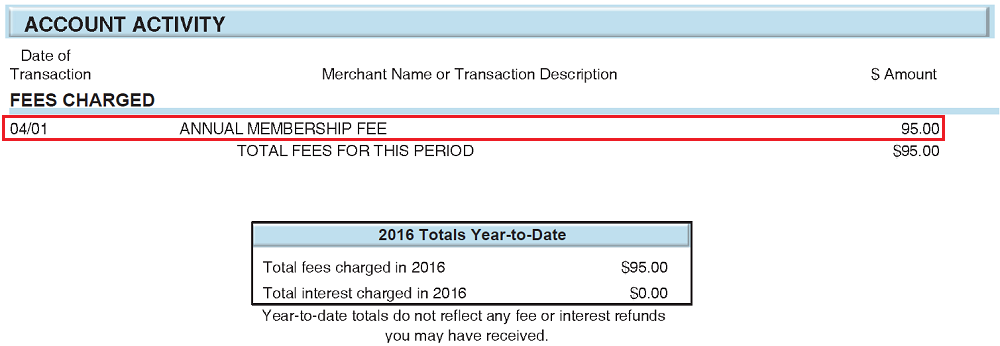

Good morning everyone. A few days ago, my $95 annual fee posted on my Chase British Airways Credit Card and I had to make a few decisions. Would I keep the credit card open and pay the annual fee or close the credit card and avoid paying the annual fee? Could I convert the credit card to a different Chase credit card? Could I transfer the credit line to a different Chase credit card? So many questions, but I ultimately decided to call Chase and ask if they could convert the Chase British Airways Credit Card into a Chase Freedom Unlimited Credit Card.

Long story short, the Chase rep said that I could not product change from the Chase British Airways Credit Card to the Chase Freedom Unlimited Credit Card because they are separate product lines. Since there is no top tier/bottom tier options (like the Chase Southwest Airlines Plus and Chase Southwest Airlines Premier Credit Card), I cannot change the Chase British Airways Credit Card to any other Chase credit card.

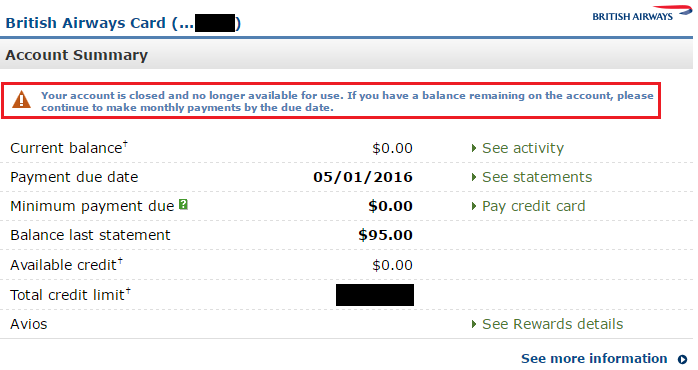

I told her I would like to close the credit card, but first I wanted to move my credit line over to my existing Chase Freedom Credit Card. She was only able to move over a portion of the total credit line, but that was fine. Moments later, my Chase British Airways Credit Card was closed.

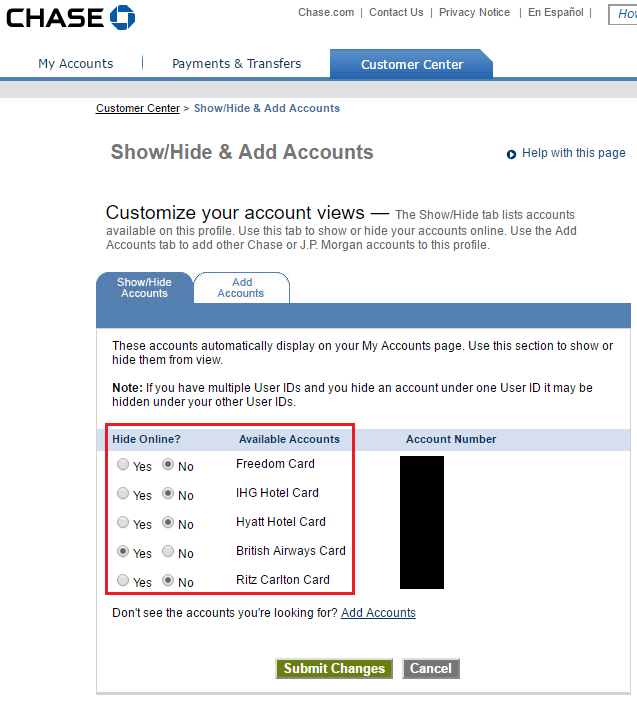

If you have recently closed a Chase credit card, you will see the above message regarding the account closure. Chase has a cool feature where you can show and hide accounts from your online profile. All you need to do is go to the Customer Service tab, look for the link that says Show/Hide accounts, then select the accounts you want to hide online. The process is instant and your online account will be updated instantly.

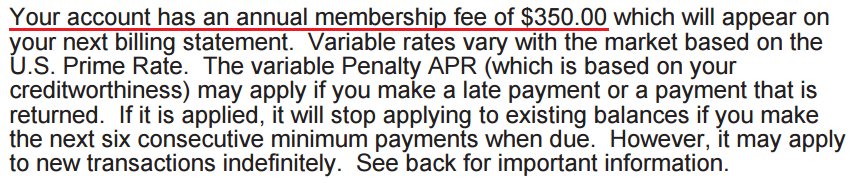

In non-Chase credit card related news, I just received my Citi Prestige Credit Card statement. At the bottom of the statement, is a message related to the annual fee. The standard annual fee is $450, but my annual fee is $350. When I originally signed up for the Citi Prestige Credit Card, I had a Citigold Checking Account open. I have since downgraded my Citigold Checking Account to a basic Citi Checking Account, but it appears that the discounted annual fee on the Citi Prestige Credit Card still applies.

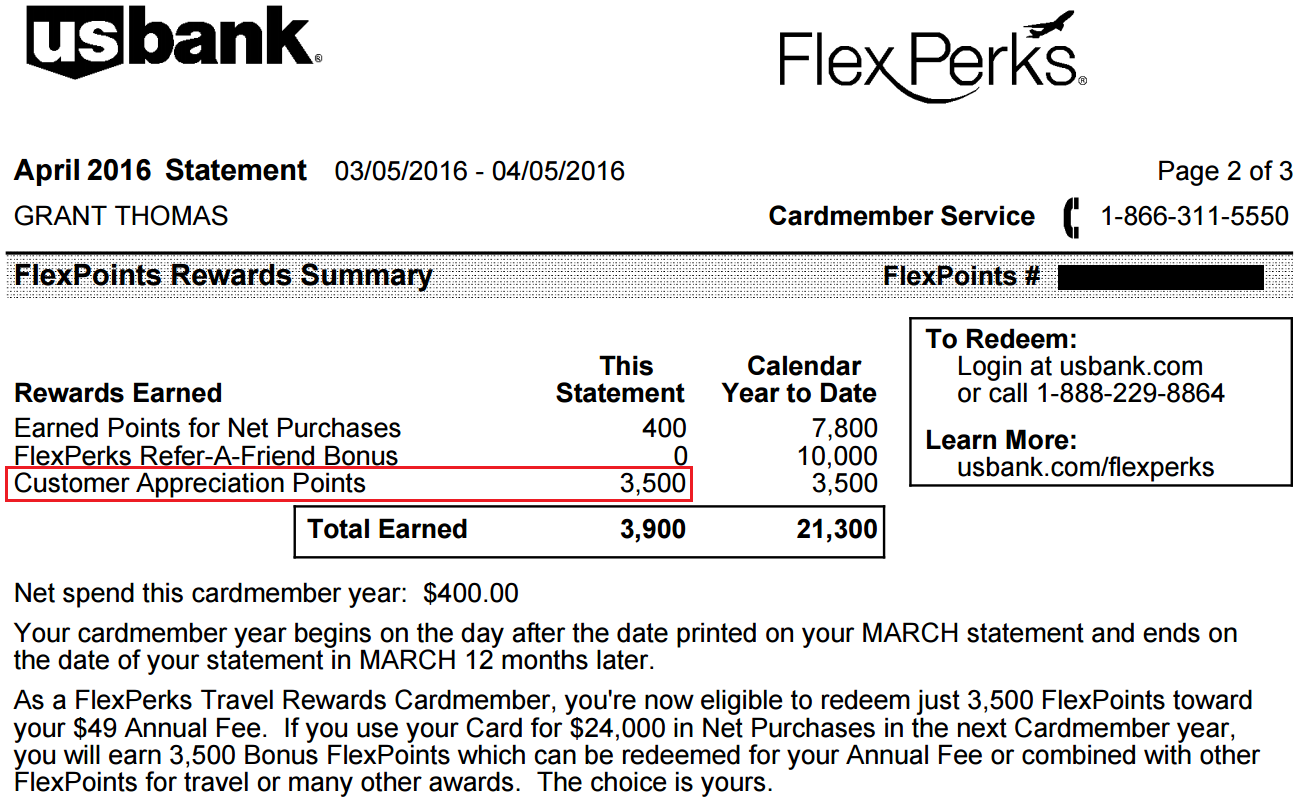

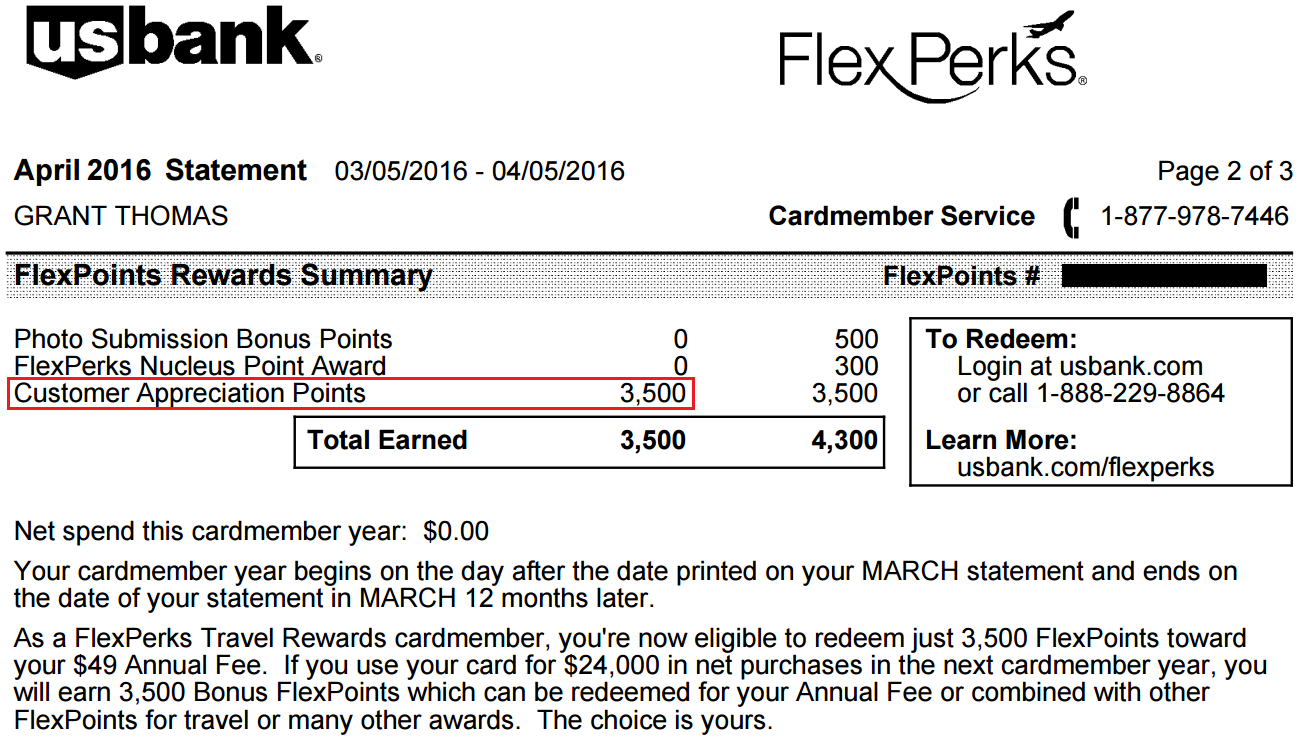

Last month, I wrote US Bank FlexPerks Visa and AMEX $49 Annual Fees Just Posted – Next Steps? I was able to speak with a US Bank customer service supervisor who offered me 3,500 bonus FlexPoints for keeping both of my US Bank FlexPerks Visa Signature Credit Card and US Bank FlexPerks American Express Credit Card open and paying the $49 annual fee on both credit card. Both bonuses posted on my next US Bank statements and are ready to be redeemed.

If you have any questions, please leave a comment below. Have a great day everyone!

Do you think I could convert a Chase Sapphire to a freedom unlimited?

You sure can.

I did this the day the FU (should we officially acronym it the “CFU”?) was available for phone PCs.

Silly goose. You can’t product change any co-branded Chase card to an Ultimate-Rewards-earning Chase card.

They do seemingly allow PCs of UR cards across the spectrum. E.g. CSP>Freedom; CSP > FU; Freedom>FU, and so forth.

Also you can PC the UR business cards: e.g. Ink Plus > Ink Cash or vice versa.

I might downgrade my Chase Ink Bold to a Chase Ink Cash/Classic soon, so hopefully that goes through easily.

I’ve done that last year and didn’t have a problem with the downgrade.

About 2 years ago I successfully PC’d a Chase Southwest Premier Business card into the no AF Chase Ink Cash. Just a data point…not sure if it’s still relevant today though.

All data points are helpful, no matter how old. As long as Chase hasn’t updated the system to prevent those conversions, it should still be possible today.

My BA annual fee is coming up in June I was planning on doing the same thing. Well, now i guess Ill just have to close the account and transfer the credit line. Did you ask for any retention offers? Last year I got 2 separate offers 3 months before my fee was due then again when the fee hit. 9,000 Avios for spending $1,500 in 3 months. That’s when Target Red card was still working so it was easy. I took both offers and scored 18,000 Avios in 3 months.

I didn’t ask for any retention offers and no offers were mentioned by the Chase Rep either.

My annual fee for BA was up in February. After it posted, I called three times to try and get a retention offer. No luck. I ended up calling a fourth time, moving over the credit line to my Chase Freedom, and closing the BA card a week or two ago.

Gotcha, thank you for the data point. I didn’t put any spending on the credit card after meeting the minimum spend, so I figured there was no shot at a retention offer.

Interesting to know, thanks. Am also hoping to get the unlimited somehow.

It seems like the only way to get it is to apply directly or downgrade from a Chase Sapphire Preferred or convert from the Chase Freedom.

Hey Grant, slightly off topic – how does cancelling a card affect the average age of your credit accounts? I see conflicting reports that say that despite the card being cancelled it may still factor into average age for 10 years.

I believe you are right. Both open and closed accounts affect your average age of accounts for 7 to 10 years. I need to recommend keeping no annual fee cards open for ever or downgrading annual fee cards to no annual fee cards.

Good instructions on savagely culling the file for cancelled Chase cards. I’ve had a cancelled card show up online for the past six months, and by the way I wasn’t permitted to transfer the last $500 of my CL on that United card to a Freedom.

My chase British Airways credit limit was $5000, but I was only able to transfer $3900. Strange why that happens.