Good afternoon everyone, I have one more quick post to share this weekend. My Citi Prestige Credit Card annual fee is set to post in early May and I do not anticipate keeping the credit card for another year, since there is a big devaluation to the card benefits that goes into effect on July 27. Doctor of Credit has more details, but here are the big blows to the card benefits:

- Eliminating 3 free rounds of golf.

- Eliminating American Airline redemptions at 1.6 cents per point (if you have any upcoming AA flights, read How to Book American Airlines Flights with Citi Thank You Points (1.6 Cents Per Point Value)).

- For all other flights booked with Citi Thank You Points, the redemption rate is changing from 1.33 cents per point to 1.25 cents per point.

- Fourth-night-free hotel benefit will be based on average nightly rate instead of the 4th night’s rate (and the fourth-night-free benefit will no longer include taxes).

- Eliminating Admirals Club access.

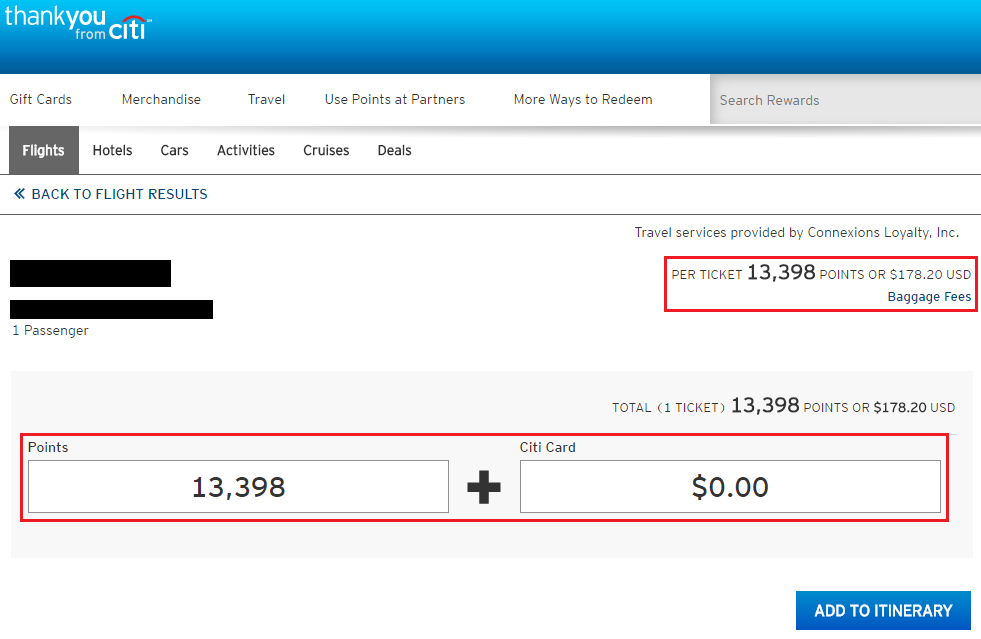

With those devaluations in mind, I wanted to redeem the full $250 airline travel credit before the annual fee posts. I wanted to experiment and see if flights booked with Citi Thank You Points and cash would trigger the $250 airline travel credit. For those unfamiliar with booking flights through the Citi Thank You portal, you have the option to pay for flights with all Citi Thank You Points, with all cash (you might as well book directly on the airline’s website) or a combination of Thank You Points and cash. In the example below, the flight costs $178.20 or 13,398 Citi Thank You Points.

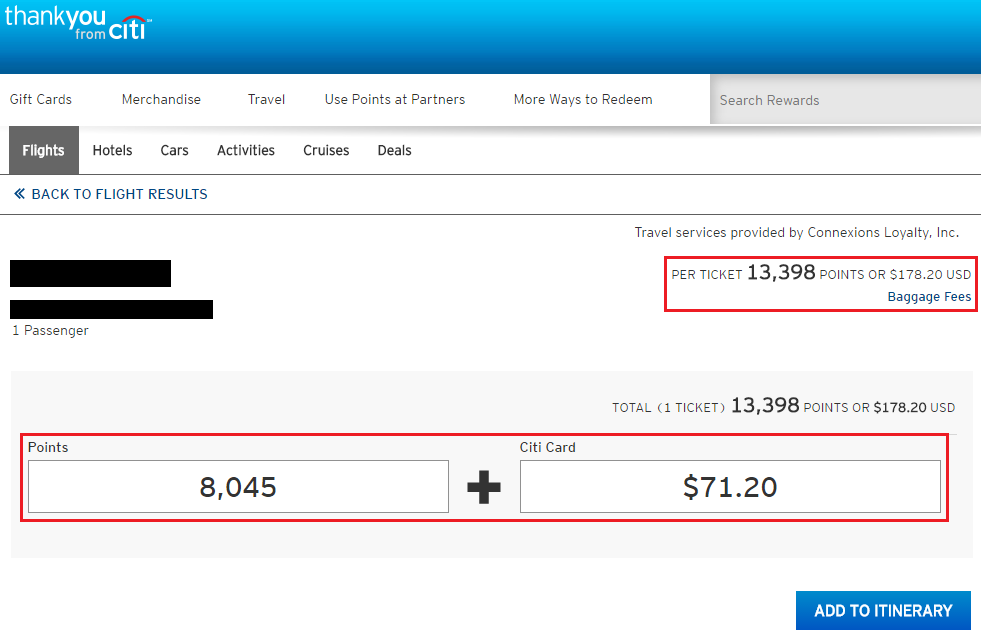

Since I had $71.20 left of my $250 airline travel credit, I wanted to pay $71.20 with my Citi Prestige Credit Card and use Citi Thank You Points to pay for the rest of the flight.

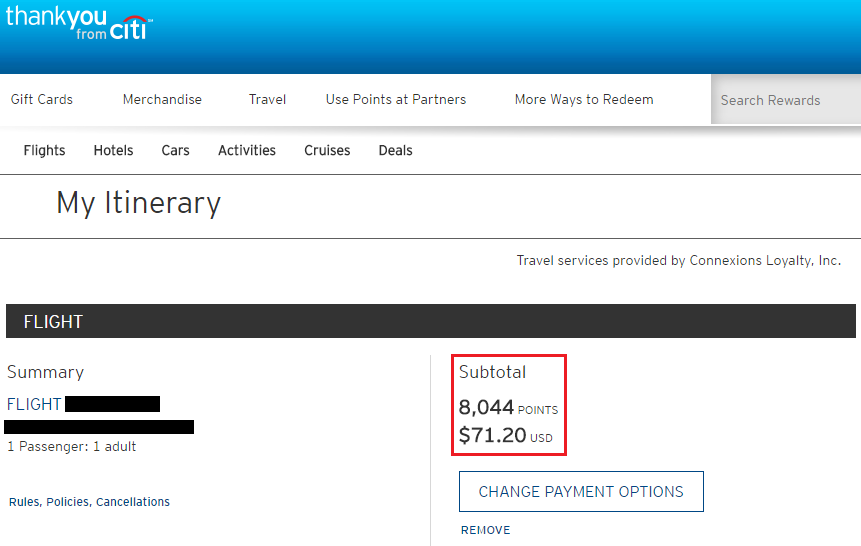

Due to rounding errors, the amount you pay in Citi Thank You Points may change by 1-2 points when you get to the checkout page. I booked the flight and paid a total of $71.20 with my Citi Prestige Credit Card and used 8,044 Citi Thank You Points to cover the rest of the cost.

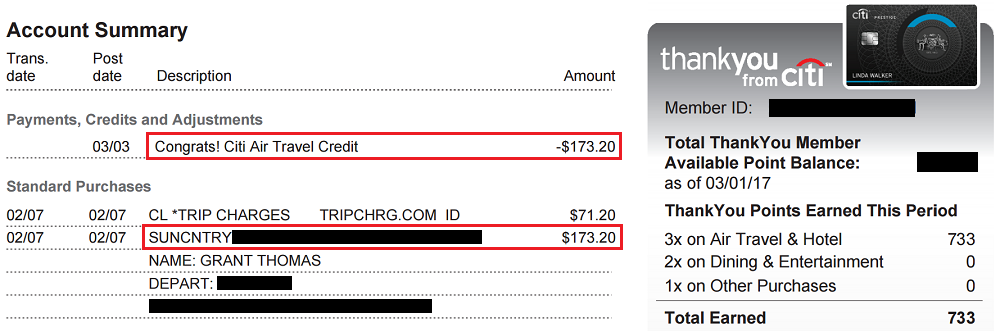

My Citi Prestige Credit Card statement just closed and I checked to see if the $71.20 charge counted toward the $250 airline travel credit. Unfortunately, the charge did not count. I thought that would be the case since you are essentially paying Citi’s travel provider (Connexions Loyalty, Inc.) and then they buy the ticket for you with their credit card (you can verify this if you look at the payment details on all flights booked through the Citi Thank You portal – the credit card used to book the flight is not yours). Since Citi’s travel provider does not code as an airline, you do not trigger the $250 airline travel credit. Surprisingly though, the charge did code as a “3x Air Travel & Hotel” charge, which was a nice consolation prize ($71.20 + $173.20 = $244.40 x 3 = 733 Citi Thank You Points).

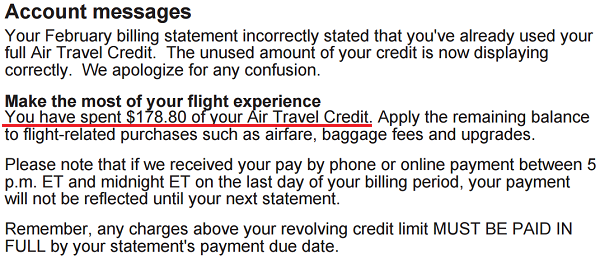

Lastly, my Citi Prestige Credit Card statement says I have spent $178.80 of my $250 airline travel credit (leaving $71.20 left to be redeemed). It also had a message that said: “Your February billing statement incorrectly stated that you’ve already used your full Air Travel Credit” which is not true – there is no message like that on my February statement. Looks like Citi has some technical difficulties with their statements. Did anyone else have that message on their statement?

If you have any questions about redeeming Citi Thank You Points or redeeming the full $250 airline travel credit, please leave a comment below. Have a great weekend everyone!

The Citi $250 airline credit is for charges directly with the merchant, yes?

Citi’s travel provider (Connexions Loyalty, Inc.) is a travel agent, not an airline. Ergo, using Citi’s travel provider (Connexions Loyalty, Inc.) would not trigger the airline credit.

Yes and yes. My experiment failed, so hopefully no one else will make the same mistake.

I was going back and forth with trying to decide if I want to keep it especially since the admirals club is no longer a part of it. What I decided was that I was going to as I spend far too much time in hotels and using the benefit, even excluding taxes, nets me a huge amount of return. Are there any other 4th night cards or similar with lounge access out there?

If I could take advantage of the 4th night free benefit, the Citi Prestige would definitely be a keeper, but I have no used that benefit ever in almost 2 years :(

Great data point Grant, I had called the Citi Thank You department last year and they said it should code as travel, therefore making it eligible for the Prestige airfare credit, but they were obviously incorrect. I wonder if there is a manual option to have them code it differently if you called in.

I think calling in would probably code the same was as booking online, but I’m not 100% sure.

Thanks for sharing, I was actually counting on this exact scenario to use up my airline credit this year. Looks like I’m back to the drawing board. That’s the problem with all these co-brand cards and free 1st checked bags, not really any airline incidental charges planned. It’s hard enough to use the credit on all these amex plats!

I keep thinking I’m going to cancel this card, but by the time renewal comes around I already have more 4th night free bookings made for the future where the savings is more than the AF, so that’s how they’ve hooked me. As long as that benefit stays I don’t know that I’ll ever cancel.

If you have plans to travel on Southwest Airlines, you can book SWA flights and pay with your Citi Prestige. Then you can cancel the flight and use the SWA travel credit for a future flight. You have 1 full year to use the credit.

Sounds like the Citi Prestige saves you more money than the annual fee costs you, so you should definitely hold onto the credit card.

For those of us paying $350 AF, I think this card is justifiable.

I’m not sure, I pay the $350 AF too, but I also have a Citi Premier that I use way more than the Citi Prestige. Other than the $250 airline travel credit and redeeming AA flights at 1.6 CPP, I don’t use any other features of the Citi Prestige (no 4th night free, no rounds of golf, and I have Priority Pass from several other CCs).

Pingback: What Charges Count Towards The Citi Prestige $250 Air Travel Credit? - Doctor Of Credit

retention offer last year they gave me 4 extra points per dollar spent on prestige -ill be calling them this week as my card is up —– I also pay 350 so for a hundred dollars getting 7x on airfare n hotels and 4th night free its a keeper but if they don’t offer 4x ill cancel

7x is a great deal. You must have spent a lot of money on the card last year to get a good retention offer like that. I barely spend more than $300 a year on the card, so I am not expecting much love from Citi.

it was 4x bonus offer – capped at 35000 citi points then plus the 3 you normally earn – that offer is good for 6 months – hope I get same offer this year but many got same offer ive read

they gave me a end year statement saying I earned 102,000 citi points in 2016

Impressive haul of Citi Thank You Points in 2016 :)

What do you typically do with your Citi Thank You Points?

Tomorrow I’m posting how I turned 93,000 citi points into 129,000 AA miles and as far as other uses of citi points ive just collected but will have to deside soon if my retention offer isn’t 4x again

Sweet, I look forward to checking out your post. Have a great night CJ.

Once you make use of the 4th night free benefit, you’ll never let go of the card. Even with the ‘devaluation’ of 4th night free now being the average of the 4 nights with no taxes, I still find it to be a killer benefit. Especially when coupled with a stay 3 nights pay for 2 offered by some really nice hotels (Lanhgam, Peninsula, etc.) – this brings the cost-per-night down from the stratosphere at these hotels into the realm of accessibility and it can then be price-competitive with the major chain hotels.

It helps that I am not a 1 or 2-night hotel stayer whilst on vacation. I like to linger in a place for a bit, so this card benefit suits me well. If I’m doing a two-week euro trip for example, i’ll divvy it up at 4-nights per destination. Plus, you still get elite credit for that 4th night if the hotel is a Hyatt or Marriott/Spg, etc.

I can definitely see the value of the 4th night free benefit, but I very rarely stay in the same city/hotel for longer than 2-3 nights. If you can take advantage of the 4th night free and stack it with other promos, it is a no brainer to keep the card long term.

I read on FT that you need to secure message or call them to get it credited properly. You should try that and let us know if it works.

I will call the Citi Prestige customer service number and see what they can do. Thanks for the tip! I will let you know what happens.

Update: I called the Citi Prestige customer service department and asked them if they could reimburse the $71.20 charge and deduct it from my $250 airline travel credit, but they said that wasn’t possible since the purchases coded as a travel agency and not an airline.

Thank you for the update.

Pingback: Recap: Save On Costco Membership, 70k Credit Card End Date, Marriott Give Away & More - Doctor Of Credit

Pingback: Why I Converted Citi Prestige to Citi Dividend & Closed Citigold Checking Account

Pingback: My 2017 American Airlines AAdvantage Status Challenge