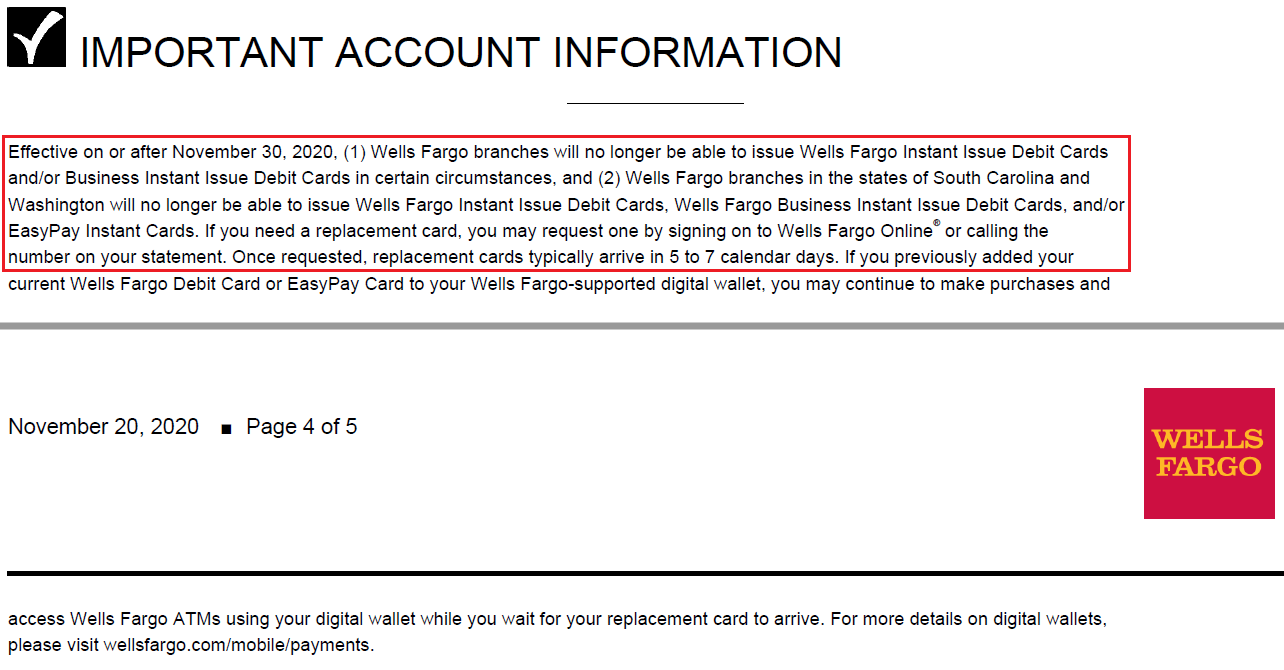

Good morning everyone, I hope your weekend is going well. I just reviewed my recent Wells Fargo checking account statement and noticed this “Important Account Information” section at the bottom of my statement. “Effective on or after November 30, 2020” (strange way of wording this change), you will no longer be able to request Wells Fargo Instant Issue Debit Cards or Wells Fargo Business Instant Issue Debit Cards. After November 30, if you need a replacement debit card (if your current debit card was lost or stolen), you can no longer get a temporary debit card at a Wells Fargo branch – you will need to use the Wells Fargo app or call Wells Fargo (1-800-869-3557) to request a replacement debit card. Once your request is submitted, your replacement debit card will arrive via mail in 5-7 days.

I don’t usually use or carry my Wells Fargo debit card (but I do have it saved in my ApplePay Wallet), but this is obviously a negative change if your Wells Fargo debit card is you only form of payment. If your debit card is lost or stolen, you will need to wait 5-7 days (or however long it takes for your replacement debit card to arrive in the mail) which could be an eternity if you need your debit card to pay for items.

I haven’t tried this in years or at Wells Fargo, but I think if you show up at a branch with your driver’s license and provide verification information, you should be able to withdraw cash from a bank teller (YMMV with this tip).

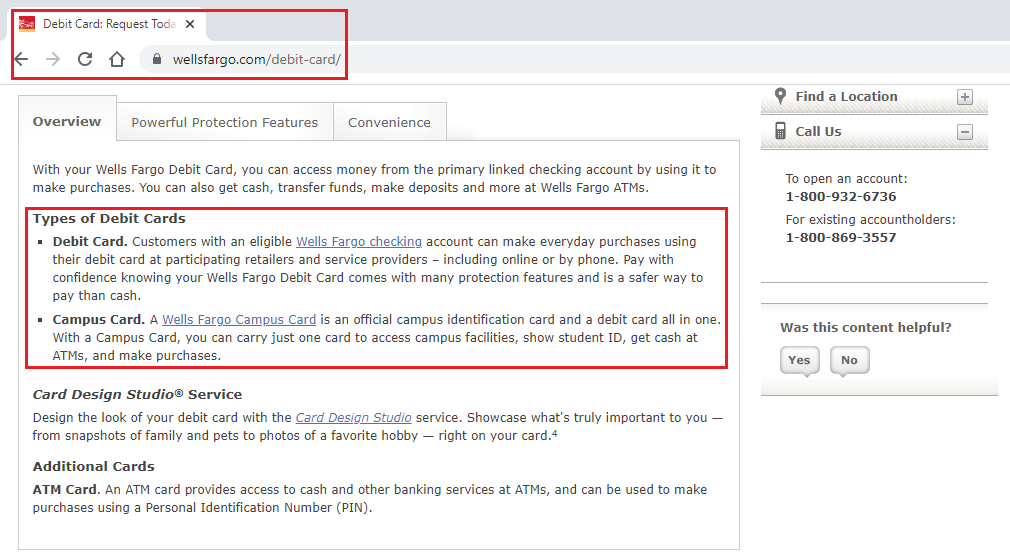

Before this announcement, I had never heard of the Wells Fargo Instant Issue Debit Card. I did some Googling to see if I could find out more information about this debit card. Google results told me to check out the Wells Fargo Debit Card page. Unfortunately, there was no mention of the Wells Fargo Instant Issue Debit Card.

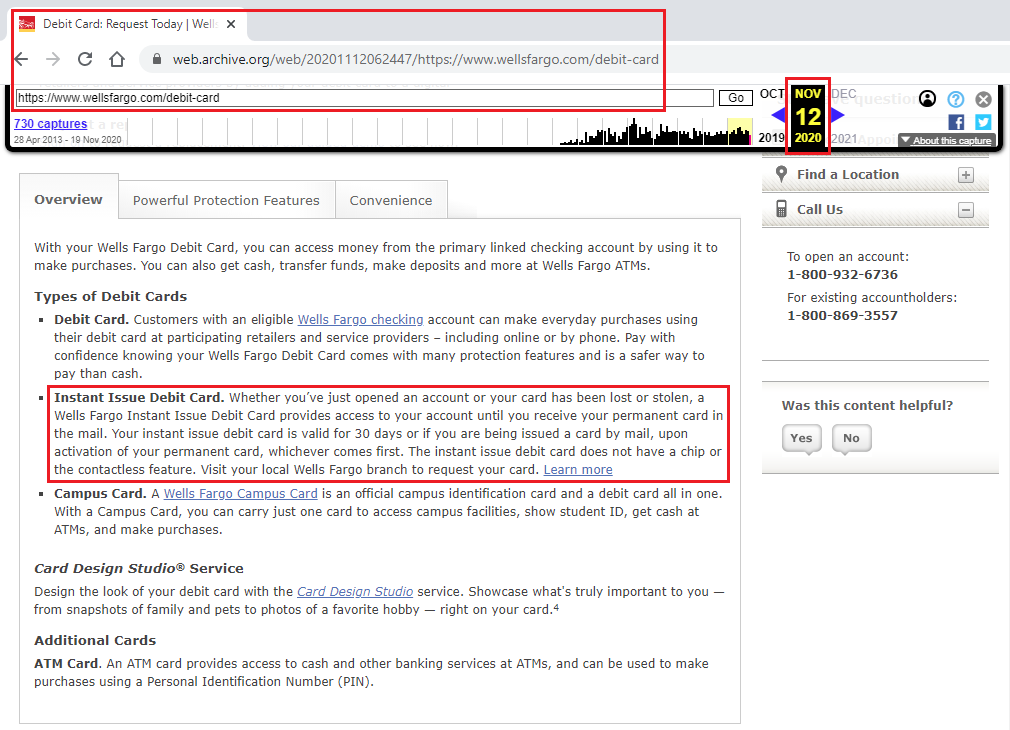

I did not give up there. I went to Archive.org to look up previous versions of the Wells Fargo Debit Card page. Luckily, Archive.org was able to find a recent version from November 12 (just 10 days ago), that mentioned the Instant Issue Debit Card. Based on the Archive page, the Instant Issue Debit Card could be picked up at a Wells Fargo Branch and was valid for 30 days or until your replacement debit card was activated, whichever came first. I then clicked on the Learn More link to see more info.

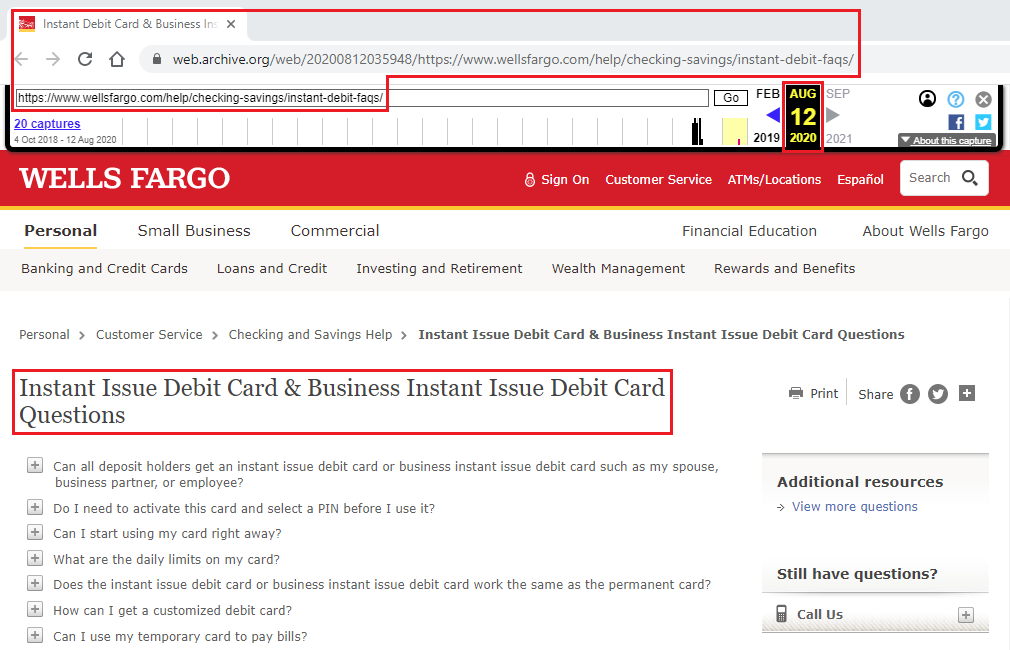

Archive.org had the Learn More page saved from August 12, but it obviously still existed on November 20. I looked through some of the FAQs.

I then decided to look and see if the same link existed today (November 22). Unfortunately, that page is gone from the Wells Fargo site.

Long story short, if you use the Wells Fargo Debit Card regularly and that is your only form of payment, you might be in for a world of hurt if your debit card is lost or stolen. If you do not use the Wells Fargo Debit Card regularly or have other forms of payment, this change should not have a major effect on your life. If you have any experience with the Wells Fargo Instant Issue Debit Card, please share your experience in the comments section. If you have any questions about this Wells Fargo change, please leave a comment below. Have a great weekend everyone!

Pingback: Wells Fargo Ending Instant-Issue Debit Cards, But There's A Proactive Workaround

I used the instant card feature a couple of times. In addition to the lost/stolen scenarios, they were convenient if the debit card physically cracked (which was not unusual, since they were quite thin, especially once the banks started using higher security ATM’s, which seemed to grab the cards more forcefully).

I’m not that surprised they’re doing away with it. I suspect there are security issues with it that create significant costs.

Hi Greg, thanks for sharing your experience with the Wells Fargo Instant Issue Debit Cards. I’m sure this is a cost reduction measure that won’t effect most customers.

well my husband lost his card ordered a new card right away. It has now been almosts 2 weeks no new card in the mail. Not a big deal as far as going into the bank to deposit but many places are moving to cashless payments only. Now he is forced to use his credit cards. Wich he doesn’t like to do for smaller transactions. Went to the nearest wellsfargo they have no clue why the card has not arrived yet said to wait one more day then order a new one. This is nuts. It did not come today just checked the mail. We are thinking of leaving wells over this whole issue.

That is really frustrating. I hope his new debit card arrives soon.

Actually it does for the younger people. Its a negative impact absolutely. I feel that people should be responsible enough to cut the temp card after they get their replacement if not it shouldn’t be on wells fargo entirely. Its quite the situation for being out of state and staying somewhere that may need a card for deposits especially when the world isn’t active with Google/apple pay.

Pingback: Wells Fargo Discontinues Temporary Debit Cards & ATM Access Code Feature (Effective April 1)

Pingback: Wells Fargo Changes: New Statement Ending Dates, TTY/TDD Numbers Retired & More

Pingback: Wells Fargo May Close Accounts with Zero Balance or Charge Monthly Service Fee (Effective August 9)

I have used temp debit cards before and it was great! Recently I had fraud on my card, cancelled it and requested a replacement. You can imagine my shock when I went in and they told me no more instant issue debit cards. It’s been over a week now and I haven’t been able to buy anything unless it accepts Apple Pay. Still no card. It’s been a real pain and I’m in the middle of leaving Wells Fargo over it. Super inconvenient!

Hi Maya, I’m really sorry that you had fraud on your Wells Fargo debit card. It’s good that you added a card to ApplePay. You should be able to go to the grocery store on pharmacy to buy a Visa or MasterCard gift card.

Hey you all ,

I’m also going through the same problem. It’s been a whole week and still no card in the mail. I went to Walmart earlier and couldn’t buy anything because they don’t take Apple Pay. It makes me feel like I don’t have any access to my money. I’m thinking about leaving Wells Fargo. I feel uncomfortable having to pay for everything with cash. I have bills that have to be paid online tomorrow and the next day for September and some of the websites ( if not most of them) don’t take Apple Pay. Wells Fargo needs to 1 to 2 day air ship them my card and they could take the money out my account to do so. I don’t care! This is making me uncomfortable and I have open up another account with another bank because I don’t want this happening anymore.

Hi Jocelyn, I’m very sorry you are going through this issue. I think it would be a good idea to have a backup account with another bank or credit Union just in case this situation happens again. I hope your new debit card arrives soon and you can get your life back to normal.

I am on a job across the country and had an ATM eat my card because I got distracted. I went to get a temporary card and could not. They told me to use Google pay which was accepted everywhere. I went to home Depot. Nope no google pay went to grocery store nope no google pay. I am m now going to transfer all my money I run a business through them to a different bank. 70000

Thousand dollars. Good bye wells fargo

Hi Ron, I’m really sorry that your Wells Fargo debit card got eaten by the ATM. If you have your Wells Fargo debit card loaded to Google Pay, you should be able to use that at a Wells Fargo ATM to get cash out. Do you have any other credit or debit cards with you?

Having the same problem currently. I lost my debit card and now I have no other way to pay my bills. My phone bill is due and I cannot pay it online. Now because they shipped my card, the virtual wallet is frozen.

If other banks still offer temporary cards, I think I will say the F word to Wells Fargo and switch to a decent bank.

Hi Ahmed, I’m sorry you lost your debit card. Are you able to get cash out if you go into your Wells Fargo branch? If yes, but a visa gift card from the grocery store or pharmacy and use that to pay your cell phone bill. Hope that helps.