Updated on 7/20/2019 at 8am: I added the Barclays rejection letter to the bottom of this post.

Good morning everyone, I hope your 2 day Prime Day shopping spree is going well. Even though I didn’t buy much on the first day of Prime Day, I did pick up a few new credit cards. My last App-O-Rama was in March, so I patiently waited 3+ months until my July App-O-Rama. As a reminder, I was approved for 3 out of 4 credit cards in my March App-O-Rama, including the American Express Gold Card, the US Bank Altitude Reserve Visa Signature Credit Card, and the Wells Fargo Business Platinum Credit Card. With those minimum spending requirements completed and the sign up bonuses redeemed, it was time to focus on these 5 credit cards. Here is a quick summary of my July App-O-Rama:

- Citi Premier Credit Card – instantly approved

- American Express Platinum Delta SkyMiles Credit Card – pending, then approved (I called AMEX and had to close an old card to open up a credit card slot)

- Barclay AAdvantage Aviator Business Credit Card – pending, then declined (too many recent inquiries)

- Banco Popular Avianca Vuela Credit Card – instantly approved

- Wells Fargo Propel World Credit Card – instantly approved (I called Wells Fargo to apply for this credit card over the phone)

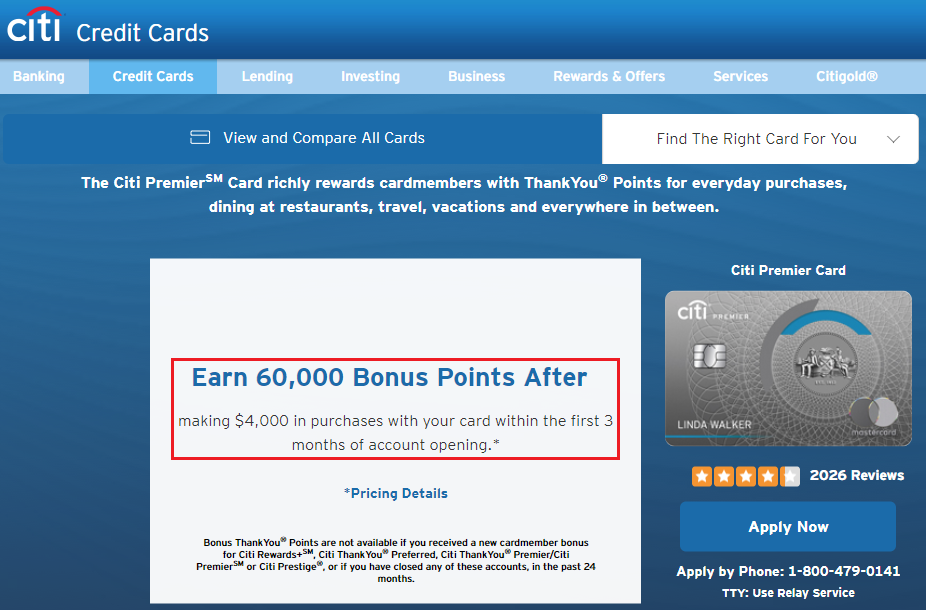

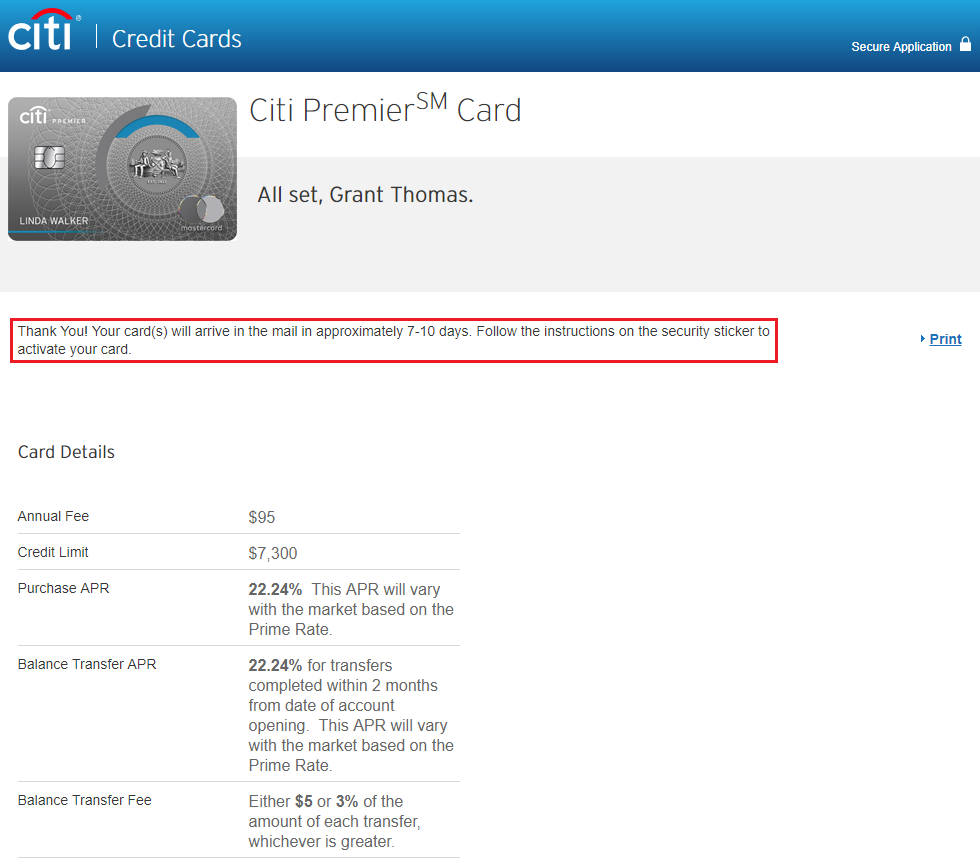

Citi Premier Credit Card

I currently have a Citi Premier Credit Card that I have had for 4+ years, but I wanted to get another one since the sign up bonus is currently 60,000 Citi Thank You Points after spending $4,000 in 3 months. If I was approved for a second Citi Premier Credit Card, my plan was to downgrade/convert my old Citi Premier Credit Card into a Citi Rewards+ Credit Card.

Thankfully, I was instantly approved for this credit card.

I also received an email with the instant approval message.

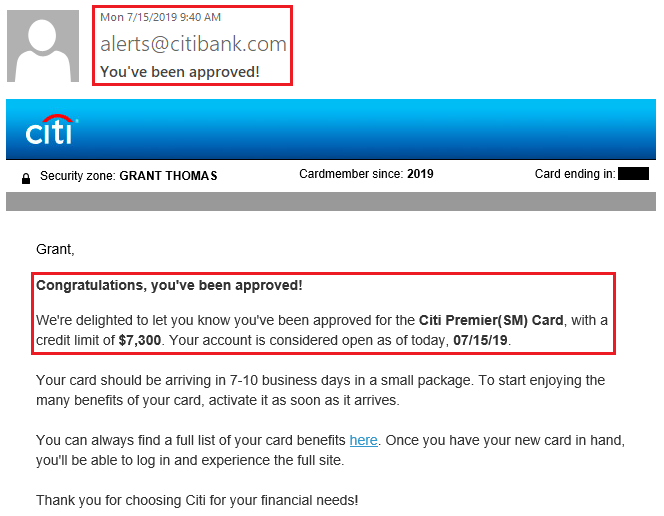

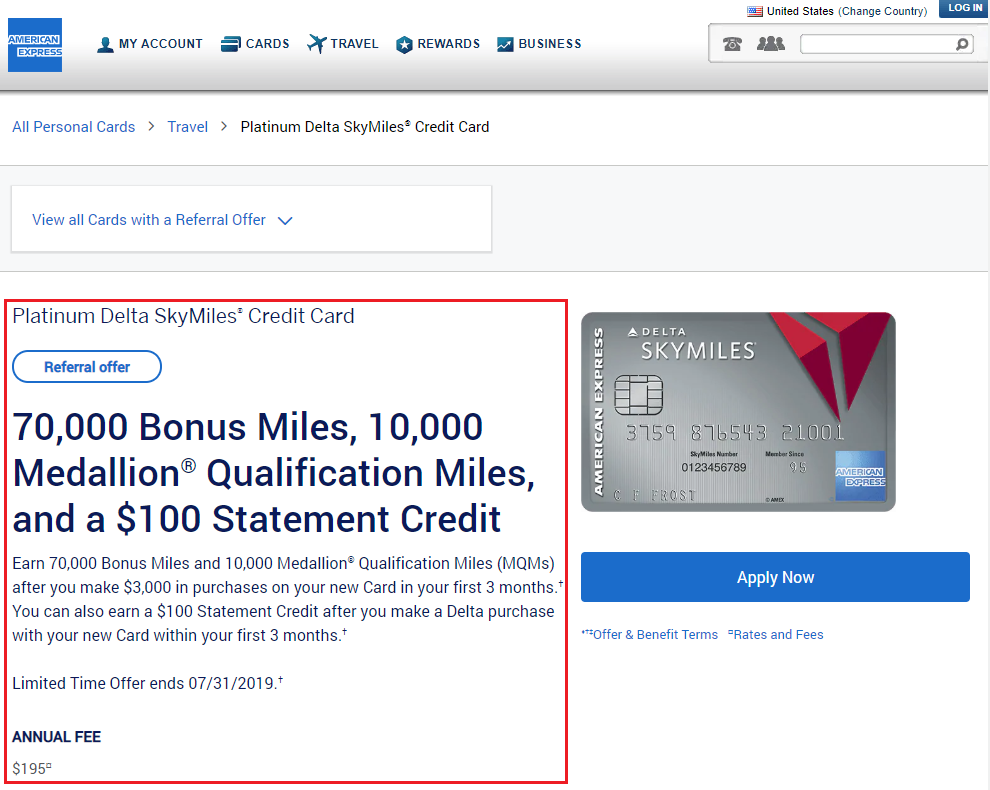

American Express Platinum Delta SkyMiles Credit Card

I was originally planning on doing an AMEX self referral to the American Express Platinum Delta SkyMiles Credit Card, but due to the recent AMEX self referral crackdown, I used my Dad’s referral link instead (you’re welcome, Dad!). I have had a few Delta Gold (both personal and business) credit cards in the past, but never any of the premium Delta credit cards. This Delta credit card currently has a limited time increased sign up offer of 70,000 Delta SkyMiles after spending $3,000 in 3 months. There is also a $100 Delta statement credit if I make a Delta purchase in the first 3 months. There are also 10,000 MQMs, but since I am not a Delta elite or regular Delta flyer, I don’t care about those Delta MQMs.

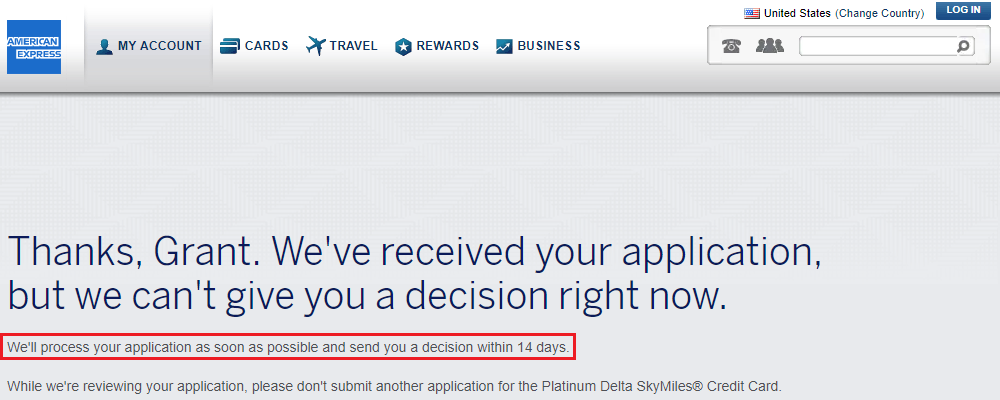

After I submitted the application, I got a pending message. This is what I anticipated since I have several American Express personal and business credit cards.

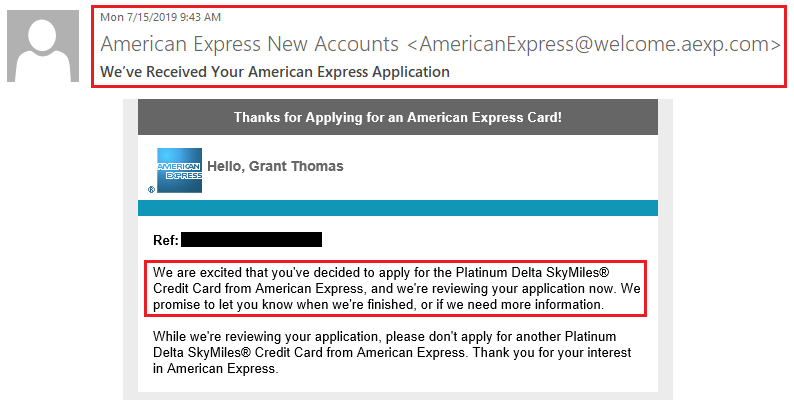

I also received an email about the pending application.

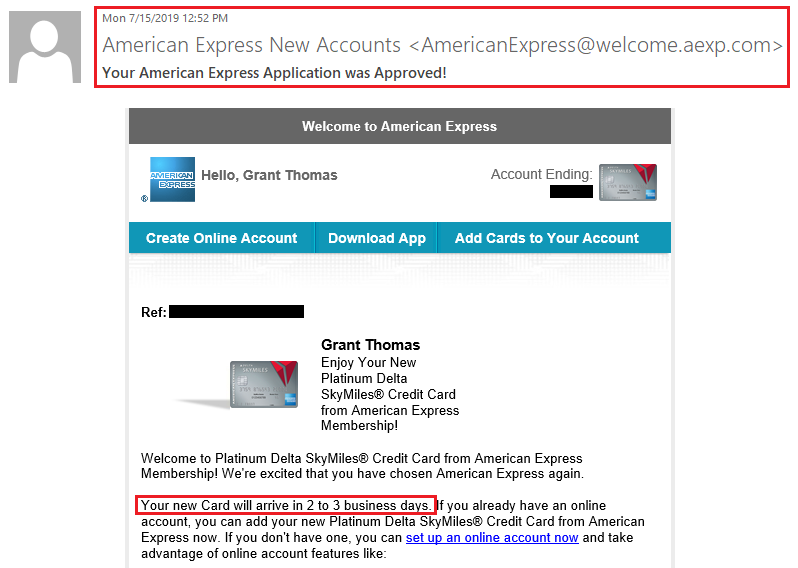

A few hours later, I called American Express (reconsideration numbers) and was able to get this credit card approved by closing my existing American Express Hilton Honors Business Credit Card (the $95 annual fee was coming due in a few weeks and I wasn’t planning on keeping the credit card another year). Without even asking, the AMEX rep told me she would expedite the new Delta credit card to me. I also received this approval email after the call.

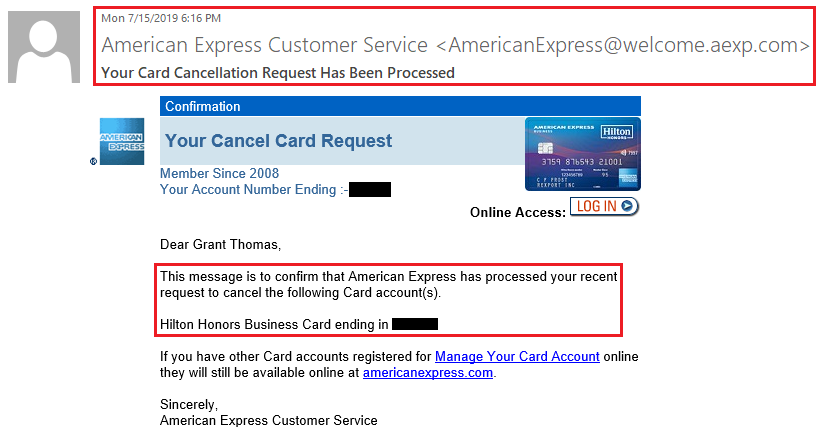

A few hours later, I received this cancellation email regarding my American Express Hilton Honors Business Credit Card.

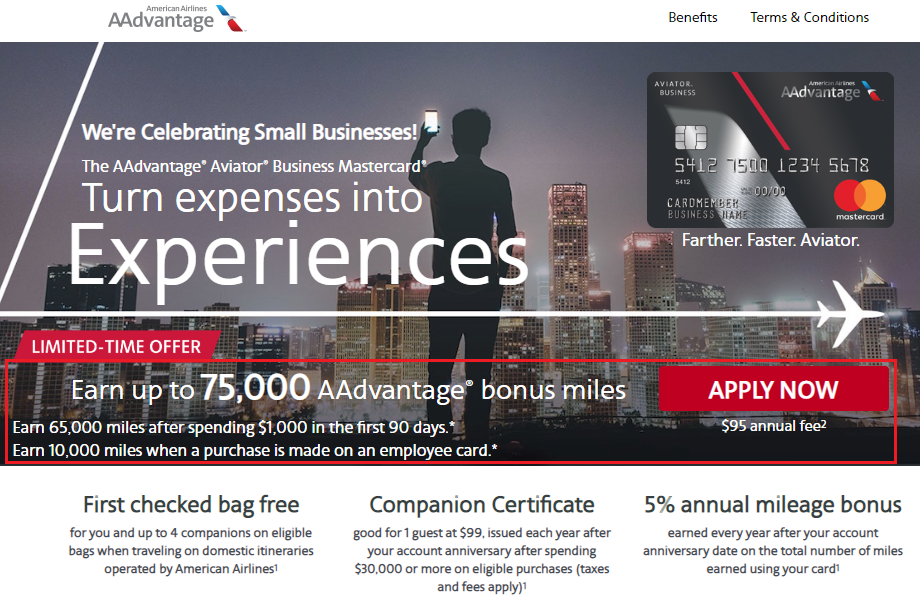

Barclay AAdvantage Aviator Business Credit Card

I am not a big American Airlines flyer and haven’t flown AA or booked an AA award ticket in 1.5 years, but I figured I would try for this credit card. This credit card is currently offering 65,000 AA miles after spending $1,000 in 3 months and an extra 10,000 AA miles after an employee makes a purchase with their credit card.

Unfortunately, I got a pending decision.

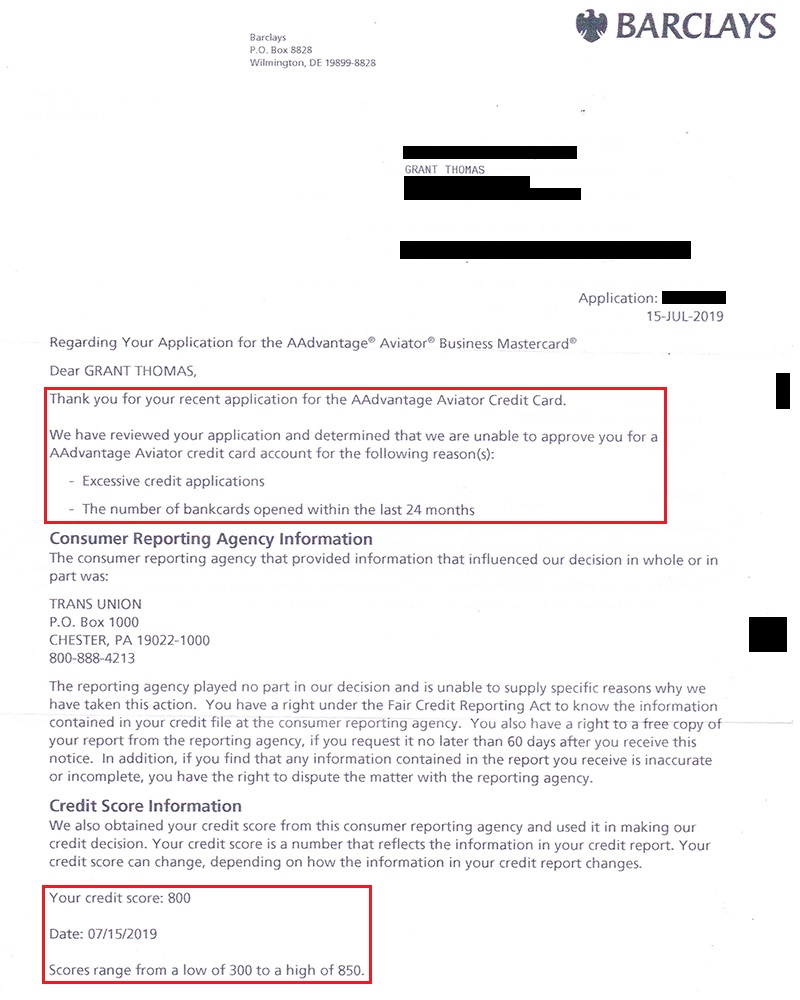

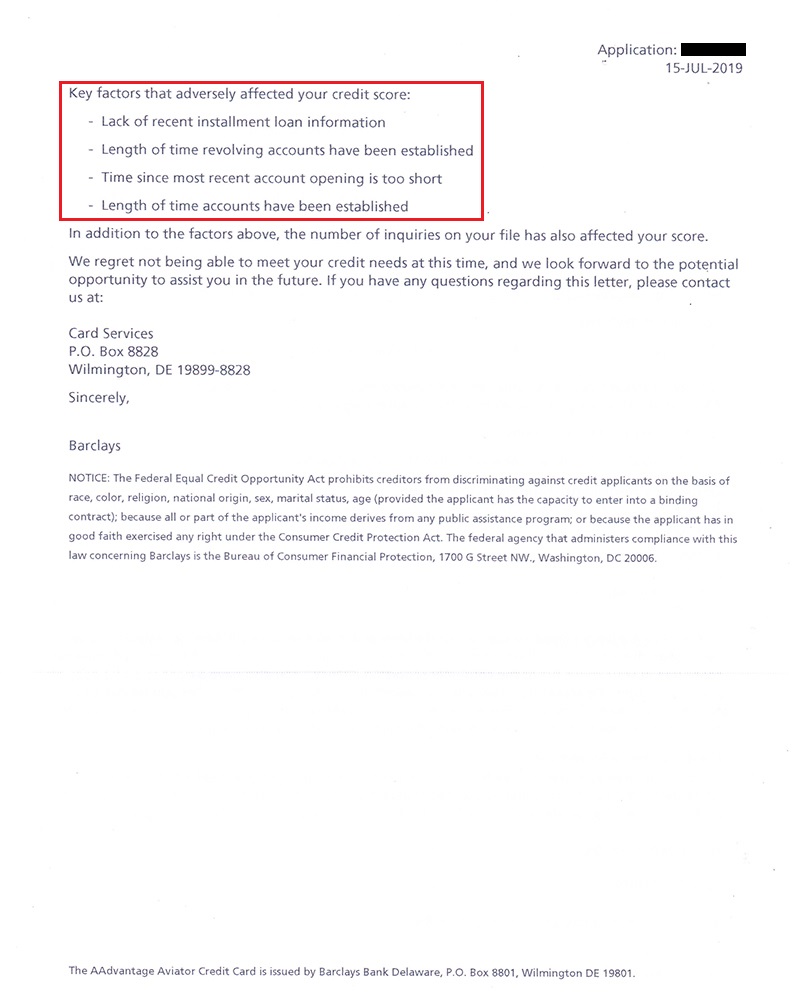

I checked the online application status and found out that I was declined. I then called Barclays (reconsideration numbers) and asked about the denial. The rep said I had too many recent inquiries and there was no way to overturn the decision, even if I closed an existing Barclays credit card. That was a bummer.

Updated on 7/20/2019 at 8am: I just got my rejection letter from Barclays in the mail that states that my application was declined because of “excessive credit applications” and “the number of bankcards opened within the last 24 months.”

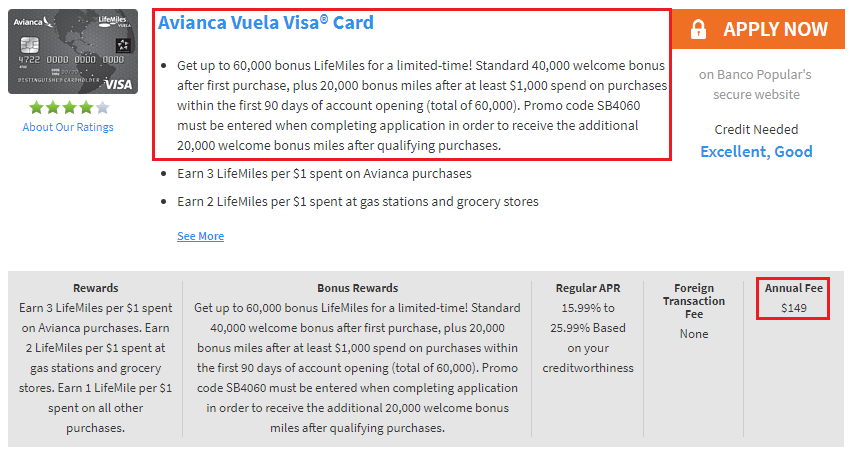

Banco Popular Avianca Vuela Credit Card

I had this credit card a few years ago from December 2016 to June 2017, so I decided to reapply. Last time I checked, the sign up bonus was only 40,000 LifeMiles, but luckily, the sign up bonus is now back up to 60,000 LifeMiles (40,000 LifeMiles after your first purchase and an extra 20,000 LifeMiles after spending $1,000 in 3 months), you just need to use promo code SB4060 during the application process.

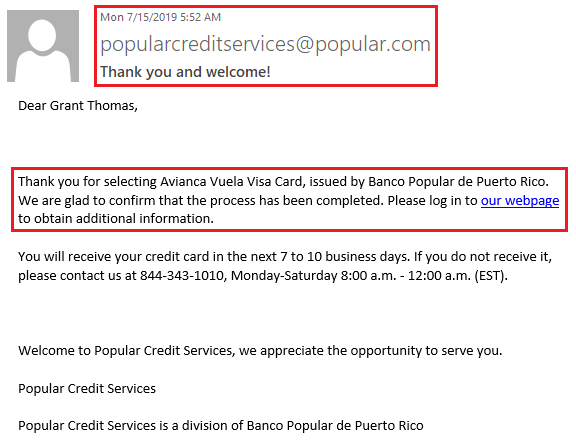

I was instantly approved, but I forgot to take a screenshot of the page. I also got this email with a link to view the application status.

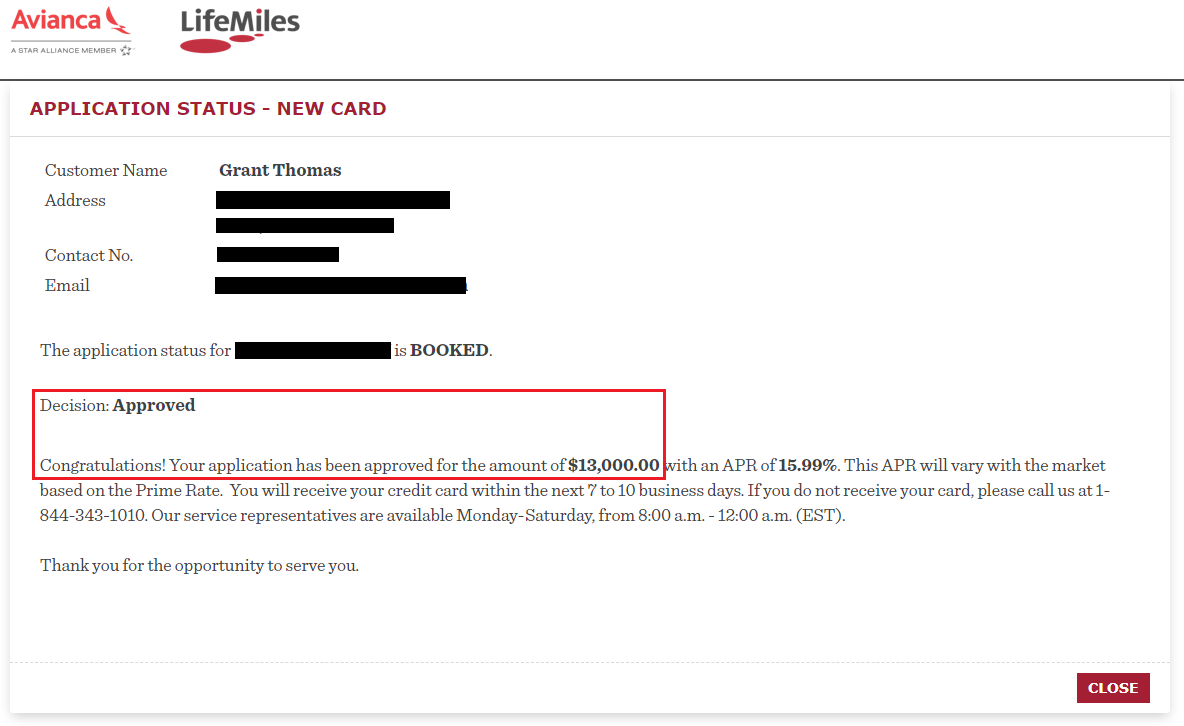

On the application status page, it shows I was approved.

Wells Fargo Propel World Credit Card

I have also had this credit card before, but decided to reapply. Unfortunately, there is no online sign up page, but Doctor of Credit has instructions regarding applying over the phone. The sign up bonus is 40,000 points after spending $3,000 in 3 months. You also get a $100 airline reimbursement and the $175 annual fee is waived the first year.

After spending 20 minutes on the phone with the Wells Fargo rep, I was instantly approved for the credit card. Here is the email I received after the call.

Here is how many points I will get after meeting the minimum spending requirements:

- Citi Premier Credit Card – 60,000 Citi Thank You Points – $4,000 in 3 months

- American Express Platinum Delta SkyMiles Credit Card – 70,000 Delta SkyMiles – $3,000 in 3 months

- Banco Popular Avianca Vuela Credit Card – 60,000 LifeMiles – $1,000 in 3 months

- Wells Fargo Propel World Credit Card – 40,000 Points – $3,000 in 3 months

All in all, I will get 230,000 miles/points after spending $11,000 in 3 months. All in a day’s work! If you have any questions about any of these credit cards or the application process, please leave a comment below. Have a great day everyone!

Hey Grant – That’s an awesome app-o-rama result! Congrats!!! I’m particularly impressed with your strategy on getting a second Citi Premier card and then downgrading your original. Well played, indeed. ~Craig

I’m planning on meeting the minimum spend and getting the sign up bonus on the new Citi Premier CC before converting my old Citi Premier CC to the Citi Rewards+ CC. I think that is the safer approach.

Agreed. Good call-out on that nuanced point.

Thank you :)

nice stack there….wondering though why you went for the av card since they sell miles for cheap you might as well sign up for a harder to acquire card ?

Getting 60,000 LM seemed like a great deal for $149. I had this card toward the end of my App-O-Rama and applied for more important CCs first.

Hi can you tell where Citi pull your credit from? DOC has a good reference on this. I am curious how accurate it is?

My FICO8 (from Expeian) is quite different from the Vantage 3 which Lifelock gives for Experian. Do you know if Citi looks at FICO8 or Vantage score for the app?

I think it depends what state you are in. I live in CA, so my datapoint would only be useful for other people who live in CA.

Citi provides FICO (Bankcard 8 Score Model) through Equifax. Not many Lenders provide FICO based score through EQ.

Good to know, thank you Cap :)

Didn’t you apply and get the Wells fargo business platinum card in march 2019?

Yes I did. Now that you mention that, I wonder if the 15 month rule will prevent me from getting the sign up bonus. We will see.

For the Premier card, what was your 24 month status for TYP cards overall? They haven’t switched to the 48 month bonus window yet, as far as I know. Btw, this is the first data point I had heard of churning the Avianca card – I thought I had read about people failing to churn it before.

I haven’t touched my old Citi Premier CC in 4+ years, I think the 24 month rule is still in place. I had a Citi Prestige CC a few years ago that I converted to a Citi AT&T Access More CC and didn’t want to mess with the 24 month rule.

I’ve tried for the Avianca CC a few times after closing my first Avianca CC and the application would always stop me in the middle to tell me I already had a CC open. Maybe I outlasted that check. I’m hopeful the bonus will post without any issues.

Was the product change to the ATT within the last 24? I product changed from Prestige to TYP less than 24 months ago, and the card number changed, so I assumed that meant I wasn’t eligible.

My conversion was more than 24 months ago. I would recommend waiting 24+ months since that conversion to be safe.

Grant, thanks so much for the tip about Citi Premier. I am in the same situation with my 4+ years Premier, and have been wanting to get the Citi Rewards+ due to the 10% points rebate. Glad I stumbled upon your strategy. I applied and got approved as well. I hope to get that 60k then convert my premier to Citi Rewards+ or wait until more information on the double cash can combine with TY points too in the Fall to see which makes the most sense for conversion?

To be safe, I would recommend completing the minimum spend and getting your sign up bonus before converting your old Citi Premier CC to the Citi Rewards+ CC. I will share my data points on the blog when I get to that point.

Pingback: View & Activate AMEX Offers on Wells Fargo Mobile App & Desktop Website

Grant, for you me Amex app, does the credit inquiry show on your credit report by Amex?

The CC from Wells Fargo will show as a Wells Fargo CC on my credit report, since Wells Fargo is the issuing bank.

Grant, I was asking Amex not Wellsfargo. Did it show hard inquiry for Amex? I heard Amex only does soft pull if you are current card holder?

I checked Experian, Credit Karma, and Credit Sesame and don’t see any hard inquires for AMEX.

Pingback: New Amex Hilton Offers, Arches National Park, Investing Generations, Hideous Blog Clickbait - TravelBloggerBuzz

Interesting DP regarding avianca. I was under the impression that you can’t get the card again (I tried before and was told I already had it) so I was gonna try for the lower tier one with 40k bonus, now I’m gonna shoot for the 60k. Last time I was rejected was about six months after closing it. Looks like waiting longer should work this time.

I’m not sure how long you need to wait before opening a second Avianca CC after you have closed the first Avianca CC, but if you do not see the warning that you currently have the CC, I think you should be in the clear. Just make sure you use the promo code to get the bonus miles!

Is there a reason why to wait to earn the sign up bonus of old premier before conversion? What will happen to your old premier TY points after conversion?

The reason I am waiting to convert my old Citi Premier is that I do not want it to affect my current Citi Premier sign up bonus. I don’t want the card to be closed or the card number to change, since that might mess up my sign up bonus.

Pingback: Dealing with Banco Popular's Avianca Vuela Credit Card Identification Verification Process

Pingback: I Completed My 4 Credit Card July App-O-Rama (Sign Up Bonus Posting Details)

Pingback: Unboxing Citi Premier Credit Card: Card Art, Welcome Documents & Active with Citi Mobile App

Pingback: Unboxing Banco Popular Avianca Vuela Credit Card: Card Art, Welcome Documents & Rewards Details

Pingback: Keep, Cancel or Convert? American Express Platinum Delta SkyMiles Credit Card ($250 Annual Fee)

Pingback: Unboxing Wells Fargo Propel World Credit Card: Card Art, Welcome Documents & Benefits Guide