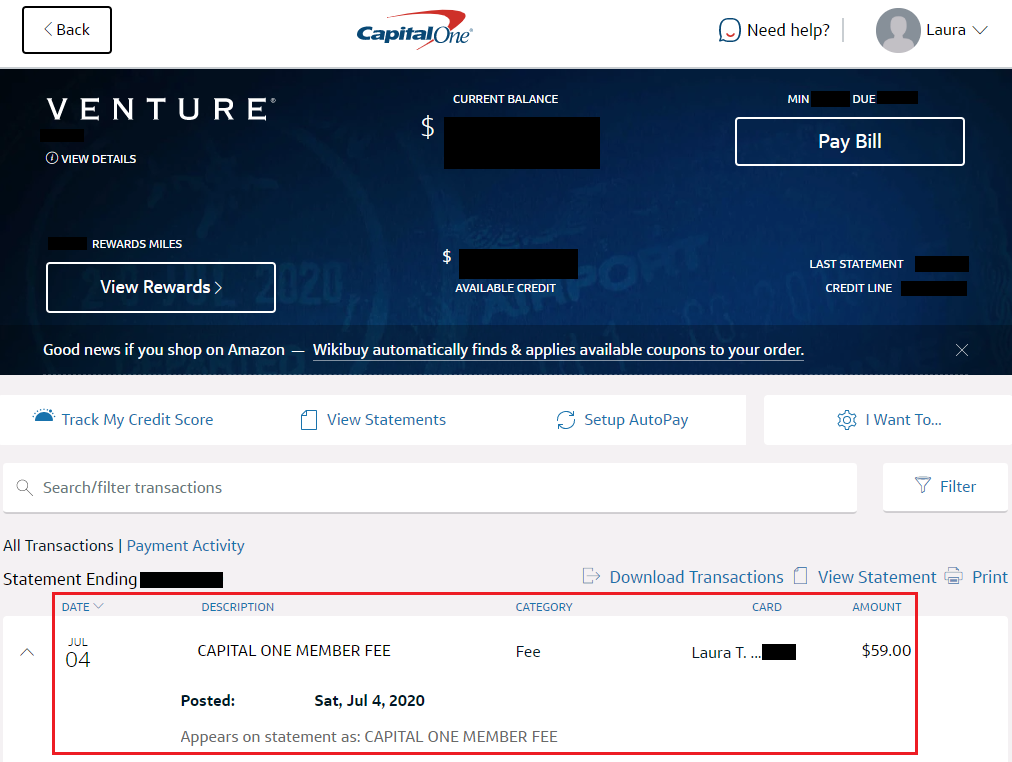

Good morning everyone. A few days ago, the $59 annual fee posted on my wife’s Capital One Venture Rewards Credit Card. Laura has been a loyal Capital One cardmember since before she met me and uses this card as her go-to 2% back everywhere card. I told her she should call Capital One and ask them to waive the annual fee. She looked at me strangely wondering why she should ask to waive the annual fee. I told her that my Citi Double Cash Credit Card earns 2% cash back with no annual fee and we aren’t travelling, so we haven’t put any eligible travel purchases on the card that could be reimbursed. Plus, she has never transferred Capital One “Miles” into frequent flyer miles. She called the number on the back of her card and talked to a friendly Capital One rep.

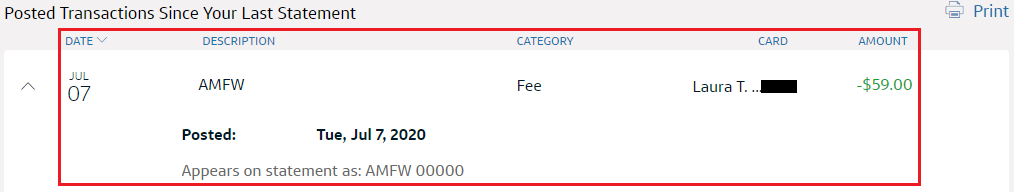

When the rep answered the phone, Laura said that she reviewed her recent credit card statement and noticed the $59 annual fee had posted. Laura asked the rep to waive the annual fee this year. Without much convincing, the rep gladly offered to waive the annual fee as a “one time courtesy” (if I had a dollar for everytime I received a one time courtesy credit, I would have quite a few dollars). The following day, there was a $59 credit with the description AMFW. I’m not exactly sure what that stands for, but it probably means something along the lines of Annual Membership Fee Waiver.

This was probably one of Laura’s quickest and easiest retention calls and I was excited to tell her, “You made $59 with a $3 minute phone call.” It is nice when Laura receives a retention offer because it makes her more willing to call in the future regarding other retention calls. If you have a Capital One credit card with an annual fee, call Capital One and see if they will waive the fee for you this year. If you have any questions, please leave a comment below. Have a great day everyone!

question – my wife and i have both got cap one venture, but her annual fee is 95 while mine is 59. would you know why?

Hmm, the current annual fee listed on the Capital One website says $95 for the Capital One Venture Rewards CC. My wife has had this CC for years, so maybe she and you have annual fees that are grandfathered in at only $59. You can call Capital One and see if they can do anything to lower the annual fee from $95 to $59 (or maybe ask for a $36 statement credit to account for the difference). Good luck and let me know what happens.

I got a CHARGE to AMFW of $175 on a SPARK Capital One card… it has no annual fee.

Hmm, that is strange. I would call Capital One to inquire about that charge.