Hat tip to my friends Bodie and Ramzi for the reminder.

Good afternoon everyone. 2 weekends ago, I was at FTU (Frequent Traveler University) Advanced in Seattle and, naturally, the topic of credit card sign up bonuses and bank account bonuses came up. Call me old fashioned, but I have a spreadsheet for just about everything – including credit card sign up bonuses and bank account bonuses. If you are just getting into the credit card or bank account bonus game (I made $2,850 last year from bank account bonuses), it is very important to be detail-oriented and organized. I have used these 2 spreadsheets since day 1 (I’ve made some modifications along the way), but I think they can definitely keep you organized. Up first, I have my Credit Card Sign Up Bonus Template.xlsx. Let me explain this spreadsheet. Please ask me a question if I miss anything or if anything is unclear:

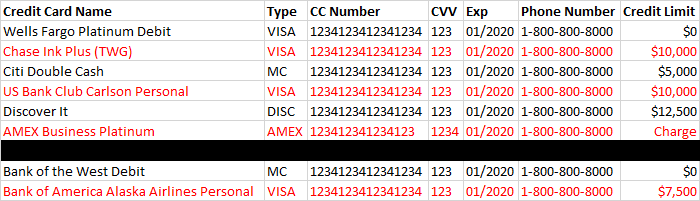

- Credit card name, merchant type, credit card number, CVV (3 digit code on the back or 4 digit code on the front of AMEX cards) and expiration date are pretty self explanatory. I use real data and password protect the spreadsheet, but you can use the last 4 digits of your cards if you feel more comfortable. I use real data so I can purchase anything online, wherever I am, without having to carry every single card with me.

- Phone numbers are great for calling customer service without having the card in front of you and come in handy if your card is lost or stolen (most of these numbers are saved into my phone as well).

- Credit limit is not super useful, but if I need to make a large purchase, I know exactly which cards have big credit limits. It can also be helpful if you need to make a reconsideration call and move some credit around from existing credit cards.

- I also track all of my debit cards and authorized user cards so all the info is in one place.

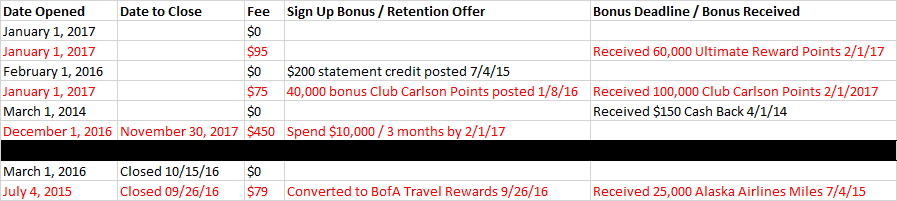

- Date opened is when the card is approved or when I get a pending decision when applying online (it is best to be conservative and assume the minimum spend clock starts right away). This also helps when you plan on applying for the same card in the future (like Citi’s 24 month language).

- Date to close / date closed is useful if you got a credit card for the sign up bonus and do not plan to keep it long term. That date is also useful if you like to call for retention offers before your annual fee posts.

- Annual fee is self explanatory. If the first year has no annual fee, but the second year charges an annual fee, I would write it as “$0 ($75)”.

- Sign up bonus / retention offer is very important. List the spend requirements and the time limit. If you get a retention offer, you can overwrite the sign up bonus cell.

- Bonus deadline / bonus received is also very important. List the deadline to get the bonus (I base it off the date opened) and then list when the bonus posts to your statement or account.

- The rows with red font color have annual fees, the ones in black font color have no annual fees.

- The rows below the black row are closed cards. I list the date the card was closed or converted / downgraded to another credit card. This comes in handy if you apply for the same card down the road (like Citi’s 24 month rule).

Up next, I have my Bank Account Bonus Template.xlsx. Let me explain this spreadsheet:

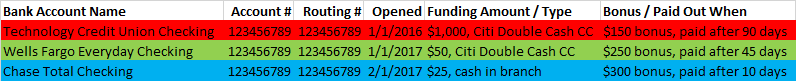

- Bank account name, account # and routing # are pretty self explanatory. Again, I use real data in the account and routing number rows and password protect the spreadsheet.

- Date opened is when I apply for the account, whether the account is instantly opened or takes a few days to process. I’m conservative and assume the bonus requirement clock starts right away.

- Funding amount / type tells me which credit card I used and the amount of my initial deposit. If the bank allows credit card funding online, I usually do the max amount. If I have to open the account in branch, I usually do the smallest amount with cash or check.

- Bonus / paid out when lists the dollar amount of the bonus and how quickly the bonus posts after completing the requirements (most bonuses post much faster, but some wait as long as possible before paying you the bonus).

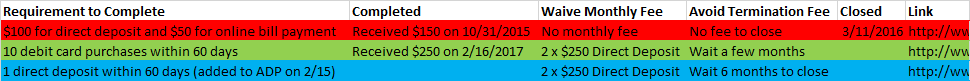

- Requirement to complete is very important. Make sure you write down exactly what you have to do (bill payments, direct deposits, debit card transactions, etc.) and then list the timeframe you have to complete the requirements.

- Completed is the date when the bonus posts to my account.

- Waive monthly fee is similar to the requirement to complete but this is where you list the way(s) to waive the monthly fee (bill payments, direct deposits, debit card transactions, minimum daily balance, etc.)

- Avoid termination fee is where I list the earliest possible date that I can close the account without incurring an early account termination fee. Most banks have a 180 day period from the date the account was opened, but some are much shorter. Pro tip: I usually keep the account open for 1-2 months after the date listed here, so I don’t accidentally close the account too early or get a derogatory note on the account from the bank which might prevent me from getting the same bank account bonus again in the future.

- Closed is the date when the account is officially closed. I usually bill pay or ACH every last penny out from my account, wait for the bill pay to post or the deposit to clear into my main bank and then call the bank to close the account. Pro tip: some banks charge for ACH (so stupid!), but bill pay is usually free.

- Link is where I found the info for each bank account bonus. 99% of the time, they come from Doctor of Credit and he has a great up-to-date list of best bank account bonuses.

- Lastly, the color coding represents closed accounts (red), opened accounts that I have received the bonus (green), and opened accounts that I am still working on the requirements and that the bonus hasn’t posted yet (blue).

I know this is a lot of info to take in, but if you keep organized, you can do very well. Do you have your own spreadsheet -what columns or data did I miss? If you have any questions about either template, please leave a comment below. Have a great day everyone!

Pingback: Amex Platinum Fee Goes Up, Iraqi Kurdistan, Airport Facts, Moscow Metro - TravelBloggerBuzz