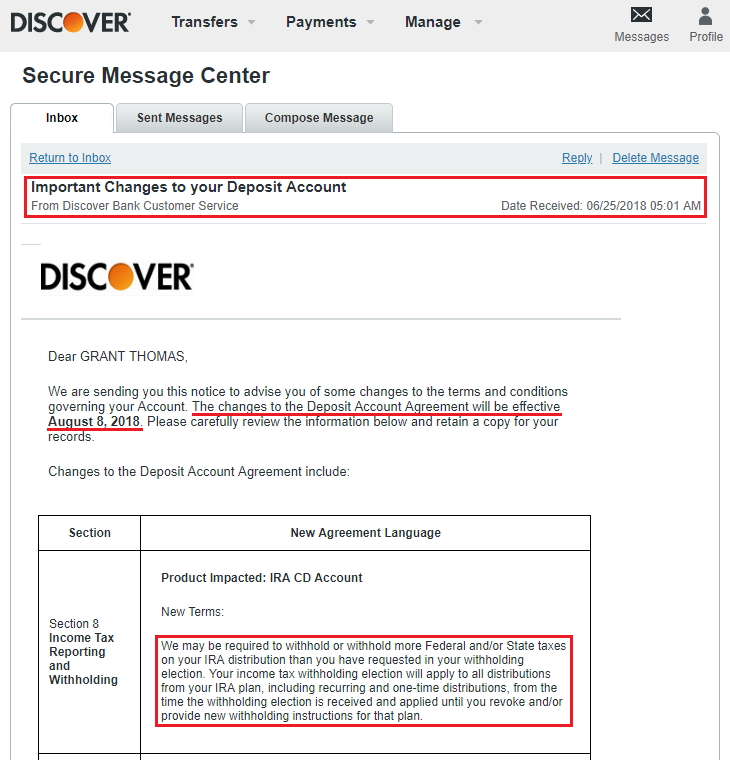

Good afternoon everyone, I just got an email from Discover regarding changes to my deposit accounts. I have 2 credit cards, 1 checking account, and 4 savings accounts with Discover (thanks to various account opening promotions), but these changes are not for Discover It Credit Card or Discover It Miles Credit Card holders, so if you only have those Discover accounts, this post is not for you. But if you have a Discover checking, savings, money market, or IRA account, there are a few account announcements you should be aware of. Here is the email I received from Discover, but the email only mentions which sections were changed, not what the actual changes are, so I logged into my Discover account to find all the details.

All of the following changes go into effect on August 8, 2018, so you have more than 1 month before the changes are live. To start off, if you have a Discover IRA CD, you may see more state and federal taxes withheld from your account. I am not a big fan of CDs (the music medium or the financial product) and do not suggest having a CD in your IRA (I am more of a risk taker, especially for retirement).

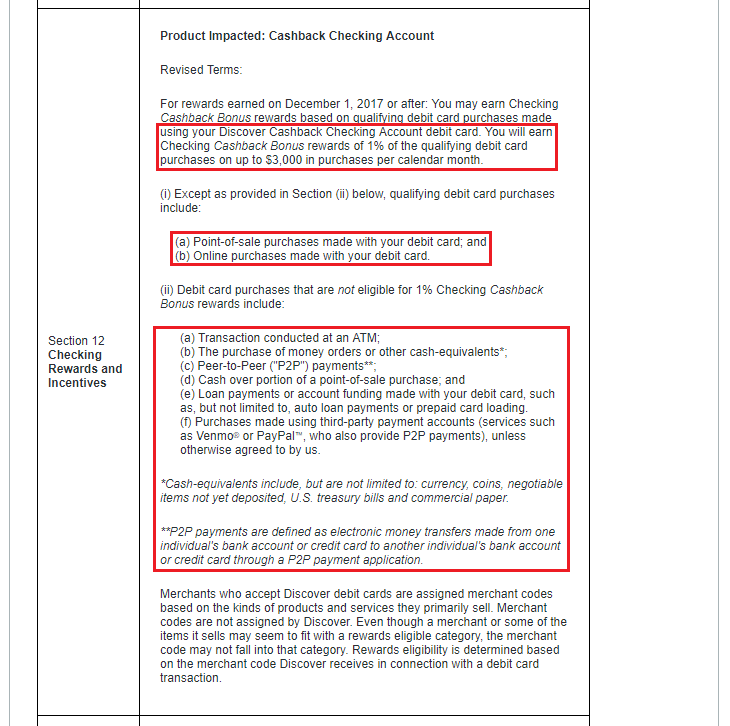

Up next, if you have a Cashback Checking Account, you are already earning 1% cash back on qualifying debit card purchases, up to $3,000 in purchases every month. Discover did clarify/add new restrictions to specify which transactions will not earn 1% cash back. ATMs, money orders, cash equivalents, and P2P payments (like Venmo and PayPal) are all excluded. I don’t use my Discover checking account much and I can get more than 1% cash back by using my credit cards.

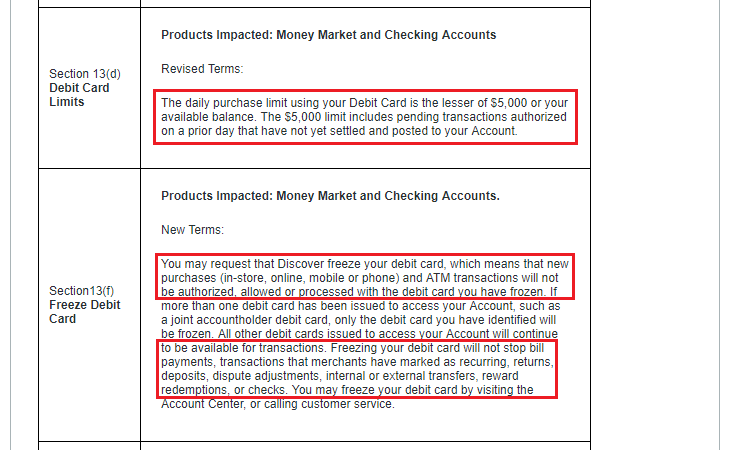

Up next, if you do use your Discover debit card, you are limited to $5,000 in purchases per day. Discover has had a “freeze” feature for their credit cards for a few months, but they are now offering it to debit card holders. By freezing your debit card, “new purchases (in-store, online, mobile or phone) and ATM transactions will not be authorized, allowed, or processed.” In addition, “freezing your debit card will not stop bill payments, transactions that merchants have marked as recurring, returns, deposits, dispute adjustments, internal or external transfers, reward redemptions, or checks.”

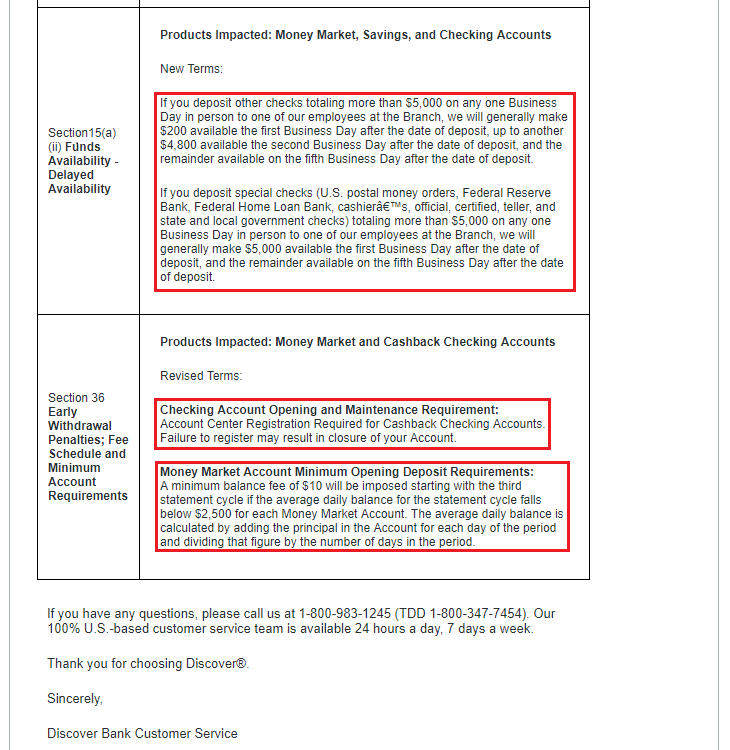

Up next, if you make deposits in a Discover branch (Discover has branches?) you have new terms for large deposits over $5,000, depending on if the deposits are personal checks or other types of deposits. This next thing is kind of strange. If you do not register your checking account for Cashback Checking, Discover will close your checking account (that seems harsh). If you have a Money Market account, you will be charged a $10 monthly fee if your average daily account balance falls below $2,500.

Nothing super important in here, but good to be in the know when it comes to financial products and fees. If you have any questions about any of these changes, please leave a comment below. Have a great day everyone!