Good morning everyone. As you know (if you read this blog regularly), I was recently approved for 6 new credit cards during my latest App-O-Rama. Keeping track of 6 credit card sign up bonuses and minimum spending requirements can be challenging, but I have a trusted system that I developed over the years. After activating each new credit card online or over the phone, I call the customer service number on the back of the credit card and ask the rep some questions:

- I ask to change the bill due date (I set all my credit card due dates to the first of the month).

- I ask to lower the cash advance limit to $0 or as low as possible (unfortunately, this is not possible with some credit card companies).

- I ask to enroll in paperless statements and text alerts (most of the time I end up setting this up online myself).

- *lastly, but most importantly* I ask about the details of the credit card sign up bonus (double checking that the sign up bonus, minimum spending and time range match my records).

Next, I create an online account or add the credit card to an existing online account (most credit cards can be linked/shown on the same online account, with a few exceptions).

If you use Mint, Personal Capital, or another personal finance tracking service, add the new credit card to that account so your credit card activity can be tracked. (I personally do not use any of these services, but they can be helpful for managing finances.)

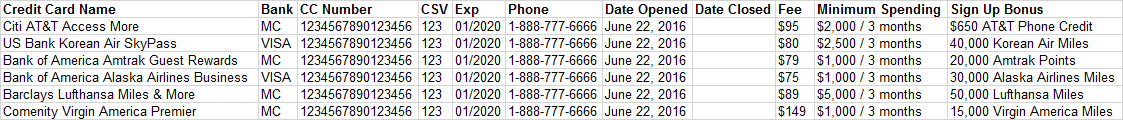

I add the new credit card info into a password protected spreadsheet, including the credit card name, payment processing network, card number, security code, expiration date, phone number, opening date, closing date (blank for now), annual fee, minimum spending requirements (with time range/end date) and sign up bonus.

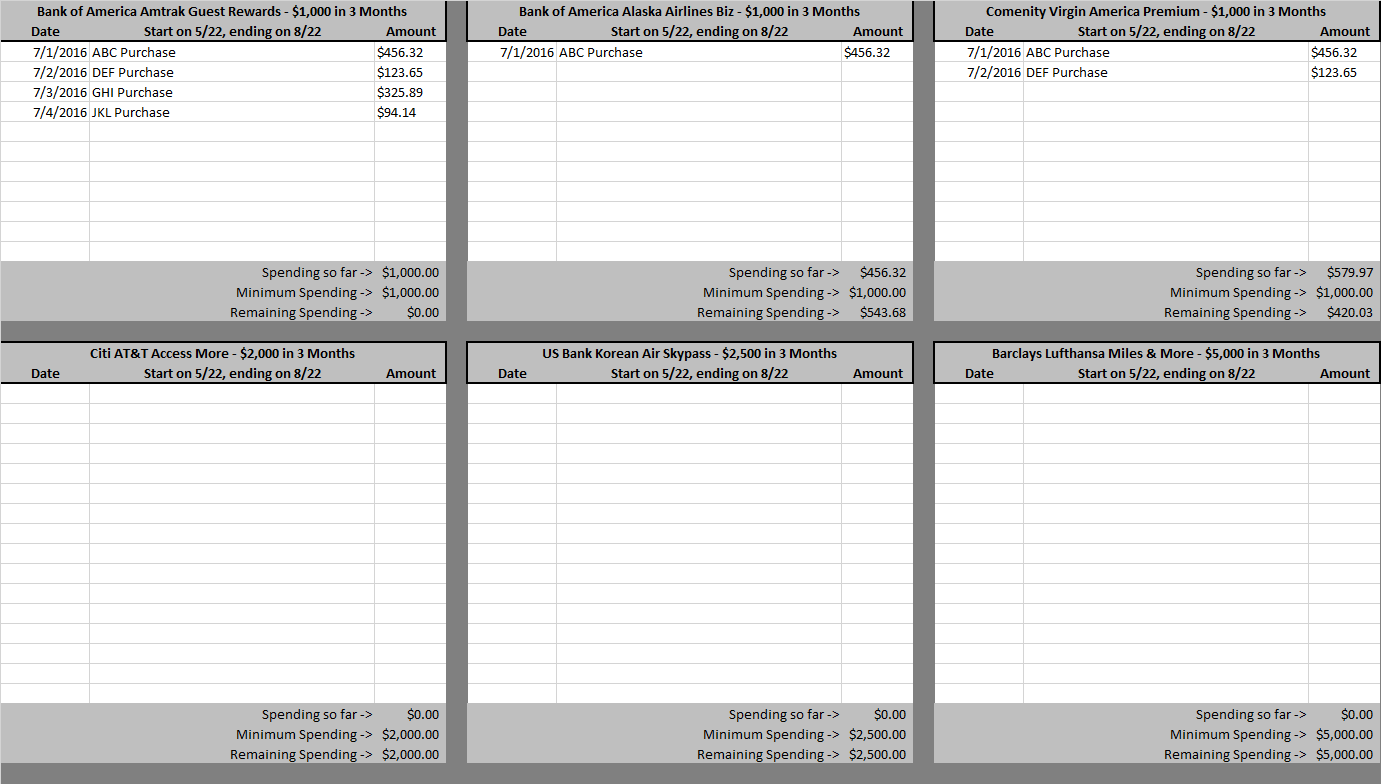

Since I am working toward several credit card sign up bonuses, I created a separate spreadsheet to track all my purchases on those credit cards to ensure that I complete the minimum spending requirement before the deadline. *Remember, annual fees do not count toward your sign up bonus minimum spending.*

After setting up my spreadsheet, I track all my credit card transactions to ensure I hit the minimum spending requirements and that the sign up bonuses post promptly. If not, I double check my records and call customer service to determine the reasoning. It’s best to complete your minimum spending 1-2 months before the deadline, that way you have a small buffer in case you miscalculated your minimum spending amount.

If you have any credit card activation tips or different steps in your routine, please let me know. If you have any questions, please leave a comment below. Have a great Wednesday everyone!

Very nice but if you are tracking five persons credit cards in the family with their permission, then I think it becomes a little bit of chaos and I don’t know what to do with it

Just make 5 different tabs on the same Excel spreadsheet. It’s possible to track many credit cards, you just need to be very detailed and organized.

Great post, Grant. This will be very helpful for each new card application. btw, I would like to know more about the password protected spreadsheet. Few questions:

1. Google docs doesn’t allow password protected document. Do you just keep it as a regular file in your system or some cloud?

2. If you have a template or a blog post with more details about this, then plz share.

I use Office 2016 and save the file to my OneDrive cloud. I can access the file from any computer by logging into my OneDrive account and then by entering the password for the Excel spreadsheet. I wouldn’t recommend using Google Doc since it’s not as secure.

I find meeting minimum spend requirements with normal purchases to be too much of a tracking burden so I do them all with manufactured spend.

Likewise, I complete most minimum spend by manufactured spending, but I put all my everyday 1x purchases on the credit card with the highest minimum spend to meet.

I’d be interested in seeing a template for this too; currently using Dashlane which also encrypts passwords for me as well. Saves all that data above and can access securely elsewhere, but that spreadsheet idea seems much simpler.

The screenshot of the template should be able easy to create on your own.

Pingback: How to Find Super Cheap Flights, Quitting Alcohol as a Frequent Traveler, Credit Card Activation Routing & More! - Miles to Memories

Funny, but I independently came up with my own spreadsheet and its so similar to yours. Only difference is I have a last column where I put in notes whenever I talk to a Customer representative with a brief summary of the conversation and the date of the conversation.

What I am having trouble with is coming up with six cards who will approve me for bonuses, after getting them once already. Is there a blog which tells you how and which cards to get again and when?

This post is a little old but it talks about which credit cards are churnable: http://www.doctorofcredit.com/list-of-churnable-credit-cards/

Each new card I do:

– Activate the card online

– Register the card with existing online account with that bank if at all possible

– SM to verify the bonus I’m expecting before I do the spend

– Set up my cell phone for notifications, esp. fraud so you can clear those up quickly.

– Register for paperless in general, except sometimes with Amex of course until I get a bonus to do so.

– Add an AU if needed and I didn’t do it during application (mostly adding me to wife’s cards, but for Amex I always add extra AU’s for Amex offers)

– Add the card to my tracking spreadsheet. I keep the spreadsheet in a Boxcryptor folder on Dropbox.

(I don’t keep my full credit card numbers in the spreadsheet, those are in LastPass for form fills).

I use background colors to track the various states–light green for spend hit, deep green for got reward, yellow to orange for the one needing focus right now. When cards get cancelled they move to the bottom of the sheet so I can keep track of when they were cancelled.

– Add the card details to LastPass including AUs. Allows auto-form fills. Protected by encryption and 2nd factor with a Yuba key.

– Add the credit card to Mint

– Add the credit card and payment date to my Google Calendar. With some cards you don’t know either so set up a date when I will know.

– For Amex cards set each one up for Amex Sync of course–new email alias, new twitter handle, set up amex sync, etc.

Or something like that… :-)

Dang, that’s a lengthy process. Glad you found a system that works for you :)

I use QuickBooks (since I use it for my small business anyway), so keeping track of spend is easy. That being said, is there an advantage to doing this on Excel vs just a Word table if I don’t need to track spending? Just starting this and don’t want to overlook anything. Thanks!

Excel is easier for creating and maintaining tables, but if you prefer Word, go for it :)

Hi, Grant! This article was so helpful! I’m fairly new to all of this. One question I have is why lower your cash advance to $0?

Cash advance charges have huge fees and interest rates. Basically, they are total rip offs. Lowering your cash advance limit to $0 prevents accidentally making a cash advance transaction.

Why do you set all your due dates to the same date?

I set all my due dates for the same date so I can make sure I pay them all off. If I have 30+ credit cards, it would be very hard to keep track of all the due dates, plus, when I set the due dates to the first of the month, I get my miles/points/cash back sooner.

Pingback: Blow $1 Million on Travel, Sharyn Canyon, Uto Island, Pet Hippos - TravelBloggerBuzz