Random News Part 2: Ritz-Carlton Statement Credits, Lounge Club Card, Freedom 5% at Grocery Stores, and a Hyatt Retention Bonus

Good afternoon everyone, here is part 2 of Random News for today (part 1 from earlier today). My Chase Ritz-Carlton Credit Card statement closed on January 4, so I have some information regarding annual fees and statement credits. There has been a lot of confusion regarding “reimbursable travel expenses” and this lengthy 90+ page FlyerTalk thread has all the details. Basically, if you buy airline gift cards, Chase knows about it now.

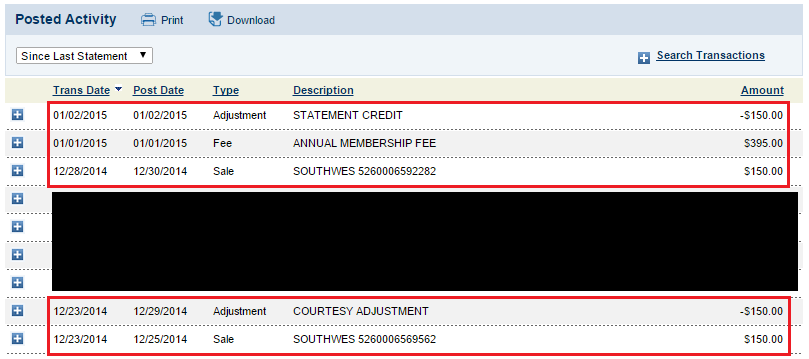

The $395 annual fee posted during the first billing period. I was able to purchase 2 $150 Southwest Airlines eGift Cards and get both purchases reimbursed by Chase. One reimbursement is posted as a courtesy credit and the second is posted as a statement credit. As far as I know, Chase will no longer reimburse any Southwest Airlines Gift Cards or eGift Cards. The transactions show up online as “SOUTHWES 5260***” and Chase is able to see the purchase as a gift card. I don’t know why I was able to get both charges reimbursed, it just depends which representative you get. Definitely YMMV situation.

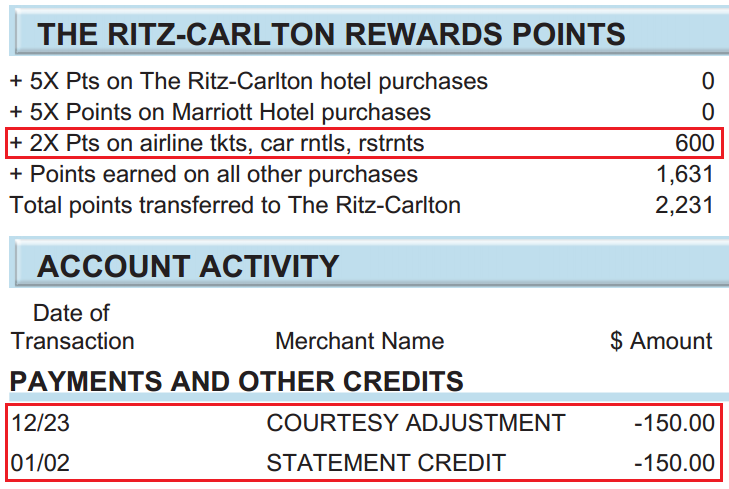

I found it interesting that both Southwest Airlines gift cards earned 2x for airfare and also counted toward my $3,000 minimum spend. I am about $1,000 short of completing my minimum spend.

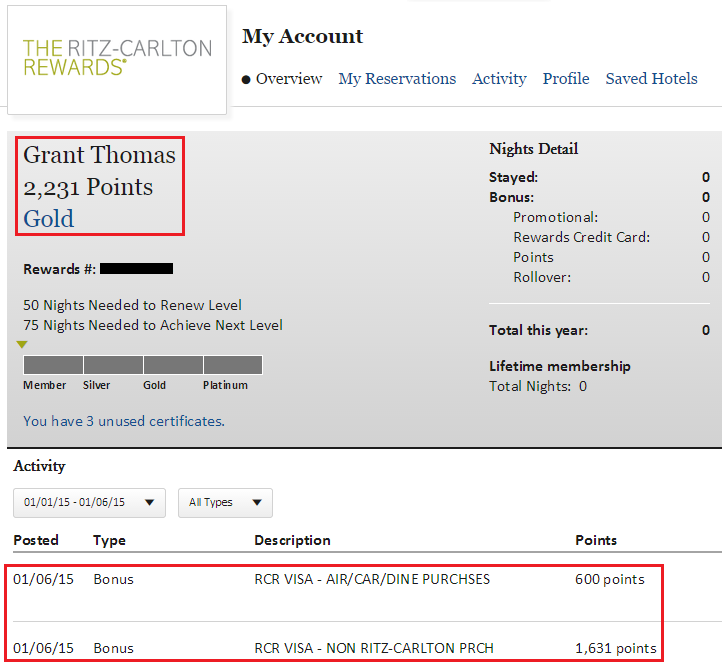

Here is my updated account balance for my Ritz-Carlton account:

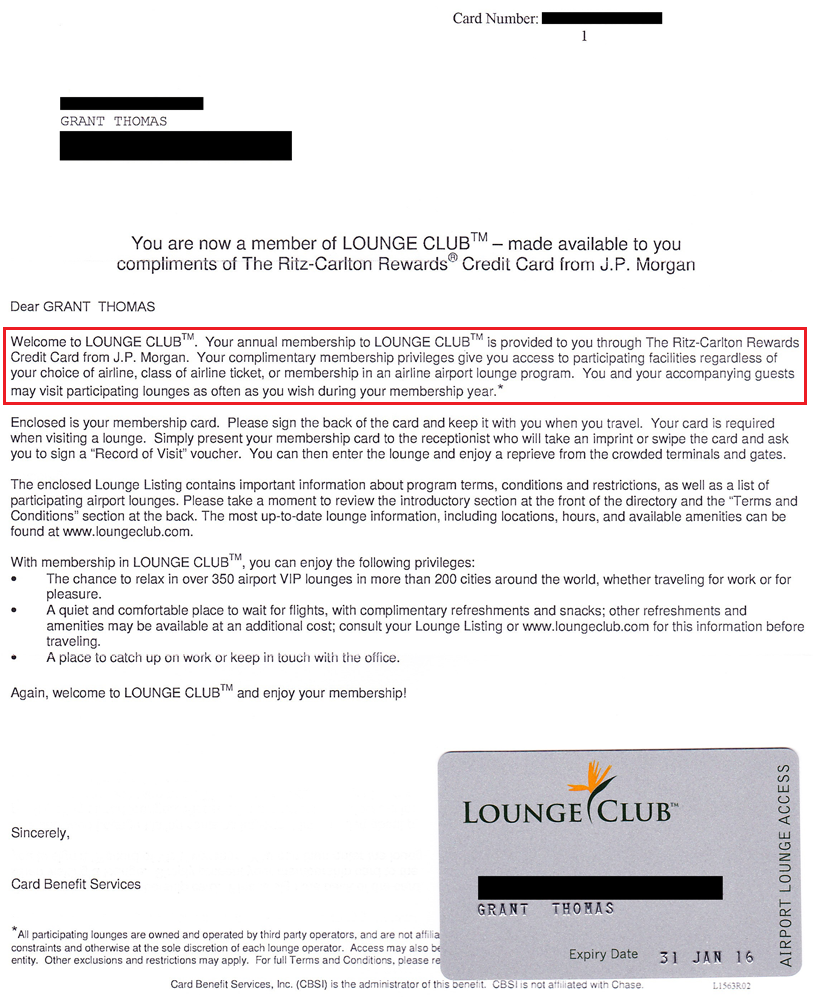

I received my Lounge Club Card this afternoon. The terms on the letter say “you and your accompanying guests may visit participating lounges as often as you wish during your membership year” (ending on January 31, 2016 for me). The letter says “guests” but doesn’t state how many guests you can bring. I remember reading that one guest was allowed, but if anyone has brought in more than 1 guest with this card, please let me know. If you haven’t received your Lounge Club Card, you should receive the card 2-3 weeks after you are approved for the Chase Ritz-Carlton Credit Card.

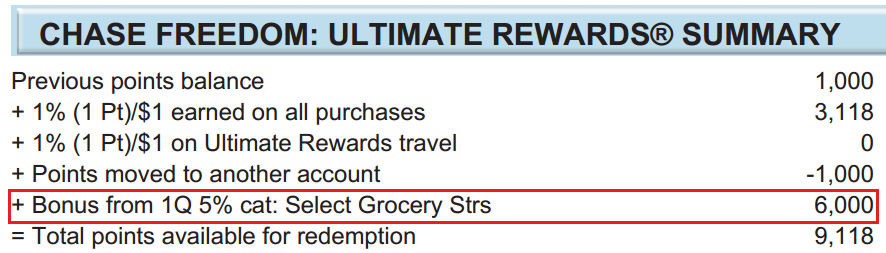

In other news, I took my Chase Freedom Credit Card to my local Ralphs on January 1 and bought $1,500 worth of Visa Gift Cards. I called Chase before I went to Ralphs to alert them of a large purchase at a grocery store. They made a note in their system and the charge went through just fine at Ralphs.

My Chase Freedom Credit Card statement closed on January 4, so here is what the 5% cash back looks like on my statement. Since I earn 1 Chase Ultimate Reward Point per dollar on everything, the extra 4 points per dollar show up as a bonus (4 points x $1,500 = 6,000 points).

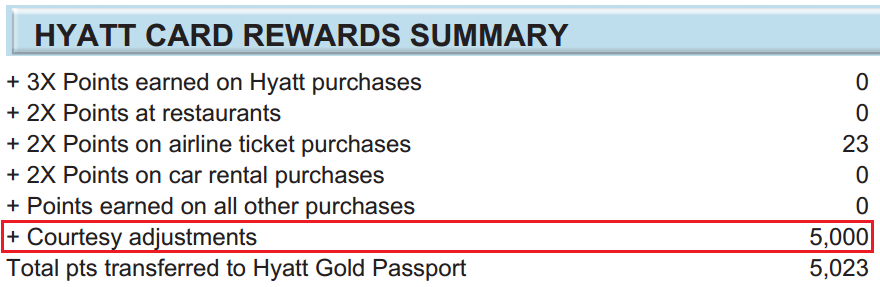

Last but not least, I got a great retention bonus on my Chase Hyatt Credit Card. For the $75 annual fee, I got a free night at a category 1-4 Hyatt and 5,000 Hyatt Points. I value Hyatt Points at around 1.5 cents, so that was a $75 bonus from Chase. Thank you! As always, retention bonuses are totally YMMV and depend on how long you have been a customer and how much you charge to the credit card.

If you have any questions, please leave a comment below. Have a great day everyone!

P.S. Part 3 is coming out later tonight with info about my US Bank Club Carlson Credit Card, new Discover It cash back terms, and American Express Platinum travel credits. Stay tuned!

Hi Grant

I have a few hotel credit cards to get annual free nights, but I usually use my new credit card with a sign up bonus. How much should I spend for each credit card to keep them? Can I just pay for the annual membership fee and just keep them to get a free night? What do you usually do?

You can keep the hotel credit cards for many year. Just pay the annual fee and get the free night certificates. I really only use the hotel cards when I am staying at that particular hotel. I believe the longer you have the card with Chase, the easier it is to get a retention bonus. If you hang up, call again (HUCA) you may get a nicer rep who will offer you a better retention offer too.

Hi I paid for early bird upgrades on a couple flights as well as gift cards an they all started with 526

Were you able to get Chase to reimburse all the charges?

Hi Grant,

Both of mine said COURTESY ADJUSTMENT.

Thanks for the data point. I assume there is a drop down menu that the representative selects when they enter an amount to refund.

I too bought $500 visa gift cards and unloaded them using money orders which I promptly deposited in a local bank. I don’t deposit them at Chase for obvious reasons.

Grant: I am seriously thinking of canceling my Amex Platinum. I barely get time to travel and only used the Centurion lounge once last year at McCarran International. How does the Lounge Club compare to the Centurion lounge?

I want to apply for the Ritz Carlton card this year, but have been hesitant due to the YMMV nature of reimbursement of the airline gift card charges. Obviously, you were lucky and ended up a nice rep.

Lounge Clubs are not as nice, but there are way more than Centurion Lounges. Lounge Clubs are third party independent lounges in many international airports.

You have a 11.5 months to figure out how to spend $300 on airline incidental charges, small denomination airline gift cards might go through fine.

Thanks for the Chase Freedom reminder! Is the best way to get that money back in my pocket and off the plastic a money order? Or can you load those visas via bluebird?

You can load the gift cards to Bluebird, Serve, or Redbird.

Do you know if Award ticket taxes and fees charged by the airline count as a legitimate expense for reimbursement? I know I will have a lot of those this year!

That’s a tough call. I would charge the award ticket taxes/fees and then ask for a reimbursement from Chase.

Grant, which drop down menu in the secure message option did you choose to send a SM regarding reimbursement? I think it is important since it will lead you to the department that has a right agent.

From my online account main page, after click on “secure message center”, it shows me “my personal accounts” and then “credit cards” has drop down menu and select my Ritz card, then it prompt you to select one of the options:

– payment inquiry

-other/inquiry not listed

-general comments

-fees/interest charges

– rewards inquiry

-disputes

-account inquiry

Which one that you chose?

Thanks!

I think I pick rewards inquiry, but I’m sure all inquires regarding the Ritz-Carlton cards go to the same department.

I can confirm its at least more than two guest. I have been part of a group of 5 visiting on 1 members lounge club pass. As a matter of fact two guest showed up after the rest of us had already been there for 30 or more minutes. However, this was a lounge club owned lounge, I believe I once saw one of their partner lounges had a two guest max but I can not remember where in our travels that was.

Thanks Philz, that’s good to hear that some lounges accept more than 1 guest.

On your $1,500 visa gift card, how do you plan to unload it?

I loaded it to my Redbird Card at Target. Doesn’t get easier than that.

Is it not going to cost extra 17.85$ for activating these Visa cards?

Yes, you are right. I paid the GC activation fees.

You still get about $50 out of it after that.

Here are my calculations: $505.95 x 3 = $1,517.85 = 1,518 Chase UR Points + 6,000 bonus Chase UR Points = 7,518 Chase UR Points x 1.5 cents/point = $112.77 value of Chase UR Points – $17.85 in GC fees = $94.92 in “profit”

The 526 is a SWA ticket number. Basically any time you give an airline money they generate a record that has a ticket-like number, and basically any time an airline charges your credit card they report that number. By the way, I had two more SWA eGift cards reimbursed via secure message a couple days ago.

Thank you for the information Andrew. I am planning on slowly spending $300 on airline in-flight meals and seat upgrades throughout the year.

Hi Grant,

I just applied Global Entry for me and my wife and just sent a request to Chase today. How long does it take to get approve for Global Entry? Hope it soon so we can use for California trip in March. After approved, you would get TSA precheck every time?

Once you pay for Global Entry, you have to schedule an appointment with an international airport (LAX, only open during weekdays). The process is pretty easy and you will receive a plastic card in the mail in a week. On the back of the card is your trusted traveler number. Enter that number when you book your airline tickets and that will give you TSA Pre Check. You can also save that number to your frequent flyer accounts.

Grant, just wondering which local

Ralphs in the bay area/norcal did you go to?

Sorry Adam, I went to Ralphs in Irvine (SoCal), when I was home for New Years.

I see… I was hoping that there’s Ralphs in norcal Bay area(maybe someday soon)

Any grocery store that sells Visa Gift Cards, should work for the Chase Freedom’s 5% cash back.

I use my freedom card and buy $500 visa gift card at Safeway in south bay. I buy 1 at a time, didn’t want to get wierd looks for buying 3 :-)

That works too! I told the cashier what I was doing and that I called Chase so they would know a large grocery store purchase was going to happen that day. Everything went through flawlessly.

Hi Grant,

I have been used MS to achieve companion pass for next year with Simon GC. It cost $3.95 for $500 GC. However, the woman at the Simon kiosks told me I can buy $1000 GC if I apply for business account. Do you know someone did it? Can you load to BB with Kate for $1000 GC? How about load $500 twice?

I’m not familiar with Simon GCs so I’m not the best person to ask. Hopefully someone else will know the answer to your question.

Hey Grant, have you tried to reload BB or serve at Walmart recently? I tried at 2 different wally with the gift card I got from Kroger and it doesn’t seem to work anymore. Maybe it’s time for me to switch the rest of my cards over to redbird.

I used my PPBDC at Walmart on Monday to load my Serve Card. No problem. Haven’t tried gift cards in a while.

I just did this afternoon. I will try to buy Visa GC which issued by Meta Bank since the machine owned by Meta Bank. I also bought Money Order by Visa GC yesterday at Walmart with 70 cents and you can pay it by cash. The cashier told me I can buy up to $1000 MO for the same fees so I will try next time.

Excellent, thanks for the data points Hoang.

Interesting! Mine’s from US bank.. maybe gc from us bank doesn’t work anymore like vanilla?

I am not sure, I haven’t tried loading US Bank gift cards in a long time, so I’m not sure what’s going on with those gift cards.

The last time I loaded US Bank card was last October. Is your MC or Visa?

I only buy US Bank Visa Gift Cards.

mine’s Visa too.. and I was using the Kiosks. I get the “no debit available” or “alternate tender required” error. I thought maybe my PIN was messed up, and I called to change the PIN.. but same thing happened.

I guess you can’t use that VGC at Walmart then. Can you unload the GC another way?

false alarm, guys! I bought another gc from kroger just to see, knowing that if all fails i can still go the redbird route. Surprisingly, the new gc worked. So, I called the customer service and they said the pin on those 2 gc was locked. I had typed in the wrong pin before changing the pin, so they locked it. Long story short, they unlocked them, and I was able to liqudate with no further problems… Thanks for taking the time to response.

Glad you were able to figure out the problem and get it resolved pretty easily. I always use the last 4 digits of the GC as the PIN, so that makes it easy not to forget :)

Pingback: Part 1: My Manufactures Spend and Redbird Loading Strategy | Travel with Grant