For those of you who haven’t already switched to my favorite phone service of all time, now might be your perfect chance. Google Fi (formerly Project Fi) is Google’s flagship mobile service that offers coverage in 200+ countries and territories, flat data rates, no contracts, and unlimited domestic calls and texts within the US.

Over the past several years, Google Fi has evolved from its beginnings with the Nexus and Pixel phones to present day, where members have the opportunity to bring their own phone to Fi. Most Android and iPhone models work with the Google Fi SIM card, so users aren’t required to buy a Pixel anymore. (I still would suggest buying a Pixel if you don’t have one, but that’s another story.)

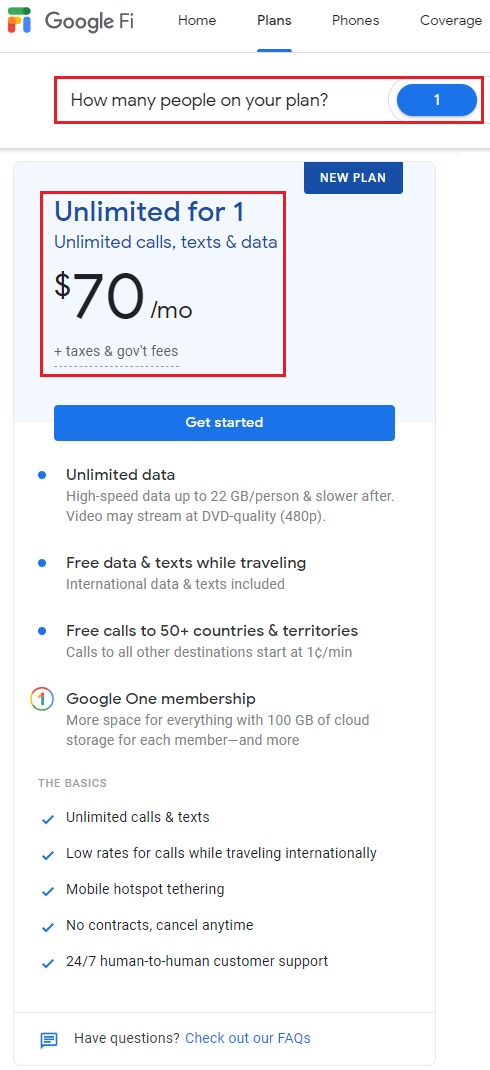

Recently, Google Fi put a $60 cap on the cost of data for each cycle. Before then, data cost a flat $10 per gig but there wasn’t any relevant volume discount, so free data after 6GB was certainly a welcome change. Now, however, Google is upping their game with new unlimited plans that especially benefit families and groups.