Chime Card Loading Fees Coming October 8, Serve Card Cash Advance Fees?, Clarifying the Citi Hilton HHonors Reserve Free Weekend Night Certificate, and AMEX Offers for Hilton Hotels and USA Today

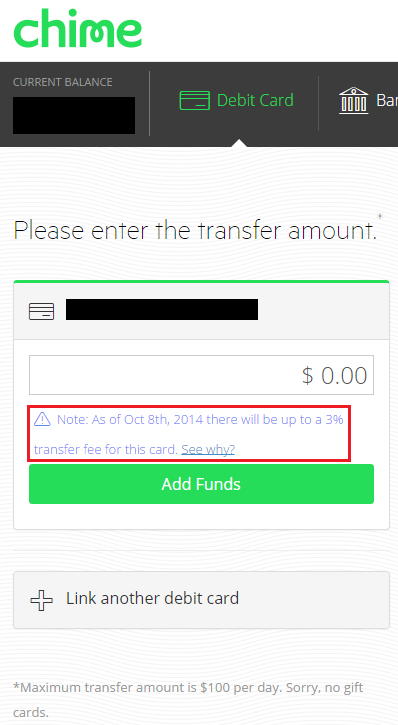

Good evening everyone! Thank you to those of you who emailed me earlier today alerting me about changes to the Chime Card. Beginning on October 8, there *may* be a 3% fee to use certain debit cards to load to your Chime Card.

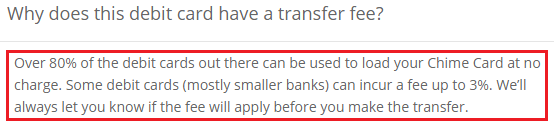

I use my PayPal Business Debit Card (PPBDC) to load my Serve Card and earn cash back in the process. Since this transaction earns cash back, that means Chime is running the reload as a credit card purchase, rather than a debit card withdrawal. Based on those facts, I think that Chime will impose a 3% fee to use the PPBDC after October 8. I would be happily surprised to learn otherwise, but I’m not holding my breath.

More proof: Evolve Money stopped allowing the PPBDC to be used as a debit card, Square Cash does not allow the PPBDC, and Venmo charges fees to use the PPBDC. It is not looking good for the PPBDC.

With that said, there is approximately 34 days left to load my Chime Card. Since my PPBDC earns 1.5% cash back (I am grandfathered in at the higher rate), that is equal to $3,400 x 1.5% = $51. If you have the newer PPBDC that earns 1% cash back, you can still make $34. Plus, if you include the purchase of PayPal My Cash Cards (PPMCC), you can earn some extra miles/points/cash back in the process. Take advantage of this before the window *most likely* closes on October 8.

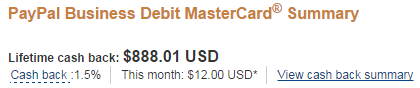

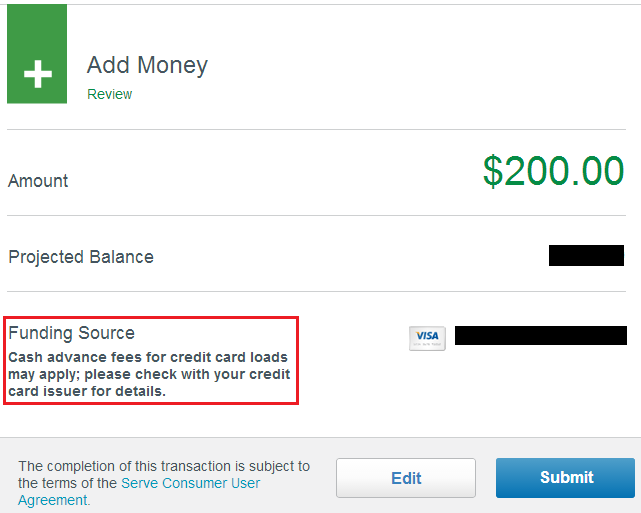

In other prepaid, reloadable debit card news, as I was loading my Serve Card this morning, I noticed the following message about cash advance fees on *some* credit card loads. I tried digging around in Serve’s FAQ page, but all I can find is Cash advance fees may apply for credit card loads; check with your credit card issuer for details. No issuers are listed anywhere. If you are worried about getting hit with a cash advance fee, call your credit card company and tell them to lower your cash advance fee to $0 – I do this for all of my credit cards as soon as they arrive in the mail.

These cards are safe to use to load your Serve Card (thank you everyone for contributing):

- Bank of America (thanks greek2me and Kumar)

- Barclays (thanks GAM)

- Capital One (thanks Jesse)

- Chase (thanks Grant)

- Citi (thanks Inflightmeal)

- Discover (thanks bsbybms)

- FIA – issuer of Fidelity AMEX (thanks jeffjobes, Marlon and GAM)

- US Bank (thanks Jun)

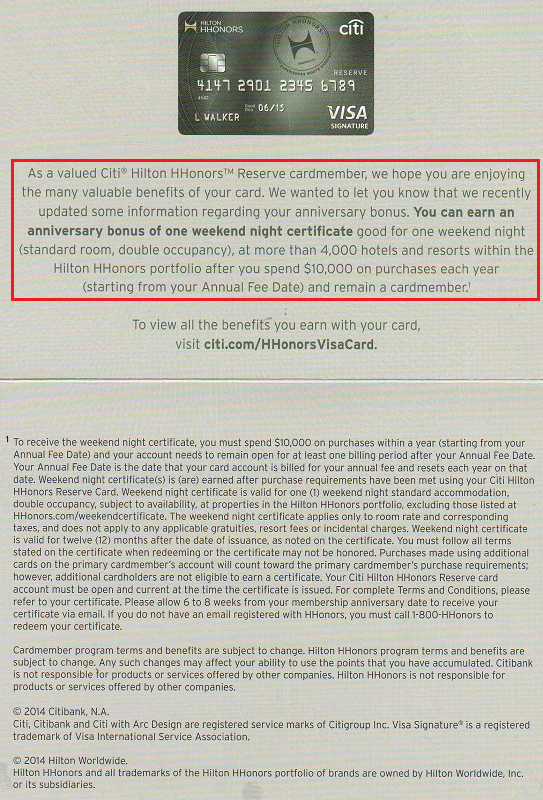

This afternoon, I received the following postcard from Citi regarding my Citi Hilton HHonors Reserve credit card and the accompanying free weekend night after spending $10,00 annually on the credit card. As far as I can tell, Citi wanted to clarify that you must spend at least $10,000 during your card member year not based on a calendar year.

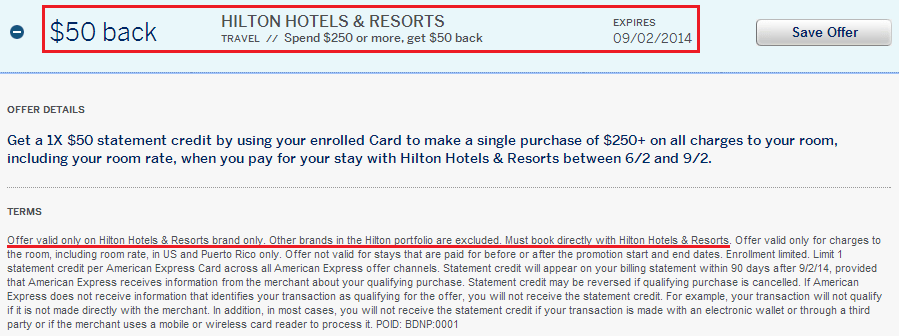

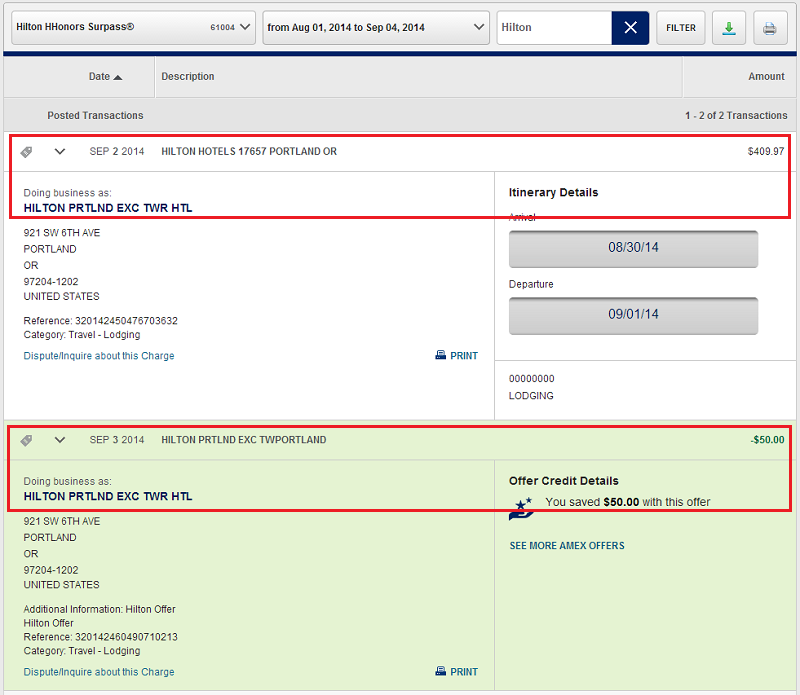

This past weekend, I stayed at the Hilton Portland Executive Towers with my parents and brother (trip report coming – maybe). I used Hilton HHonors Points for Friday night and paid for Saturday and Sunday night with my AMEX Hilton HHonors Surpass card (12x on Hilton stays) and to receive a $50 statement credit from American Express (offer expired on 9/2/14).

The following day, I received the $50 American Express statement credit. Very fast service on this statement credit compared to other AMEX Offers.

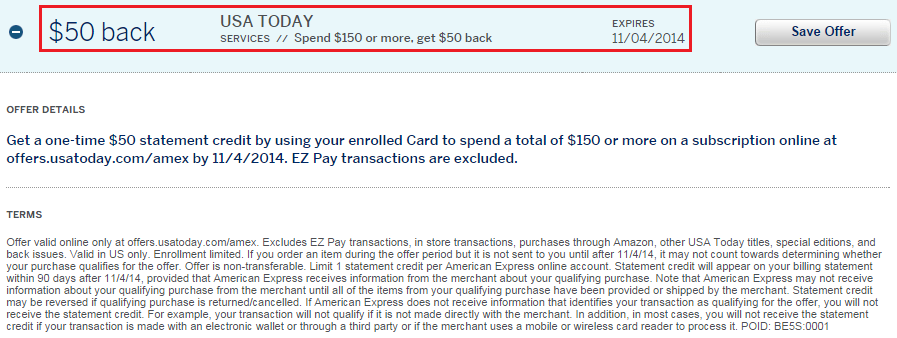

Last but not least, if you like the USA Today, there is a good AMEX Offer available. Spend $150 (on newspaper?!?) and get $50 statement credit.

If you have any questions, please leave a comment below.

My Citi AAdvantage codes in our favor on Serve.

Excellent. I’ll add Citi to the list of working credit card companies.

I just signed up for Serve + ISIS and that warning message has been around since I opened the account.

I have been using my Barclaycard Arrival+ for loads with no issues.

Thank you GAM. I typically load my Serve Card the first week of the month so maybe that message starter appearing after August 7. I’ll update the credit card list by adding Barclays.

Been using Chase SW card with no problems.

Thank you for the data point Steve.

Capital One Quicksilver has no fees (so far).

Thank you Jesse, I will add Capital One to the list of approved credit card companies.

Fidelity Amex works on Serve no CA fees

Thank you Jeff, I will add AMEX to the list of working credit card companies.

FYI: The Fidelity AMEX isn’t serviced by Amex, but by FIA.

I see, I will make the necessary change in the post later today. Thank you for the correction.

Been using Fidelity AMEX, so far so good.

Thank you for the data point Marlon

My understanding from previous posts is that AMEX cards do not charge a fee but also do not accrue any points (e.g. SPG points). Does anyone have experience otherwise? Thanks

I have no experience using AMEX cards to load to Serve, I always use other credit cards.

How long does this Chime card take to get in? Hope mine shows up soon. Sounds like this and ppdc will be trashed come Oct 8th.

I think they ship the cards from Utah so it shouldn’t take too long to arrive.

us bank FlexPerks charge as purchase as today, but CSR won’t be able to lower the cash advance limit .

Thank you Jun, I used my US Bank credit cards in the past. Glad they still code as purchase. I think US Bank can only lower the cash advance limit down to 25% of the total credit limit, so if you have a $10,000 credit line, you can only lower your cash advance limit to $2,500. Does that sound right to you?

I use my BofA Privileges to load Serve- posts as purchase

Thank you for the data point. I will add Bank of America to the list late today.

Discover works as well.

Thank you for the data point, I will add Discover to the list. :)

BOA Alaska works fine for me so far.

Thank you for the data point :)

You flip back and forth between saying Chime and Serve in the first paragraph? Are you saying that Chime will charge fees for loads from the PPBDC or that Serve will? Or both? It is very confusing to parse what you are saying there.

Sorry for the confusion, I meant to say Chime Card in the first paragraph, but somehow I typed Serve instead. I just fixed the typo above. Hopefully it is more clear now. As of today, it looks like Chime Card is fee-free until October 8, after that, they will probably charge fees for using debit cards. As of today, Serve credit card loads have no fees, but there is a possibility that some cards could be charged with a cash advance. Based on the data from multiple readers, there is no confirmed cases of cash advances being charged to any credit cards. I will let you know if anything changes. Have a great weekend!

Pingback: Chime Card To Add Fees For Some Debit Card Loads » Doctor Of Credit

@Grant, How can I sign up for Isis serve for my sister’s Tmo line using my own cell phone that already has isis serve sim and account?

Our’s is family line and I wanted to sign up for Isis serve for my sister but I don’t have her phone with me.

Thanks

Good question. I don’t have ISIS Serve so I’m not much help. Maybe some one else can answer your question.

Isis can only be loaded and used on the physical phone. She will have to download the app from the play store on her phone.

Thank you Steve, that makes sense.

Just got my Chime card today and want to use it wile I can. So I know to load my ppdc to load to chime. Do you transfer the whole $500 over at once or is this to risky for pp?

You can load a PPMCC to PayPal and then use your PPBDC to load $100/day to Chime. Repeat throughout the month.

Pingback: Random News: Ebay and PayPal Split, Hilton Free Night Certificate, RebAgents, Emirates Miles, $160 AirTran Credit, and Nickelodeon AMEX Offer | Travel with Grant