Originally Posted in January 2017 – Updated with new data points in September 2017!

Buenos dias!

If you or someone you know has a Mexican passport or resident card, they might be leaving money on the table when they purchase airline tickets to/from/through Mexico.

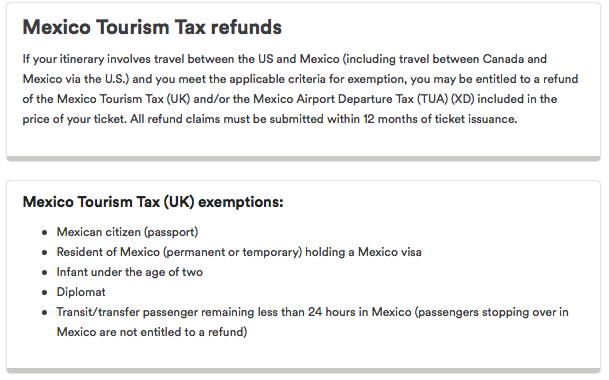

When you purchase a plane ticket to Mexico, the fare has a tourism tax built in – similar to US customs and immigration fees. This fee goes toward the cost of immigration processing and the arrival / departure card required for foreign visitors. The fee is 500 Mexican Pesos, which is roughly $28 USD. (The fee increased from 390 pesos at some point in 2017). On your ticket receipt you may see this referred to as UK (the IATA code for this tax) or DNR (the Spanish abbreviation).

Screenshot from ITA Matrix showing the Mexico tourism tax – tax and exchange rate as of December 18, 2016.

However, not everyone is required to pay this fee. If you have a Mexican passport or resident card, or are spending less than 24 hours in Mexico, you’re exempt from this tax. (Infants under 2 and diplomats are also exempt.) This is outlined (in Spanish) on this Mexican government FAQ page, question 16.

Mexican carriers typically know not to charge this fee to Mexican citizens based on the citizenship information you enter at the time of booking, but otherwise, there’s a good chance this fee will end up on your ticket even when it shouldn’t. (There’s actually a class action lawsuit pending against several US and Mexican airlines for this practice.) Fortunately, most airlines are pretty good about giving you a refund upon request.

Alaska Airlines

Difficulty: MEDIUM

Alaska was the first airline I found that documents the existence of this tax refund on their website. You can present your documentation to an airline representative at checkin to have a refund request submitted for you, or you can submit copies by mail or fax after travel is completed. After my trip on Alaska’s inaugural flight from San Francisco to Mexico City, I sent a fax with the ticket numbers and IDs and received an email about two days later letting me know the refund had been processed.

American Airlines

Difficulty: EASY

American now has a page on their website about Mexico tourism tax refunds too. In the past, I used to submit refund requests via Twitter. Now, you can contact Reservations before your trip, or submit a refund request through their website after travel has been completed. The online refund request is very easy – I just selected ‘refund of taxes’ as the reason and uploaded a copy of my resident card, and the refund was back on my credit card within a few days.

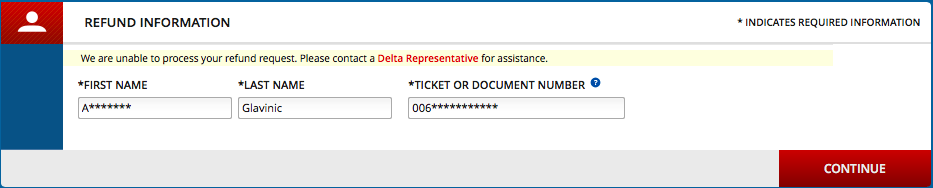

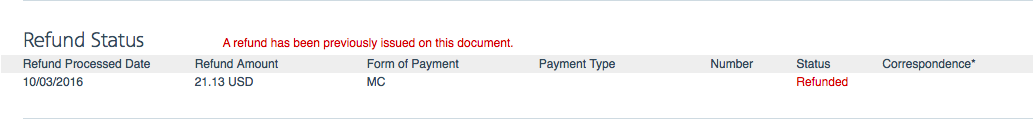

Delta Air Lines

Difficulty: MEDIUM

Delta has information about tourism tax refunds buried on their Legal Notices page, and also on their “Pro” website for travel agents. The Legal Notices page directs you to their online refunds tool, but when I tried to submit a request for a refund for a previous flight, I got a big fat error message. Attempting to request a refund for an upcoming flight forces you to cancel the ticket first, which isn’t helpful either. I reached out to their Twitter team for assistance, but they told me to call the International Reservations Sales Team at 1-800-241-4141 for assistance.

Update: I sent a fax with ticket numbers and ID copies to Delta’s Passenger Refunds department at 404-715-9256 and received an email about two days later saying that the refunds had been processed to the original forms of payment.

No luck requesting a refund from Delta online.

Jetblue Airways

Difficulty: IMPOSSIBLE

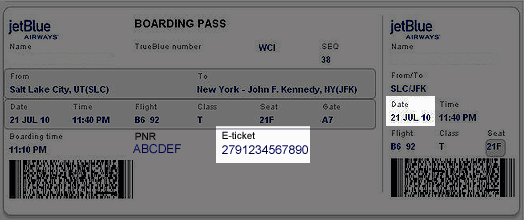

JetBlue has an unnecessarily convoluted system for requesting tax refunds. In theory, it’s relatively simple: you show your receipt and your documents to Jetblue agents at checkin and they submit the refund request on your behalf. In practice, this is way harder than it sounds. Their Twitter team told me that you can’t just submit a copy of your e-ticket – you have to request a Comprobantes Fiscal Digital por Internet (CFDI) receipt through a third party website at least 48 hours but no more than 30 days after purchase.

This website (in Spanish) is buggy and full of inaccurate and conflicting information. For example, on the first page you have to enter your ticket number and date of purchase, but if you enter the actual date of purchase it doesn’t work. The site shows a sample boarding pass with the ticket number and departure date highlighted, but that doesn’t work either – their system doesn’t allow you to select dates in the future.

When I reached out to their Twitter team for help, they suggested entering the date I was requesting the receipt as the date of purchase (even though I bought the ticket last month) – that didn’t work either. Their Twitter team then directed me to email dearjetblue@jetblue.com, who couldn’t help with a receipt or refund, but sent me a $50 Jetblue voucher for my trouble.

Southwest Airlines

Difficulty: NOT SO BAD

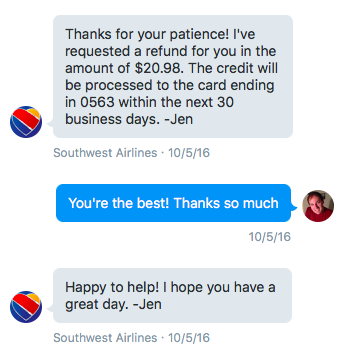

I’ve had good luck getting Southwest to refund tourism taxes via Twitter. Since Southwest tickets are so flexible, you have to wait until travel is completed to submit a refund request. Their Twitter team told me to fax a copy of my documents to their Refunds Department (972-656-2568) with my confirmation number. The first time I requested a refund, it took nearly two months – I submitted my documents on April 5, and didn’t receive a refund until the end of May. When I followed up with the Twitter team on May 20th, they said the Refunds department was still handling requests from March 21st. However, I submitted a request for a different ticket via Twitter on October 4th and was able to get a refund processed the next day without having to resubmit my documents.

Spirit Airlines

Difficulty: EASY

Bill reported in the comments that he was able to obtain a refund easily by sending an email to customer service, presumably with the relevant ticket numbers/record locator(s) and a copy of the necessary documents.

United Airlines

Difficulty: EASY

I used to use Twitter to get tax refunds from United, but now I just use the United Refunds website. Select the “Contact United Refunds” option, fill out the form with your ticket details, and upload a copy of your resident card or passport; you’ll get an email in a few days informing you that the refund has been processed. As a bonus, United automatically removes the taxes from roundtrip itineraries originating in Mexico.

Aeromexico

Difficulty: EASY

The first time I traveled to Mexico, I had separate tickets from LAX to Mexico City and an onward connection (within 24 hours) from Mexico City to Santiago, Chile – which meant that I was exempt from both the tourism tax and Mexico City’s steep international departure tax. If I had booked that as a single ticket, those taxes would have been removed automatically, but their US refunds team (amusrefunds@aeromexico.com) was able to process the refund quickly. That’s also the department for requesting tourism tax refunds based on citizenship or residency – just email them your ticket number and a copy of your passport or residency card. Note: From the comments, others have reported difficulty with Aeromexico. YMMV.

All Nippon Airways (ANA)

Difficulty: HARDER/TBD

I booked an ANA award ticket earlier this year that included a United segment from SFO to Mexico City. I reached out to ANA on Twitter and was directed to call them at 1-800-235-9262 for assistance. But I hate making phone calls, so I haven’t gotten around to it yet.

Air France / KLM

Difficulty: IMPOSSIBLE

Last year, I booked two award tickets for my partner on Aeromexico using Flying Blue miles and was charged tourism tax on both tickets. I tried multiple times to reach out to Flying Blue, Air France / KLM, Delta (which handles some of their customer service in the US), and Aeromexico, both myself and through an agent at getservice.com. Air France told us to contact Aeromexico, and subsequent requests to contact either airline – even through executive channels – were met with complete silence. Ultimately, getservice recommended that I initiate a chargeback with my credit card company, and I also considered filing a complaint with the US Department of Transportation, but at that point the tickets were so old that I didn’t want to bother with it anymore.

Air Transat

Difficulty: IMPOSSIBLE

Isabelle in the comments reports that despite reaching out by both phone and Twitter, Air Transat just pointed her to the fiscal receipt request page on their website and said that she would have to request a refund from the Mexican government.

Volaris

Difficulty: IMPOSSIBLE

The Volaris website asks you if you have a Mexican passport when you book your ticket, but since I have a US passport, there is no way to avoid being charged the fee automatically. I reached out to their Twitter team for advice, who incorrectly told me that since I have a foreign passport, I have to pay the fee regardless of my residency status.

I then reached out to the Volaris chat support team, who directed me to email Customer Relations at yourexperience@volaris.com. I’ve gone back and forth with them via email multiple times – they don’t seem to have a great grasp of how the law works, and in any case have decided that it’s my fault that the tax was charged because I selected “US Citizen” instead of “Mexican Citizen” at booking. Their policy (apparently) is that customers are completely responsible for whatever charges appear on the website at time of booking, and it sounds like they wouldn’t refund me even if I had a Mexican passport. Volaris told me that to avoid this fee in the future, I should just say that I am a Mexican citizen during the booking process. I ended up filing a chargeback on my Citi Prestige card, but since the amount was so small Citi just granted me a permanent credit without investigating.

!["Thank you for writing, I inform you that [a refund] is not possible since on the return flight you would be entering Mexico as a foreigner, which is why the charge was applied."](https://travelwithgrant.boardingarea.com/wp-content/uploads/2016/12/Screen-Shot-2016-12-18-at-9.49.27-AM.png)

“Thank you for writing, I inform you that [a refund] is not possible since on the return flight you would be entering Mexico as a foreigner, which is why the charge was applied.”

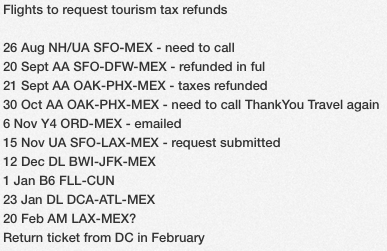

Frankly, this is an annoying process and requires quite a bit of record keeping and hassle. The savings definitely add up over time, due to the amount of travel that I do. The amount of money saved on taxes will more than cover the cost of my one-year temporary resident card. There’s relatively little information about this process online, so I’m hoping this article will help people save some time and money. I still have a few unresolved tax issues, but hopefully the refund process gets simpler, easier, and quicker in the future.

Do you have any experience requesting tax refunds from an airline? If you have any questions, please let me know in the comments. Adios amigos!

Do you have any experience requesting tax refunds from an airline? If you have any questions, please let me know in the comments. Adios amigos!

Can you ask for reimbursement after the flight was taken? Thks

Hi Jorge, yes several of these were reimbursed after the flight was taken. (In fact, some airlines like Southwest require it.) Was there a specific airline you’re curious about?

Thanks! Yes, Aeromexico to be exact.. You just drop an email requesting the refund with the tix and passport info?

That should work! Let me know how it goes.

Here is a big no from Aeromexico they don’t care … Southwest takes two months

Dear Mr. Sang:

Thank you for taking the time to contact us.

Receive an apology for the delay in the response.

It is important to state taxes are not paid to Aeromexico, those are pays to government; therefore cannot be refunded.

Also it is important to acknowledge you that we only keep records for our flights and reservation for a yearlong.

Best regards,

That’s really disappointing – thanks for the data point.

Sorry, but NOT easy at all with AeroMexico. We E-mailed them a copy of the ticket, passport and Residency card, and they told us you have to have joint citizenship – contrary to what it clearly states on the government web site. We have now E-mailed them a copy of the government’s remarks to see how they will respond. Very disappointing, AeroMexico!

Sorry to hear that! Let me know if you have more luck with a second representative.

Is a mexican passport required to go on a flight to mexico from the airline volaris? Because I am Mexican American and I already bought tickets for my family. Although I have a USA passport.

Not at all – you can use any passport to travel on them, they just ask if you have a Mexican passport so they can adjust the taxes accordingly.

Thank you!

Did you ever manage to get the refund from Delta? I’m trying to do it with them now and I’m going round in circles!

No I still haven’t tried. Let me know if you have any luck.

I spoke to them over the phone and by email, over the phone was a bit more of a challenge as the guy genuinely had no idea what I was talking about but he went out of his way to find out. APPARENTLY we were never charged it in the first place so they couldn’t refund it. It was actually quite painless and they were very good at responding to the emails!

Hi Rebecca! I was able to get a refund from Delta via fax. Updated information in the post :)

Great news Tonei! I’ve got an upcoming flight with Jetblue next month. Not holding my breath as have never been able to get in back in the past, but it’s worth a shot right ;)

I have residency in Mexico, and I’m legally not required to pay this tax. However, on the Volaris booking, there’s no option to select residency, just passport country. For my family, this means we pay an extra $100 that we shouldn’t have to pay. I’ve seen one other place online where people just say “Select Mexico!”. I don’t want to get stranded at the airport however. Anyone actually tried this?

That’s the same thing Volaris’ own reps told me to do – as far as I can tell, the only thing that option does is toggle the tourism tax. I haven’t flown Volaris in a while though, so I haven’t personally tried it.

From my experience with Volaris, it also toggles the ability to pay using anything but a México-based payment method. Of course it may have changed since I last tried it!

Good catch! I think last time I bought a Volaris ticket I ended up using PayPal to circumvent that restriction.

You are right. When we have booked on Air Canada there is nothing to state country of residence – just passport. As there are no longer Visa restrictions for Canada, I shall be using my Mexican passport from now on to avoid ther tax But this won’t be available to my husband who has permanent residency in Mexico.

Hi All,

Has anyone had any experience getting the Mexico Tourist Tax Refund from Spirit Airlines? I appreciate any advice or assistance. Thanks! Bill

I haven’t flown Spirit internationally – good luck, and let me know how it goes!

FOLLOW-UP—SPIRIT AIRLINES

My wife and I have Residente Permanente from when we lived in Mexico. I applied for the Mexican Tourist Tax Refund from Spirit. We got an almost immediate response from Spirit. Jorge in their customer service department was extremely helpful in crediting the refund to us. A lot of people like to pick on Spirit but I find them transparent in their advertising.

Nice! Glad to hear that this worked out so easily.

Hello Bill,

Could you please give me details about how you proceed with Spirit? I have a claim with them and they said they have never refunded this Mexican tourism tax. By the way, I possess an Mexican permanent residence as well.

Many thanks in advance for your response

Hi,

This is what I received from the Spirit Team regarding my request:

“Please be advised that any refund requests for government taxes paid for at the airport should be requested at the airport directly before boarding the flight. Otherwise, it may not be granted. We strongly encourage you to coordinate with our team members at the airport ticket counter for further help”

In other words, they didn’t provide me with any procedure to request my Mexican tax refund due to my last flight with Spirit on December 2017.

Any other suggestion to get this refund are more than welcome.

Thanks

I contacted them and they processed the refund

With Air Transat, seem impossible. I contact them by phone & twitter. Both send me to this link. They said they cannot refound it, it need to be done by the mexican governement. https://webportal.edicomgroup.com/customers/airtransat/pasaje/consulta-ticket-cfdi-airtransat.html

https://webportal.edicomgroup.com/EdiwinViewer00/ayuda/FormAyuda.jsp?tipocliente=anonimo&idioma=ES&dominio=ATA870429CZ5

I am trying now to get a refound from Interjet. First thing their billing doesnt explain if we got charge for it or not.

I contact them by twitter, no helpfull. By email they send me this: “Agradecemos los minutos que nos otorga de su día para el envió de este mensaje, es importante considerar que a pesar de ser residente el impuesto de salida es mandatorio por cuestiones migratorias razón por la cual este no es rembolsable, sin embargo, requerimos que pueda señalarnos que impuesto expone ya que hay diversos impuestos que ya esta precargados en su compra. ”

Basicaly they don’t event know if we got charge & say it’s mandatory to pay the DNR. Wil see what happen whit that & uptade.

Update, what a complicated thing with Interjet. By email they said to contact by phone. After spending an hour on the phone with them, they come to the conclusion that we have not been charge. On the confirmation of purchase there is no description of impuestos. At first they did not understand what I was talking about but at the end apparently we don’t have that charge & they cannot send me a detail or proof of that. Will see the day of the flight!

I did reach out to INM too about that & the official name of that taxe is DNR.

This was the response I got from them:

28/08/2017 5:14 pm Instituto Nacional de Migración

Buen Día En atención a su consulta Le comento, el DNR es el derecho que deben de pagar los extranjeros cuando ingresan a México bajo la condición de estancia de visitante sin permiso para realizar actividades remuneradas (turista), por vía aérea, terrestre o marítima. Actualmente es de $500 por persona. Si la estancia de los extranjeros es menor a 7 días en territorio mexicano, no se paga el DNR. Saludos Cordiales

It’s the number 16:

https://www.gob.mx/inm/articulos/preguntas-frecuentes-del-programa-paisano

Does anyone know how to file the tax return from Mexico after the fight was taken? I was trying to file the tax return in the airport ,but I’ve been told they do not have one in terminal 4 which they only have it in terminal 3 and 2 , and they told me that I can’t go to the other terminals but I can file it on the airplane which later on the flight attendant told me they do not have it on the plane

They may have thought you were trying to get a sales tax refund for purchasing items in the country…as far as i know the only way to get this tax refunded is through the airline, typically their refunds department.

Any experience with LAN? Have a transit in MEX on separate tickets with the tax collected by LAN.

Nope – but let me know how it goes!

I sent by USPS mail to Alaska Airlines at their address in Seattle a written letter with three past flights, including flight numbers, dates, and e-ticket numbers. Received a credit on my (Alaska Airlines/BofA) credit card about 3 weeks later.

Nice!

Hey Tonei, Any ideas for Virgin Atlantic, I just asked them on their instant chat and the poor girl had no idea what I was talking about! I only just got the ticket today so I’ve got plenty of time to figure it out!

I would try their social media team first, and if they can’t help email or fax their refunds department. Let me know how it goes!

I just had a look at the fare breakdown on the ticket and it doesn’t even list the Tourism Tax (UK) as one of the taxes included in the total.. It’s got the TUA but not the UK which is interesting… This is the price breakdown that they provide!

Base Fare

Carrier-imposed Surcharge (YQ)

Mexico – Transportation Tax – IVA (XO)

United Kingdom – Air Passenger Duty (APD) (GB)

Mexico – Airport Departure Tax – TUA (XD)

United Kingdom – Passenger Service Charge (UB)

What’s your routing?

Cancun-London-Cancun

Direct Flights both ways..

and I booked using the details from my UK passport, not the Mexican one!

Dear all,

I’ve send an email to Aeromexico (to the email address mentioned in the article), but Aeromexico wants the tour operator to refund it. This is nonsense, right? According to Mexican law, the airlines are the ones obliged to refund the tourist tax, right?

Any advice on how to request the tourism tax back from AeroMexico?

Thank you! Yvonne

Great article! I’m glad to hear there is a lawsuit pending. I have residency status in Mexico, but fly to the US for business at least 6 times per year. My carrier is United, and after going through a huge merry-go-round with them trying to get them to waive this tax when I fly, I’ve finally given up! No one there seems to understand what I’m talking about, and I have been told many different things by many different people there.

At one point I was told that there was no way to remove it or refund it since I was booking on-line. So then I tried to book with a phone call and have it waived at that point, and got transferred around to different departments, speaking with people who had no understanding of what I was referring to, to eventually be told that everyone except for diplomats pays that tourism tax!

This is why, just now, booking with American Airlines I am very pleased to see the notification for a possible refund. Hope the other airlines catch up soon!

That’s really disappointing to hear! I’ve had nothing but positive experiences with united on this front – they don’t charge the tax on round trip tickets originating in Mexico, and when I have had a ticket that included the tax, a request through their online refunds form with a copy of my resident card has been quickly resolved.

I just booked a United ticket online today and the Mexican tourism tax is there. I called them and the “supervisor” said I had to be a Mexican citizen for a refund. I am a resident with a residency card. My last two flights have the tax on them and I cannot get them removed apparently. Also, they do have a refund site but you have to choose a dropdown menu reason and this is not one of the choices. FYI.

Hi Derrick,

Customer service tends to be pretty clueless. Try submitting a request with the “E-Ticket refund” option – I think that I’ve had success with that in the past. If that doesn’t work, you could also try sending them a fax or a request by mail – unfortunately it looks like they’ve removed the option to contact them via email.

Fax:

1-872-825-9364

Address:

United Airlines

United Refunds

P.O. Box 4607, Dept. NHCRF

Houston, TX 77253-3046

Thank you. I called back and persisted on the matter with someone in international flights for a good 30min and think it will work. It is a battle for 500 pesos but it can add up. It definitely isn’t automatic leaving out of Mexico and back. I will use the above idea to avoid the call and see how it goes.

As you can see from their reply to my request for a refund, Aeromexico is stone-walling still if one doesn’t have a Mexican Passport. Residency Card doesn’t qualify, even tho Mexican regulations accept it.

Dear Mr. Dailey,

Thank you for contacting us.

Our requirement to process Mexican Tourism tax refund is a valid Mexican passport, if you do not have it

please contact amcomplaint@aeromexico.com.

Any question, please do not hesitate in contact us.

Kind Regards,

De: Robert Dailey

Enviado: miércoles, 6 de junio de 2018 18:10

Para: AM US Refunds

Asunto: Fwd: Refund Mex air tax

Dear Sirs,

Note my attached ticket # AM 8139978598 and copy of my Mexican Temporary Resident card. These were requested by you after receiving my attached previous email. Thanks for your kind consideratioin.

RH Dailey

It seems like I got lucky with Aeromexico my first time – my experience with their customer service hasn’t been great, so at this point I try to avoid booking through them if possible for flights arriving in Mexico (often it’s possible to book Delta codeshares for a similar price, and their customer service is much better).

Fingers crossed that escalating it and pointing to the regulation may help – i ultimately gave up on my last Aeromexico ticket because i was tired of fighting with them. Alternately, you may be able to do a chargeback on your credit card for the amount of the tax.

It is taking 150+ days now to get a TR in QRoo Mexico… can I get refunded for each flight in/out to get permission to leave the country again to continue the TR process?

I’m not 100% sure – but definitely worth a shot, depending on the airline you may be able to just provide them with a copy of the visa issued by the Mexican embassy, or perhaps a copy of your permission de salir y regresar with the letter showing that your application is in progress. (And so dsorry it’s taking this long!)

Tonei

I’ve got 4 refunds cooking- with AM, Delta, American and SWA. The experience with AM has been laughable, surreal,

and hard to believe. I think they just aren’t making refunds, and making excuses to nix the requests. They can’t really be as ignorant as they profess [eg, only Mex. passport holders are eligible, etc]. Anyway, I look at all of this as part of my miles/points hobby and a learning experience. If I lived in the real world instead of being retired, I couldn’t possibly be able to rationally pursue such rabbit warrens…

If I can, I’ll let you know of any successes. Don’t hold your collective breaths.

I booked a flight with Volaris today and when I selected U.S. passport there was a blue line that popped up:

“People from other countries and without a residence should pay a fee on the counter.” In addition, I was charged $40 per ticket in taxes but only $4 in fees. So I think they’ve begun to make you pay at the counter when you check in.

Aeromexico now says that they have paid the taxes to the government and you must request reimbursement from the government not them. I went through about 4 emails and a copy of the government website rules to no avail. So it seems their level has risen to impossible now. American airlines was great and fast.

Exactly my experience with AM

Pingback: How to get a refund of the Mexican Tourism tax on your Mexico flights - TexMexExpats

SUCCESS PROCEDURES WITH SOUTHWEST AIRLINES

SEND YOUR SWA REFUND REQUEST TO: RefundsDox@wnco.com

SEND: your name; confirmation no.; ticket no., Residency documentation.

Kudos for SWA!!! I’ve attached their procedure, and if one follows it closely,…success will follow: But, be aware:

1] You must send them front & BACK your resident card.

2] Your boarding pass is a good way to show you have travelled, and it has the confirmation no. on it.

3] However, the required 10 digit ticket number does not appear on the boarding pass. It is a) at the end of your original email confirmation [along with the breakdown of fees and taxes with the Mex. Tourist Tax clearly marked], and b) also surprisingly on your credit card statement that you used for payment.

I emailed the required info [see below], and within 2 weeks received an approval; the refund is made to the credit card used in ticket purchase. I currently have refund requests in to Delta, American and United, and I’ll report my results as I get them.

I have just finished with an unsuccessful prolonged refund attempt with Aeromexico. I won’t torture you, dear reader, with the blow by blow. It was Sysiphean & futile. But, I recently gave them one more chance, and resubmitted a new request. NOTE; it failed!

I hope this info is correct and helpful. If I’m in error on any of this, kindly so inform me. Thanks.

IMG_0279.jpg

A RAY OF HOPE WITH AEROMEXICO FLIGHT REFUNDS!!

You can get the refund on Aeromexico flights ONLY if the flight was a partner miles/points award written by Delta, NOT if the flight was obtained from Aeromexico.

The award CANNOT be obtained on-line from Delta; the refund site is there, but has been non-functional forever [the Delta agent confirmed this]. One must do it by phone, as follows: phone 800-847-0578, [Delta] and ask for “refunds dept”; you’ll be transferred. You’ll be asked for your ticket number [on boarding pass and your purchasing credit card statement] and your Mex. Resident card no. [on its back] plus personal identifying info. You will be on hold for quite some time while the agent confers with several other depts. You will, finally, be given a reference no. and email, and a positive response will come by email in a week or two. Others on the internet have reported success with this methodology.

Don’t bother trying to get this refund from Aeromexico. It’s a fools errand.

Nicely done! I should clarify in the post that it’s always the ticketing airline that you need to deal with – in examples like this where you have an Aeromexico flight on a Delta ticket, since Delta is the ones that collected the money, they’re the ones responsible for issuing the refund.

Can you update your United information. They still charge me the tourism tax when my round trip ticket originates in Mexico and ends there .great information I appreciate this article!!

Are you booking directly on united.com? I just tried booking a ticket MEX-IAH roundtrip and it didn’t have the tax attached. I wasn’t signed in to my MileagePlus profile, either.

https://www.dropbox.com/s/1xdnz3s7nb5ad3y/Screenshot%202018-11-29%2000.24.46.png?dl=0

I just purchased a ticket to Mexico for my wife, who is Mexican, and myself, and once I put in her nationality, it took around $20 off the ticket price. No refund request needed, I ended up at this site because I was trying to figure out what that meant exactly.

This is a bit off topic but do you know if every airlines already include the DNR in their airfare? I was about to book with Volaris because it had the cheapest price but when I chose my nationality the DNR fee was added automatically but at Aeromexico or Delta, the airfare didn’t change at the time of payment so I’m not sure if they include this fee automatically in the airfare. Do you have any idea about this?

Yes, most airlines include it by default – the only exceptions I know of are Volaris (if you mark that you’re a Mexican citizen) and United (for round trips originating in Mexico).

Thank you so so much :))

I’m on the phone with JetBlue trying to get this issue resolved. They told me that we have to go through this process in person with the gate attendant at the airport before boarding the flight and they’d file whatever form is needed on our behalf.

I actually found out about this tax when we purchased our last tickets through American Airlines because once you put in your nationality, they subtract the amount of the tax from the total amount due, which lowers the total ticket price.

Thanks for that info! I always found it challenging to get people at JetBlue who had any idea what I was talking about or how to deal with it.

Do you have another link for Jet Blue? The one in the article isn’t working for me. I asked a representative and they told me I had to go about the reimbursement directly with “Mexico.” As if that is not a very vague concept… haha

Pingback: Mexico increases tourist tax on your Mexico flights; How do you get a refund - The Mazatlán Post

So what happens if I’m a us citizen and I put I have a mexican passport to get out from paying the tourism tax. Do I have to pay at the counter? Will they find out?

Same question here…. Still dont know what to do now! :(

I’ve just been doing the phone dance with AeroMexico. I am a Mexican permanent resident, and as others have reported AM says they only reimburse for citizens. This is clearly different to the Mexican federal law. They actually told me that Mexican law doesn’t apply to foreign citizens. I might try quoting that next time I pass through immigration / get stopped by the police / walk out of a shop without paying!

https://www.gob.mx/inm/articulos/preguntas-frecuentes-del-programa-paisano

But, I think it isn’t worth the effort. If you have a choice, book through Delta on a codeshare. Their process is straightforward.

Pingback: The Era of Visa-Free Living in Mexico is Over