PayPal My Cash Card Warning Email and Explanation

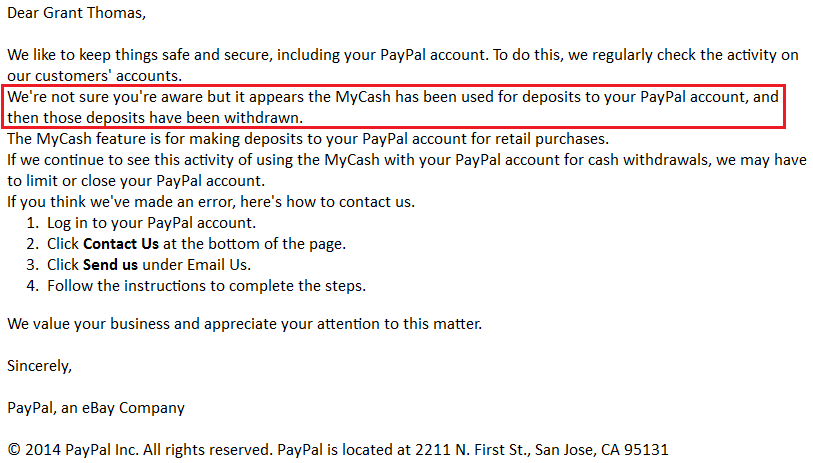

Good morning everyone, I finally got a few answers as to why my personal and premier (business) PayPal accounts both received the dreaded PayPal My Cash Card (PPMCC) warning email. For those unfamiliar with the email, this is what it looks like (generic email with no specific details as to what PayPal is accusing me of doing):

Here is what a typical month looks like for me:

- My premier PayPal account is linked to my Ebay account, has primary and authorized user PayPal Business Debit Cards (PPBDC), and a PayPal Extras MasterCard (PPEMC).

- I use my PPBDC for online Serve reloads ($200/day, $1,000/month) and my authorized user PPBDC for online Serve Reloads to my dad’s Serve Card ($200/day, $1,000/month).

- I always max out the $4,000 monthly limit of PPMCCs to fund my premier PayPal account.

- I also have a personal PayPal account that does not have a PPBDC or a PPEMC.

- I usually max out the $4,000 month loads of PPMCCs to fund my personal PayPal account.

- I normally move funds from my personal PayPal account to my premier PayPal account.

- I occasionally load my Serve Card at Walmart with my PPBDC to move funds from PayPal to Serve.

- Lastly, I usually pay my PPEMC with my PayPal balance which was mostly funded with PPMCCs.

After calling PayPal a few times and hearing similar answers from all of the PayPal representatives, I can give a more informed explanation of what caused the warning emails. All the representatives told me that paying my PPEMC (a credit card product) with my PayPal balance that was mostly/entirely funded with PPMCCs was a red flag, since it could have been used as a way to get a free cash advance from the credit card. I don’t agree with their logic, but I will not pay my PPEMC with my PayPal balance (now I can use Evolve Money and earn 1% cash back with my Discover It credit card). All the representatives said that using my PPBDC for all types of purchases and debit card transactions are fine (online Serve reloads and Walmart in-store Serve loads). I would caution not to use your PPBDC to withdraw large amounts of cash from ATMs (basically a more expensive way of withdrawing funds to your bank account).

I asked why my personal PayPal account received the same warning email even though I did not do anything similar to my premier PayPal account. They all said that since my personal and premier PayPal accounts both have the same name and address, they automatically sent out the warning email to both accounts. I was also told that loading funds to my personal PayPal account and sending those funds over to my premier PayPal account was fine, nothing to worry about.

So as long as I don’t pay my PPEMC with my PayPal balance, I should be good to go. *fingers crossed* If you have any questions, please let me know. Have a great day everyone!

Did you gradually bring the monthly load to 4K or started doing that much right away? I am also using this method but feel a bit uncomfortable to max it out.

I maxed out the loads in the second month. You have to figure out how you will unload the funds in your PayPal account before you plan on purchasing PPMCCs.

I am using it primarily with Visa Buxx,

That will work too :)

It actually has one interesting advantage: it is a round-about way to load Visa Buxx using Citi or US Bank cards without cash advance.

Good thinking, wish I had a Visa Buxx Card.

I don’t see PPEMC in the Evolve payee list? Mine is issued by synchrony bank.

Evolve Money shows it as PayPal Buyer Credit.

Amazingly helpful! Thanks so much for this one!

You’re welcome, I’m glad you enjoyed the post.

Grant can you do a large load to serve at once eg $2500 ?

Walmart will not let you load more than $1,000 at a time, so you can do $1,000, $1,000, and $500 if you want.

Using it only for online Serve load, as well as Walmart Serve load, DOES generate the warning email. No withdrawals or bank transfers necessary.

Thank you for the data points IL. The PPMCCs are tricky to figure out.

Have you bought MO’s with the PPDMC in your unloading strategy?

I’ve never bought a money order in my life :)

I received the warning email as well, and I only use it for Serve loads.

It appears nothing is safe then :(

(I received the warning email as well, and I only use it for Serve loads.)

Ditto. Online Serve loads.

Thank you for confirming the earlier data point. I haven’t heard anyone get their PayPal account shut down for only doing online Serve reloads.

I’ve been diligently loading $4k/month each to a personal and business PayPayl account for the past 7 or 8 months. I’ve been withdrawing via Bluebird, Soft Serve, and payments to family members. In early Feb, I got a warning email regarding each of my PayPal accounts that was identical to the email in the blog post, except that the text in the red box included the following additional words: “via Bluebird and American Express Serve”

In other words, the warning email was specifically triggered by withdrawing via Bluebird and Serve. It appears that paying family members is okay, at least for now!

PayPal definitely knows what is going on and they don’t like what they see. After you get your first warning email, you need to be careful since PayPal may shut you down if you continue. I received 2 separate warning emails (a few months apart) and now I stopped using PPMCCs.

Pingback: I Challenged Paypal on their Warning Email; Here's Their Response... - Doctor Of Credit

I have used it only for serve and money orders at the post office. I actually got the warning email twice! I’m going to have to tred carefully

Be careful, you’re playing with fire!

To be safe I have never load more than $2000 per month. Also, when I withdraw the money I always have some sort of balance to go along with it. So I’m not withdrawing exactly $500 or $1000. I have been doing that for the past few months, I haven’t received the warning email … yet. I have been thinking about doing the whole 4k, and using PPBDC to buy stuff **cough*** MOs ***cough***.

It doesn’t seem like anything is safe, so I’m not sure playing it safe is the way to go either.

So you load 8k total per month between the 2 accts??

Yes, that is what I try to do every month.

Hi Grant, I have one PP Business account and I load 4k a month, I transfer them to my bank and withdraw them through cash and spend a little bit every now and then. I have been doing this for 3 months, maximizing the 4k each month, and have not gotten an email. I am wondering if you think creating a personal account enable to load more would risk getting this email, or is it spending it on serve reloads and others that triggers the email.

I am not sure what triggers the warning email. I am glad you haven’t received a warning email. I wouldn’t risk opening another PayPal account, that might draw suspicion from PayPal.

Hi Grant, thanks for all of the help. Do you tend to transfer one large sum to your premium acct from the personal or do you do it in small amounts over the month?

Depends on how much money I need in my Premier account. I’ve moved it all to Premium sometimes, no problem.

FYI, I recently received an “account has been limited” e-mail saying something vague about possible high risk account activity, nothing specific like yours. Mind you I never once withdrew money to a bank account. Used for daily spending 99% of the time and an occasional online Serve load, but nowhere near the max. I called and a rep told me that people don’t really buy MCCs unless they don’t have a bank account, and noted that I have a bank account tied to my PayPal account. I then uploaded some requested documentation to verify my account further, like ID, statements, etc. and they lifted the limitation immediately. I asked what would happen if I loaded funds with MCCs in the future and the rep said it ~might~ lead to a limitation again, but mentioned that I wasn’t doing anything outside their TOS. So basically MCCs are by themselves a potential problem, even if you do nothing wrong. Good luck.

Thanks for sharing Scott, it seems like no matter what you do it’s still against terms of conditions. PayPal is very strange.

I read that PayPal My cash is going away, how accurate is this?

I believe that is true, but I think it is going to be replaced by an in-store loading process.

Pingback: SmarterBucks & Radius Bank Unlimited 1% Cash Back Toward Student Loan Debt - OUT AND OUT

•I used my PPBDC for online Bluebird eloads ($200/day, $1,000/month) recurring loads.

•I always maxed out the $4,000 monthly limit of PPMCCs to fund my premier PayPal account.

got the warning email. called PayPal. Called and they said I couldn’t transfer $$ to another

debit card. So I stopped (one Transaction got thru the next day before I stopped the transfer).

(continued by chaz)

so 6 weeks later they froze my account. ‘violation’ was moving money from PayPay to Bluebird according to ‘customer service’.

I pointed out on my next call that I had stopped when asked. they reply that isn’t the reason

the complaint now was I always did the max monthly reload. I said well I pay a fee to do this,

and they said they lost money on each card – I said This should not be my problem.

next call – they said they couldn’t close my account for 6 months because somebody I had sold to might be entitled to a refund. I pointed out there were no transactions ever where a consumer sent me money. well they still couldn’t close it because I might request a refund. I said I’ll take my chance. No dice.

next call, I say I might contact the state banking commission (they need a license in each state to transfer money). They said that under the terms of the account, I could have my account frozen for ‘making disparaging statements about PayPal’. I asked If I had no legal rights and they replied that the terms of the account let them do anything they wanted.

Hi Chaz, thanks for the play-by-play. Unfortunately, there is nothing you can do with PayPal after they freeze your PayPal account. Did you have any money in your account when they froze your PayPal account?

so I currently have about $1,000 frozen by paypal, they will not release funds for 6 months, they claim the need to hold for customer returns (I don’t have any sales to customers so they have really no claim for this) they claim that I violated their terms by using the paypal my cash card funds that I put on paypal to send money to bank, load prepaid cards, or other activities that are not allowed. I have only used it to send money to people to pay for expenses or for retail purchase so it should not be consider a violation of their terms, The communication from them is very vague and very frustrating, this just happen last week so everything is new. I hope I can get some sort of solution soon but not sure if will be successful on getting them to release funds before the 6 months

I understand your frustration. I don’t think there is any way to get your money back before the 6 month period is over.

Pingback: Earn Miles & Points & Cash Back Paying Rent | Million Mile Secrets

You don’t agree with their logic? It sounds like exactly what you were doing.