How to Add a Debit Card to Serve

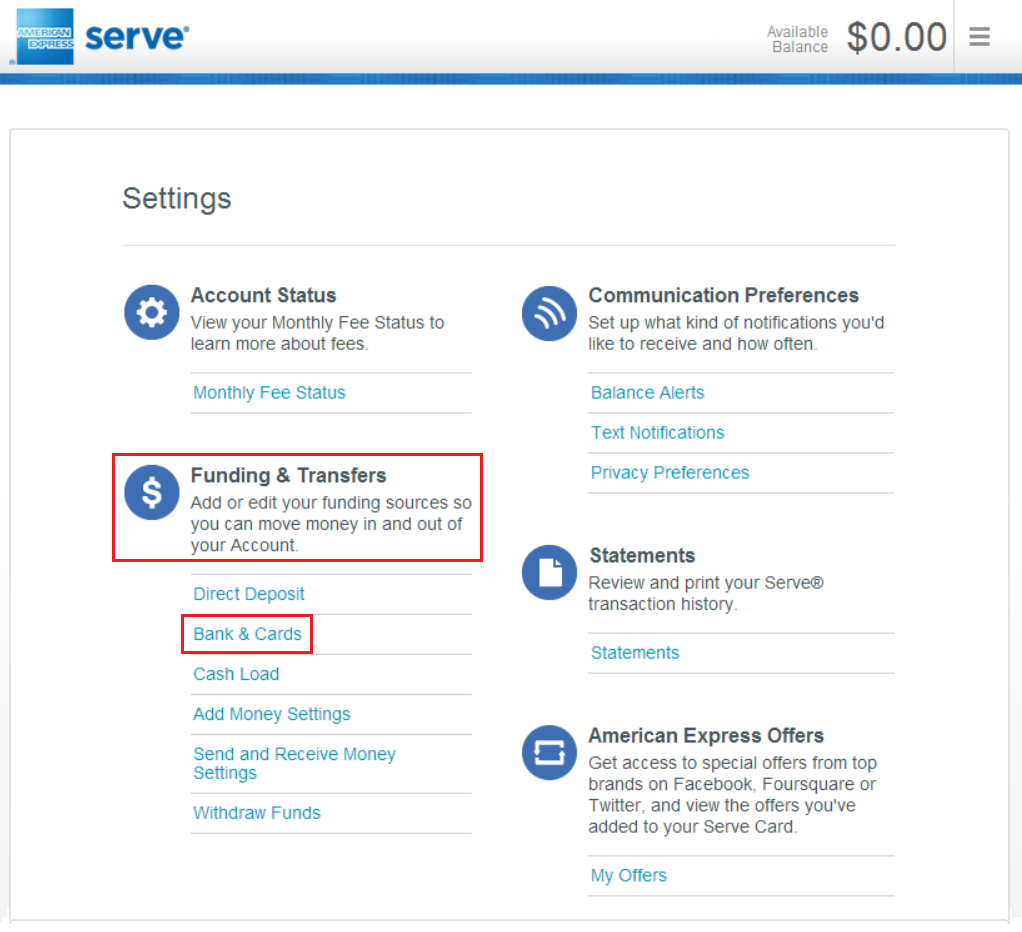

To add a debit card to your Serve account, navigate to the Settings page, and click on Bank & Cards.

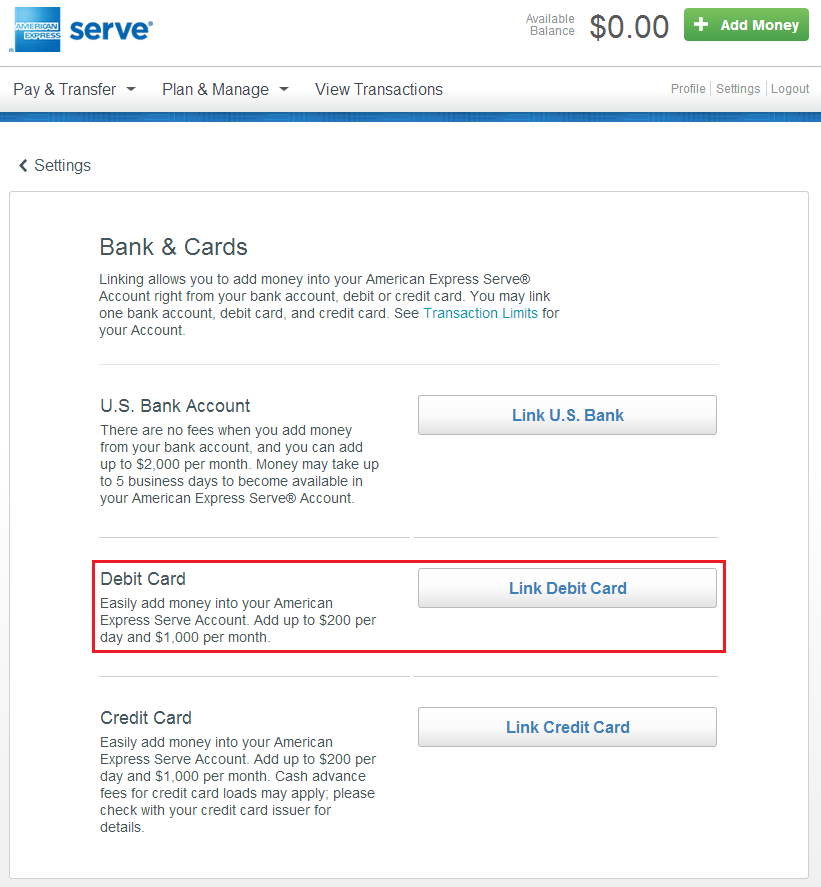

Then click the Link Debit Card button.

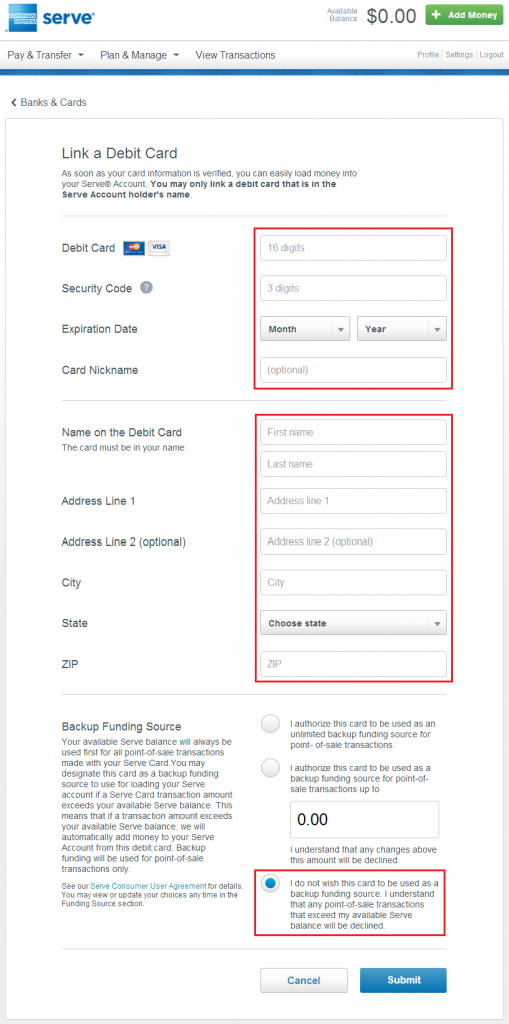

Enter your debit card information as well as your mailing address. You should use a real debit card, not a gift card, or any other card. The best card to use in this case is a PayPal Business Debit Card, since it earns 1.0-1.5% cash back on each purchase, and these reload purchases earn cash back. I wrote a similar post for Bluebird about the process (link). After entering all the information, click the Submit button at the bottom.

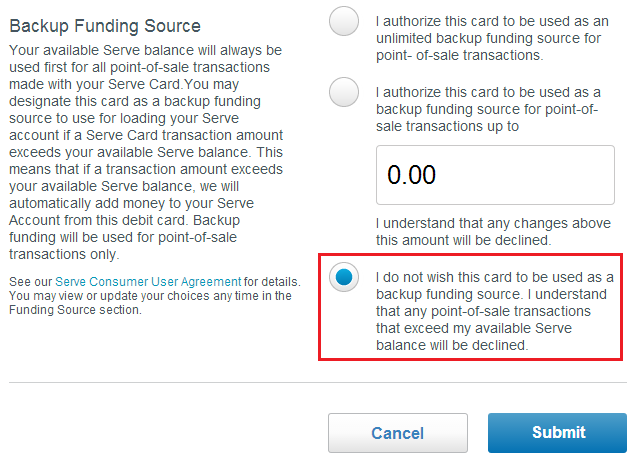

Read and understand what the Backup Funding Source is/does. It means that if you use your Serve Card to make a purchase larger than your current available balance, the remaining charge will come from your debit card. I don’t recommend using that feature, but you can do what you want.

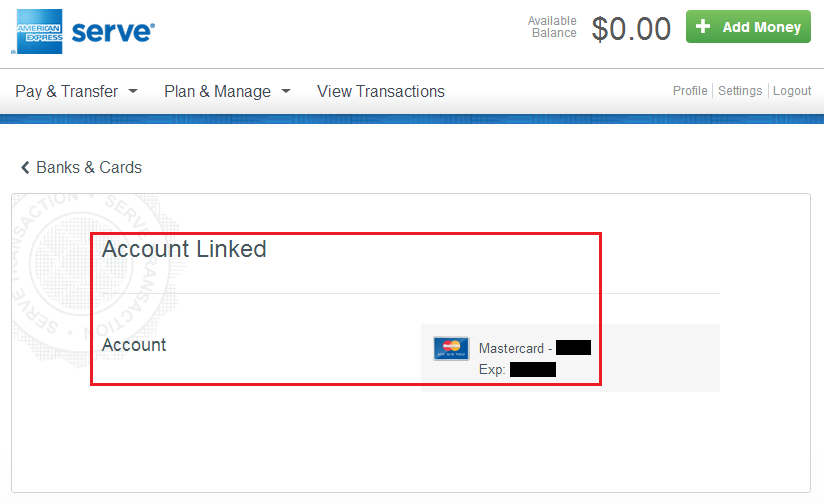

Congratulations, your debit card has been successfully linked to your Serve account.

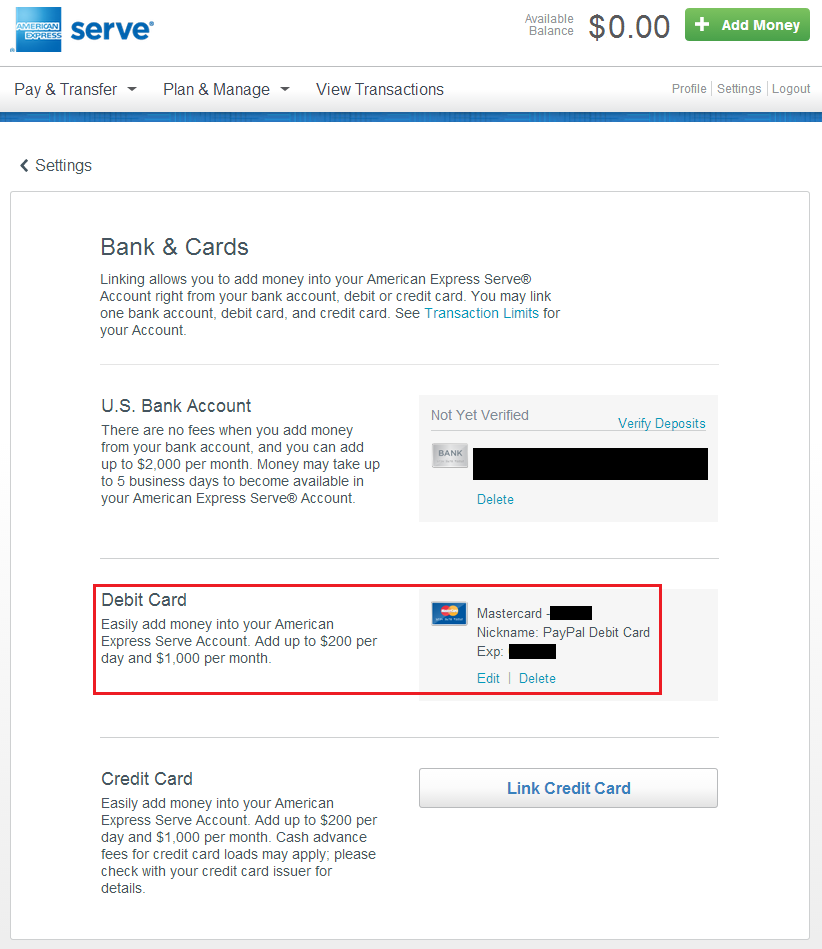

Back at the Bank & Cards settings page, you can view your linked debit card. You can only have one linked debit card at a time, so if you want to change it, you will have to remove the current debit card and add the new debit card to your Serve account.

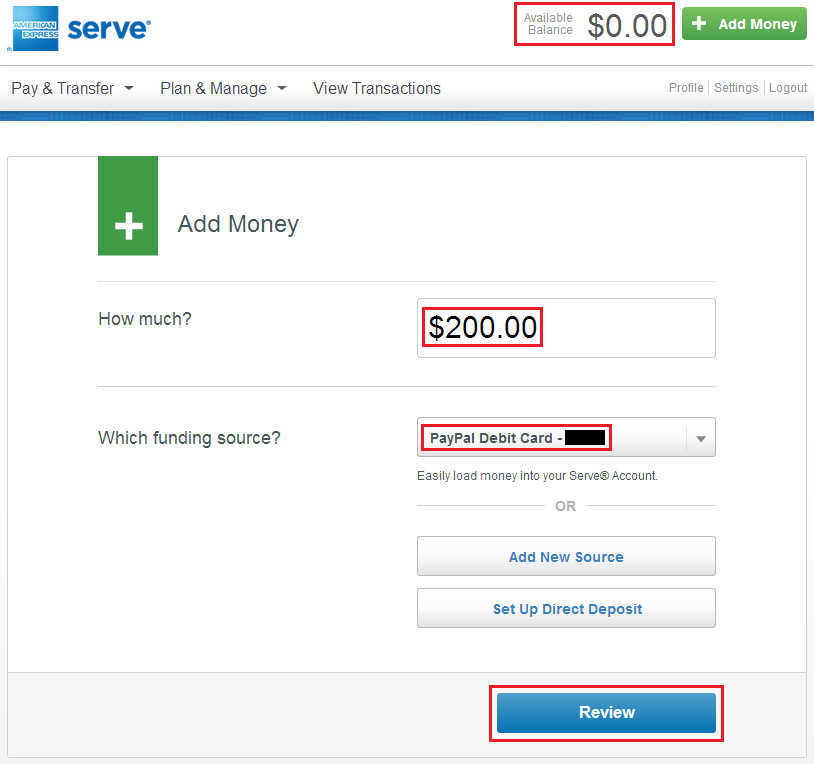

Now to add money, click the Add Money button, and type any amount up to $200 (that’s the daily limit for adding funds from a debit card). Select your debit card from the funding source drop down menu and click the Review button.

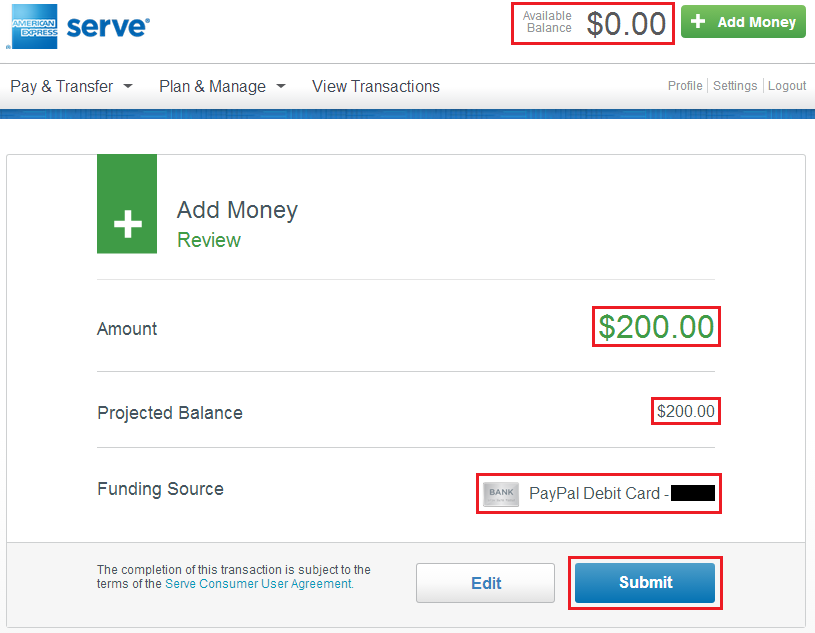

Double check that the amount you entered is correct and that you have chosen the correct funding source. If it all looks good, click the Submit button.

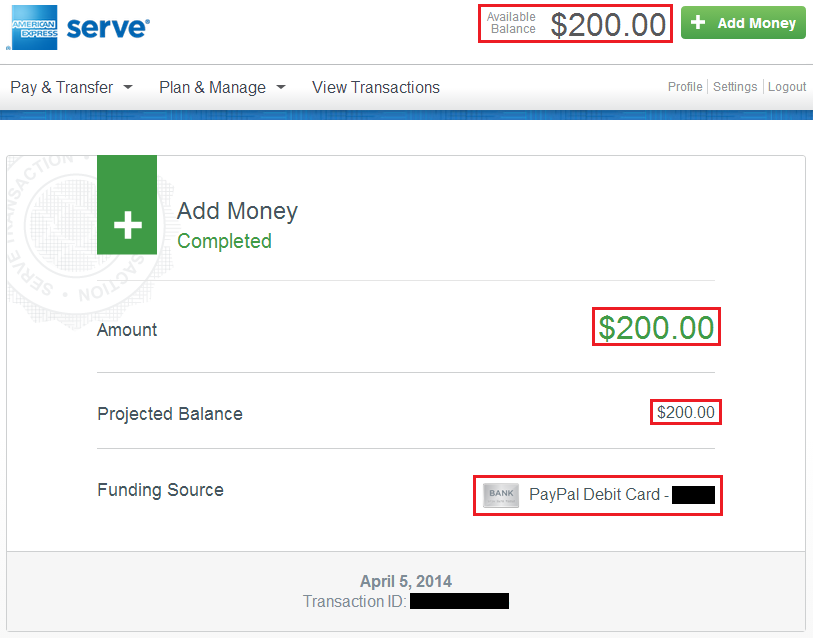

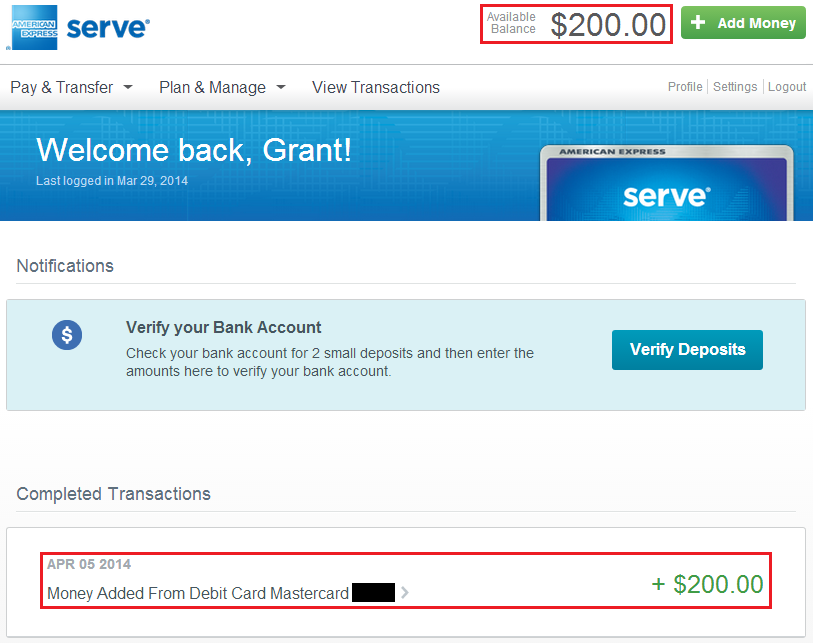

Congratulations, you just added funds with your debit card!

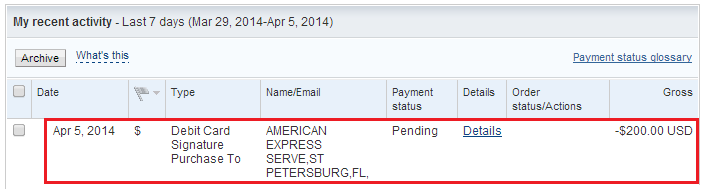

Back at your Serve home page, you can see all your recent transactions, including the $200 debit card reload.

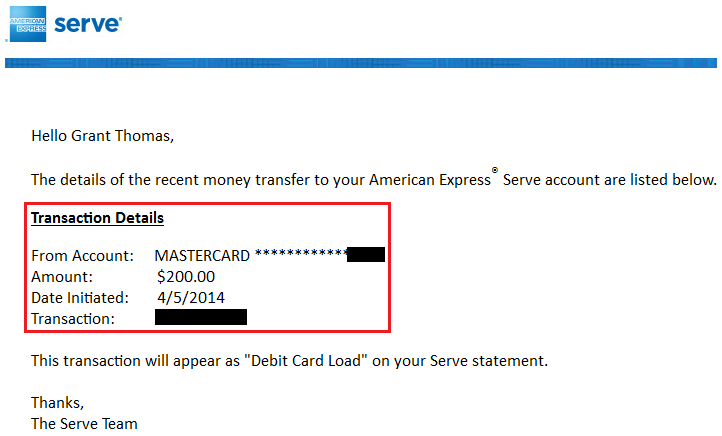

You will also receive a confirmation email from Serve with details of the transaction.

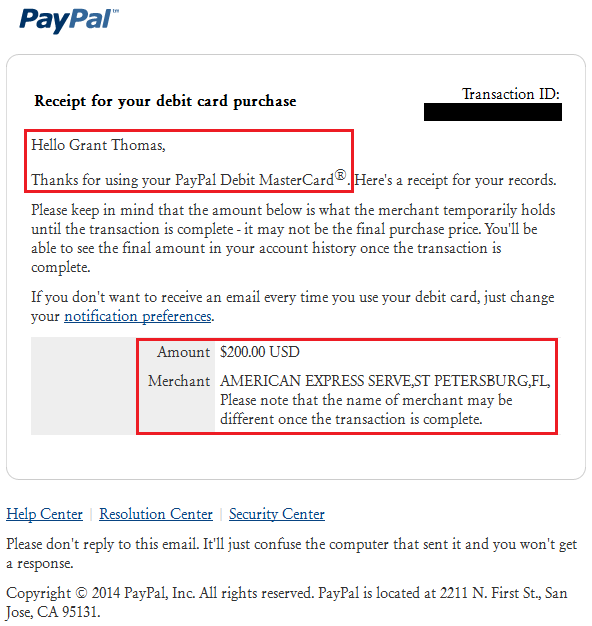

Since I used my PayPal Business Debit Card, I received a confirmation email from PayPal with details of the transaction.

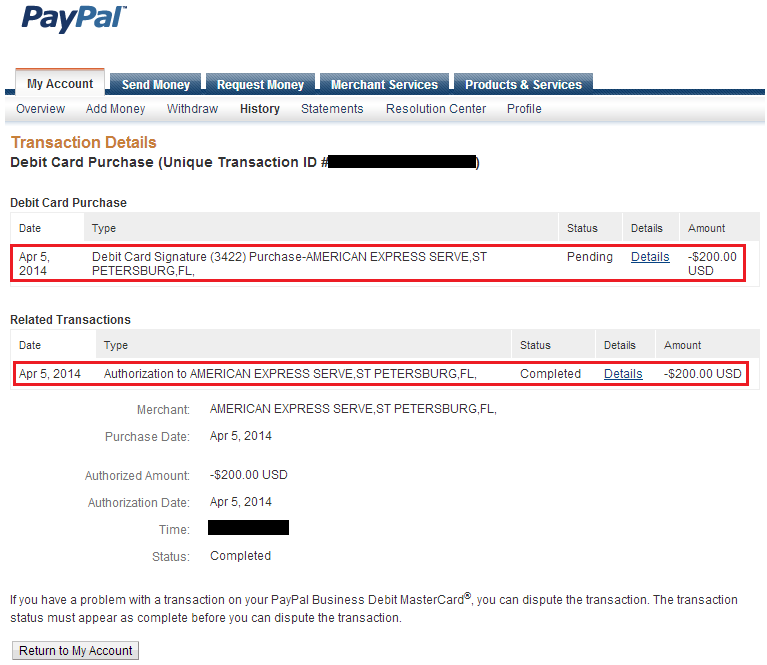

After logging into my PayPal account, I can view more details of the transaction.

Clicking on a transaction shows even more details about the transaction.

With Serve, you can load up to $1,000 per month with a debit card. Since my PayPal Business Debit Card earns 1.5% cash back, I earn $15 every month.

If you have any questions, please leave a comment below.

Thanks for the great tutorial. Does Serve allow you to schedule transfers from a debit card? I have scheduled “adds” set up with my 2% cc right now and don’t want to disrupt that to find out. Strange that they don’t let you schedule more than one add at a time or keep more than one credit card in your account but hey, I’m grateful for what they do offer. :)

Yes you got it. I wish they had more scheduled load settings.

So I have to load the gift cards in person at Walmart and not online?

Yes, no online gift card reloads unfortunately. :(

Hey Grant,

Can you load SERVE or Bluebird with a Buxx card?

I’m sure you can. If it says debit on the front, it should work with Bluebird or Serve. I haven’t tried so that is just a guess.

You haven’t had paypal lock your account up for buying paypal cash cards and then charging over to serve, have you?

I’m getting my feet wet here and don’t want to lock up my paypal account. Thanks.

I have never had any problem buying PPMCC, loading to my PP account, or using my PPBDC to fund my Serve account. I also fund my PP account and use the funds to pay off my PP Extras MasterCard statement. PayPal makes money off Serve debit card loads, so they are happy that we use that card :)

I recently *did* have such a problem, though it’s a bit complicated. I posted the whole weird story here. (Scroll all the way to the end of the comments.)

http://outandout.boardingarea.com/pay-bills-paypal-cash-business-debit-card-radpad-evolve-money/

I’d really appreciate any input.

I just finished reading your comments and I appreciate you sharing your story with me. In regards to PPMCCs, I had the same reaction from PayPal. Using them with my PPBDC is what got my account frozen. You might want to avoid purchasing PPMCCs unless you solely use them to pay for Ebay items and other online items. You can still deposit $1,000/month from your bank account to your PayPal account, then use your PPBDC to fund your Serve Card. In regards to your Ebay issue, I am glad you did not get screwed by the no-longer registered Ebay user.

Hi Grant, thanks for the quick response.

What do you make of the conflicting PayPal CSRs? Is it really just money laundering they’re worried about, or something more (like losing the $3.95 PPMCC reload fee on the cash back, perhaps)?

Why in the world would I want to buy PPMCCs to spend the money on purchases, when I could just spend the money directly from a linked CC?

What about loading Serve from the PPBDC *in store*? Would the debit show up as a Serve reload, or as the business doing the swipe? Does ‘online’ mean strictly online (no B&M)?

(Are there any stores that still do debit card reloads? NYC, so WalMart doesn’t count. I tried two 7-11s the other day, with a standard bank debit card, both of them said they can only do it with cash. My impression was that they weren’t *unwilling* to do it, but *unable*, i.e. hard-coded registers. Even if PPBDC is dead, this would still be useful for pin-enabled VGCs.)

Incidentally, I did actually look at the two links in the PayPal email. I didn’t find anything directly related to PPMCC funds.

It seems ridiculously easy for a fraudulent buyer to scam the system on eBay, and PayPal doesn’t really seem to care, as long as they don’t end up footing the bill. They did not seem overly interested in tracking down the AGC that the buyer claimed he never ordered (but that was delivered to his address).

Grant, the flyertalk thread on Serve says that the paypal business debit card is a “no-no” for online debit card loads. Any idea why? You’re still using it with no issue?

http://www.flyertalk.com/forum/manufactured-spending/1199432-serve-another-paypal-amazon-payments.html

Grant, I successfully link my debit card to my account yesterday in addition to my credit card. Can you ADD MONEY ($200 per day) using both “debit card” and “credit card”? Please advise. Thank you.

Yes, you can load $200 per day with your debit card and your credit card. I hope you used a Chase or Barclays credit card, since most other card issuers will charge you a cash advance fee for online credit card loads.

Has anyone had any recent luck with adding the Paypal Debit Card? I tried earlier today and they asked me to send in verification information. I sent in the photos that were needed and they denied my request. For some reason, the last 4 number of the debit card where different in the email they sent me of what my “suppose card number was” compared to the actual card I had.

Remove the DC from your Serve account and try adding your PPBDC back to your Serve account. Then call Serve and tell them to transfer you to the Security Team where they can verify your PPBDC.

Given that PPBDC is like playing with fire, any other worthwhile debit card loads to serve now??

Hmm, good question. You can still use a PPBDC without funding it by PPMCCs. You should be safe doing that. No other debit cards I know of offer rewards for Serve reloads.

Yes, I should have clarified my comment. I don’t think I’ll be using PPMCC cards from now on. I guess the 1% on loads is better than nothing.

Yea, that is about as good as it gets now.

FYI I was banned from PayPal for using the BBC to load serve

How were you finding your PayPal account?

Hmm good point. Via my cash cards

Yes, every problem I have had with PayPal has been due to PayPal My Cash Cards :/

Does anyone have trouble linking their Paypal Business Debit to Amex Serve? I have been trying and it keeps saying the card entered is not available to be registered. Please enter a different number.

It is weird because I had Redbird and I had it linked together.

Does the address on your PPBDC match your Serve Card?

Hi Grant,

I’ve been loading my Paypal with PPMCC for the past 6 months. I did some money orders, and I got the “warning message” to only use PPMCC with the PPBDC for “retail” purchases. (In the two months since that message, plastiq.com has worked just fine, but no more USPS MO).

Am I playing with fire to try and use my paypal balance to load Serve? It is exclusively loaded with PPMCC. However, I never let my balance go below $1,000, so I know they are at least getting a decent amount of interest as I’m always floating between $1,000-$3,500 in my account.

Thanks for your advice!

Hmm, I’m not sure what a safe level is. Worst case scenario, they freeze your account and hold onto the funds in your PayPal account for up to 6 months. Never have more in there than you can afford to be without over the next 6 months.

On the flyertalk Serve Wiki it says that for online debit card loads ” The use of pre-paid debit cards (Netspend, Paypower, Univision, Paypal, etc.) and VGC/MGC/AGCs is not allowed. While initial transactions may work, your account will eventually be flagged. ”

Do you guys find this to be true in your experience?

I have 1 softcard account and would hate to lose the $1.5k easy spend potential per month.

That is true, unfortunately. If you change the “debit card” on file with your Serve card, AMEX will ask for proof of the card to allow future reloads.