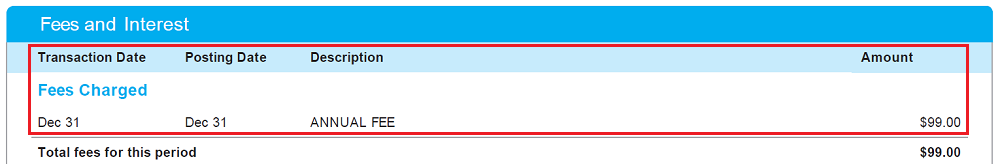

Good morning everyone. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit cards to make sure they still deserve a spot in my wallet (or at least my credit card drawer). A few weeks ago, the $99 annual fee posted to my Barclays JetBlue Plus Credit Card. I don’t fly JetBlue very often, but I do enjoy getting a 10% rebate on my redeemed miles and getting 5,000 bonus anniversary points every year. Those 2 benefits alone are probably worth close to $99, depending on how much you value JetBlue points and how many JetBlue points you redeem. So the question is, is this card a keeper? I was leaning toward keeping the credit card, but I decided to call Barclays and ask if there were any retention offers available anyway. Good thing I called…

I spoke to the Barclays rep and said that I was reviewing my recent credit card statement and saw that the $99 annual fee just posted to my account. I told her that I do not fly JetBlue very often and asked her to waive the $99 annual fee. She told me she would look into my account and see what offers were available. She came back and said that she could not waive the full $99 annual fee, but that she could waive half the annual fee, or $49.50. That was a great offer, but I asked her if there were any other offers available. Yes, she said, there was also a spending offer where I could earn 5,000 bonus JetBlue points if I spent $1,000 in the next 3 months. I was torn between which offer to accept, so I asked her which offer she thought was better. Without missing a beat, she said that she could apply both offers to my account. I immediately accepted her offer and she read the terms of the spending offer to me. The following day, the $49.50 statement credit posted to my account, but was backdated to December 31, I’m not sure why. I paid the remaining $49.50 balance and am working on spending $1,000 in the next 3 months to complete the spending offer.

I reviewed my credit card activity since last year’s annual fee and it looks like I received the same offers last year: $49.50 statement credit to offset the $99 annual fee and a spending offer to get 5,000 bonus JetBlue points after spending $1,000 in 3 months. It looks like I also received another spending offer in September 2018 since I spent exactly $1,000 in that month. Including the 2 spending offers, I only spent $2,028 in 2018. As you can see, I have not spent much money on my Barclays JetBlue Plus Credit Card, just enough to complete 2 spending offers in 2018.

If you have any questions about the Barclays JetBlue Plus Credit Card, please leave a comment below. Have a great day everyone!

This is my #1 favorite card that I will always keep! I do fly JetBlue once or twice a year, and with the free bags plus 5000 points, that is worth way more than the $99 fee. I use this card for groceries so I get lots of points that way. I am able to redeem flights maybe once every 2 years or less.

That is great to hear. Make sure you call Barclays every now and then to get nice spending offers.

That is very good to know. I just picked up this card with the intention of pairing it with the Business Jetblue to get the 20% back, but I saw it looks like it’s dead. However even without that, I think the card is worth the full annual fee since you get back some of the points anyway. I calculated it as about a $20 annual fee which is essentially the cost of one bag per year for break even. But next year I will definitely be asking for the “advice” of the rep to help me decide between the offers. :)

Let me know how your call goes, when you do make the call.

My husband and I recently took out two separate Jet Blue (Barclay’s) credit cards. I begin by saying that our previous credit cards were American Express cards whose service is impeccable. I recently called your customer service to dispute a charge on my card. I had ordered items online relying on measurements given on the web site. When the items arrived they were 3″ shy of the stated width and length measurements. I want to return the items but the supplier will not reply to my emails. There is no address listed on line. I wanted the charge disputed. I was told that in order to dispute the charge of the measurement being wrong I had to hire a professional seamstress to write an affidavit stating that the measurements were not the same as what appeared on their website. Nionna (agent) was adamant that she could not take a dispute based only on MY word. I needed a second opinion.

I have never in my life heard such a request from a credit card company! Never! Our credit card usage is probably small change to you, but we do spend about $4000 a month on our credit cards. We use them for everything. Nionna has promised to have a supervisor call me within 48 hours to discuss this further. I asked her three times if she could possibly be mistaken in her understanding of the requirements to take a dispute from a customer. She said that these are the rules! She has since called me back and offered to put in the dispute for me but at this point I want to talk to a supervisor. Based on this horrific experience we will probably cancel both cards.

I’m sorry Barclays is not be very helpful. I do not work at Barclays, so there is nothing I can do. My recommendation would be to keep calling Barclays until you get a supervisor / manager who is able to help. “The squeaky wheel gets the grease” so keep following up. Good luck on the resolution!