4 Uber Rides in 24 Hours (FTU Seattle) and 3 Planned Retention Calls (Chase United, AMEX Delta, and Citi American Airlines)

Sign up for Uber and get a $10 Uber credit on your first ride (link)

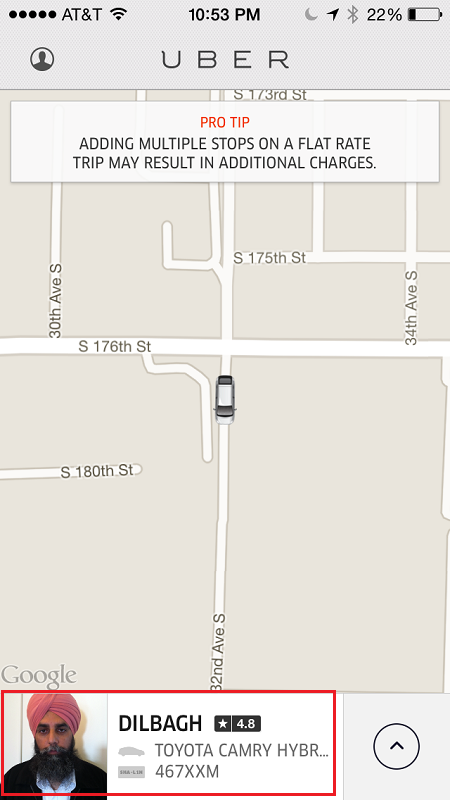

During my weekend in Seattle for FTU Seattle, I had the pleasure to try Uber 4 different times (within 24 hours). For those unfamiliar with Uber, it is an on-demand taxi service, meaning you can request a taxi ride whenever and wherever (Uber is supported). You need a smartphone and the Uber app needs to be installed. Once you load the Uber app, it finds your current location and shows you all drivers nearby. When you are ready to be picked up, just set your pick up location and the nearest available Uber driver will come pick you up. The Uber app shows you where the car is and who the driver is along with the make of the car and their license plate.

You can read the whole article about why Uber is awesome here.

I also wanted to share my thoughts on my 3 planned retention bonus calls that I will be making tomorrow morning. I did a similar summary last month for Planning for Retention Bonuses for a Chase Ink Bold MasterCard and an SPG American Express Credit Card and my results for Retention Bonus Results for a Chase Ink Bold MasterCard and an SPG American Express Credit Card.

The ultimate goal of these retention calls is to either wave the annual fee or offer miles/points that offset the annual fee. If not, you could try to hang up and call back, I have gotten different offers on subsequent calls. If still nothing, then close the card and move the credit line over to other cards.

Card #1: Chase United MileagePlus Credit Card

- $95 annual fee

- Opened May 17, 2012

- Free checked bags, priority boarding, and 2x United miles on United purchases

- Last year, I was given 2 bonus United Club Passes and a choice between $100 statement credit or 10,000 United miles (guess which I picked?) to keep the card another year

- I don’t fly United frequently so if I have to close this card, I will ask that they distribute the credit line over some of my other personal credit cards.

Card #2: American Express Delta Skymiles Credit Card

- $95 annual fee

- Opened June 15, 2013

- Free checked bags, priority boarding, and 2x Delta miles on Delta purchases

- I don’t fly Delta frequently, but I have an upcoming trip this Memorial Day Weekend to Salt Lake City, Utah, (Delta hub), so I won’t really cancel this card until after that trip. I will see what they will offer me on this call.

- After the trip, if the retention offer is not good, I will call to cancel and request that they distribute the credit line over some of my other personal credit cards.

Card #3: Citi American Airlines Platinum Credit Card

- $95 annual fee

- Opened June 10, 2013

- Free checked bags, priority boarding, 2x AA miles on AA purchases, and 10% rebate on redeemed miles (10,000 mile rebate cap per year)

- Since I got my Citi American Airlines Executive Credit Card mid March, this card doesn’t really benefit me besides the 10% annual rebate on redeemed AA miles (I think I am around 7,500 rebate miles this year already).

- If they can’t offer me anything, I will ask if they can downgrade me to a no annual fee Citi AA credit card and move the majority of my credit line over to my other personal credit cards.

To read my retention call tips, please read Planning for Retention Bonuses for a Chase Ink Bold MasterCard and an SPG American Express Credit Card. I plan on calling tomorrow morning, recording the call, and then sharing the results with you all tomorrow evening.

If you have any questions about retention calls, please let me know in the comments section.

Did you choose $100 statement credit over 10,000 miles?

Guess again John.

Dear Grant, THANK YOU for making your Blog EASY to follow! You explain things VERY clearly—EASY to UNDERSTAND! You are doing a GREAT JOB! Thanks!

Thanks Kim, I am glad my thoughts and ideas are actually helpful to readers like you. I’ll keep writing if you guys keep reading. Deal?

Grant, I’m fairly new to your site and I wanted to know what do you mean by “move the majority of my credit line over to my other personal credit cards”. Is there an article on this I can read? I have a few cards I want to close, since I want to stack up on points with my new AA Citi Card, and start opening newer ones as I continue to read your input. Thanks!

Good morning Josh, the only article that comes to mind is this page: http://travelwithgrant.com/credit-cards/6-things-to-do-before-closing-a-credit-card/

If you have a $5,000 credit line on card A, you can have them close card A and move the $5,000 credit line to card B (or C or D).

Thanks Grant! Great article! Keep them coming!

Thanks Josh.

Pingback: Retention Bonus Results for a Chase United, AMEX Delta, and Citi American Airlines Credit Card | Travel with Grant