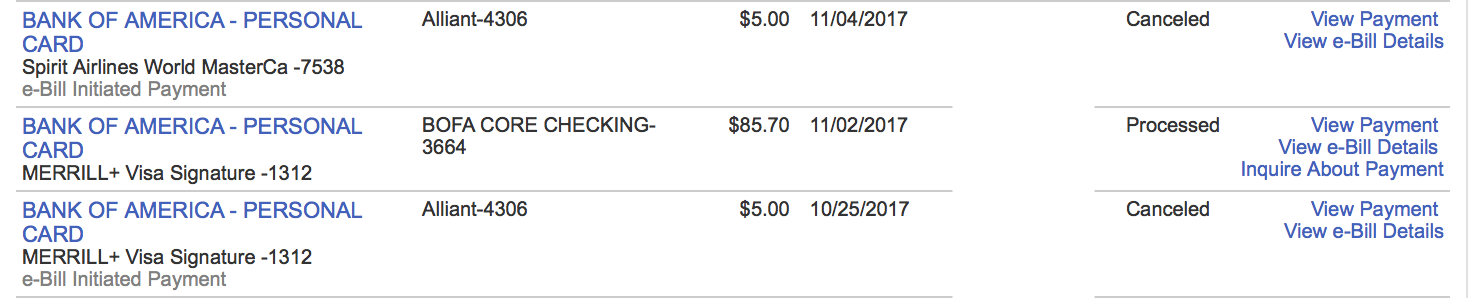

Buenos dias everyone! A couple of months ago, I logged into my Bank of America account and was surprised to see that my Merrill+ Visa Signature Card had a past due balance. Since I have a lot of credit cards, I always set them up for automatic payments initiated by the credit card company – that way, they’re usually on the hook if something goes wrong with a payment. Upon further investigation, I discovered that my automatic payment for the end of October had been scheduled and then canceled without any explanation. I also noticed that the same thing had happened to my Bank of America Spirit Airlines World MasterCard.

I went ahead and made a manual payment to both cards, set up automatic payments again, and sent a secure message to Bank of America asking why this had happened. They quickly replied with an unhelpful message:

I hate making phone calls, so I procrastinated until I happened to log into my account again in December and discovered that my bill was past due again! I immediately paid the bill and sent another secure message to let them know that it seemed like there was a systemic problem, and asking for a refund of the associated fees. (I was in Asia at the time, so it was a bit of a pain to try and call them.) They replied again saying that they had “previously addressed” my concerns by telling me to call the Online Banking phone number. Gee, thanks.

I finally got around to calling up Bank of America today, and was met with an automated message saying that my estimated wait time was between 2 hours 17 minutes and 3 hours. Thankfully, they offer an automated call back feature, so I asked them to call me when someone was ready. I got a phone call about two and a half hours later, and was quickly connected with a representative. I explained the issue to her, and she said that she needed to consult with someone in the credit card division. I thought I was being put on hold, but then I found myself cold-transferred to another phone rep; fortunately, once I explained the issue, she was able to dive in and find out what the cause was.

Bank of America has two versions of their bill-pay service: a sort of “light” version (my words) for people who only have credit cards but do not have a checking account, and a full-fledged version for checking account holders that allows you to send payments to other payees besides Bank of America (this helps explain why their bill pay system for credit cards is so clunky). When I opened a new checking account to take advantage of a $300 bonus offer earlier this year, the system transitioned me from the ‘light’ version to the full version – and in the process, canceled my automatic payments.

This was the cause of the first canceled payment. She said the second past due payment happened because it takes 1-2 statement cycles to enable automatic payments, and apparently November 2nd was too late to activate a payment due on December 25th. Fortunately, Bank of America keeps a very close eye on their bill payment system, so the representative was able to identify exactly what had happened and obtain authorization to waive the late fees and interest charges that had been applied to my account.

Moral of the story: if you open a new checking account with Bank of America and use automatic payments for Bank of America credit cards, keep an eye on your Bill Pay center and your account statements – you may need to reconfigure your account.

Great article! I recently opened a B of A checking account for the $300 bonus and my prior payment account disappeared. When I called customer service they knew nothing and couldn’t tell me what happened.

Banking in the US is still in a quite primitive stage compared to most other countries.