Off Topic: I updated the Bluebird Bill Pay post and the Bluebird Add Funds post to reflect Bluebird’s new website layout.

Helping a Friend get out of Credit Card Debt (Part 2)

Warning: I am not a financial planner/adviser/consultant, so please proceed at your own risk.

Please read part 1 before reading this post. The first thing you need to do is assess the current situation without judging or asking “what did you buy at XYZ for $430??” There are a few key pieces of financial information that you will need to find out. Such as:

- Current balance plus all pending charges

- Current interest rate

- Total credit limit

After determining those figures for all of your friend’s credit cards, you can see the big picture.

| Card Name | Date Opened | Balance | Credit Line | Interest Rate |

| Store-branded credit card | Jan 2011 | $2,800.00 | $3,000.00 | 20% |

| Capital One credit card | May 2012 | $650.00 | $1,500.00 | 18% |

| Chase Freedom credit card | Nov 2013 | $2,800.00 | $3,000.00 | 0% |

| Bank Americard credit card | Nov 2013 | $2,200.00 | $5,000.00 | 0% |

The last 2 cards have 0% interest through December 2014, so he/she has more than 10 months of no interest on those balances.

First off, using 40-95% of your available credit limit is a sure way to decrease your credit score. Ideally, you would want to use less than 30% of your available credit limit and under 10% is great. Learn how your credit score is calculated here.

The next step is to see if there are any recurring charges on any of the cards that you do not need to pay for. On my friend’s Capital One card, he/she was enrolled in Capital One’s payment protection plan, which means he/she would not have to make any payments if he/she had serious medical issues, lost a job, or other dire situations. In exchange, Capital One was charging 85 cents per $100 balance per month. So a $650 balance would generate 85 cents x 6.5 = $5.53 every month ($66 a year), on top of the 18% interest. I told him/her to turn off the payment protection plan right away.

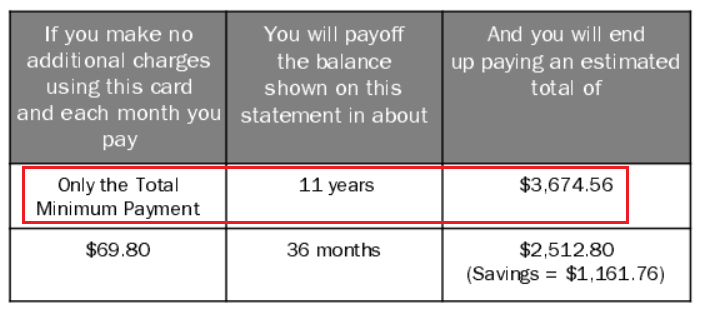

The next thing I looked at was his/her payment history for each credit card. He/she told me that he/she pays only the minimum on the first 2 cards and a lot more on the last 2 cards. This is actually the opposite of what I would recommend. By paying only the minimum amount on the 2 cards that charge you interest, it will take you a long time (several years) to pay off the entire balance and end up costing hundreds of dollars in interest over that time.

My strategy would be to pay only the minimum amounts for the last (newest) 2 cards since they have 0% interest for 10+ months and focus the remainder of your available payment on the 2 oldest cards. So assuming you had $500 each month to pay towards your credit card debt, I would pay the minimum amount toward the newest 2 cards ($35 each) and the remaining $430 toward the 2 oldest cards.

At this point, there are a few different payment strategies to consider.

- Pay off the card that has the smallest balance (in this case, the Capital One credit card).

- Pay off the card that has the highest interest rate (in this case, the store-branded credit card).

- Hybrid payment plan where you add up both balances and determine what percentage each card is and pay that percentage toward each card (see chart below).

| Card Name | Balance | Percentage | Payment |

| Store-branded credit card | $2,800.00 | 81% | $348.30 |

| Capital One credit card | $650.00 | 19% | $81.70 |

| Total credit card balance | $3,450.00 | 100% | $430.00 |

Since option 1 and 2 give conflicting answers, I would recommend option 3. If he/she was really serious about paying down the debt as soon as possible, I would recommend applying for the Chase Slate credit card. The card offers 0% interest for 15 months and 0% balance transfers for the first 2 months. If he/she were approved for the Chase Slate credit card, he/she should move the current balances from the first 2 cards over to the Chase Slate, and depending if there was room for more balance transfers, I would actually move all the balances to the Chase Slate credit card. At this point, put all the credit cards away and pay the entire $500 toward the Chase Slate credit card.

If you add up all the balances, the total comes to $8,450. If he/she paid $500 each month for 17 months, he/she would have paid off the entire balance. Since you get 15 months of 0% interest, this would be the cheapest and most efficient option.

| Months | Balance |

| 0 | $8,450.00 |

| 1 | $7,950.00 |

| 2 | $7,450.00 |

| 3 | $6,950.00 |

| 4 | $6,450.00 |

| 5 | $5,950.00 |

| 6 | $5,450.00 |

| 7 | $4,950.00 |

| 8 | $4,450.00 |

| 9 | $3,950.00 |

| 10 | $3,450.00 |

| 11 | $2,950.00 |

| 12 | $2,450.00 |

| 13 | $1,950.00 |

| 14 | $1,450.00 |

| 15 | $950.00 |

| 16 | $450.00 |

| 17 | $0.00 |

If you have any questions, please leave a comment below.

This person should stop using all credit cards until ALL balances are paid in full. In the meantime, get a debit card, and use the debit card or cash for all purchase. He/she should look into if there is any debit card which earns reward. .

If anyone who has to carry a balance in credit card, he/she should stop this game.

Good advice, this person was not in the miles/points game, just the “credit cards are great cuz I get free money” game.

Wouldn’t the most saving come from making amazon payments on the cards with no interest and get money into their bank and pay off the cards with high interest, and then pay off the cards with no interest? The amount of total used credit will stay the same, and they can put the saved interest onto their payments, and just with on paying it off before Christmas..

Interesting plan. That might work if you are really organized but might be difficult for my friend to keep track of.

That is what I had my friend do, or have him get a bluebird and buy the vrc and pay off his other cards so he doesn’t need to complicate with excess amazon accounts, then cut up the cards so he doesn’t spend on them. Paying off 2 credit cards with no interest should be easier to handle then 4. If you wanted to complicate things he could get additional credit cards for the sign on bonuses and use that towards debt, but only MS so as not to accumulate more debt. A budget would probably help a lot so they don’t buy whatever they feel like because they have credit, that way they tell their money what to do instead of their money just being spent and wondering how did I spend all that money at the end of the month.

I mean this seems pretty self explanatory. Sounds like your friend has problems if he doesn’t understand to pay more money to cards with higher interest rates. I think all public high schools should have a required class Finance 101 for people entering the workforce especially for people that lack

Agreed, it seems like common sense to most of us, but unfortunately this person did not taking any finance/business related classes in high school or college.