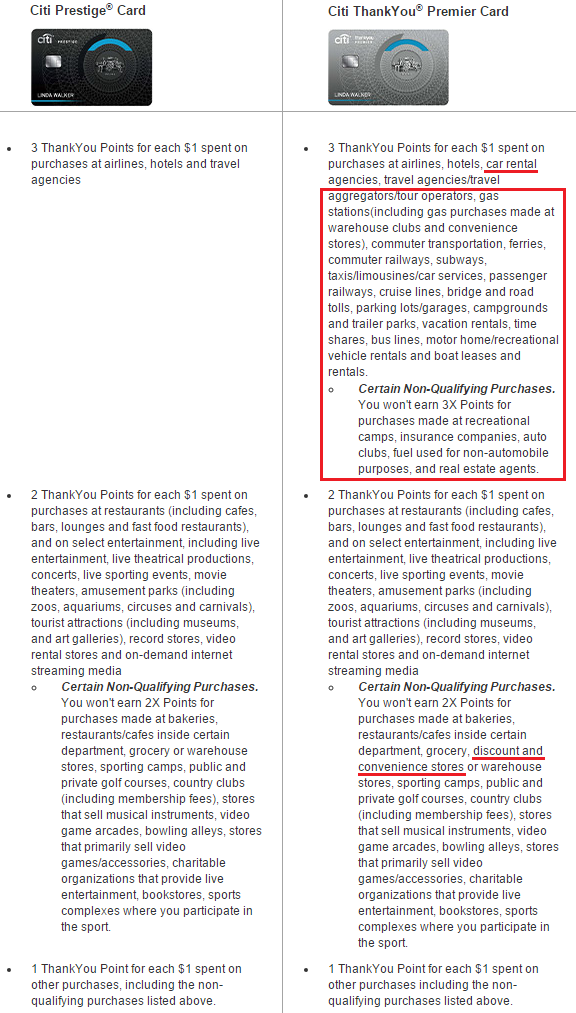

Up next on the terms and conditions page, I found information about the Citi Prestige and Citi Premier. I created this side by side comparison to illustrate which card has the far superior earning abilities. Would you be surprised to know that the Citi Prestige has a $450 annual fee and the Citi Premier only has a $95 annual fee? You would think that the credit card with the higher annual fee would have better earning rates and categories, right? Well, you are right, but apparently Citi disagrees. When in doubt, use your Citi Premier for all travel expenses (except the $250 airline reimbursement on the Citi Prestige).

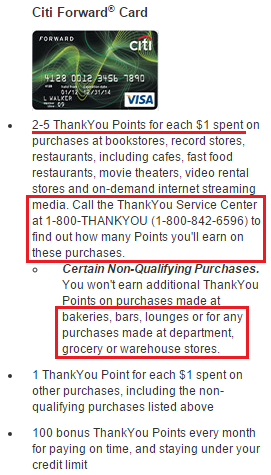

I had a mini heart attack when I looked at the Citi Forward terms. It says “2-5 Thank You Points for each $1 spent” at all the familiar categories. I think “On-Demand Internet Streaming” was added later since Netflix, Hulu, HBO Go, etc. were not as popular when this card first came out. But, getting back on track, the part I found frightening was that it says “Call the Thank You Service Center…to find out how many points you’ll earn on these purchases.” So I called the Citi Thank You Service Center and asked a few questions, mainly, was I going to lose my 5x earning capabilities? After the rep double checked, she told me that since I signed up for the Citi Forward when it was offering 5x, I will continue to earn 5x. She said that Citi tested out the Citi Forward with only 2x, so those cardholders (suckers!) will continue to earn 2x. I don’t know if I would be more mad that I was going from 5x down to 2x, or if I had signed up at 2x and everyone else was getting 5x except me. Also deeply troubling is that the Citi Forward earns 5x at cafes, but bakeries are excluded. Bars and lounges are also excluded, which is not good either.

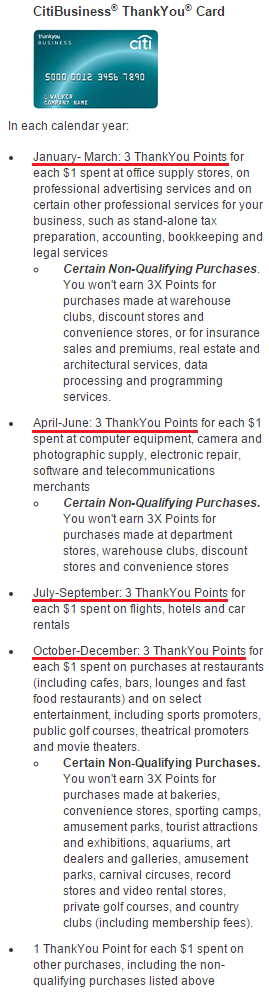

Last but not least, I stumbled onto the Citi Business Thank You Card. I have only heard stories about this card, but never seen it in the wild (like the Great White Whale in Moby Dick). This card has interesting rotating cash back categories like “office supply stores, electronic repair, flights, and restaurants.” While I was still on the call with the Citi rep, I asked her if this card was still available or if I could product change from my Citi Business American Airlines Card (which is getting quite dusty). She put me on a long hold to inquire. Unfortunately, the Citi Business Thank You Card is not available for new sign ups or for product conversions. Drats!

I didn’t see the Citi Dividend mentioned anywhere on the terms and conditions page, so I’m sure that credit card will not be along much longer. You better product change to that card while you still can, if you still want it.

If you have any questions, please leave a comment below. Have a great day Super Bowl Sunday everyone!

I did a product change from the citibusiness AA into the citibusiness thank you card last summer when they didn’t have a retention offer I was interested in. The agent actually suggested it. I wasn’t aware of the card before then…

Dang, you got to do the product conversion when that was still available. I wish I tried to do that sooner.

What an amazingly ridiculous and complicated point expiration policy. Is it so hard to simply have a no expiration policy like almost everyone else?

That being said, great post, Grant. I will be removing my Pay with Points accounts from Amazon immediately.

The different expiration dates are crazy confusing. Glad to help with Shop with Points on Amazon. TYPs are too value to use on Amazon.

I do like long, boring posts about Citi credit cards so thank you =]

How I wish I was able to get the Forward card still. If only I knew how valuable Thank You points would become back then.

Also, small fix, you stated the Prestige gave a $200 airline credit when it’s actually $250.

Ahh, good catch. Let me fix the $250 airline credit. Glad you enjoyed the nitty gritty credit card details.

So, how is that spirit mastercard been working? I was thinking about getting on possibly if it gets cheap short flights actually. Also, any good ideas on what to do with my BCP Amex card. I chatted online, but they did not offer me anything and only recommended changing to the plain blue cash card. Thanks

Product change the AMEX Blue Cash Preferred to the AMEX Old Blue Cash (this might be difficult for the rep to understand). I continue to put $5/month on my BofA Spirit Airlines CC to keep the miles from expiring. I have about 25,000 Spirit miles right now. I haven’t used them yet, I’m just waiting for one of my friends to tell me they need a cheap last minute flight to Vegas, to book the award flight for them :)

Just got a notice in the mail the citi forward points are dropping for me from 5x to 2x in June…

Yes, me too. Very sad indeed. I need to write a follow up post to this post.