Chase Freedom, Discover It, and Citi Dividend Q2 Category Comparisons

On you marks, get set, shop! It is almost April (technically today is March 16, so we round to the closest month), so here is a run down of all the rotating cash back categories. (Hint, bust out your gardening gloves and tool belt, it’s time to get to work!)

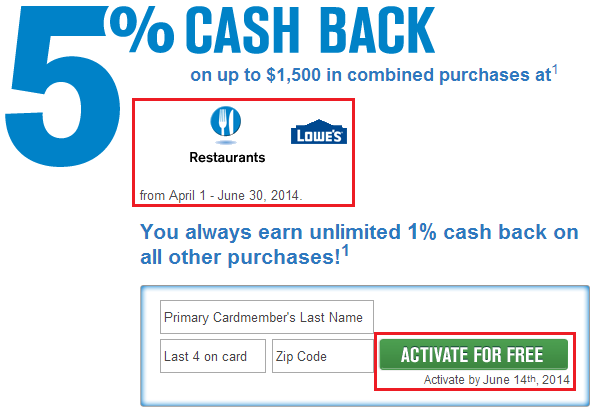

Chase Freedom Categories:

- Restaurants

- Lowe’s Home Improvement Stores – you can buy Lowe’s gift cards for a 9.6% discount by going through Gift Card Granny.

Discover It Categories:

- Home Improvement Stores

- Furniture Stores

- Bed Bath & Beyond – you can buy Bed Bath & Beyond gift cards for a 9.5% discount by going through Gift Card Granny.

Citi Dividend Categories:

- Home Furnishing Stores

- Home & Garden Stores

- Home Depot – you can buy Home Depot gift cards for a 8.2% discount by going through Gift Card Granny.

As you can see, there is a lot of overlap between these three cards. I call them the cash back trifecta and feel like everyone should have all 3 cards.

The Chase Freedom and Discover It cards have $1,500 in spending limits, so you will be capped at only $75 cash back ($1,500 x 5% = $75). However, the Citi Dividend has no quarterly cap and only a $300 annual cash back cap ($6,000 x 5% = $300). So technically, you could rack up $450 in the next 3 months in cash back, assuming you haven’t spent a penny so far this year.

If you are not sure what your local merchant is classified as, please check out this guide to determining the merchant’s credit card code (link).

You can find out more about these three cards on my comparison page. If you have any questions, please leave a comment below.

What are your thoughts on the U.S. Bank Cash+? I just maxed out my Citi Dividend thanks to some ice cream and our friendly neighborhood pharmacy.

I don’t know much about the Cash+ card. Are you interested in cash back cards? I really like the US Bank Club Carlson credit card.

The US Bank Cash+ card is great, but comes with no sign up bonus. Fortunately you can downgrade an existing US bank card to the cash+. So choose your favorite sign up bonus, receive it and after a few months try to do a change to the cash+.

Good to know Doc. What purchases do you normally charge to your Cash+ card?

For example, you can select 5% cash back for restaurants in alternating months where the other cards don’t have that option. I believe the max per quarter is $2k spend. The neat thing is if you request a check for $100, U.S. Bank will give you an extra $25 back. So $125/2000 = 6.25% cash back on restaurants, capped at $2k, per quarter. No annual cap.

Decent card to have, I downgraded my U.S. Bank Flexperks to Cash+ to avoid the AF, but I have yet to use it since I’m trying to meet spend elsewhere.

Interesting, that sounds like a pretty cool cash back card. I’m still waiting to hear back about my US Bank FlexPerks Winter Olympics offer. Sounds like no news = bad news = declined application.

Can you use the Lowe’s giftcard to buy a visa giftcard?

Maybe, but you could use your Chase Freedom to buy other gift cards at Lowe’s.