Crazy Weekend: UCLA Graduation, San Diego Wedding, LAX Flight, and My Credit Card App-O-Rama Updates

TGI Friday everyone! This might be my last post for a few days, but I will still be able to answer comments with the WordPress iPhone app. Here is my schedule this weekend:

- Friday Night – My younger brother’s UCLA graduation

- Saturday Afternoon – My older brother’s wedding in San Diego

- Sunday Night – Family vacation from LAX to Spain/France for 2 weeks

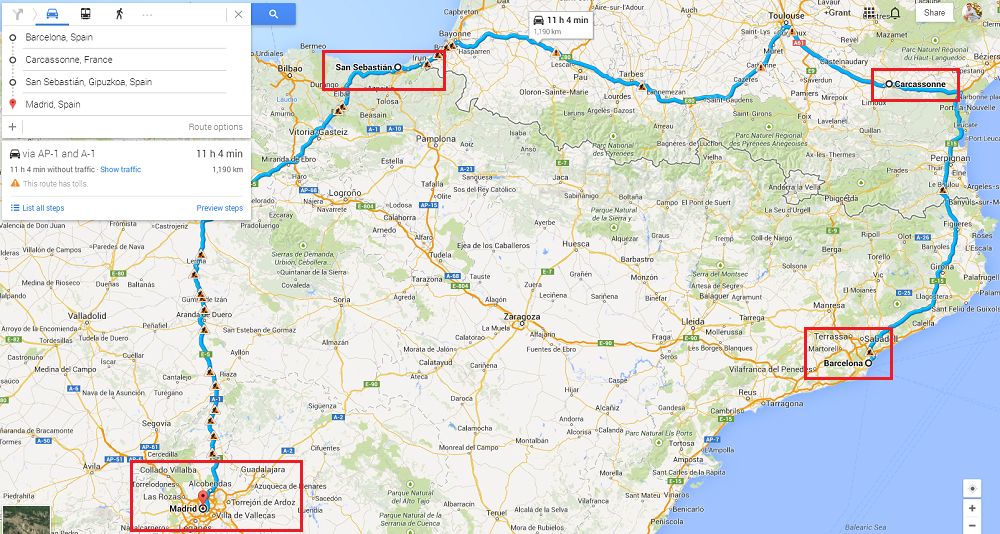

My dad scored 4 award seats 11 months ago for LAX-DUS-BCN on Air Berlin (economy baby, woo hoo!) returning on 4 separate awards seats from MAD-FRA-LAX on Lufthansa (economy again!) We are doing a big road trip from Barcelona up to Carcassonne, France west to San Sebastián, and down to Madrid. I imagine some epic World Cup viewing parties in my future.

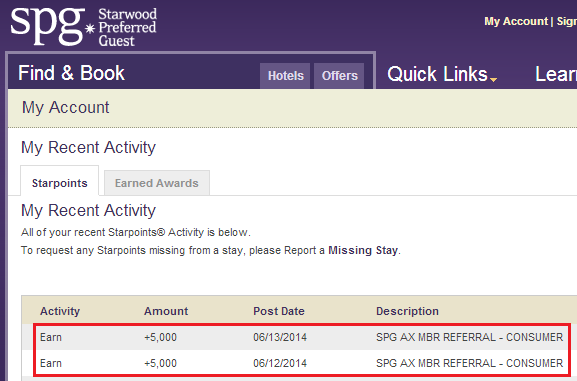

In other news, SPG refer-a-friend (or blog readers) bonus SPG Points post very quickly to your SPG account. I believe it took only 1-2 days to post. (hint: if anyone else needs an SPG referral, please check out this post).

Last but not least some credit card App-O-Rama updates (see previous post here):

- I was automatically approved for the AMEX Premier Rewards Gold (PRG) Charge Card on Wednesday morning and received the credit card Thursday afternoon via UPS Next Day Air, very fast delivery AMEX!

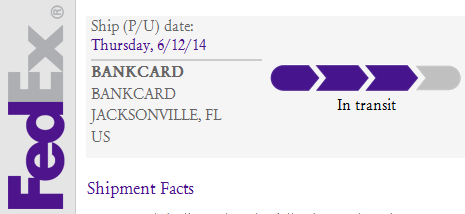

- I got an email from FedEx that I am receiving a package from Jacksonville, Florida. After a quick Google search, I believe the card is coming from Bank of America. Therefore, my Bank of America Alaska Airlines Platinum Plus Credit Card will be arriving shortly.

- I called US Bank’s automated credit card status phone number, punched in my SSN and zip code and was told that I was approved for the US Bank Club Carlson Business Credit Card, woo hoo! Then I was told they had only approved me for a $2,000 credit line. That will make it a little difficult to manufacture spend, but I plan on calling and requesting that US Bank move some credit from my personal Club Carlson credit card and FlexPerks credit card. The most important thing is to be approved. Moving credit lines around is easy after you get the card.

So this is my spending for the next few months:

- Citi American Airlines Executive – $10,000 / 3 months

- AMEX Premier Rewards Gold – $2,000 / 3 months

- Chase Southwest Airlines RR Plus – $2,000 / 3 months

- US Bank Club Carlson Business – $2,500 / 3 months

- Bank of America Alaska Airlines – no spending, just waiting for 10,000 Alaska Airlines miles to post

- Total = $16,500 / 3 months

- I can theoretically do this all in 1 month with my 3 Serve Cards, so this should be easy. I like going after the smaller minimum spending requirements first, spreading out the love across Chase, AMEX, and US Bank. I will use the Citi AA Exec card to fund my Serve Card online.

If you have any questions, please leave a comment below. Have a great weekend everyone!

Hi Grant how do you get 3 Serve cards?

1 for me, 1 for my mom, and 1 for my dad. Do you have any friends or family members who will get a Serve Card?

I have 3 BBs. Is there any advantage to switch them to Serve?

Like BB, with Serve you can load $5000 at Walmart per month. But with Serve you can also load an additional $1000 with a credit card and $1000 with a debit card online, for a total of $7000 with Serve. If you get the ISIS version of Serve, you can load even more.

My understanding is the credit card and debit card names must match the name on the Serve account. How do you get around that?

My mom’s Serve account is linked to her CSP, same for my dad. They don’t use the online debit load feature.

You are right Bill, the names do have to match. And the card being used must be in the name of the primary cardholder, not an authorized user. So yeah there probably isn’t much of an advantage, unless the person whose name is on the serve card can let you use their credit and/or debit card to load it.

You can add a card to Serve that you’re an authorized user on. That’s what my SO uses.

I don’t think you are supposed to use an authorized credit card. I’m glad it is working for you.

What makes you say that? Whenever my SO has called Serve, they just want to know that it’s her name on the card. I’m sure they’ve been told that she’s an AU when they call whichever bank it is but they’ve never said anything to her about it.

I see, that’s interesting. Whenever I change my credit card on file with Serve, they always ask me if I’m the primary cardholder.

Hmm, maybe I’ve never paid close enough attention to what they actually say, I thought it was always, we want to make sure your name is on the card you’re trying to use.

It depends if you use Bluebird checks and load money online.

I don’t use BB checks and usually I load at Walmart. I’m fortunate (?) to live near a decent Walmart.

Me too. You are only missing out on the $1,000 per month online credit card load by sticking with Bluebird.

Are you able to load with CC using someone’s acct? I thought the names have to match?

The names have to match and they have to be the primary user of the credit card. The credit cards are my parents credit cards, so they are earning the miles/points.

You got 3 Serve accounts?

Is it possible to have more then one Serve Account?

1 for me, 1 for my mom, and 1 for my dad. Do you have any friends or family members who will get a Serve Card?

Have fun and safe trip with your family! Nice to meet you last weekend…

Thank you Steven, it was nice meet you last weekend as well. You missed out on an exciting dinner…

Maybe next time you are down in San Diego, I will join you…

I might be back down to San Diego at the end of July. Let me know if you are ever in the OC area.

Do you have any good tips outside of online serve load for the $10,000 citi min spend? Their cash advance rules limits some of my favorite techniques. Does AP count as a cash advance?

AP does not count as a cash advance. You can also call Citi and have them lower the cash advance limit on your credit card.

You can buy visa gift cards at CVS and use them to load serve/bluebird, or just buy money orders with them at Walmart.

Congratulations to your brothers on their events. Have a great trip.

I’ll go over to the Foothill Ranch Walmart every so often to keep their fingers in shape for when you return,LOL

Thanks Steve, the people at that Walmart are really nice. Good easy on them.

Hi Grant,

If the credit line is low, you can pay off the balance before the statement.

Yes, that is what I normally do, even for credit cards with larger credit lines.

Watch out for Barclay or BofA when doing extra payments in conjunction with autopay.

Barclay stmt closed on 3/5, total balance owed $4,000 to be autopaid on 4/2

Paid off the $4,000 balance on 3/8. Online statement reflected a balance of -0- owed. Barclay then proceeded to take out another $4,000 on 4/2.

Now BofA has done the same thing.

On the other hand Chase, Citi and AE have got it right. If you make an extra payment prior to your statement due date, they will adjust the total owed and your autopay will reflect a reduced amount. That’s even stated in their terms of autopay.

For Barclay, I called and said the WTF?! You already got my $4k awhile back. Why you double dipping, your online accounting clearly showed no more money due on 4/2. She said it is automatic. If you sign up for autopay they deduct exactly what is due on the statement. She said they consider any prior or extra payment as just that. She had no problem crediting the $4,000 but it took a few days.

Has anyone else had problems with Barclay or BofA? And another thing, BofA autopay is horrendous. I know all of this comes with the territory of MS and miles and points and I cannot live without autopay. Too many cards to keep track of to pay individually.

I’ve never used Auto Pay. I set my credit cards bill due dates to the first of the month so I know to check all my accounts and pay them off then. I can’t imagine juggling multiple credit cards with due dates spread out over the month. You can call your credit card company and they can change the due date if you want.

Thanks for the tip. One thing I do enjoy about autopay is not having to log in and pay each account manually but you make a good point about having them scheduled on the same day if you don’t autopay.

I wonder if I’m in the minority with autopay and if most MSers or churners just pay manually.

Wait a minute, I just realized you are in Spain. Hope you are having a great time!

Greetings from Barcelona. I prefer to pay down my bills during the month and having about $10 due when the statement closes. I think that helps my credit score by having a really low credit utilization ratio.

I set up autopay to pay the minimum amount due on my cards. That way I’m protected from damaging my credit and getting hit with late fees if I make a mistake and forget to make a payment.

Ya that is good advice too, but I rely on my 10+ weekly alerts to remind me.

Thanks for the heads up about the Barclay auto pay. I just got the Arrival card and always pay my balance early, but I have auto pay set up just in case. I called Barclay to confirm, even if you pay the balance early auto pay will still deduct the statement balance. So now I have to change it to jus pay the minimum balance. Thanks again

It’s annoying that Barclays can’t fix their auto pay feature to be more in line with the other banks.

Hi Grant,

I remember someone said you can buy Simon Visa Gift card and load to BB, have you ever tried this? This would be a good news for me since there is a Simon Mall near me. By the way, I live in Montgomery County, PA and they have special offer buying $100 Sears or JC Penney you get $10 AMEX gift card. Wife shops at JC Penney and sometime I bought Nike Air sneaker so it is a very good deal. I just bought 2 Nike Air sneaker for $100 so in theory only cost me $90 and earn some points.

Good deal on the Simon Malls GCs. I think they are a good deal. No Simon Malls near me to try them out. I think you can buy up to $1,000 per card. Greetings from Barcelona!

Hey Grant! I love your blog. Found you by your comments to other blogs I read. If you ever come to San Diego again, let’s get together with your new friend Steven.

Thanks Kristin, I may have another miles and points meet up down in San Diego later this year, I’m not exactly sure. If I do, I will send out a blog post with more details on the date and time.

You mention ” I will use the Citi AA Exec card to fund my Serve Card online.” How do you use it to fund without getting hit with cash advance fees? Or instead of a direct link are you talking about buying GC?

No cash advance fees on those purchases.