Good morning everyone, happy Friday! I’m sure most of you have seen the Experian Boost commercials on TV or online, but how many of you have actually checked to see if it would boost your Experian credit score? According to the Experian Boost small print, the average credit score increase is 13 points (which is not a lot), but it’s better than nothing. Speaking of nothing, some customers may not see any score increase at all (which is what happened to me). The last thing to keep in mind is that this will not improve your Equifax or TransUnion credit scores and some financial institutions may use a different FICO score or model. Your credit score will not increase 100 points with Experian Boost, so keep your expectations in check.

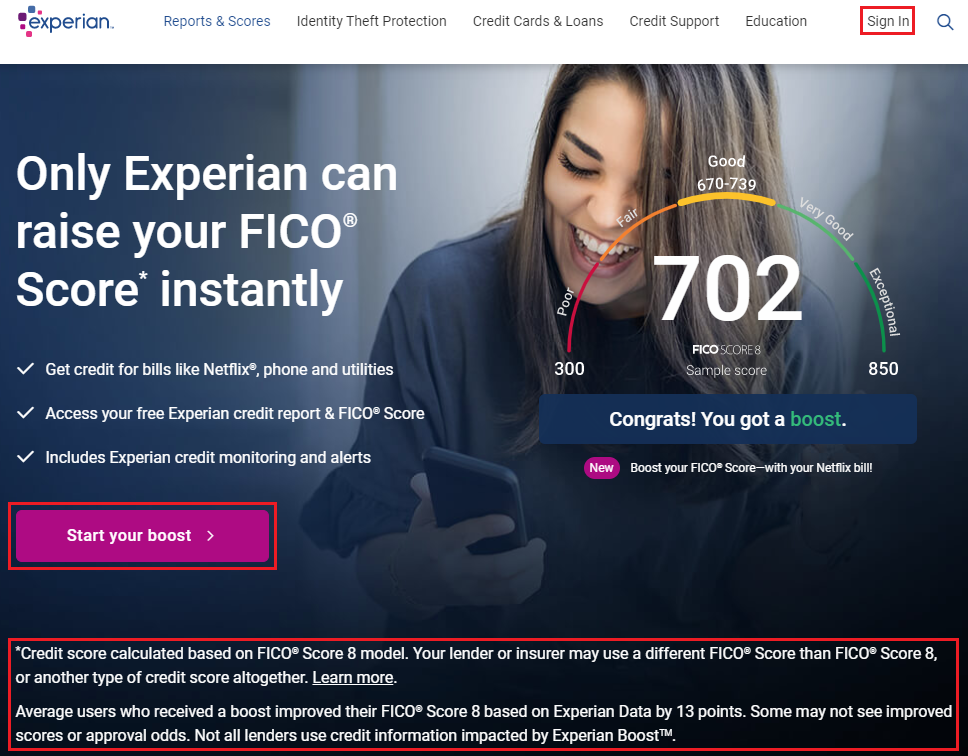

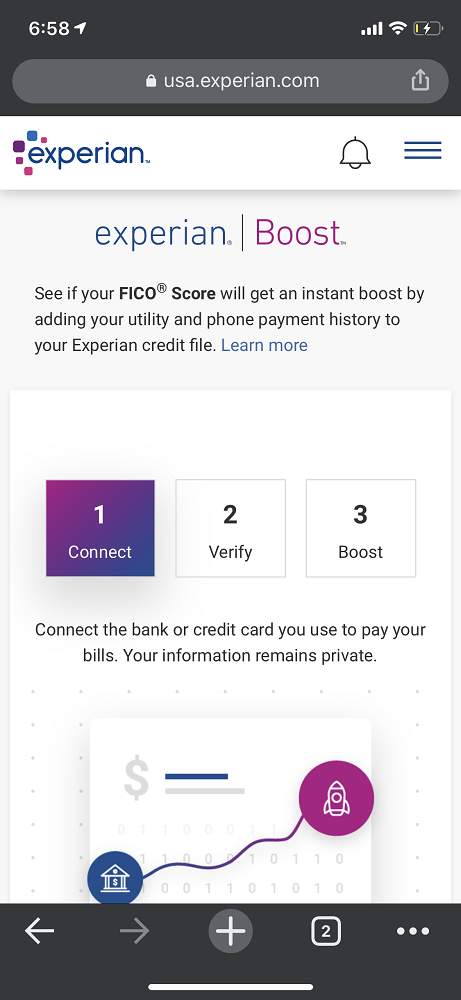

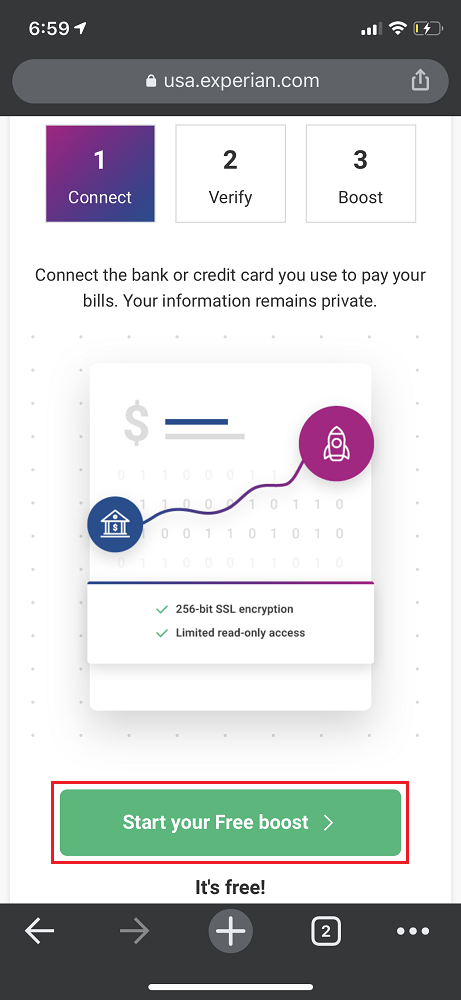

The entire process took about 10 minutes and involved logging into my Experian account and linking my financial institutions that I use to pay recurring bills (like Netflix, phone and utilities). After you link your financial accounts to Experian, Experian Boost will scan your accounts and recent statements to find recurring bills. Once they find recurring bills, you will be asked if you want to add those recurring bills to your credit report, which may or may not increase your credit score. In this post, I will walk you through all the steps. To get started, go to the Experian Boost page and sign in or create an account by clicking the Start Your Boost button.

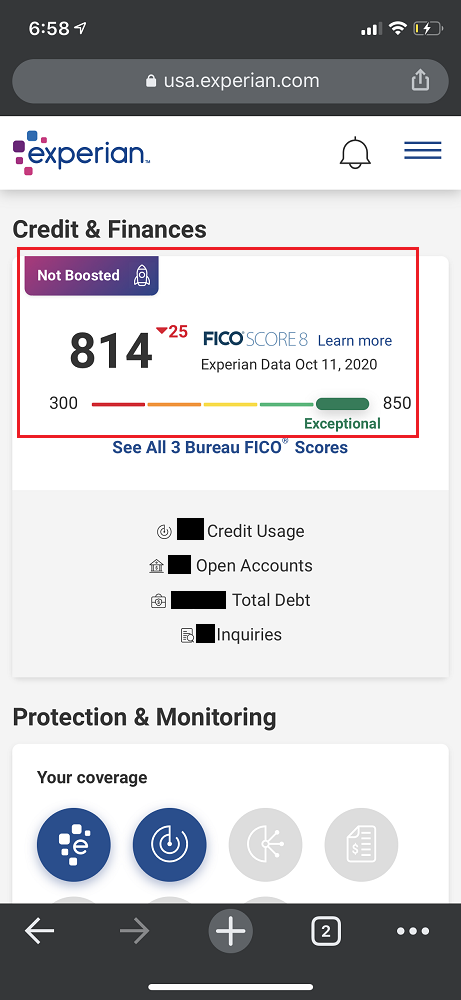

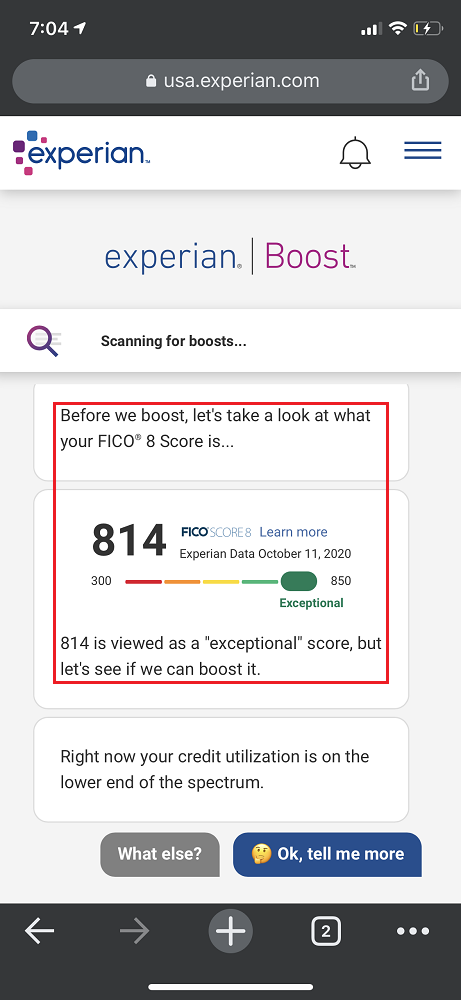

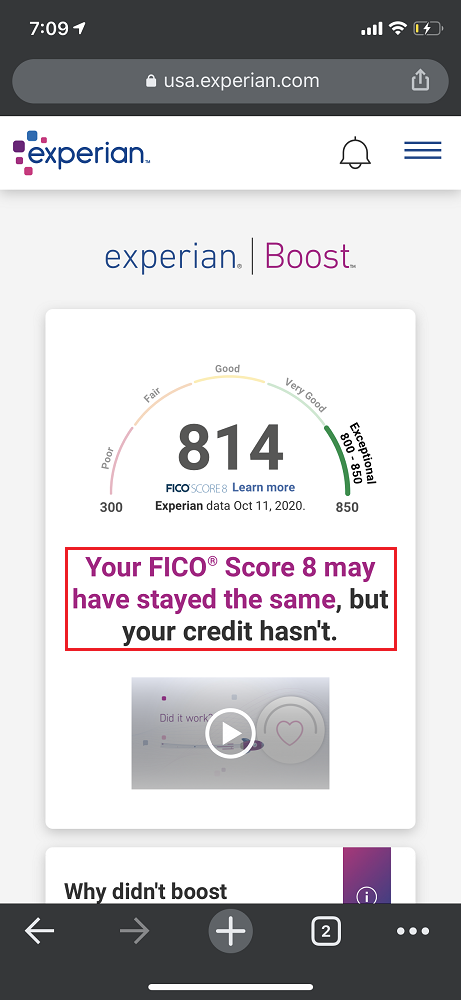

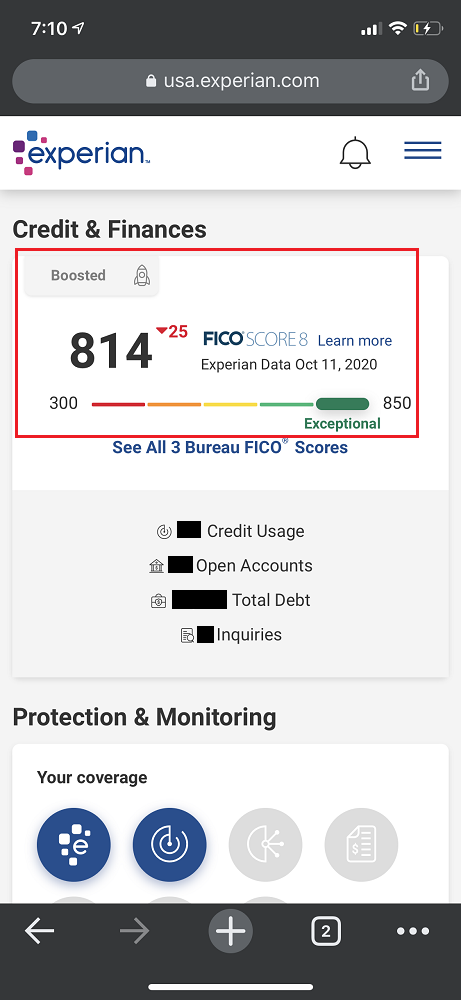

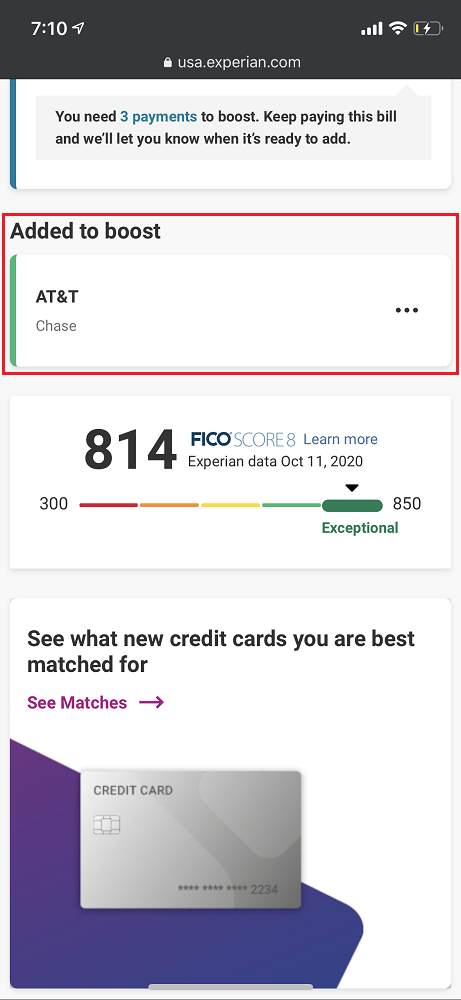

The following screenshots were taken on an iPhone, but the process should be almost the same for all mobile devices and desktop web browsers. As you can see, my Experian credit score was 814 on October 11. Scroll down until you see the Experian Boost section and click the Start Your Free Boost button.

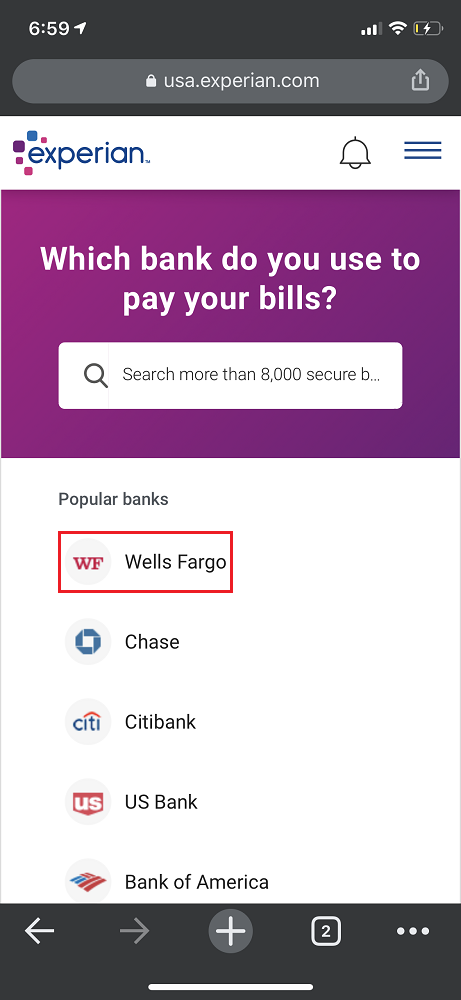

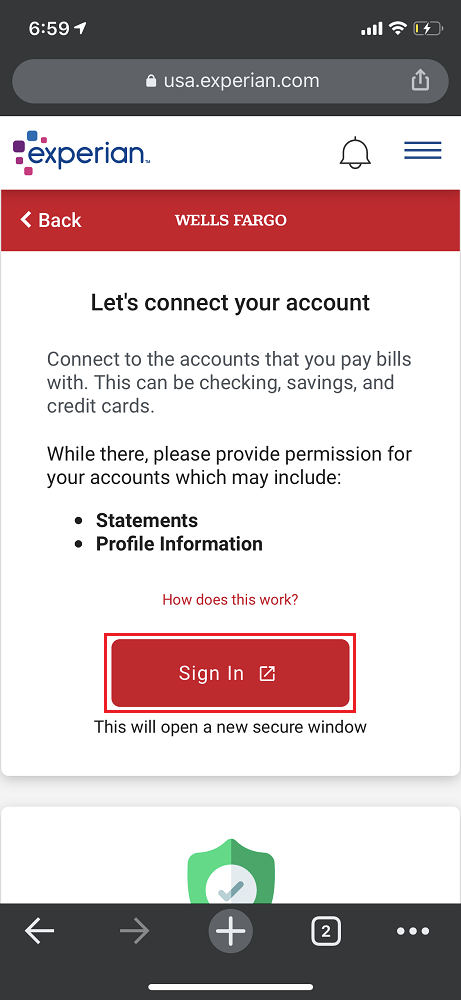

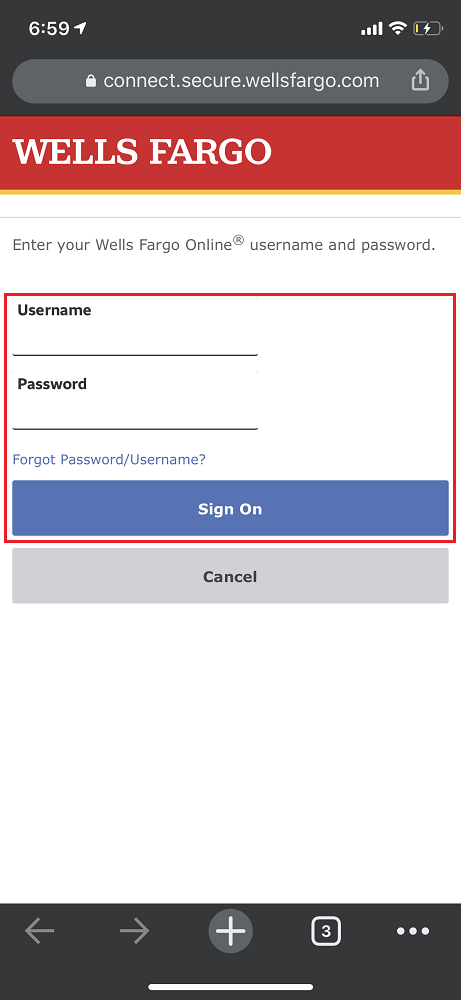

Find your financial institution and link your account to Experian. Since I have a Wells Fargo checking account, I decided to link Wells Fargo to Experian. The flow may vary slightly by the financial institution you use, but the steps should be pretty similar to this. Sign into your account…

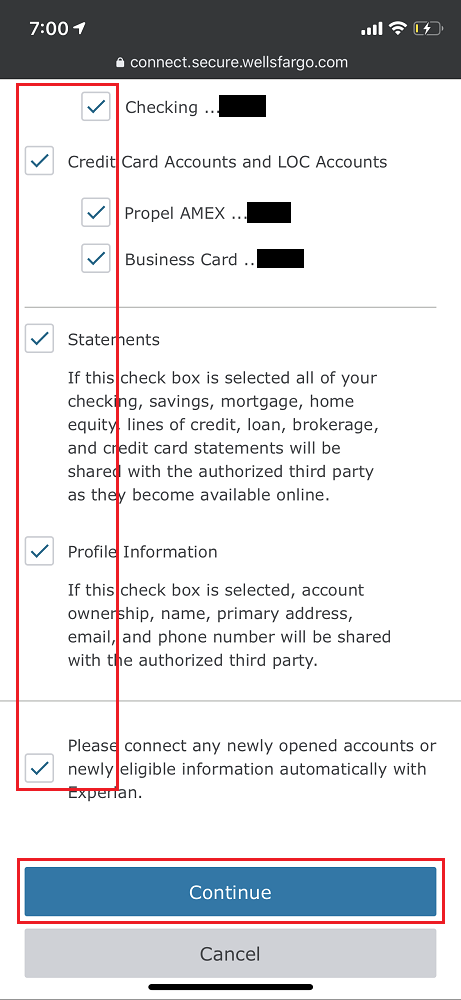

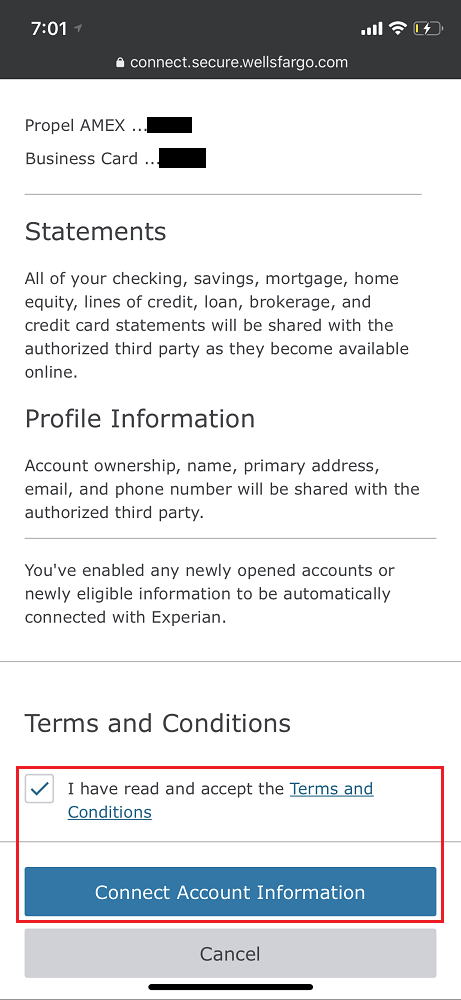

Select all the accounts you want to link to Experian, agree to the terms and conditions, and click the Connect Account Information button.

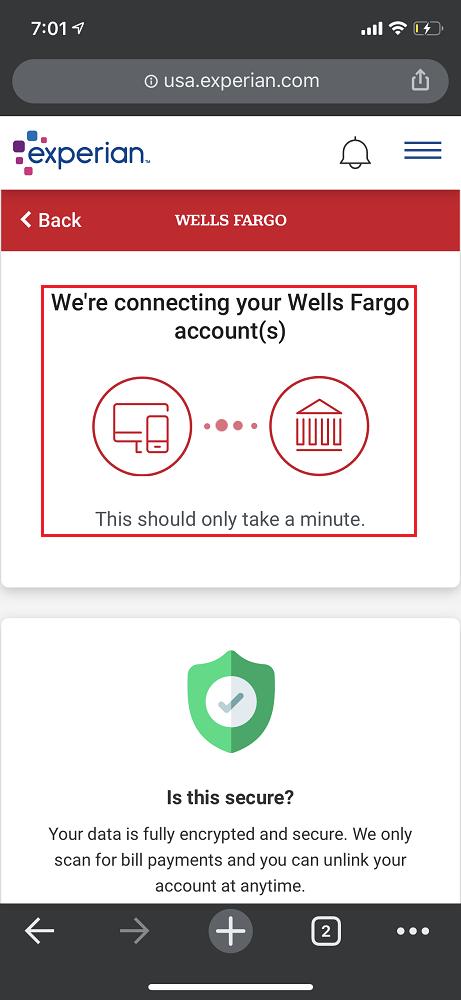

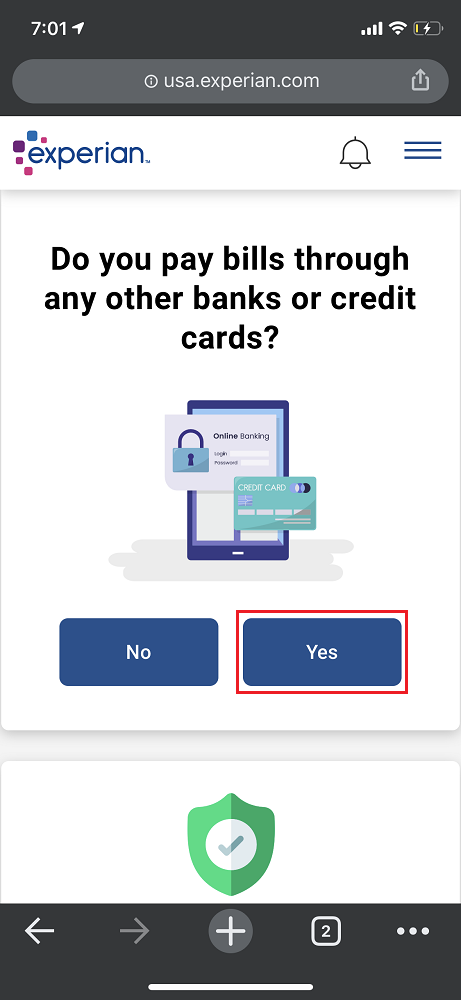

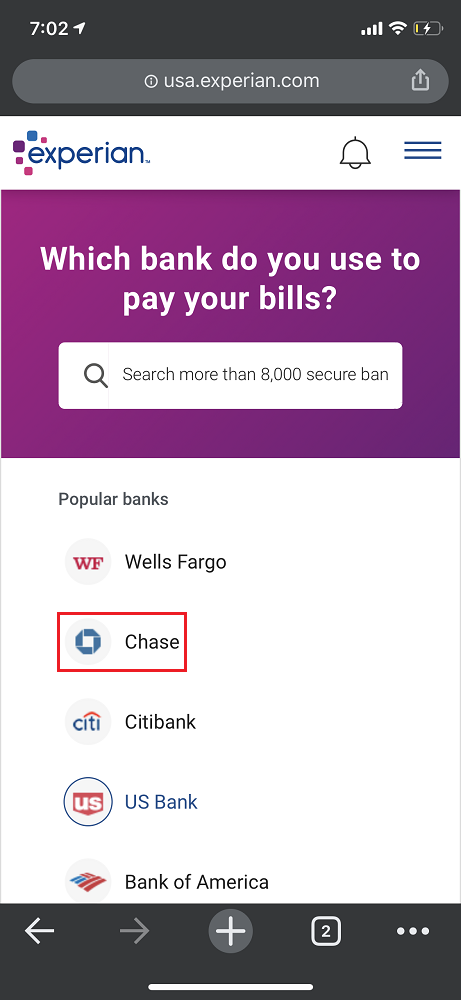

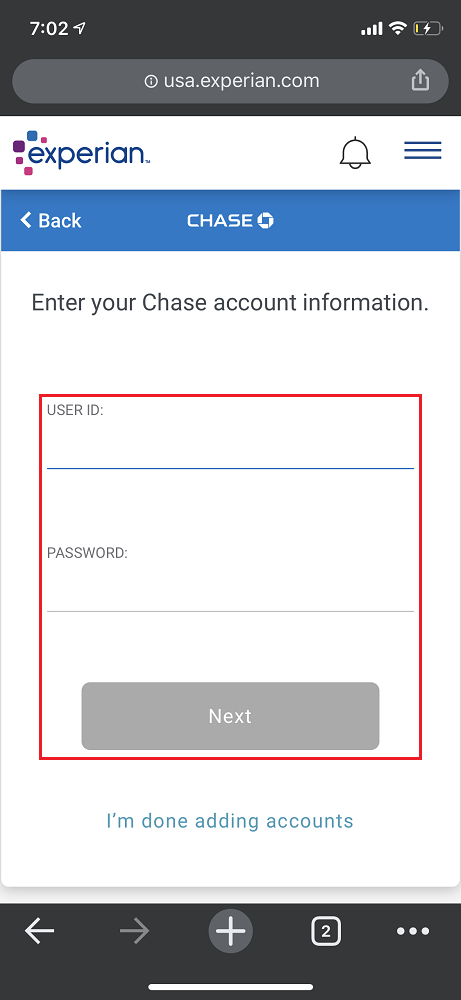

The linking process will take 30-60 seconds and then you will be asked if you want to link another financial institution to Experian. Since I use my Chase Ink Plus Credit Card to pay my AT&T and Comcast bills, I decided to link Chase to Experian.

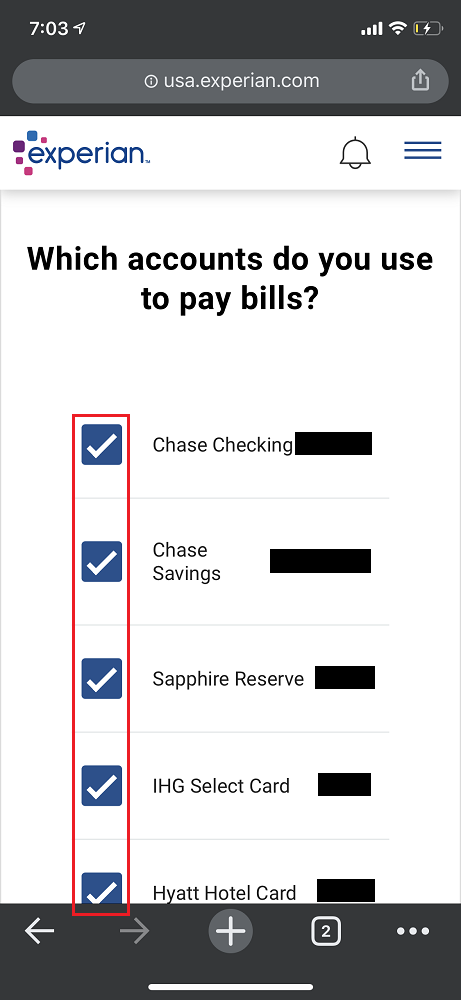

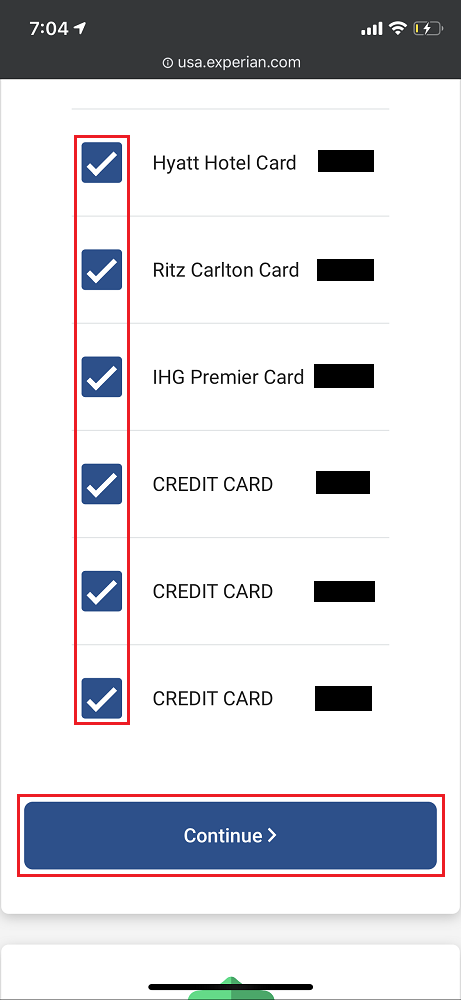

I repeated the same steps as above. I signed into my Chase account, selected all my accounts, and clicked the Continue button.

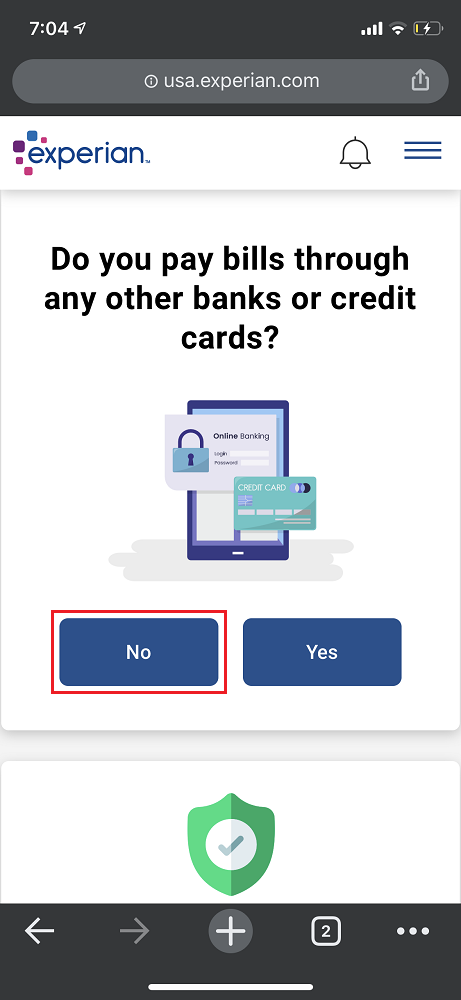

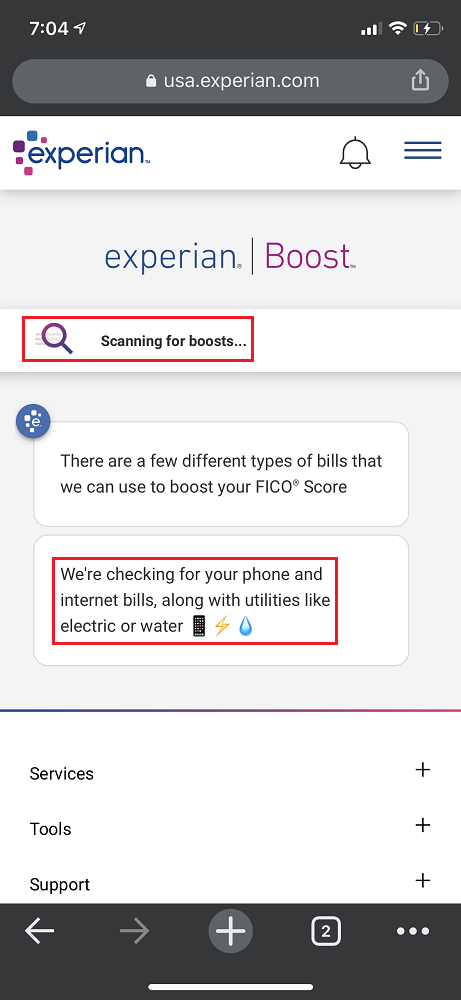

After I finished linking Chase to Experian, I clicked the No button since I didn’t have any other accounts that I wanted to link to Experian. The Experian Boost process began by looking through my accounts for qualifying recurring bills like phone, internet, electricity, and water. The scanning process took about 2 minutes and provided helpful info on my credit score and how my credit score worked.

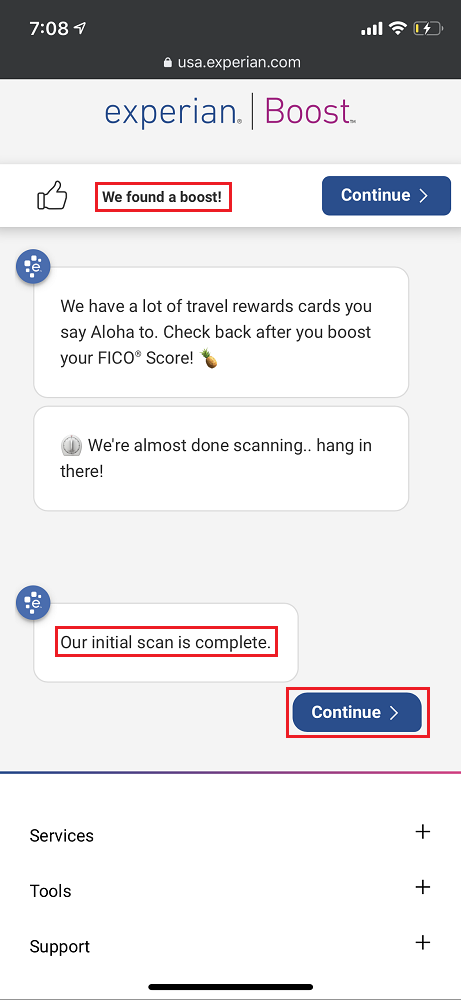

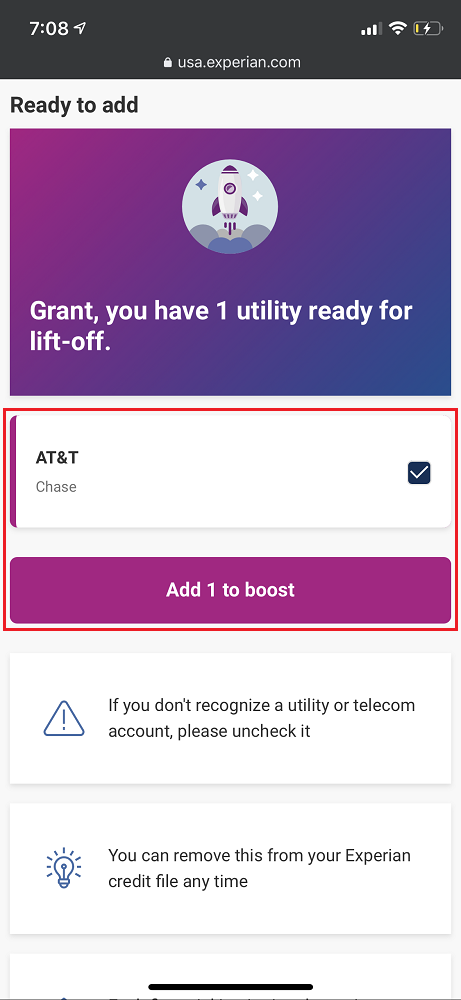

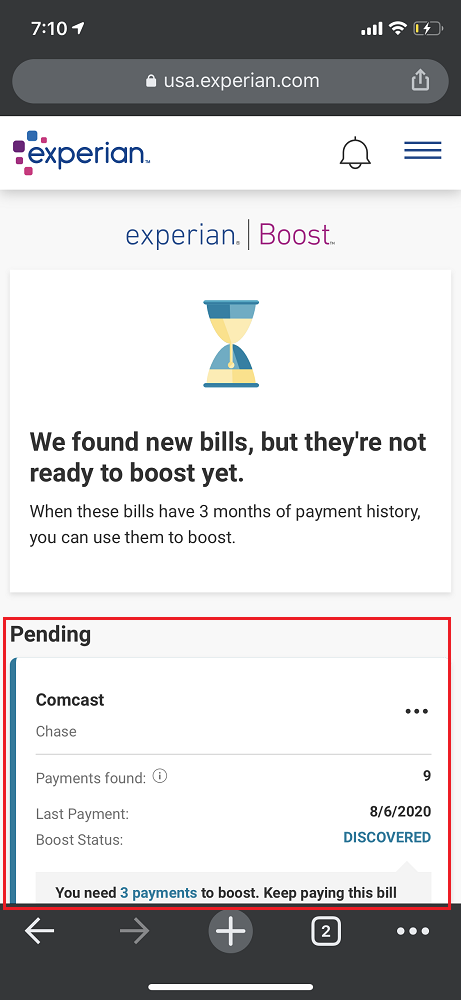

After 2 minutes, Experian Boost said they found a boost for me, so I clicked the Continue button. Experian Boost identified a Comcast recurring bill and an AT&T recurring bill. Even though Experian Boost found 9 payments to Comcast, I didn’t qualify to use that since I did not have 3 consecutive months of payments (sometimes I make purchases with other credit, debit, and VGCs to pay or prepay my Comcast bill). Luckily, my AT&T purchases qualified. I checked the box and clicked the Add 1 to Boost button.

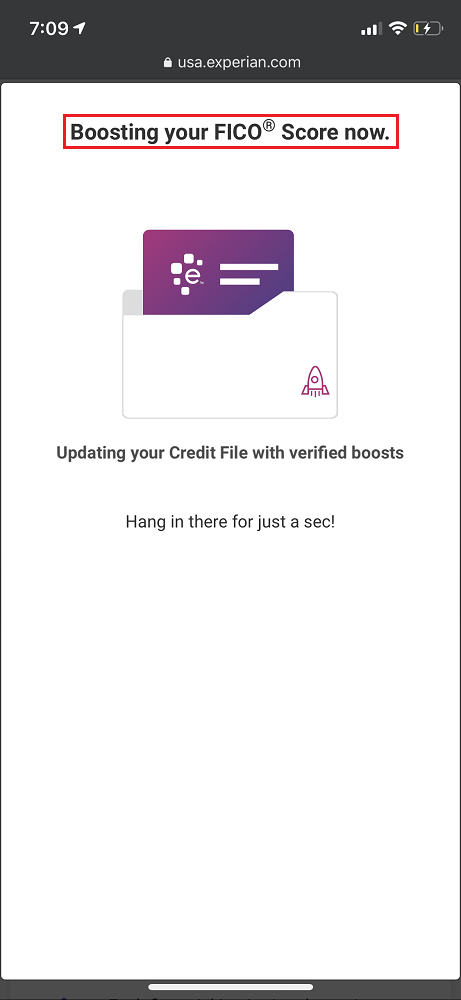

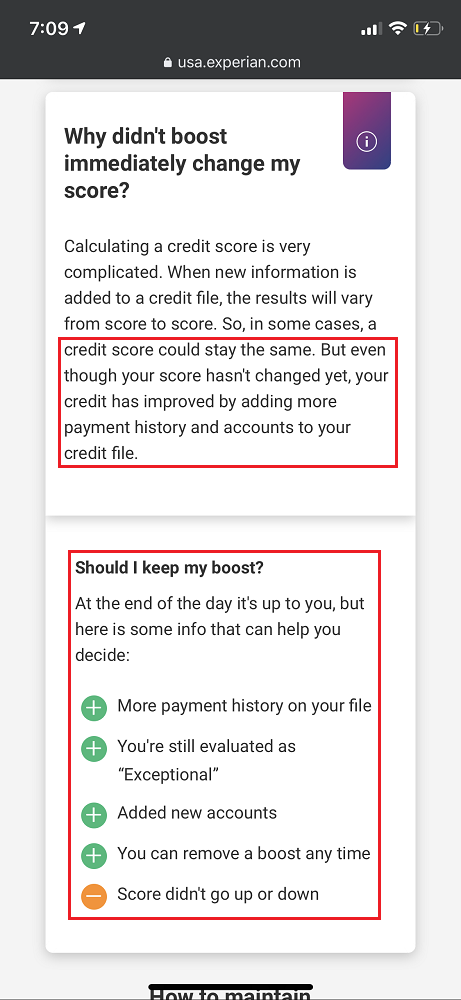

Experian Boost worked their magic to increase my score. Actually, my credit score did not increase from 814. It is strange that it says my “credit has improved by adding more payment history and accounts to your credit file,” but that did not result in an increased credit score. Since my credit score was so high already, I don’t think there was much room for Experian Boost to raise my credit score.

Back on my Experian account page, it shows that my credit score was “Boosted” but my credit score is the same as before. Since my Wells Fargo and Chase accounts are linked to Experian, Experian Boost will routinely check those accounts to see if I qualify for my Comcast boost or any other boosts.

Long story short, I spent around 10 minutes trying to boost my Experian credit score with Experian Boost, but my credit score did not increase. There is a chance that down the road, Experian Boost will increase my credit score, but only time will tell. If you have any questions about Experian Boost, please leave a comment below. Have a great weekend everyone!

this might work for people looking to establish/re-establish credit just like being added as an AU leads to a minor increase. not going to work with someone with a credit score of 800+. honestly, would be pretty stupid if it did as such a score already assumes you can pay some minor recurring bills.

Hi R, it would be great to see some data points for people that have lower credit scores to see how much their credit score increased.

What a racket! Just another way to collect more information about people! Welcome to the only country that feeds on debt (not necessarily you) and then saddles its citizens with something called a ‘credit score’ to help banks decide if you deserve things like shelter.

Hi Kalboz, I know, another company that wants to collect more of out info. I assume Experian and the other credit bureaus already have a ton of info about us, so a few more pieces of info does not bother me.

Thanks for doing this Grant! I did this myself years ago & had the same result (or lack thereof).

The underlying factor driving all credit scoring models (FICO, VantageScore, etc.) is payments. Many people I’ve worked with experience a better boost from using cards that have gone unused for months for a small transaction like a $0.50 Amazon load, then setting the card to autopay, and repeating every month.

I expect there to be no increase for Consumers with excellent scores based on my experience with others & EXP Boost. The only exception I could imagine is a Consumer with an excellent score but short payment history (<48 months). This is a rare exception.

I can attest to your lack of increase due to inconsistent payments reported for utilities. I only pay my gas bill ($100 annually) just once ($100) or twice ($50) a year. Experian saw my gas payments appear but it wasn't consistent so it was neglected.

The only exploit I see possible, is to partially pay for cable/phone/internet (99%) with a hi-return credit card. Then pay the residual 1% via bank account. This results in payments being reported on two fronts – once via conventional credit reporting for the 99% amount, and another via the bank account reporting through EXP Boost.

When it comes to credit, there's no such thing as having too many payments. Don't confuse the quantity of payments reported each month with the total dollar amounts of payments reported. I usually have 20 $1 payments report every month via conventional credit reporting which adds up quick after a year.

If I ever had a Missed Payment report, it would definitely stand out, but would be drowned out with so many timely payments being reported around it. This solidifies a Borrower's narrative of an isolated incident and increases the odds of a goodwill letter working or other favorability from Lenders.

As a result, I've got thousands of payments in my credit history. Having lots of $1 payments report is better. Remember, good credit activity can stay in your credit file for 10 years or longer, unlike derogatory marks' shorter 7 years.

Thanks for the screenshots Grant, EXP has updated their interface nicely since I last did this

~Cap

Hi Cap, thank you for sharing your experience and your insights into the Experian FICO credit scoring model. What you say makes sense and I typically have several payments every month for around $5. I wonder if the Experian Boost will have any affect if it ever picks up the Comcast recurring payments. I’m guessing not, but only time will tell. Have a great weekend :)