Use Amazon Mom, Amazon Student, and Amazon Subscribe & Save to Save Money on Every Amazon Purchase

You may already be familiar with Amazon Prime, the free 2-day shipping, unlimited online video streaming, and Kindle ebook reading program from Amazon.

But have you heard of Amazon Mom or Amazon Student? Probably not…

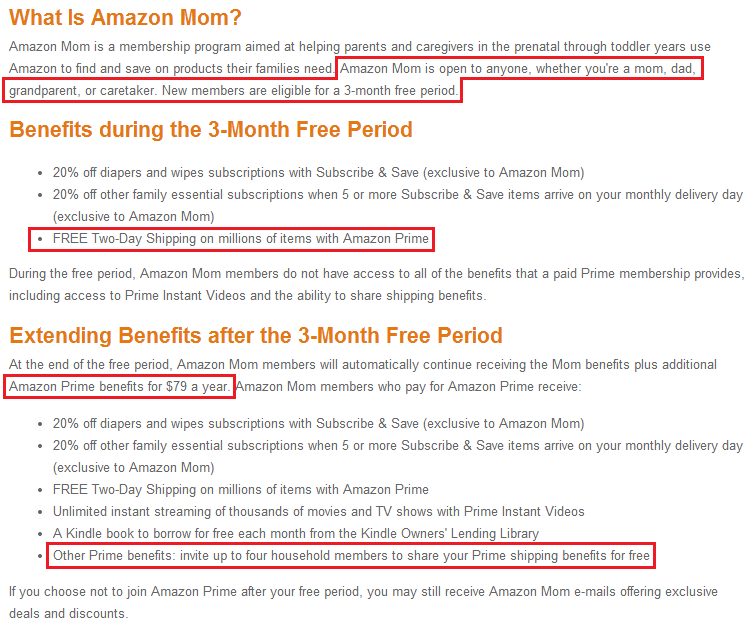

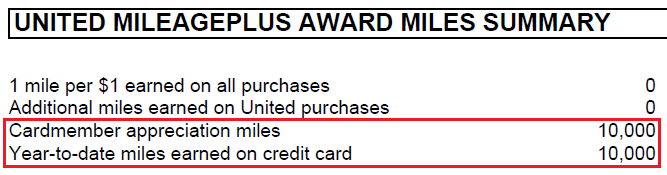

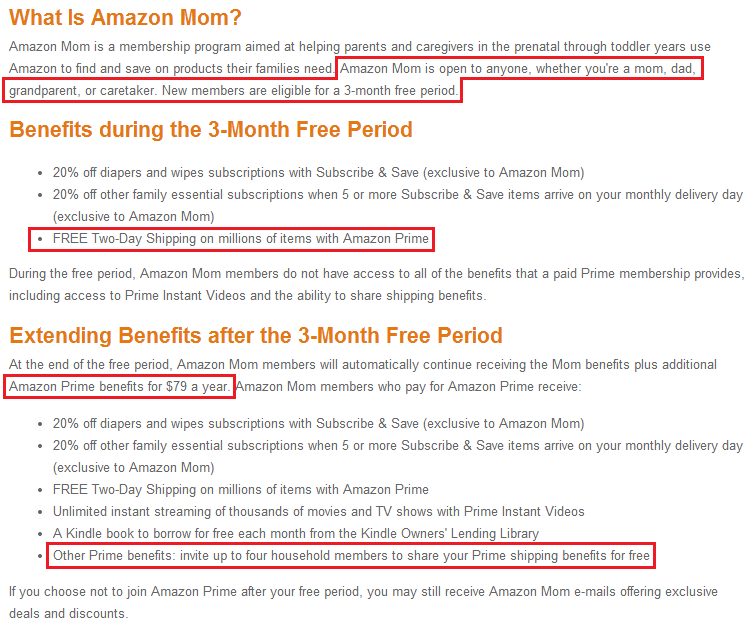

Amazon Mom (actually it says you can be a mom, a dad, a grandparent, or a caretaker, but that isn’t as catchy as “Amazon Mom”). You get the same benefits of Amazon Prime as well as 20% off diapers and wipes (for your baby) through the Subscribe and Save option (more details below) and another 20% off other family essential subscriptions. Not too bad, right?

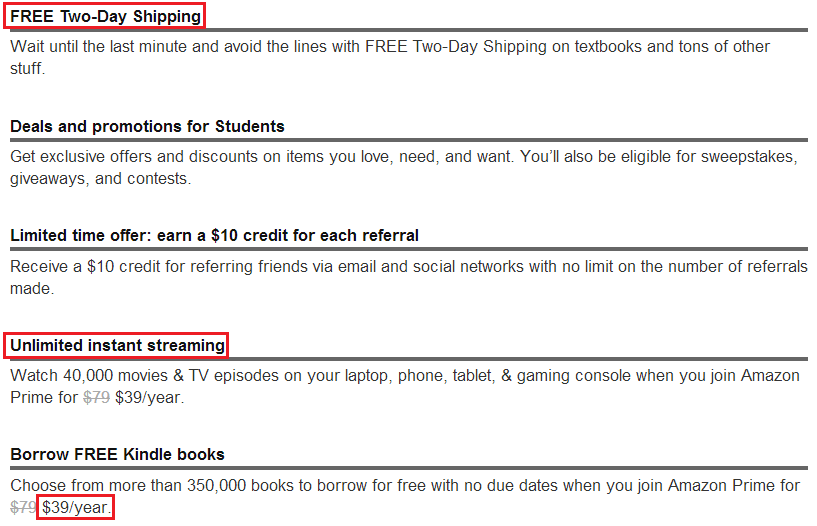

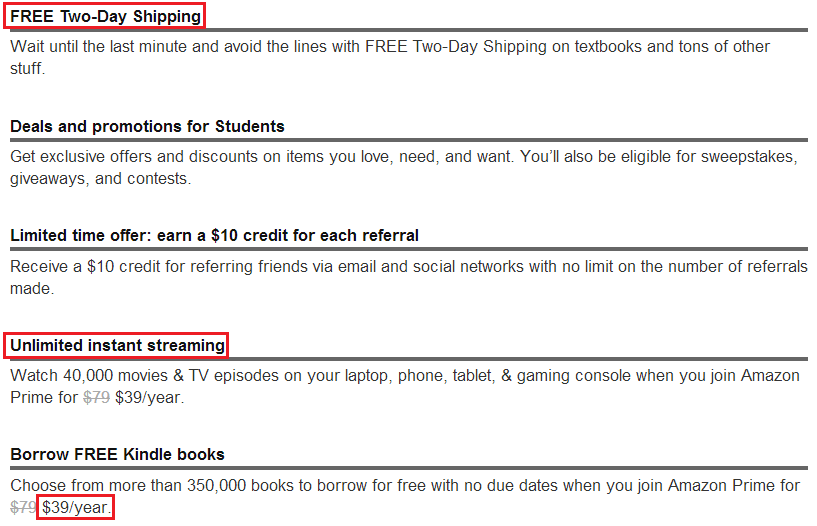

Amazon Student is very similar to Amazon Mom but is targeted toward college students. The sign up bonus for Amazon Student is pretty cool since you get 6 months of free 2 day shipping, lots of discounts on stuff students usually buy, and then a half priced membership the last 6 months of the year. You can cancel your free trial anytime before your 6 month trial period ends.

Here are more details of the Amazon Student program:

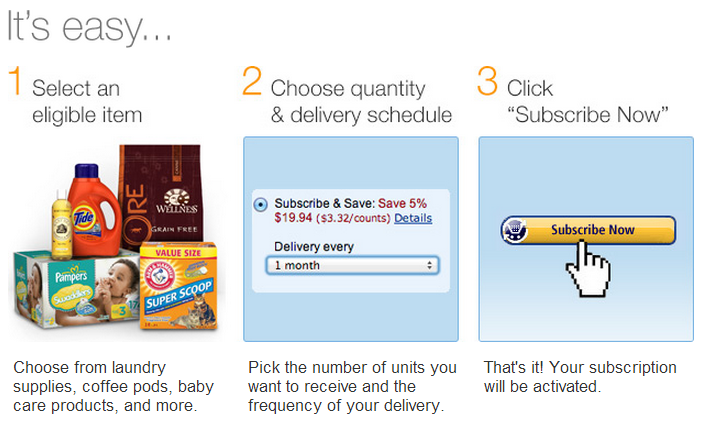

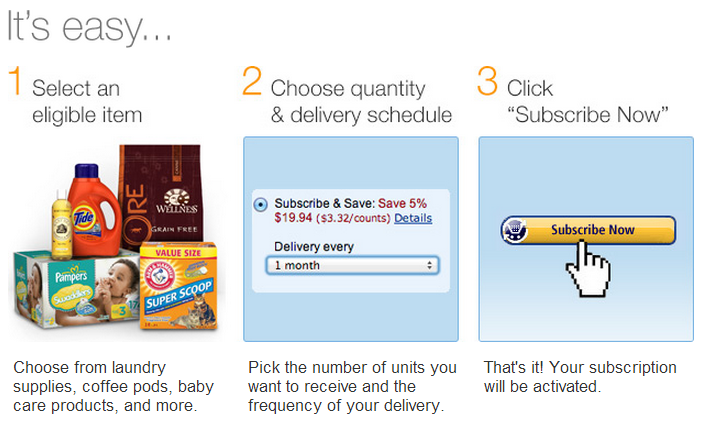

Amazon also has a third program called Subscribe & Save which does not cost anything (it comes included with the above mentioned programs).

Subscribe & Save is simple to understand. Most people buy the same stuff every month, every 2 months, 3 months, 6 months, etc. What if you could save up to 15% on the stuff you buy repetitively? Now you can, with Amazon’s Subscribe & Save.

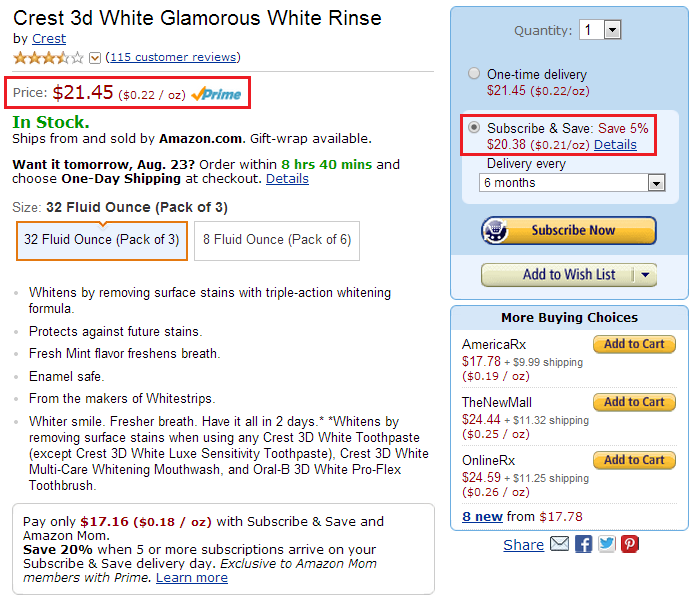

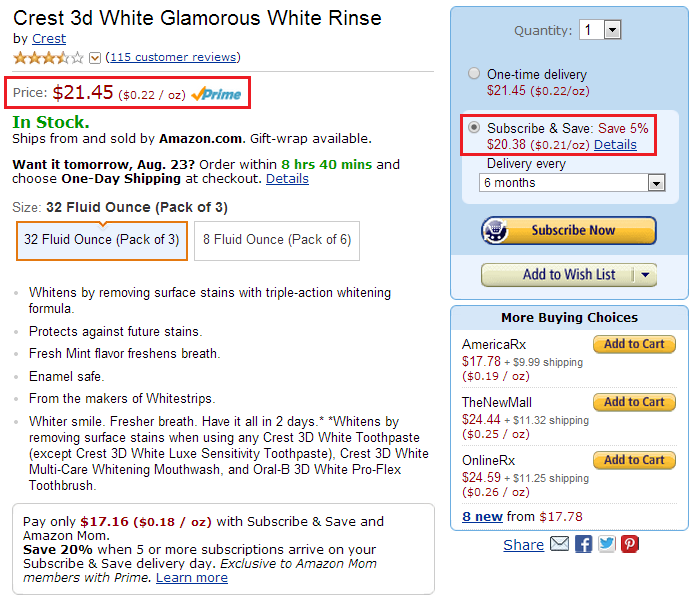

Even if you do not want to reorder the same thing every few months, you can use Subscribe & Save to your advantage. Let me show you how. I needed to order some more mouthwash and they had 3 bottles available for $21.45, which would be 3 / $21.45 = $7.15 a bottle, cheaper than my local grocery store, so I am already ahead. If you look on the right side, there is a Subscribe & Save option for $20.38, which would bring my cost per bottle down to 3 / $20.38 = $6.79.

If you go over to the delivery options, you can chose how often you want your order to be billed and shipped to you. I selected 6 months, since I think it takes about 2 months to go through each bottle of mouthwash.

At the checkout screen, it says my first order will be delivered on September 3 and shipped again 6 months later.

After creating my subscription, I can view the subscription details, change the delivery schedule, skip next delivery, and request a shipment right away.

If you don’t want to continue your subscription, you can cancel anytime and you will not be charged a penalty for the difference between the Subscribe & Save price and the regular Amazon Prime price. Do you see what I mean…?

You can go to the Amazon Mom sign up link and Amazon Student sign up link. I will earn a $10 Amazon Gift Card for everyone who signs up for either program.

If you have any questions, please leave a comment below.