My $503.95 Dilemma with CVS and American Express

The following is a long, true story. The names and places have been blacked out to protect the innocent. Enjoy…

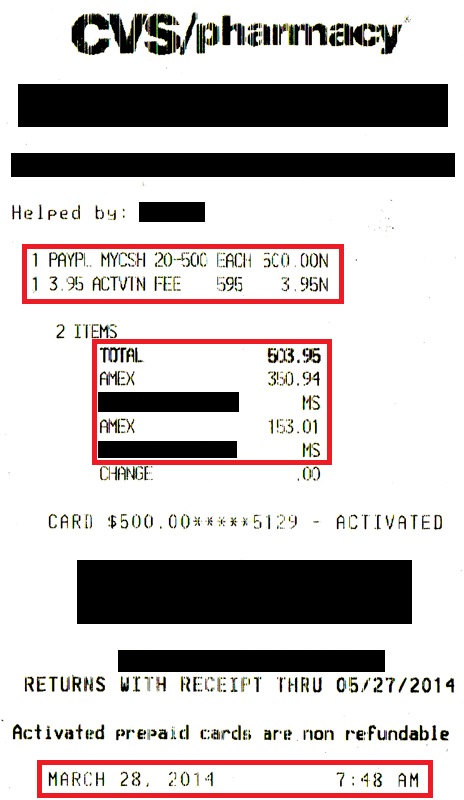

Some background information first. On March 28, I went to my local CVS and bought 2 PayPal My Cash Cards. I tend to split my *large* CVS purchases onto different receipts to eliminate the need to scan my drivers license and today was no different. I grabbed 2 PayPal My Cash Cards from the gift card rack and brought them up to the checkout counter. There was no line in the morning and I chatted with the cashier for a few minutes. The first PayPal My Cash Card loaded fine, but the second card did not ring up properly. I told her I would go grab another card from the gift card rack. That PayPal My Cash Card rang up fine and I took both cards and receipts home. I used my American Express Target card and a really old American Express Prepaid card (pre-Bluebird). Here is a copy of receipt #1:

I was able to drain both American Express cards with one purchase. Life was good.

A few days later, I grabbed the cards on my desk and realize that I had a PayPal My Cash Card and a Vanilla Reload Card. Where did my other PayPal My Cash Card go? I loaded the PayPal My Cash Card to my PayPal account without any problems. I then tried to load the Vanilla Reload Card to my Bluebird Card and got an error message that said the card was not activated. I called Incomm (parent company that issues Vanilla Reload Cards) and was told that the Vanilla Reload Card was never activated and had no balance. Uh oh, this is bad.

I still had the original receipt (see receipt above) so I took that back to the same CVS on Monday morning. I talked to the store manager and tried to explain what happened. My story is hard to believe, but he decided to go in the back room and check the security footage. After 10 minutes, he came back to me and said he saw the problem. During the time when I bought the first PayPal My Cash Card and the second PayPal My Cash Card, the cashier had put the activated PayPal My Cash Card to the side of the register. After activating the second PayPal My Cash Card, she handed me a Vanilla Reload Card on the side of the register. I both prepaid cards stacked on top of one another with receipts placed in between the cards. I didn’t give it a second look because I had done this hundreds of times before and never had a problem. Anyway, by looking at the video recording, the manager saw that the activated PayPal My Cash Card was thrown away by mistake. Nooooo!

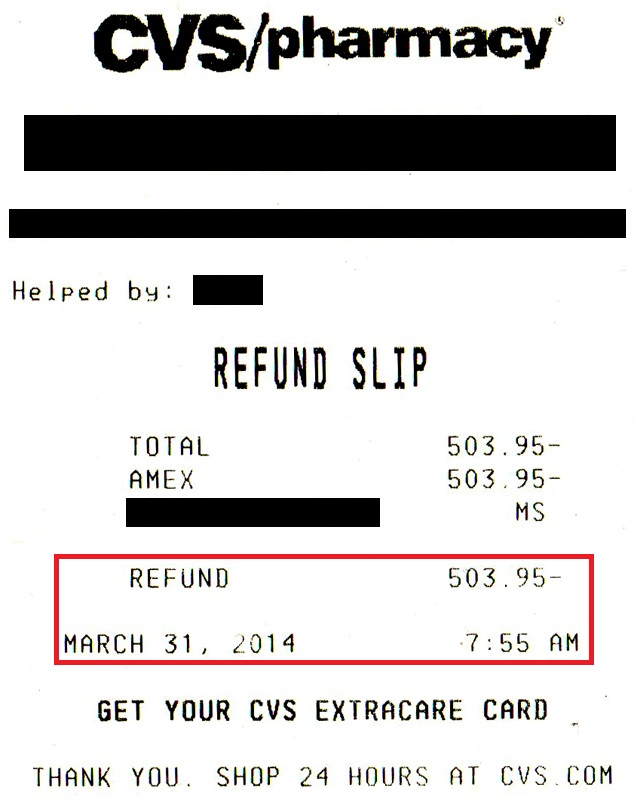

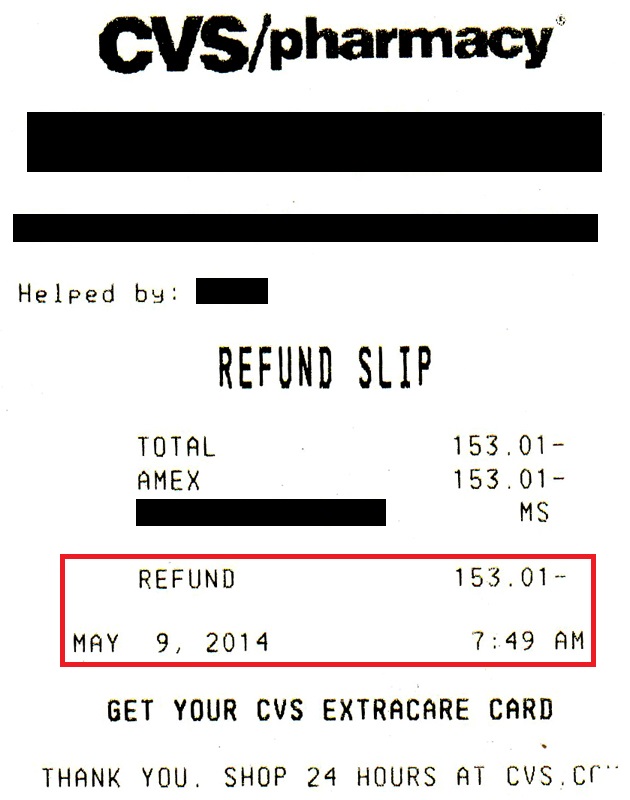

All was not lost, he said he would be able to issue a refund back to the card I had used to pay for the PayPal My Cash Card. Since I only had my American Express Target card with me (and not the other American Express Prepaid card), I told him he could just refund the full amount back to that card. See the refund slip below:

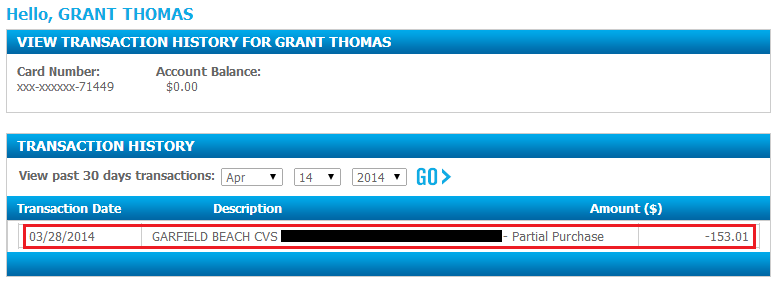

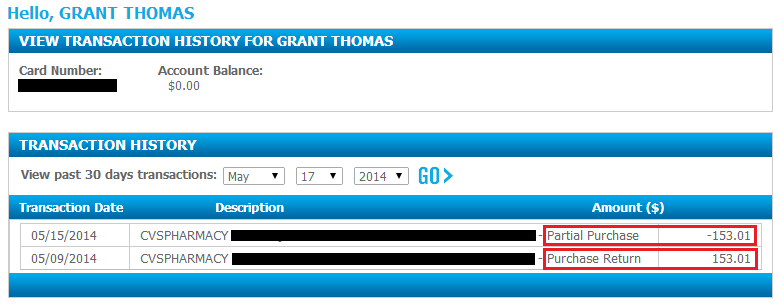

A few days later when I checked my American Express Target card online, I saw the original purchase of $350.94 (remember I split the payment over 2 cards), the $503.95 refund from CVS, and a $503.95 “Reversal of Chargeback Credit” – what the heck is that? I called the American Express Target card phone number and was told that since the refund amount ($503.95) was more than the original purchase ($350.94), they automatically rejected the refund and gave it back to the merchant (CVS). I didn’t like that decision…

I went back into the same CVS and spoke with the store manager again. I could tell he was getting annoyed with me and I didn’t want to upset him. After all, this is my favorite CVS store – so close to work and a Walmart. I told him not to worry, I would figure it out.

I called CVS and was told that I had to talk to American Express. After talking to American Express, I was told I would have to go to CVS and have the store manager process refunds for each card for the original purchase amount. The store manager told me that he could only process a refund once and was unwilling to process another refund. I was totally screwed. No one could help me…

After contacting the CVS Twitter team (I love Twitter, by the way), I was told that CVS’s accounting department would contact American Express and see what was going on. After about a week, I got a call from CVS that said that their accounting department contacted American Express and confirmed that the refund was processed back to my American Express Target card. I said yes, the refund was processed back to the American Express Target card, but then American Express rejected the refund. Again, I felt screwed. No one could help me…

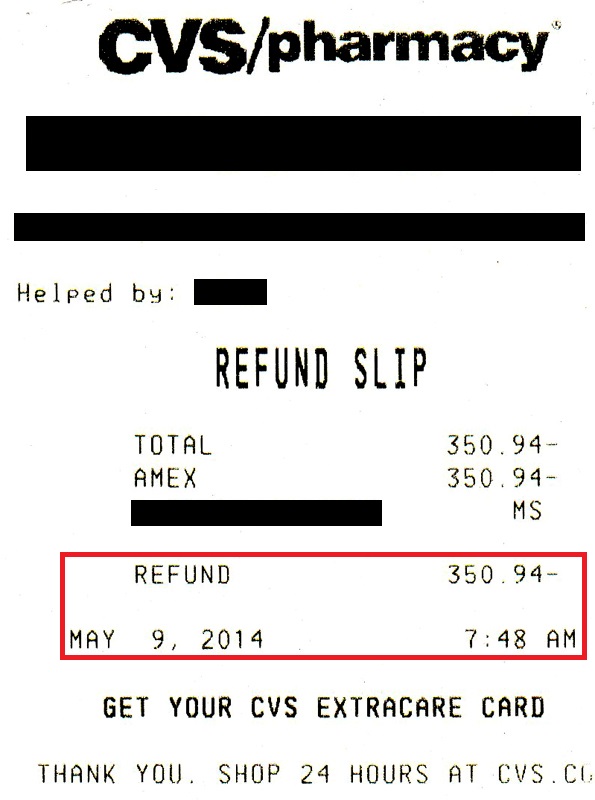

Then I had a *brilliant* idea to call the American Express Target card customer service number and request that they conference call in CVS’s customer service. It was an interesting experience since I’m sure it was a first for both representatives. They both spoke very professionally to one another and it made me smile. After the American Express Target card representative confirmed that the refund was processed and then rejected, the CVS customer service representative understood the problem and said she would contact the regional store manager for my local CVS and the would contact the local store manager about the situation. A few days later, I got a call from my local CVS store manager and he said that I could come in anytime and bring both of the American Express cards to process the refunds. The following morning, I went inside and spoke with the store manager who promptly refunded both cards with the same amount that was originally charged to them.

The original refund was done on March 31 and the replacement refunds were done on May 9. This was a good sign, but I had to wait a few days to see what American Express would do. Would they screw with me again?

Luckily after a few days, I checked both American Express cards and saw both had a positive balance on them. So the next day I went back to CVS and bought 2 One Vanilla Gift Cards and liquidated both American Express cards.

After successfully loading both One Vanilla Gift Cards to my American Express Serve Card, I was finally free of this problem. What a month it had been.

Lessons I learned from this experience:

- Double check that the receipt matches the gift card purchased. Do not leave the store if they do not match. This would have solved my problem in 30 seconds.

- Always keep your receipt and gift card packaging until the gift card is successfully activated and unloaded.

- Try not to sit on gift cards too long. The longer you hold on to them, the more time there is for something to go wrong.

- There is a really big price to pay if you screw up buying/unloading gift cards. It would take a lot of MS to make up for $500 lost, so always be careful and don’t take anything for granted even if you have done something 100+ or 1,000+ times. 1 screw up will really set you back.

- Twitter is your best friend. I have had several issues over the months and Twitter has helped solve all of them, including issues with Staples Easy Rebates, The Counter Burger, Experian Credit Monitoring Service, IHG, Chase, American Express, Citi, Discover, Marriott, and Hilton; all have been resolved by going through Twitter.

If you have any questions, please leave a comment below. Have a great Saturday everyone!

Playing games by splitting charges caused the problem. I guess you’ll never do that again. Having CVS swipe my drivers license (It has a magnetic stripe same as a credit or debit card.) doesn’t bother me a bit. Why the paranoia?

I still split purchases. CVS lets me use $200 Visa/MC GCs from Staples to buy other prepaid cards and OVGCs.

It’s not that I’m paranoid about giving them my drivers license, it’s that I’m more afraid that a large purchase will be blocked by the credit card company (I’m looking at you Citi) and I tend to use multiple credit cards to buy reloadable cards.

With every card, call to to say you will be spending (the minimum spending amount) + $500 more and you need it *unblocked*. Otherwise, the card company Fraud program kicks in and the card could be declined. Their computer doesn’t believe you are buying $1,000, $2,000, etc. in groceries or drugstore supplies. Why mess around with Staples-an extra trip and step? I buy One Vanilla often with credit cards at CVS.

I usually have problems with the first $500 purchase at CVS, but after I clear that up with the bank, it’s smooth sailing. I find Chase, Bank of America, and most US Bank cards don’t give me trouble.

Step by step instructions to avoid Citi fraud alert for, say, 10K in purchases: Day 1Buy $4500 worth of merchandise at your favorite drugstore.

(Optional step Day 2 make a payment at a branch or over the phone)

Day 3 Buy another $4500

Day 3-5 Buy something from that payment service Amazon runs.

Fraud alerts are the result of mixing in small purchases. Save any of them for the end of your spending.

Citi would freak out if I tried to buy $4,500 at one time. I called Citi before making a large UCLA tuition payment for my brother and didn’t have any problems. I usually only make small purchases using my Chase Freedom card for restaurants.

Including Citi, I have no problem buying One Vanilla debit cards at CVS with credit cards from ALL banks.

My single OVGC this morning was blocked by Citi. I don’t necessarily blame them, I hadn’t used that credit card for 10+ months and all of a sudden they see a large $500+ charge to the card. I called their fraud department and got it all straightened out.

I told Citi to approve all future purchases at CVS in my city. Problem solved.

That’s a good idea, can they stop flagging all CVS purchases, no matter how large? Did you have to tell them a reason why you were spending so much money at CVS?

Grant, I admire your persistence and ability to get Amex and Target to talk like that!

Also, makes me feel better about some of the MS mistakes I’ve made. Good habit to check everything after the transaction.

Thanks, some days of MS are better than others. I’m still making mistakes and learning everyday.

A couple of years ago I tried buying the paypal cash reload cards at Rite-Aid with a credit card for the first time. I wanted to buy two. The cashier talked to the manager and they were very hesitant to let me pay with a cc, but eventually said I could buy just one. Unfortunately they activated one and gave me the other to take home. I few hours later i tried to load the money and of course it didn’t work. I rushed back to the store to tell them what happened. Thankfully they were able to find the card that had been activated and let me have it. Ever since then I always check the receipts very carefully before I leave the store with any reload or gift cards.

I’m glad it was a quick fix for you. After my CVS incident I try to follow all of the lessons at the bottom of this post. So far, so good.

I still have VR cards I bought in March … better hurry up and deposit them into my BB account!

Send the codes over to me if you need help depositing them to Bluebird ;)

I thought you can’t buy the Paypal My Cash Card anymore at CVS since it’s a reload card?

This purchase was back in March (when everything was great, remember?)

WOW! At first, I thought you had a problem with lost money in between loads (it happened to me twice, and that was a battle with both companies, and I got the money back eventually), but when I read that you were given unactivated card instead of the activated one, I started to wonder if CVS has a “trend”.

Last year, I was never given a gift card back, and when realized that at home, called the CVS (in Central Florida). The same person (being a supervisor/cashier) pretended that he didn`t understand what I was talking about, but when I said I wanted to see the security tape, he said that “he`d call Denise (district manager) to fix it”. Later, I called a store manager and insisted on the recording. He then called me back and said that he saw that that supervisor didn`t give the card back to me and put it in a drawer and then couldn`t track what happened to it. I got the funds (after providing receipt), but doubt that he couldn`t track the card-they worked very closely together (I`ve been the customer for a long time to see what`s going on). Do not trust CVS and their employees.

Thank you for sharing Kat, I’m glad you got the issue resolved. Some cashiers are easier to work with than others. I know it is such a pain to deal with cashiers, store managers, and video footage, but I’m glad it ended well for you.

The fact your complaining is disappointing as a big time blogger everyone knows Amex sides with care holders but you are publicly exploiting things. If you take 5 steps forward andb1 step back don’t complain. Resolve and teach of take it as it is.

Thank you for thinking of me as a big time blogger. I don’t think I’m complaining, it’s more of a painful learning lesson than anything else.

I finally signed up for a Twitter account not long ago, still don’t understand the ins and outs of it haha. How do you use Twitter for customer service issues?

Just search on Twitter for a company you want to talk to, then click the compose tweet button. Your message will start with “@twittername” and then you just type your message in 140 characters or less. So for my case with CVS, the message probably looked like “@CVS I need your help. I had a purchase refunded by CVS then AMEX rejected the refund, so I am still out the $$. Thank you!” Usually you will get a response back in a few minutes and they will probably send you a direct message (a message only you and CVS can see) with some info and a phone number to call them. Maybe I should do a Twitter introduction…

Ahh ok, thanks! And I do like your idea of a Twitter introduction :) I am kind of clueless but felt I had to at least get an account since Twitter seems to be applied everywhere, including weather warnings!

Yes there are always new ways to use Twitter, be in AMEX Sync promos or other Twitter contests.

I understand that different regions of the country offer varying opportunities for the purchase of reloading instruments. I must say that the CVS habit seems like more of an addiction than a convenience. Since the CVS shutdown on CC purchases of VR’s I have been able to acquire them in the Southeast, Midwest, Mid Atlantic Coast and places in between at multiple gas station/convenience stores. Am I missing something with the continued loyalty to CVS?

I buy only One Vanilla at any CVS which stocks them. Why mess around with reloads?

I think CVS is the only nationwide chain store that consistently sells OVGCs, so that is why their name comes up so frequently.

Here in Dallas, Texas, some CVS stock One Vanilla and some don’t. Not consistent.

Hmm that’s how it was with VRCs back in the day.

Pingback: Can Economy Be Good? Bread Crumbs Bad? And A New Place to Stay On Kauai! (Bits 'n Pieces for May 18, 2014) - View from the Wing - View from the Wing

Couldn’t you just get another PPMC instead of a refund?

CVS wouldn’t have been able to activate the new PPMC Card, so we opted to go for a full refund.

Pingback: Lake Louise, Amtrak trains awards, Barclay Arrival vs Fidelity Amex, Dining miles, 911 museum, MS horror story, train rides, Firenado, Grand Canyon, Movie Insults, Advice for 2014 Class | TravelBloggerBuzz

I once had an incorrect $500 charge applied to my credit card by CVS. I discovered this several weeks after the fact while looking at my credit card statement. I went to CVS and the manager had an envelope with $500 in cash ready for me–apparently he’d already discovered the error and was awaiting my arrival without me having even called them. I was extremely impressed with CVS there.

Wow, that is really nice of CVS, you must be a regular customer at that store, right?

Last november, I purchased $7k worth of vanilla reloads at CVS. I had a great opportunity to make 6x and cash out, so I took it.

But when I tried using them up (I control 4 Bluebird accounts), they wouldn’t work!!! None of them.

I contacted InComm, who launched an inquiry and later told me that they’d been deactivated by the merchant.

I contacted CVS who told me that I’d have some sort of a resolution within 2 weeks, either re-activation or a refund.

When I contacted them after 2 weeks, they got me in touch with their financial/accounting dept, who promised me it would take just a little while longer.

I waited another week and when I called back, a different agent told me that she couldn’t even find me case.

I had to file everything anew. AND wait another 2 weeks.

This agent was much nicer, she gave me her extension and told me that she’d fix this for me.

But 2 weeks later, I still hadn’t heard anything.

Then suddenly I got a voicemail saying that they were aware that they had deactivated it, but they would NOT be reactivating it, nor would they give me a refund.

And I’d just have to go file a dispute with my CC.

I’m not kidding. I have a recording of the voicemail.

I filed the dispute. After a long wait, multiple calls and emails, and 3-4 conference calls, my CC finally managed to get in touch with the people necessary. They said it would be taken care of.

My CC gave me the refund.

Then a week later, the charge had been put back on to my CC.

Again I called my card up, and they launched an investigation and 3 weeks ago (!!!!!!!!!!!), they finally managed to give me a final refund.

This ordeal started in November and was resolved in end of April.

Wow, your ordeal trumps my order big time. That sucks what CVS did to you, what credit card were you using?

(Edited by Grant)

The eBay Mastercard. It was a limited time offer.I earned a LOT of $$ :)

And yeah, having $7000 stuck there wasn’t a lot of fun. And the only good thing was that they didn’t take away the points. :P

By eBay MasterCard, do you mean the PayPal Extras MasterCard issued by GE Bank that earns 2x points on Ebay/PayPal purchases? I have that card too.

When did you get the card? I’ve had mine for a while now…And it was just called the eBay mastercard back then. Does yours say “Paypal Extras” anywhere on it? Because mine doesn’t.

I keep getting emails or mail about offers. 4x for a week. 5x for a fortnight. $20 bonus credit after $50 purchase etc etc.

You don’t?

I’ve had my PayPal Extras MC since at least January 2011, It has always said PayPal Extras. Maybe you got the version before mine, but I think they are only issuing the PayPal Extras MC now, couldn’t find a working link for the Ebay MC. Sometimes I get targeted offers, but most are not good for me. What do you do with the points typically? I tend to hold them until I have enough for statement credit or an Amazon/Ebay gift card. Its hard to get 1 cent in value per point.

It is the GE Bank one.

And yeah, I have to say, they were phenomenal in taking care of this. Two different people gave me their phone numbers, direct lines if I had any problems, and they’d always pick up or get back to me in 24 hours.

Nothing is consistent about this game. Examples:

1. Internet went down during the the money order purchase at WM. Took me over an hour to straighten it up (in the meantime, was told to go home, and OV would credit back $2K, yeah right!).

2. Credit card refuses the purchase. That’s the most annoying part of the game. Have had it with everyone,

a) A large purchase would get approved, then a smaller one would not. Unless you call the CC every time before every purchase it will happen over and over again.

b) Got a call from the new Amex Plat Biz that my spend was too high (really for a business card with $10K spend requirement???).

c) Got my cards blocked on a few occasions.

d) Received a call from the Barclaycard Fraud Dept dude, who couldn’t understand how I could charge the card at Rhode Island and then a minute later in Queens, NY (I didn’t, I got a coffee at McDonalds, next to CVS, but of course, the CVS purchase was processed by their HQ in Rhode Island). How on earth can they not know those things?

There is a reason why I do NOT envy people who do this full-time.

Haha, you just have to figure out what works for and stick to the plan. Who cares about other people who spend $10,000 a day. Focus on spending $1,000 a day and get it right every time, then slowly work your way up. Just like juggling balls, you can start with 10, just with 2, then move to 3, and then master 4, etc.

Grant, I realize this is somewhat off topic, but a couple of commenters on another blog have mentioned that they haven’t been able to load gift cards, even OVGC’s, onto their Bluebirds at Walmart. Of course, it was only 2 or 3 people who said this, and then probably another dozen or so responded that they had not had any problems whatsoever. I loaded 2 $500 OVGC’s to my BB at Walmart today. But I’m always concerned when I see these comments. Have you had any problems or heard of anyone else having problems? I’m settling into a routine now. If I time it right with the closing dates of the two miles-earning credit cards I use, I can clear 10K miles in just 5 walmart trips each month with both of our BB cards. I continue to experience a wide range of inconsistent policies at CVS’s about being able to purchase the OVGC’s with credit cards. One store will be solid for several weeks, then one day, *poof* it’s cash/debit only. The good news is that there are CVS stores on every corner here in LA. I just hate the runaround!

I have read reports of some people having problems using OVGCs at Walmart. I haven’t had any issues, so I’m not sure what is happening to them. It could be a One Vanilla activation issue, a Walmart issue, or a Bluebird/Serve issue – who knows. My favorite CVS only had 3 OVGCs when I went yesterday, so hopefully they get a new shipment soon.

I went to Rite-Aid to fill a prescription, and I asked them if I could buy OVGCs with a credit card, fully expecting them to say no. When they said yes, I was so shocked that I accidentally used my Amex Blue Cash that I had out to purchase my prescription. (Yes, I have the original Amex Blue Cash: 5% cash back on drugstores, gas & groceries, no caps; don’t hate!) So I will net about $20 cash on that one. Then I bought two more $500 OVGCs with my Skymiles Amex. I had no idea that Rite-Aid was an option!

I’ve heard a few success stories about Rite Aid, but there are no close Rite-Aids near me. Only CVS and Walgreens. I’ll stick with CVS for now, but will try to find a Rite-Aid one of these days.

Beautiful Nora! Where’s that Rite-Aid located?

Had a problem yesterday. Picked up 2 OV’s at CVS and when the clerk ran the 1st card she said she couldn’t sell me that one, grabbed another, now there are 3 cards on the counter. When I left I was handed 2 cards and receipt. I didn’t check the numbers! Tried to use one and it was BLANK! Went back today and had everything, receipt, packaging and a photo copy of it all. Thankfully they had the correct card behind the register for some reason, maybe thinking it was a bad card. All is good now…card is now a dead soldier, he gave his life for my miles.

**Lesson Learned** – check the numbers BEFORE you leave the store!

Good work, glad it was an easy fix.

Pingback: GiftCardMall Return, Cole Haan Return, Amex Gift Card Return & Walmart Return » Doctor Of Credit

Pingback: Gift Card Warning: Check Packaging for Signs of Tampering | Travel with Grant