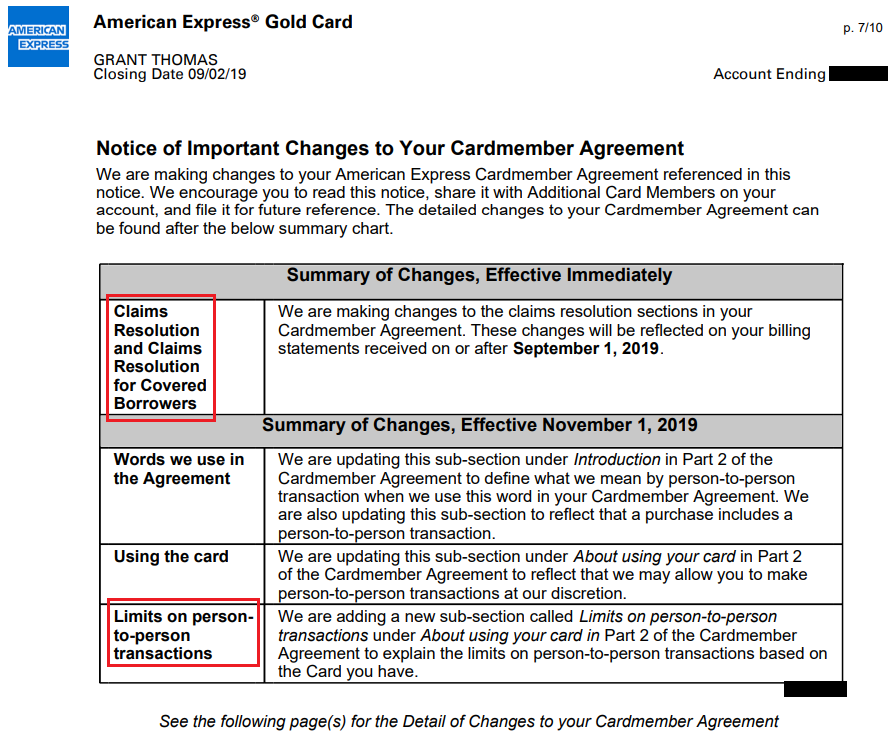

Good morning everyone, I hope you had a great Labor Day Weekend. My American Express Gold Card statement just closed and I noticed that there were a few “Important Changes” listed at the bottom of my statement. I will share the details of those changes and provide my thoughts. There was also a change to the Plan It feature listed on my American Express Everyday Credit Card statement, which I will share at the bottom of the post. To get started, American Express announced immediate changes to the “Claims Resolution and Claims Resolution for Covered Borrowers” section and upcoming changes regarding “Limits on person-to-person transactions” that will go into effect on November 1, 2019.

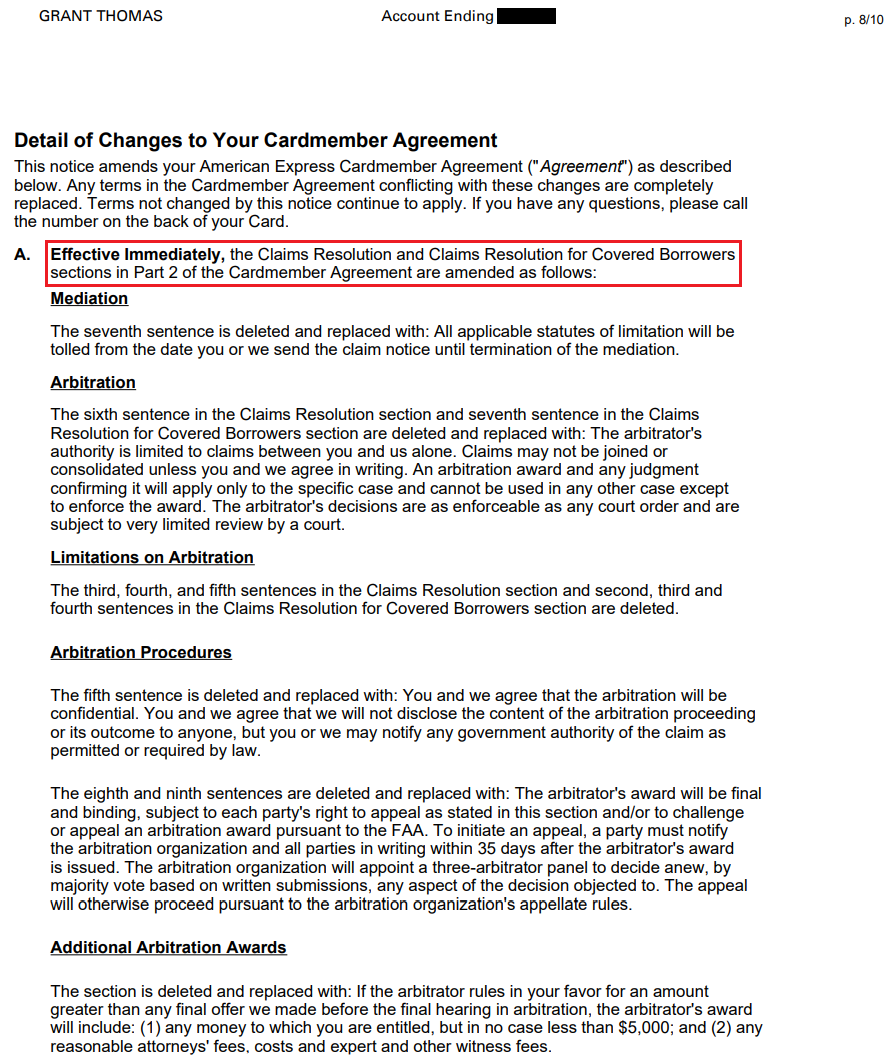

Here are all the details regarding changes to the claims resolution process. I am not an expert on mediation and arbitration, but if those things matter to you, please read this section.

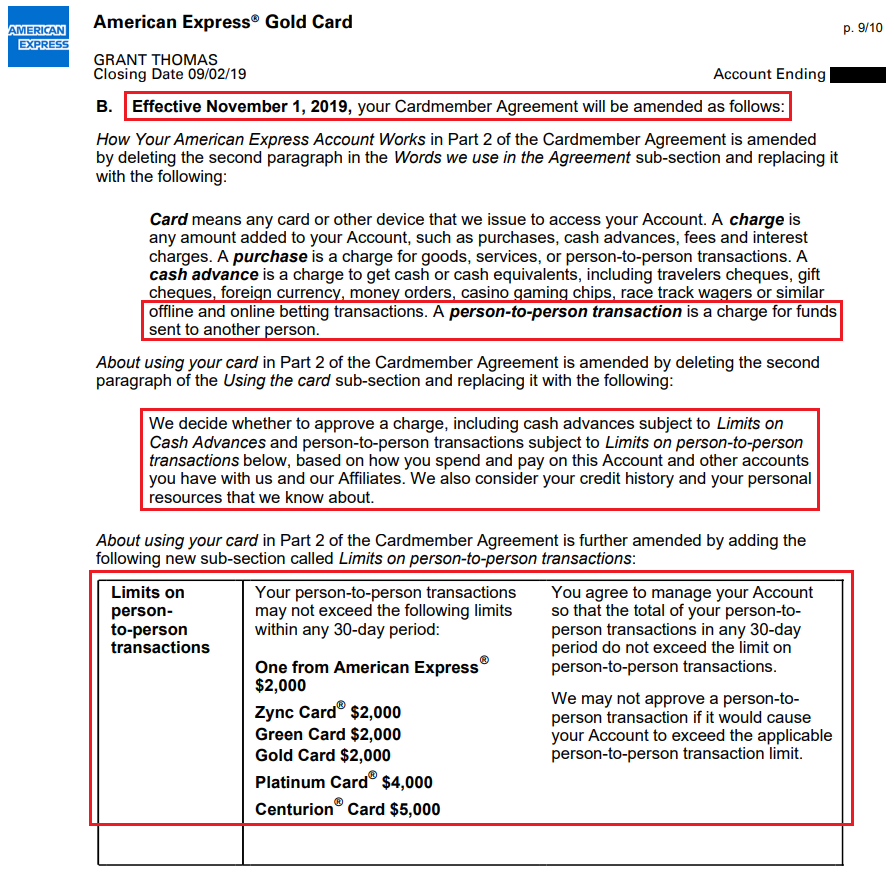

The next change is regarding person to person transactions. Beginning on November 1, 2019, there will be a limit on the dollar amount you can charge for person to person transaction (I think this is in reference to PayPal, Venmo, Bravo, and other services). This limit is based on a rolling 30 day period and depends on which American Express credit or charge card you use to make the payment. Person to person transactions usually incur a 2-3% fee, so are not realistic for manufactured spending purposes, but can be useful for completing minimum spending requirements.

I searched the American Express Gold Card terms and conditions and I could not find an exact definition of person to person transactions, but it is grouped with buying gift cards. Here is the exact quote:

“Eligible purchases are purchases for goods and services minus returns and other credits and do NOT include: fees or interest charges; purchases of travelers checks; purchases or reloading of prepaid cards; purchases of gift cards; person-to-person payments; or purchases of other cash equivalents.”

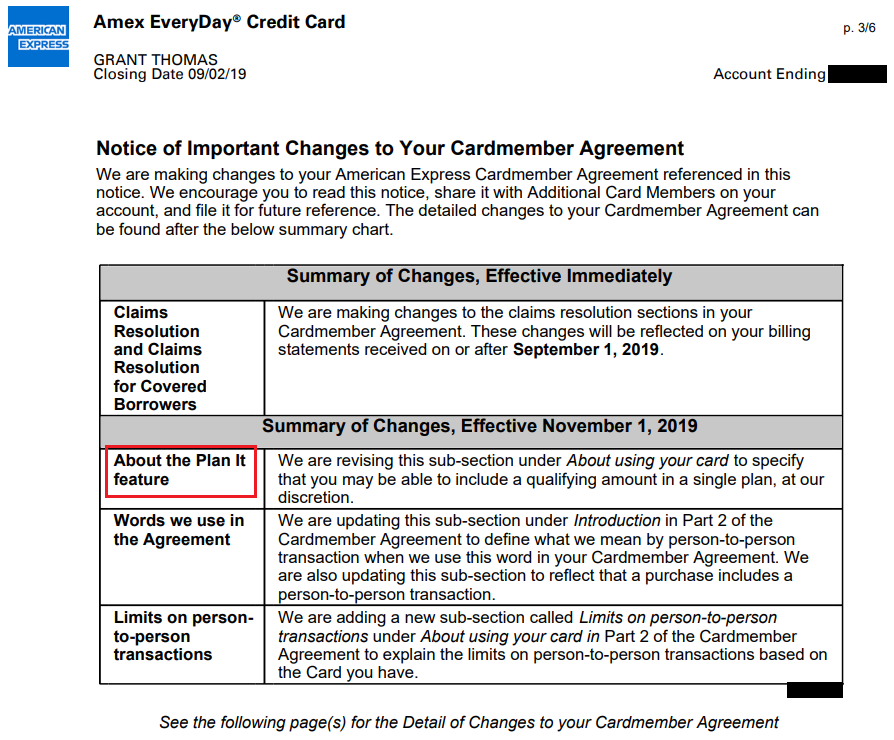

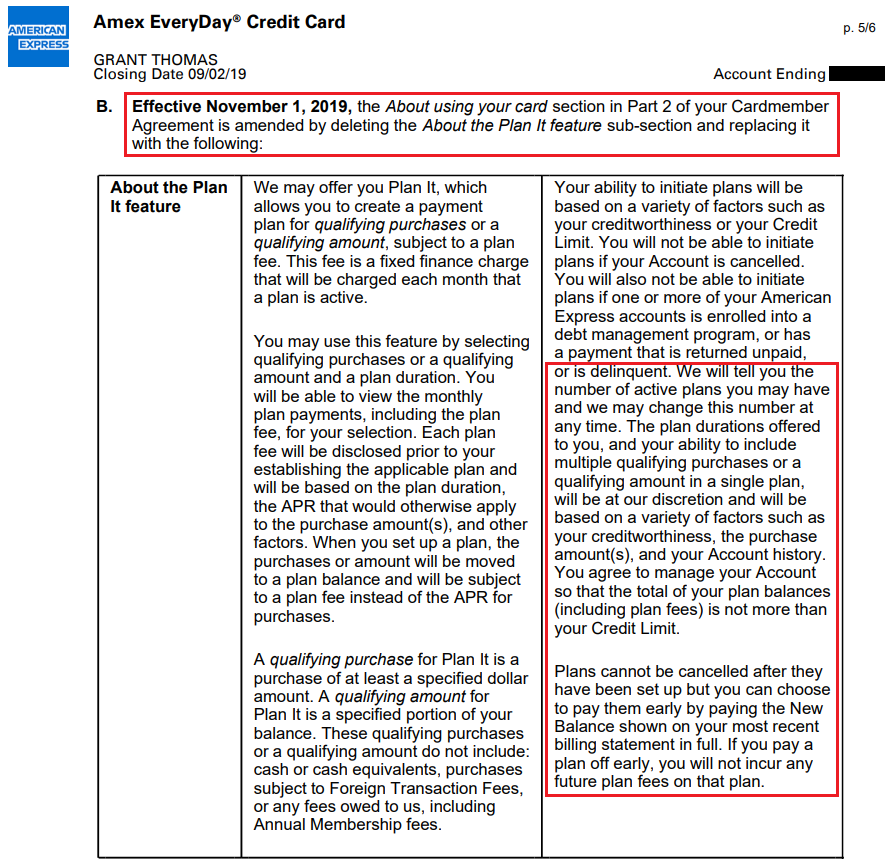

There is also a change to the Plan It feature that goes into effect on November 1, 2019.

Here are the details about the upcoming change. I have never used this feature or looked into it very closely, but it seems that American Express is making changes to allow them to decide the number of Plan It plans you can have and the duration of each plan.

If you have any questions about any of these changes, please leave a comment below. Have a great day everyone!

Pingback: Recap: American Express Card Changes, Silvercar Freebies In Austin & More - Doctor Of Credit

Wow. Just wow. Great catch! I can’t believe they are adding a freaking gag clause to the arbitration agreement. That is low and unheard of (although most banks require a gag clause to settle). The last arbitration change (or Sentence 27 as Amex would say) is bizarre. It appears to be a reverse Rule 68??? But an arbitral award usually contains those elements already. Unless Amex is arguing that those are the only 2 kinds of relief that can be granted? Very confused. As to Plan it, they’ve realized it allows users to print their own 0% (+fee) APRs offers at any time. Not very smart! I’ve used Plan it twice with no fee. Works great. Your autopay even adjusts to pay the new minimum to stay in grace so you can set it and forget it.

Wow, I just learned 2 things from you. Glad you were able to take advantage of the Plan It feature twice :)