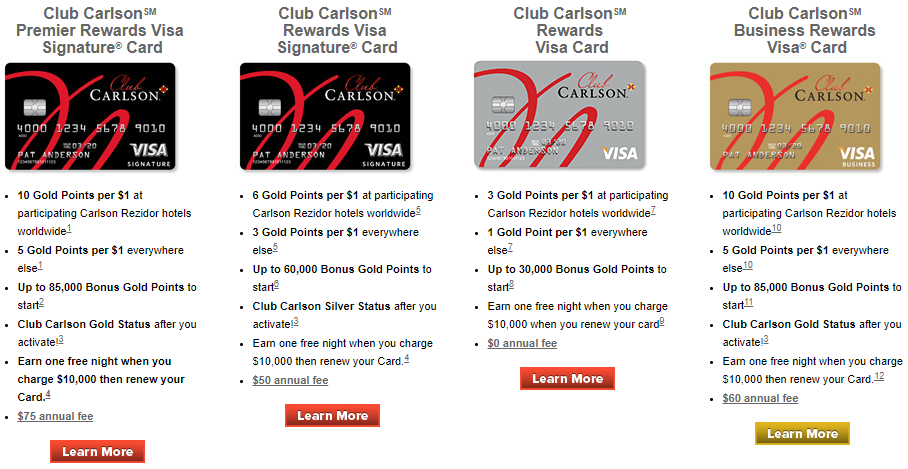

Good morning everyone, happy Friday! A few days ago, I wrote How to Redeem your Club Carlson Domestic Free Night Certificate ($10,000 Yearly Spend Required). While working on that post, I was reminded that there are not 2, not 3, but 4 US Bank Club Carlson credit cards. I only have the US Bank Club Carlson Premier Rewards Visa Signature Credit Card and the US Bank Club Carlson Business Rewards Visa Signature Credit Card (the 2 best US Bank Club Carlson credit cards, in my opinion), but I wanted to take a closer look at the other 2 US Bank Club Carlson credit cards to see if there was any reason to consider product changing to those credit cards. To learn more about all of the US Bank Club Carlson credit cards, click here.

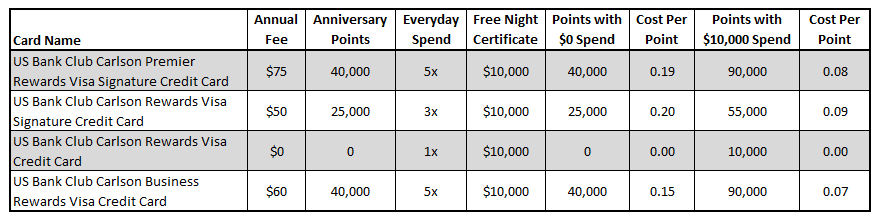

The only 2 features of the various US Bank Club Carlson credit cards that interest me is the free anniversary points when you pay your annual fee and the domestic free night certificate that you earn when you spend $10,000 or more on the credit card during your cardmember year. Since each credit card has different annual fees, different amounts of anniversary points, and different everyday earning rates, I wanted to determine how much the Club Carlson points would cost if I spent exactly $0 and $10,000 on the credit card during my cardmember year.

Just as I expected, the best returns are on my US Bank Club Carlson Premier Rewards Visa Signature Credit Card and my US Bank Club Carlson Business Rewards Visa Signature Credit Card. If you are totally against paying annual fees or want to keep your Club Carlson points active, the no annual fee US Bank Club Carlson Rewards Visa Credit Card is a decent option. The $50 annual fee credit card does not make any sense to me. For $25 more, you get an extra 15,000 Club Carlson points on your anniversary and your everyday spend goes up from 3x to 5x.

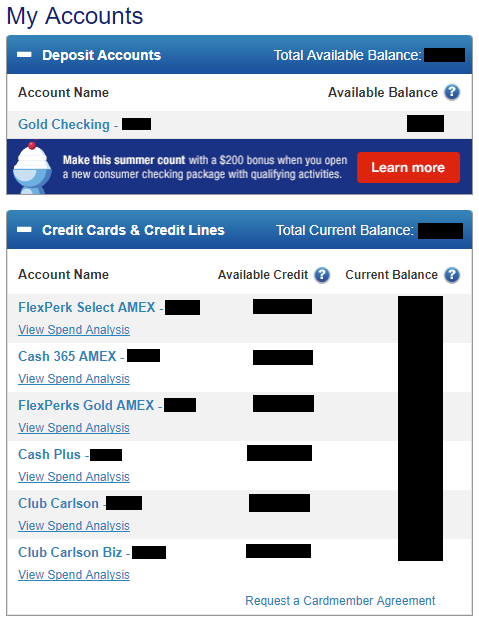

I have 2 other US Bank credit cards that I don’t really use (US Bank Cash 365 American Express Credit Card and US Bank FlexPerks Select+ American Express Credit Card), so I wonder if I could product change them to a US Bank Club Carlson credit card. Has anyone tried that recently? Did it work for you? I would have to create 2 more Club Carlson accounts, but since you can Instantly Combine or Transfer Club Carlson Points with a Simple Call, that would not be a problem. If you have any questions about the various flavors of US Bank Club Carlson credit cards, please leave a comment below. Have a great weekend everyone!

Great idea. I’d love to hear if this works.

I’ll let you know if it works for me :)

I asked US Bank about this on Twitter and this was their response:

Pingback: Reminiscing About and my Plan for my US Bank Radisson Rewards Premier & Business Credit Cards