How to Set Up Automatic Serve Reloads

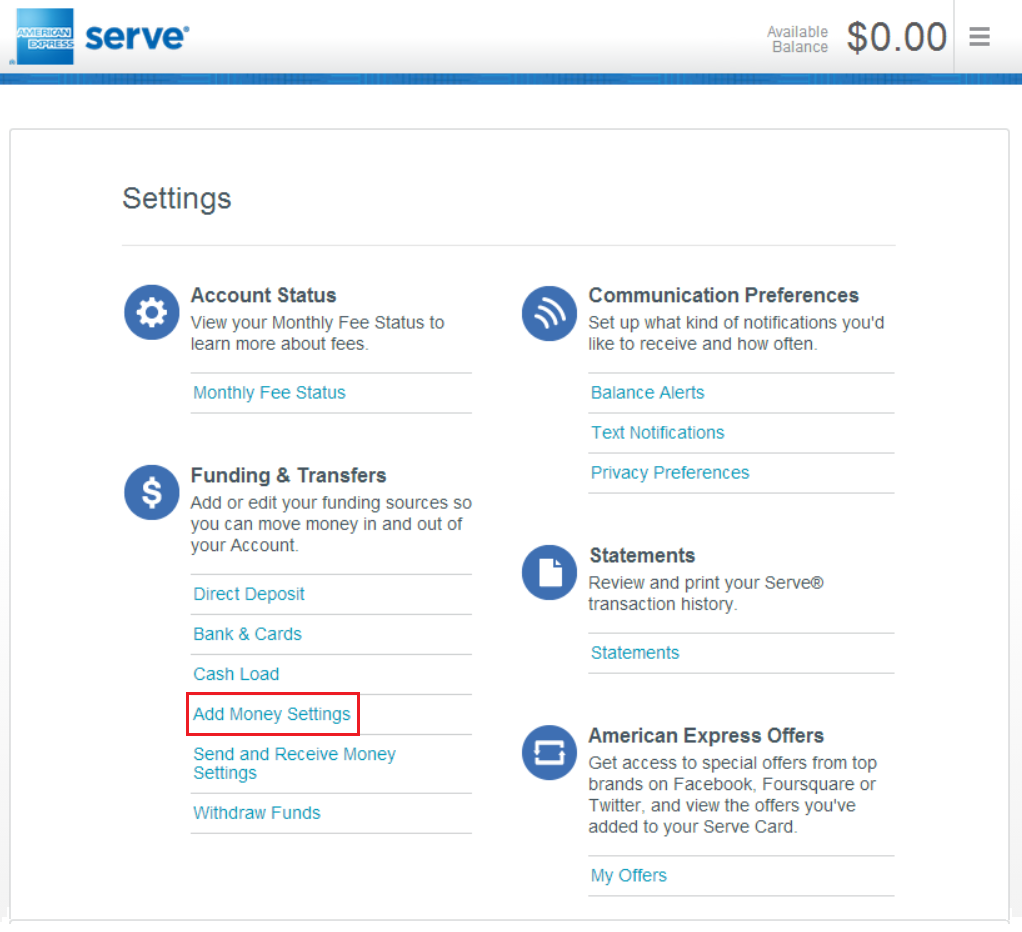

One of the cool features of the American Express Serve Card is that you can use a credit or debit card to fund your Serve account online. On top of that, you can set up an automatic reload that happen daily, weekly, or monthly. To set up an automatic credit or debit card reload, navigate to the Settings page, and click on Add Money Settings.

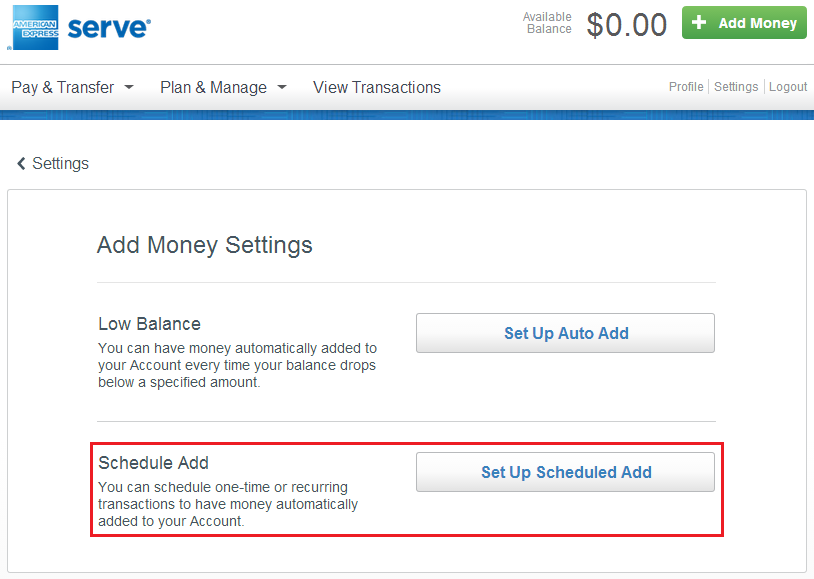

Then click the Set Up Scheduled Add button.

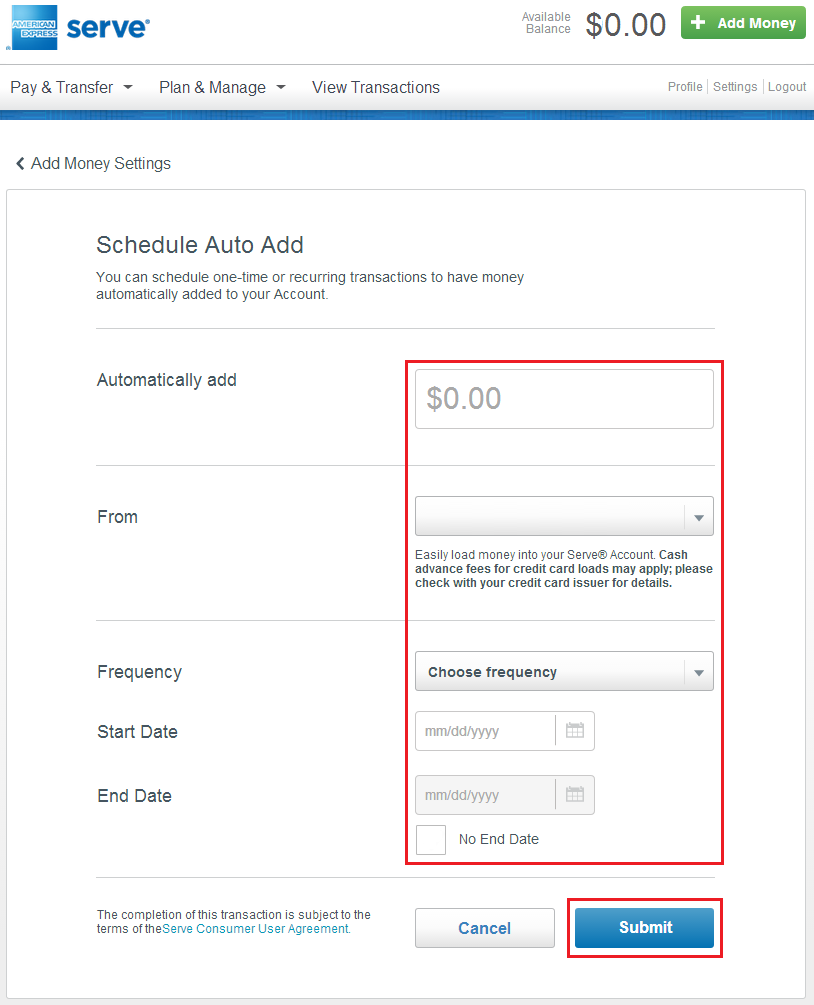

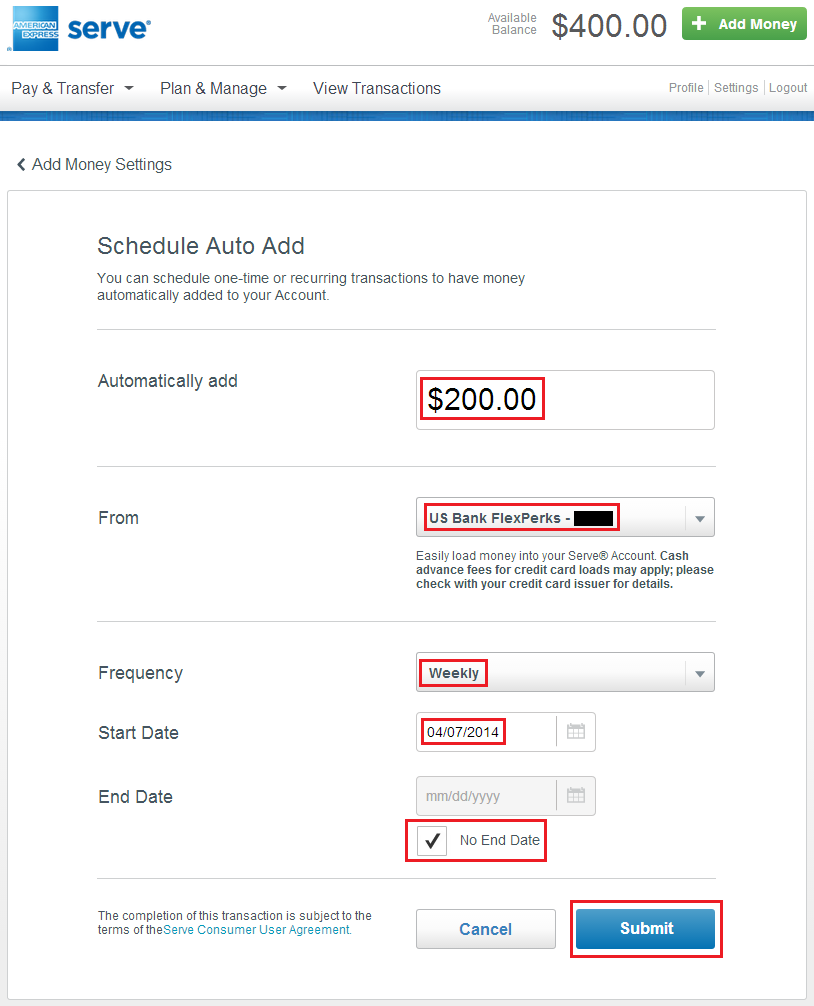

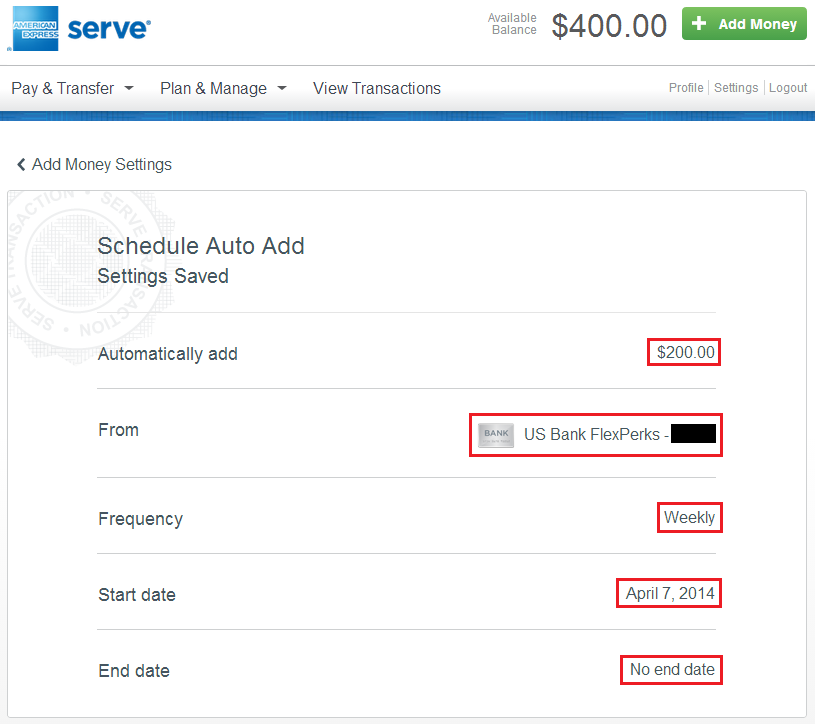

From here, enter an amount you want to automatically reload ($200 or less), select either your credit or debit card from the drop down menu, chose the frequency (daily, weekly, or monthly), the start date, and the end date (if desired). Verify all the information is correct and then click the Submit button.

This is how I set up an automatic credit card reload. You can also do manual credit and debit card reloads whenever you want.

Congratulations, your automatic credit or debit card reload settings have been saved.

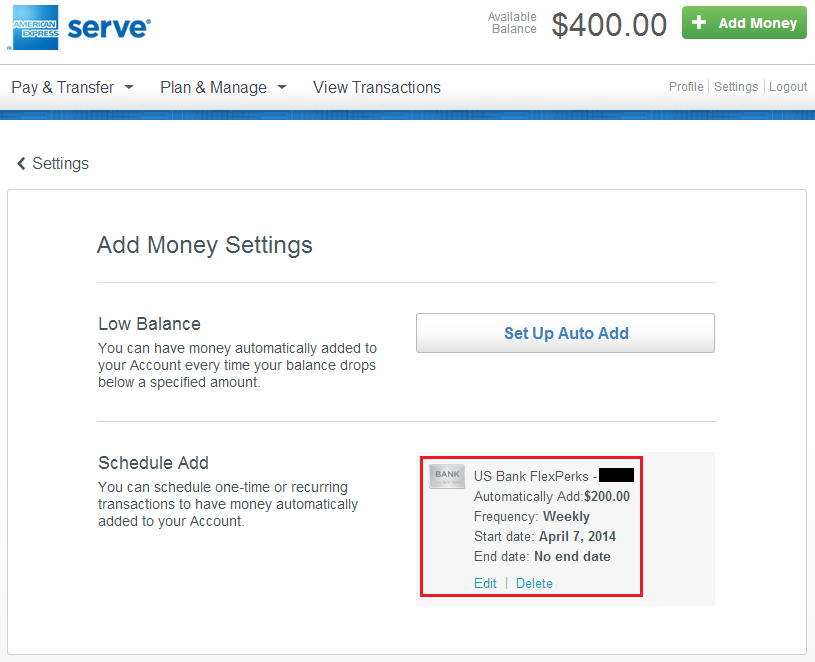

You can view, edit, or delete your automatic reload anytime from the Add Money Settings page.

If you have any questions, please leave a comment below.

Brilliant!

Thanks Harlan, I’m sure you are pretty brilliant yourself!

Pingback: State of the Union: Bluebird and Serve as of April 22, 2014 | Travel with Grant

So this means that I could buy 2 OneVanilla GC less every month? Hence saving me $9.90/mo on fees?

No, not really. You would still be able to buy 10 x $500 One Vanilla Gift Cards per month, plus you can fund $1,000 for free with a credit card.

I’m new to this Bluebird/Serve using gift cards/Vanilla reloads idea. Now that you can’t use a CC to buy reloads at CVS in $5,000 increments I question if this financially makes sense to do anymore. If you could buy one $5,000 reload with my CC the cost of those miles (straight up) was .077 cents per mile (395/5003.95). Now to achieve the same “value” the cost is .77 cents per mile (because I have to buy 10 cards instead of 1)

I do understand that some companies will give me 2x the miles or 5x the points with my CC purchase. Is this the only time this makes financial sense to go through these gyrations? OR in the event I am trying to meet minimum spending requirements. Right now I am in the boat meeting a $10,000 spending limit on my AA card to qualify for 100,000 miles.

Comments on my logic?

You are right, it does require a bit of extra work. If you can buy $5,000 of One Vanilla Gift Cards at one time, you can load them over 5 trips to Walmart during the month. Do you typically go to Walmart around 5 times per month?

Meeting the minimum spend requirements is the ideal use for this technique, but you can go to slow and steady path to generate miles/points over time. It just depends how you value your free time and gas expense.

When I tried to automate debit card loads from my paypal business mc to BB, it failed. I needed to do manually. Seems to be a paypal block. Did you have success?

Serve might have a temporary lock. Can you try setting up an automated credit card load?

Right now I have BB, though I’m planning on switching. Did you have success making automatic debit loads from PP to BB or to Serve?

I did manual PayPal reloads to serve. I had automated credit card loads to Serve though.

Two specific questions…

(1) It is indicated that American Express credit cards will not earn miles/points but will count as purchases if using it as credit load with Amex Serve. Can I set up daily automatic credit load with Amex EDP to satisfy its 30+ transaction requirement in order to get the 50% more points for that month? It probably will not work according to the benefit terms “Purchases do not include …. purchases or reloading of prepaid cards, or purchases of other cash equivalents..” Did anyone actually try it?

(2) Sometimes a debit card requires a certain amount of PINless transactions in a month to get better reward or higher interest for the checking account. Will I be able to get PINless transactions if I set up Amex Serve to automatically do debit load on such debit card?

I’m not really sure about either question. My only suggestion would be to try it the first month and see what happens.

Since I have Serve with Isis, I have $1500 per month online credit card loads. In order to auto load $1500 as quickly as possible each month, can you enter $1500 beginning May 1st and Serve will break up your load into three daily $500 loads? It accepted it for me, but I don’t know if it will actually work yet. Otherwise I don’t see how you can automate it; you would have to come back each month to set it up, no?

I think you can only load $500 per day if you have ISIS with Serve. Set up a $500 load every week. It will fail on the 4th or 5th load attempt each month but will start working again at the beginning if the following month.

how did you attaint the $1500/mo limit please?

did you open the serve acct through isis? i already had serve. installed isis. added serve to. now im trying to remove serve from my isis. then cancel serve. then order serve anew, through isis. correct?

i cant figure out how to remove serve from my isis. any advice?

thanks!

Good evening Gene, I have no idea. I would t worry about ISIS, Serve is good enough by itself. Maybe someone can share their experience with you.

how do you sing up for serve through isis please?

To sign up for Serve with ISIS, you need a android phone or an iPhone case. Then you can download the app from the app store, if that works then you can sign up for ISIS. If that doesn’t work, then you probably don’t have the right smart phone. It only works on certain phones.

i have the proper phone. ive signed up for isis. but how do i actually sign up for serve through isis?

thanks

Is there a way to add your Serve Card to ISIS or sign up for a Serve Card from the app?

finally jumped through all of the hoops to arrange softserve. serious mission

Good work setting up Softserve :)

You’re probably right, but wouldn’t it be great to automatically have $1500 on the 3rd of every month with no effort? I’m tempted (but probably won’t follow through, we’ll see) to leave the $1500 entry for May 1st and see what happens.

Grant, have you used Serve to send money to individuals yet? I’ve paid my apt rent (that I had to manually set up), but I’m wondering if I can manually set up pay to an individual.

I haven’t do any money transfers (no one I know has a Serve account yet) nor have I done a bill payment yet (waiting to do a tutorial and want to start from scratch). Soon I will though.

I made the mistake of canceling my Serve account in order get the higher CC load limit with Serve With Isis. It is my understanding that you have to sign up with Serve THROUGH Isis in order get the higher limit and credit. I had a Serve account before I realized this. I even setup Isis and everything. Very frustrating to have to waiting 31 days now. Some posts on the internet indicated that you could cancel and immediately reapply through Isis “Add New Card” feature on the app. That didn’t work for me.

Hmm that’s a bummer. I have no experience using ISIS.

Yeah, its a bummer. I figured it was worth a shot though. Between me and my wife, it was a difference of $3000 CC load per month versus $2,000. Big difference over the course of a year.

Rob, I went from BB enrolled to Serve/isis enrolled in about one hour. I would try again if I were you. There is great variance between Serve CSRs.

Man I feel like a dweeb. Grant answered my dilemma, almost. I can auto load $500, daily, starting May 1st, and after three days totaling $1500, it won’t allow any more. HOPEFULLY, it will restart on its own June 1st, but I’ll have to see it happen. Serve is great for those of us who haven’t the time or the desire to MS more than $4k per month from our computer. Timewise, $4K takes less than 45 minutes, and part of that is going to CVS to buy One Vanilla.

Glad I could help!

Just an FYI experience with credit card automatic reload to Serve account: Chase Bank blocked my first 2 transactions from going through. I called Amex Serve, who in turn called Chase, to get some kind of verification that was needed for approval.

The next 2 transactions went smoothly. The third transaction was blocked by Chase. I received an email from Chase regarding a Fraud Alert. I needed to respond with a Yes or No if I authorized the transaction.

Now I need to reset the automatic reload date or just do it manually to get to the $1,000 maximum for the month. Maybe I should set it for weekly vs daily in the future.

This was for my wife’s Serve account. I plan on getting my Serve account next month and will probably call Chase ahead of time to try to prevent this from happening to my account.

Yes, AMEX Serve is annoying in that you have to verify your cards when you add new cards. After a few reloads, Chase will stop flagging the charge and it will be easy to auto load. You can also do a load with their app in only a few minutes.

Just now got my Serve card reinstated after cancelling so I could switch to Isis Serve. I had to call about 5 separate times. They kept asking me to call back, saying that they were aware of the issue and that I should try again in 2 or 3 days and if it didn’t work, call back. Called back today. On hold forever. The agent told me Serve and Serve with Isis both have the same monthly limits. Wrong, but I decided to just not worry about it at this point. They gave me a $10 credit, which I didn’t even care about, I wanted that higher limit. At least its open.

Good work Rob, never give up!

Can i load my Serve Card with Gift Cards at Money Pass machines?

Are you talking about Money Pass ATMs outside if Walmart or the Money Center ATMs inside Walmart? No to the first question, yes to the second question.

@Grant

interesting.

but how do you set up auto add from CC to serve in order to max out the $1k/mo? $200/week…not every month has weeks.

what will happen if i set up daily? will it auto stop after $1k/mo reached?

thanks!

I set up $200 loads to occur daily for 5 days (set a start and end date).

touche. thanks

can i use my CC to fund someone else’s serve?

account got suspended.

any ideas please?

thanks

Did you fund someone else’s Serve Card? That’s probably not a good idea. Call Serve and see if they can unsuspend the account.

Grant, what time do the scheduled transactions post? From your post I assumed 12:01 a.m. the day scheduled or something. I had one scheduled for today and it’s 9:15 p.m. and still hasn’t happened.

I am not sure what time Serve actually processes the charges, but I know it happens in the middle of the night. Fun fact: Serve/Bluebird are on east coast time, so after 12AM EST or 9PM PST, a new day begins and you can do another load. Great for us on the west coast :)

Ah, I see. I added after 9 p.m. (I’m PST) so my load “yesterday” must have counted for today so my scheduled add probably declined as I’d already hit the daily limit.

Yes, I believe so. That is a bummer, if only you were an hour earlier…

yes. i added my serve to my isis. but… according to the comments on your blog.. merely adding an existing serve acct to isis will not increase the limit to 1500/mo.. must actually sign up for serve THROUGH isis. but how?

thanks

You can try calling Serve and see if they know how to help. Otherwise, you might have to close your Serve Card and reapply through the app (probably not worth the effort, but that is just my guess).

i feel like no one has actually used serve in conjunction with isis to attain the $1500/mo CC load limit

What’s the minimum you can automatically reload with Serve? I just want to use this to keep an old credit card active and not have it cancelled from inactivity.

Ok, I just called them myself and the CSR I talked to said there was no minimum. Also, she said I could set it up to reload quarterly, is that an option? She said I could set it up for whatever cycle I want, really, like every 2 days. Is that right, or is she mistaken? It looked from this post that the only options were daily, weekly or monthly.

And to avoid the $1/month fee, it says I can either use direct deposit, or add $500 a month. Could I really just set up a $1 monthly EFT/ACH transfer from my bank account to my Serve card and not have to pay the fee? That’s what it looks like.

Do you load more than $500 per month to your Serve Card? If not, you might not even need a Serve Card.

I don’t have a Serve card yet. What I want out of the Serve card is the ability to automate some small credit card activity every month to keep my cards active, my balances low, and my credit history developing nicely. Serve lets me do that without constant monthly maintenance. I can just set it and forget it.

Serve has two options to avoid the $1 monthly fee, as I understand it. You can either load $500 on to the card each month, or you can do a direct deposit of any amount.

I’m still wondering if you can set up Serve to pull funds from a credit card quarterly? Can you see if that’s an option, besides daily/weekly/monthly? Is there an option to set a certain number of days/weeks/months? That’s what the CSR made it sound like.

Thank you very much!

The problem with that plan is you can only link 1 credit card at a time with Serve, so if you have multiple credit cards you want to use, it will be very difficult. I suggest buying a 50 cent Amazon egift card every few months with your various credit cards. That will only take a few minutes per month of work.

I think $1 is the minimum, otherwise you can buy 50 cent Amazon egift cards.

I have 2 serve accounts and I am no longer able set up a new automatic reloads (AKA “Schedule Add” on either. Luckily, I have a couple set up already on the one account, but I was hoping to max out the monthly limit (5 x $200). I wonder if other folks still are getting the option to set up a new ‘schedule add’?

Can you delete an existing schedule add? You can call Serve and they might be able to fix it for you.

I’m having the same problem. I deleted all of my scheduled adds. Now it will only allow me to schedule 1 add in total (this includes debit loads and credit card loads).

I thought you were only able to set up either a credit or debit automatic load schedule.

Perhaps that was a recent change. For a while there, I had 3 credit card loads and 3 debit cards scheduled per month ($500 per load). Now it will only let me schedule 1 credit OR debit load per month.

Hmm, maybe AMEX updated the system last week to disable that feature. In that case, that is a bad change.