Go Bank Experiments

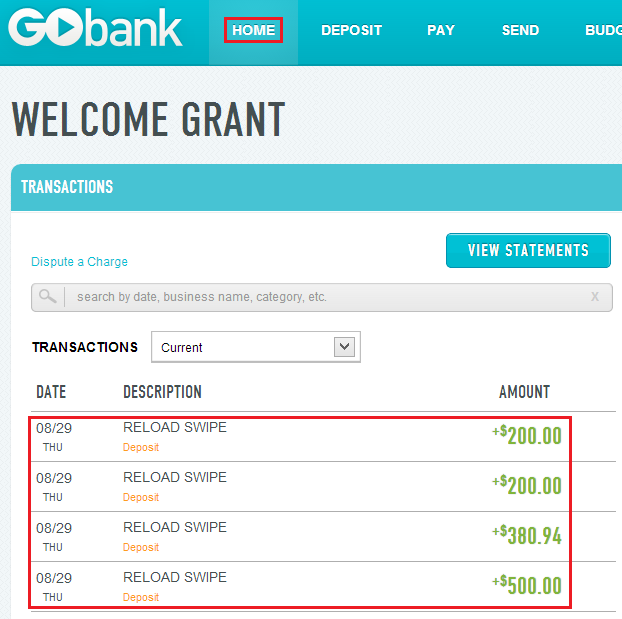

Let’s start with the basics, Go Bank is similar to Bluebird, so similar, Frequent Miler wrote a great post comparing the 2 cards here. You can load up to $2,600 on your Go Bank card in one day, compared to the $1,000 limit for Bluebird. To illustrate, I loaded $1,280.94 to my Go Bank card at Walmart in one day. The loading process is exactly the same as a Bluebird card, whether you load at an ATM or with a cashier.

Now that the money is on your Go Bank card, you can start using it like a credit card, like a debit card (ATM withdrawals), send money to other Go Bank cardholders, and for bill pay.

Go Bank Bill Pay

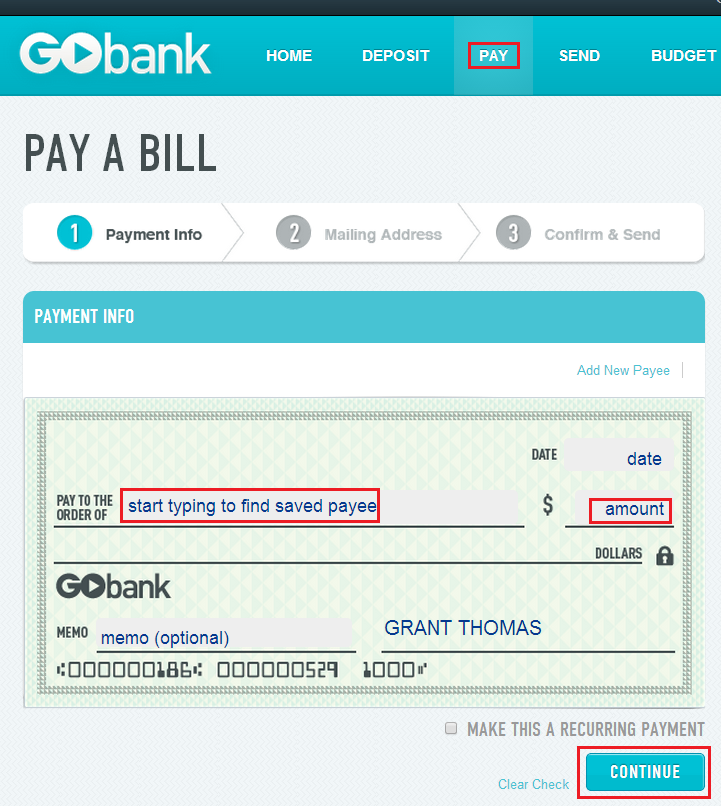

To set up bill pay, click the pay tab at the top of the page and enter the name of the bank/company you want to pay.

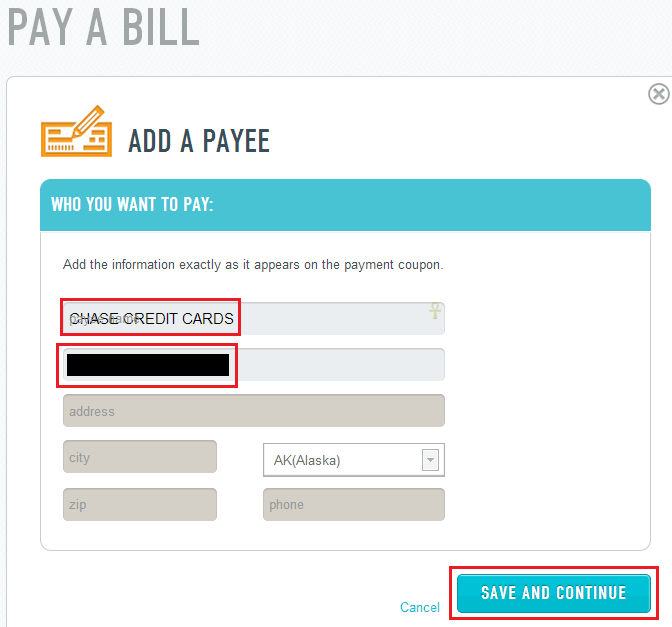

Type the payee’s name and enter your account number. If you are paying a credit card company, type the name of the bank and your credit card number.

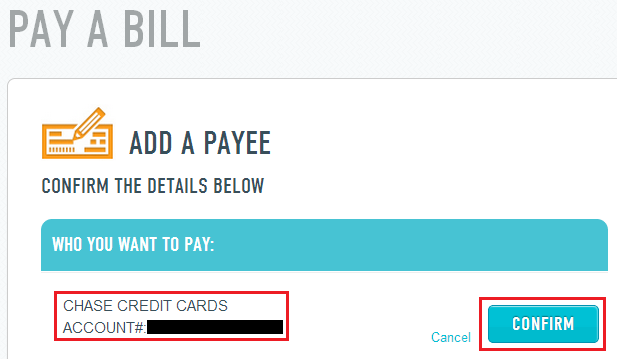

Verify the number typed is correct and click confirm.

Woot! Payee saved! Click the ok button to continue.

Now enter the amount you want to pay. The amount will be automatically written on the check.

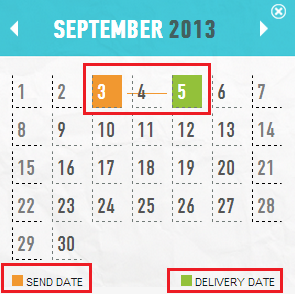

Click the date in the upper right corner of the check and select the date you want to send the payment. This is a great feature if you want to pay bills in the future. Otherwise, select the earliest possible date.

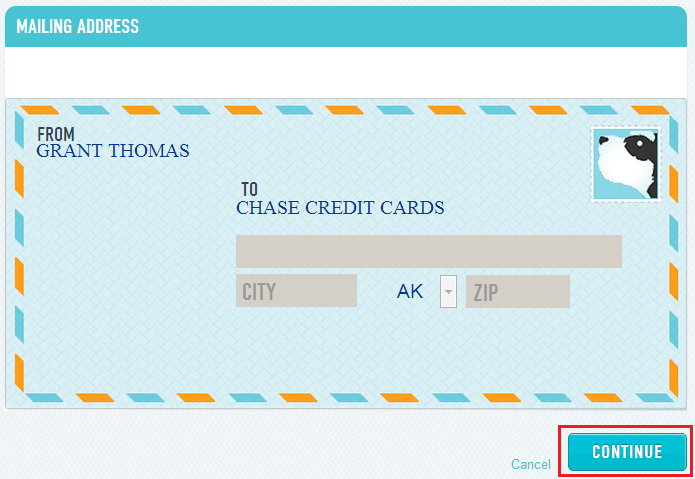

If the payee is in Go Bank’s system, there is no need to enter their mailing address.

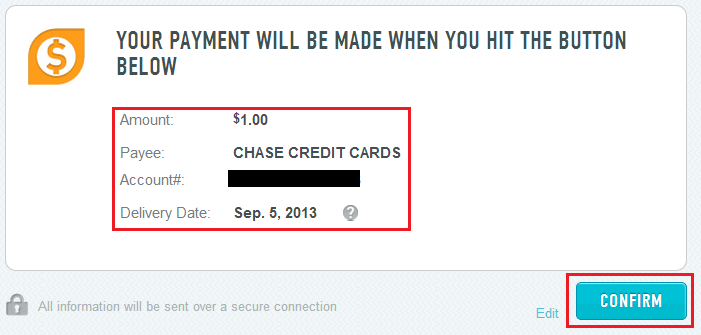

Verify the payment amount and delivery date before clicking the confirm button.

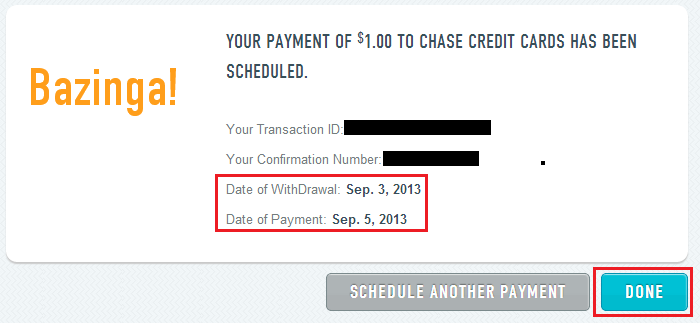

Bazinga! Your bill payment has been sent/scheduled. Click done to return to the home screen.

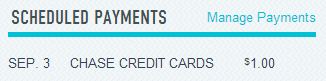

On the right hand side, you will see all your scheduled bill payments.

Go Bank will send the payment on the date you selected.

Go Bank as Online Checking Account

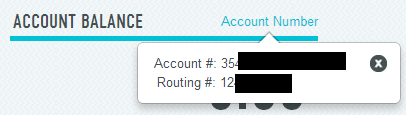

Every Go Bank account is like an online checking account, with both routing and account numbers. To view your numbers, click the link in the upper right corner to display your routing and account numbers.

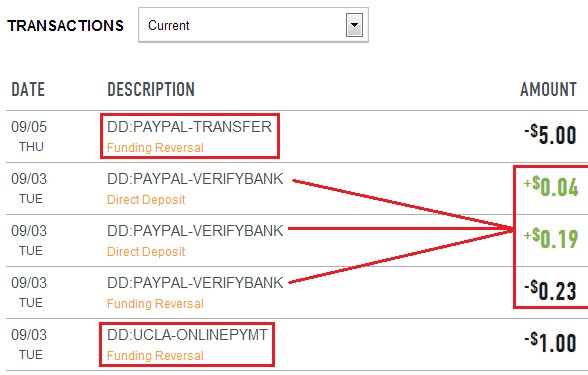

To test this out, I was able to pay $1 to my brother’s UCLA Bruin Bill. To UCLA, the routing and account numbers act like a normal checking account, so this should work with all similar online activities.

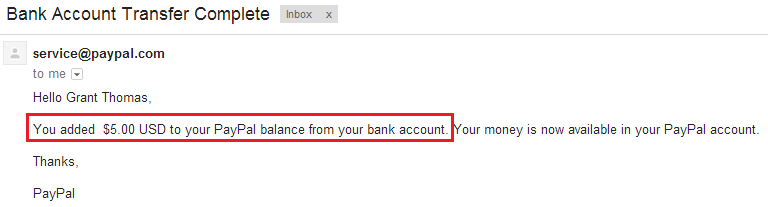

Go Bank calls all transfers out of your account “Funding Reversals” which makes it sound bad, but it essentially means withdrawals. Similarly, I was able to link my PayPal account to my Go Bank account (those small charges are used to verify my account) and transfer $5.00 to my PayPal account.

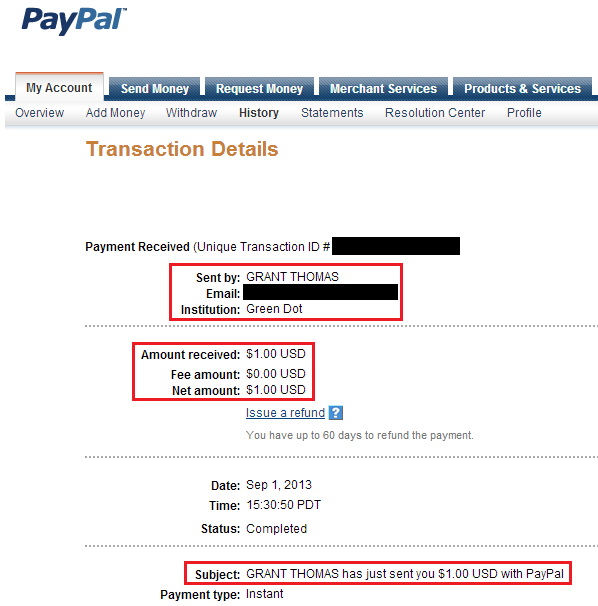

Confirmation email of a successful bank transfer.

$5.00 transaction details in my PayPal account.

I wouldn’t do this to drain my Go Bank account, since Go Bank will probably shut you down.

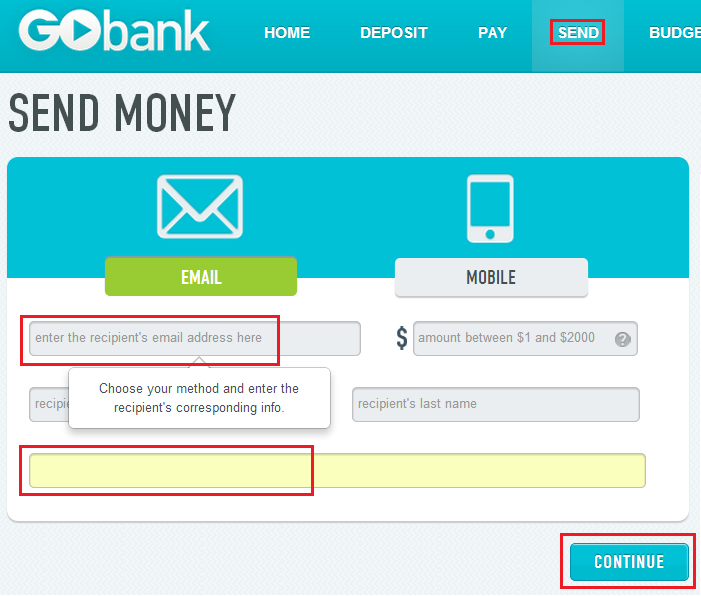

A Faster Way to Send Money to PayPal

Here is a faster way to send money from Go Bank to your PayPal account or to a friend/family member’s PayPal account. Click the send tab at the top of the page, type your friend’s email address, enter a dollar amount, type your email address, and click continue.

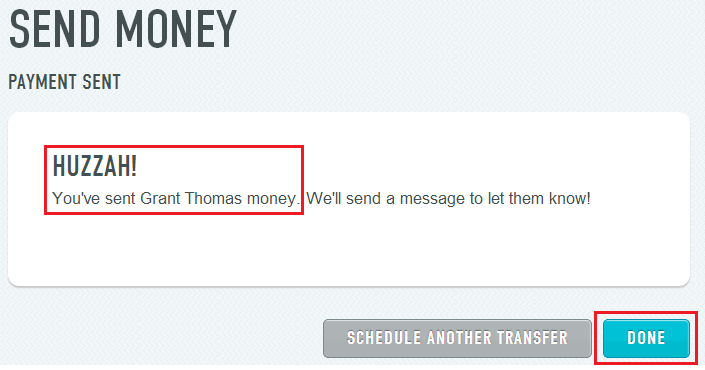

Your money has been sent to your friend/family member.

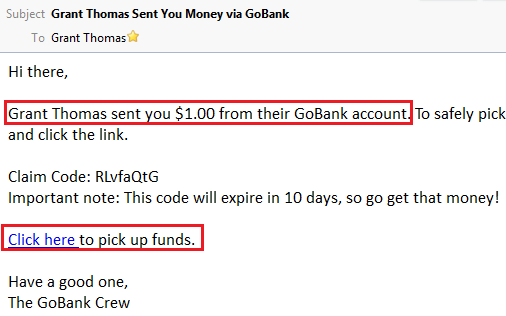

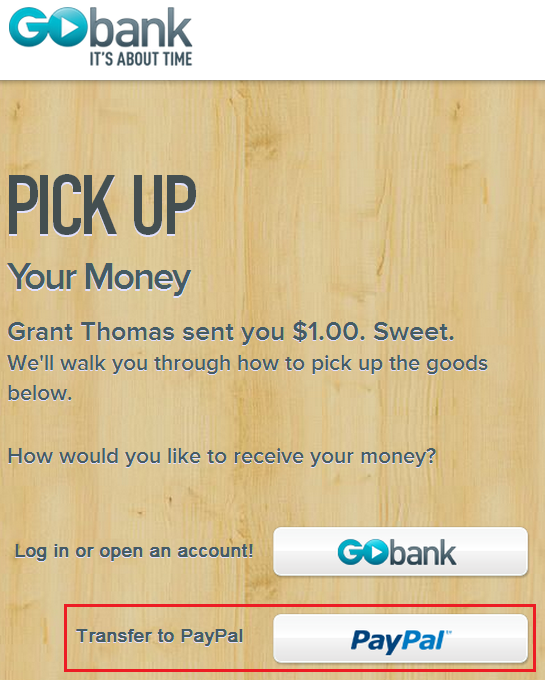

Your friend/family member will get an email from Go Bank with a link to pick up the funds.

When they click on the link, they have the option to log into their Go Bank account, create a Go Bank account, or transfer the money to their PayPal account. Click the PayPal option.

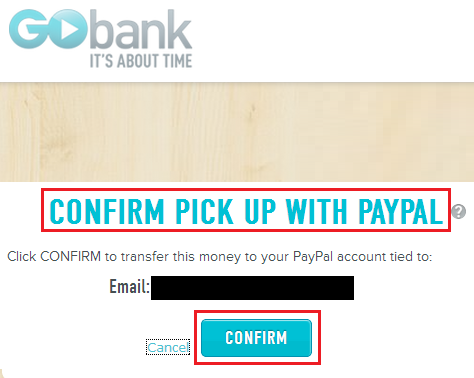

Confirm the email address is associated with your PayPal account and click confirm.

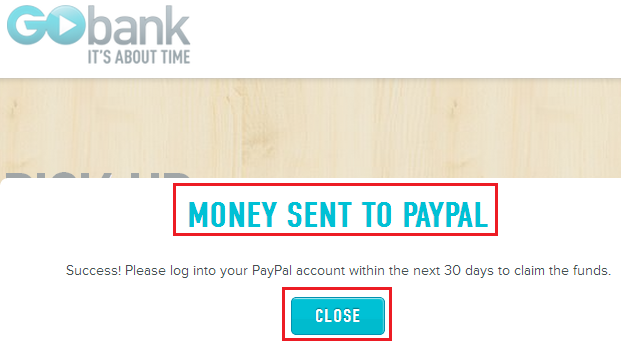

The money will be redirected to your PayPal account.

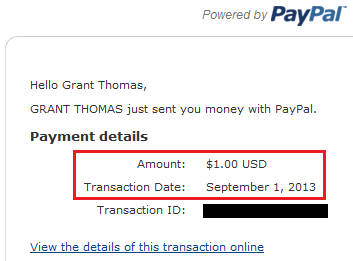

In a few minutes, you should receive an email from PayPal alerting you that you have received a new payment.

Logging into your PayPal account, you can see the details of the transaction. You will also see that there is no fee for using this method.

If you have any questions about any of the steps above, please leave a comment below.

I heard that loading Paypal with Paypal reload cards has a limit of $4,000 per month. If transferring money from your Gobank card to your Paypal account, then does that count against the $4,000 limit?

In PayPal’s eyes, linking Go Bank to your PayPal account is just link linking a bank account to your PayPal account. There should be no limit on the amount of funds you can transfer.

Does still working this way? I would like to add gobank to my PayPal and want to add fund or send money through PayPal. Any idea?

great job on the experiment, now the question is, is Go Bank as flexible as BB with loading and paying bills with large manufacture processes. the bottom line is , will they shut account down with these type of activities ? as you know BB is so ease of use and rarely heard of account shutdown. that is really the big issue here. if its works just like BB with no issue, I ll jump on this.

I would max out Bluebird before using Go Bank. Since you have several Bluebird cards, I would probably ignore Go Bank.

just read Miller wrote up on this topic, there is nothing said on “what if” all the activities are to load and pay bills(back to the CC). what would happened ? will this lead to shutdown ? I dont know about you but that sum up all my activities on BB. need to know anyone done this before I jump in.

Flyer talk has a thread of Go Bank users and reasons why some people got shut down.

Hello Grant. I used my gobank account to get paychecks deposited and saved up a lot of money. How can I safely get all that money out now? The spend limit makes gobank useless for me…

I don’t know how GoBank works anymore. Can you transfer the funds out to another bank account? Can you withdraw funds via an ATM?

Great summary Grant. I been enjoying the benefits of GB for about 4 months now. There have been many shutdowns. My best advice to your readers is load and drain before loading again. This seems to be the best strategy to stay alive. Also, the phone app is the best way to use the bill pay.

BTW, when’s the next In and Out meet up ;-)

Idk about the next In-n-Out meet up, probably next month sometime. Gotta check with Travel Summary to see what his schedule is like.

I created a GoBank account online just now. I went to my favorite 3-letter drug store to buy a GreenDot MoneyPak, so I could fund the account and get the GoBank debit card. Unfortunately, the registers at that drug store won’t let you purchase MoneyPaks with a credit card.

So, I plan to return with $54.95 cash to buy a MoneyPak. They, when I’ve received the plastic debit card, I can start using VRs to reload it.

Questions:

– GoBank told me that transferring debit card funds to the GoBank account is either not enabled in every WalMart or is only doable by way of a bank issued debit card such as the Chase Gift Card which was shut down yesterday. What might you know of debit card/gift card/reloadable transfers?

– Bluebird is absurdly restricted for online card fund transfers. $100/day with $2 fee. Not even close to worth it. But, $1K in-store/day transfers are worthwhile. What’s the GoBank limit on in-store? If it’s $2600, that beats the hell out of BlueBird.

By the way, when I loaded $1000 yesterday to BB via Walmart and 5 $200 Visa gift cards, they told me they can only take 3 cards per transaction. Initially the monkey behind the counter thought it meant 3 cards per day. The manager came out and clarified that it’s 3 cards per entry meaning that the store needs to do an immediate reset and then take any number of cards between 1 – 3 in order to keep piling on to the transaction. In other words, you can effectively load $1000 through 10 $100 cards, it’s just that it requires Walmart to turn it into 4 transactions to get it done = 3 cards + 3 cards + 3 cards + 1 card.

I haven’t loaded my Go Bank card for a few weeks but was able to load it exactly the same way as a Bluebird card.

I haven’t had any problems using multiple gift cards to load Bluebird, as long as they all have PINs and the total amount is less than $1,000 per day and $5,000 per month.

That’s good news. The Walmart thing was yesterday so maybe they’ve changed something. It’s immaterial in that they can continue to load it’s just that it takes a bit more time.

What’s the monthly limit on funding a GoBank account in total and with in-store Walmart loads?

I’m not sure what the Go Bank limit is. FM says $50,000 in his post, but I don’t recommend having that much on it at one time. Double check the FAQs on Go Banks website.

I’ve done 5 different debit card loads at Walmart. Each one used a cashier. Each had a degree of pain in that each employee had a different level of knowledge of debit card transfers, limits, even how to key the machine.

Is it really easy to do it using the ATM that’s right there? Any gotchas to the process?

I have a step by step guide for using the ATM at Walmart. Some people prefer the process, but there are a lot of steps. Personally, I like going to cashiers since it is faster, but the ATM is easy too.

Bluebird canceled their $2 fee for online debit card transactions. Still $100/day and $1000/month in limit. It was canceled on the 17th.

Do you know if the $1K online is additive to the $5K in store?

I hadn’t heard about the fee being dropped. Can you send me the link for the info?

All types of reloads count toward the $5,000 limit. VRC, WM reloads, and online BB reloads.

I went to the site and didn’t see any fee listed, although I had never gone to the site to see that one had.

I did call back and talked with another rep who told me the same thing. $2 fee eliminated as of 9/17

You cannot load a Visa Vanilla Gift card online, correct? Only reload cards?

I have never loaded a gift card or a debit card before so I’m not sure of the process.

In my area, Seattle, all grocery and superstores sell MC, Visa, and Amex $20 – $500 (you pick it) blank gift cards for $5 on average as the activation fee. BB accepts these in store. There are no vanilla reload cards I’ve seen for sale anywhere and CVS does not operate in the Pac NW. Since the major stores all carry $500 ability for $5, it’s not conspicuous at all to spread around purchases since there’s no level of detail to the actual items purchases. To me, that’s worth the extra buck or two per $500 to make sure it’s relatively attentionless. The only big store that does not take c cards to buy these cards in-store (right next to the BB machine) is…..wait for it…..Walmart.

Now if you combine the gift cards from grocery stores with the Amex Blue Cash Preferred, you will get 6% cash back which offsets the small activation fee.

You might like this post: http://travelwithgrant.com/how-to-guides/get-435-cash-back/

I know you’ve probably covered this 50 times, but which card/cards would you use if your only consideration was hitting big spender targets to achieve extra bonuses and statuses? I have an ability to manage a lot of cash in float in cards and use multiple GoBank and BB accounts.

This post from MMS should help: http://millionmilesecrets.com/2012/07/02/big-spenders/

My mortgage payment is $25XX, so it looks like the $2600 daily limit is exactly what I need.

Do you think I risk shutdown if I am only loading 1 time each month at WM using my Alaska Airline debit card to pay mortgage?

Just call Bank of America and tell them that you are making a large debit transaction at Walmart. As long as you have enough money in your bank account, the charge should go through.

Thanks, BOA is not something I worry about. Do you think Gobank tolerate loading $2500 at WM and billpay next day once each month?

Also do I load it at the WM kiosk machine or Money Center? My experience with loading Bluebird is that any transaction above $500 needs to be done at MC (prompted on the kiosk screen).

Thanks!

I would probably wait 2-3 days after the reload. I don’t think it costs GoBank much to do the bill pay so I wouldn’t worry too much.

Ok i have one question. If you can send money from Go Bank to Paypal can you do the opposite from Paypal to Gobank like can i get money out of PP to GB

You might be better off moving money from your PayPal account to your bank account.

i just sign up GoBank yesterday, and while i’m still waiting for the debit card, i got a stupid question….while i’m still able to purchse VR (before it become permanently change to cash-only). You can transfer from VR to GoBank right??

I do not remember if GoBank works with VRCs. Can you check the GoBank website for reload options?

I don’t see any reload option….but i can give a try once i received the debit card from them and i’ll just take one of the Vanilla Reload card and load them there.

Can you load the Go Bank account directly from your credit card? I have no access to Vanilla or gift cards.

No, just gift cards at Walmart. Very similar card to Bluebird, but it’s a Visa not AMEX card.

I believe AMEX Serve can load from cc directly according to Grant’s blog on AMEX Serve http://travelwithgrant.com/amex-serve/add-a-credit-card-to-serve/

Have you been shut down or warned against using all of these strategies? I’ve realized that I could do a simple loop between my ST delta to GO Bank then ACH back to ST.

I wouldn’t do just this, but I am wondering if you are still charging ahead with this.

I don’t do that. I just do bill pay after having the funds sit in my Go Bank account for a few days.

How does one sign up to Gobank?

I think Go Bank has stopped accepting applications. You used to be able to open an account after receiving money from another Go Bank member. I would check back in a few weeks to see if they open up registration. I’m sorry.

GoBank is a rathole of time leading to an eventual shutdown………….unless you do very small transactions, rarely remove money, only service your own account, and don’t even cough the wrong way.

I’m been walking a careful line with Go Bank so far :)

Here’s my GoBank experience. Back in January, after a couple of transactions they froze me. So, I went to RiteAid and bought $50K of transaction free cards and loaded each with $500. These were the zero cost loaded starter cards they entice people with. I cleared out the drugstore rack. Then I called their corporate office and said I wanted to cash each out. They told me I was frozen. I said I wanted my money back. They really had no choice. 3 weeks later they sent me $50K.

So, I got my $50K in manufactured spend and am now done with them.

If I wanted to, I could have just repeated it and there was nothing they could have done about it. Instead, I found that money orders make all of this Serve/Bluebird/GoBank stuff irrelevant.

I know we MS’ers abuse the core concept, but the GoBank people are “Shoot first, ask questions later.”

Wowzers, that is hardcore. Glad it worked out for you in the end.

If I opened up my account online (given an account number) without funding am I able to purchase a starter pack (so that I can use the card now) and then have that card linked to my account I opened online or will they just send me a personalized card for the online account?

I really don’t know. I haven’t used my Go Bank card in a long time.

Hello, I was wondering if I could link a go card to my paypal for a payment method. I don’t have a regular bank account becouse of over draft fees. With me linking it to my paypal I would like to make several direct deposits of $20 or so from eBay a day. Would go bank close my account?

You should be fine doing that. Moving money from your PayPal account to your Go Bank account is perfectly fine.

Hi Jacob, were you ever able to link your PayPal to a Go card? I was thinking about doing the same thing

Okay cool cool. Thank you for your response and my much needed help!

Is GoBank still working? Have a Visa Pin Acitivated GC would love to try to move to GoBank to pay mortgage etc.

thanks

I’m not sure, I no longer have my GoBank card. Does anyone know if GoBsnk cards still work?

Trying to accept a pmt from a friend on gobank but when I enter card number and then ex date , the card number disappears it dont stay

On the website or on the app?