Set up Apple Pay in Passbook on your iPhone 6/Plus

(Hat tip to Mac World for the info)

As of today (October 20, 2014), you can add these credit and debit cards to your Passbook (other banks will be supported over the coming weeks/months, including gift cards):

- American Express

- Bank of America

- Capital One

- Chase

- Citi

- MasterCard

- Visa

- Wells Fargo

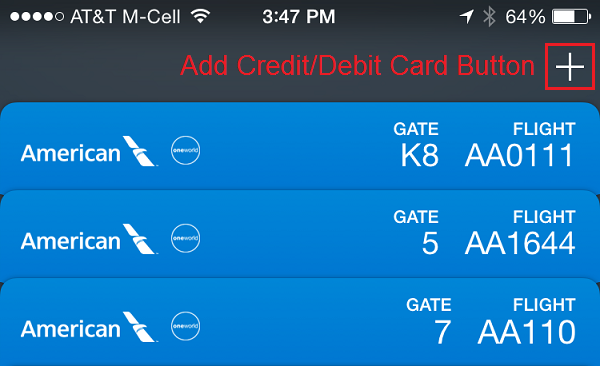

If you have an iPhone 6/Plus that is on 8.1 or newer, you can set up Apple Pay. Click the Passbook icon on your iPhone and then scroll to the very top and click the ‘+’ button to add a credit or debit card to your Passbook.

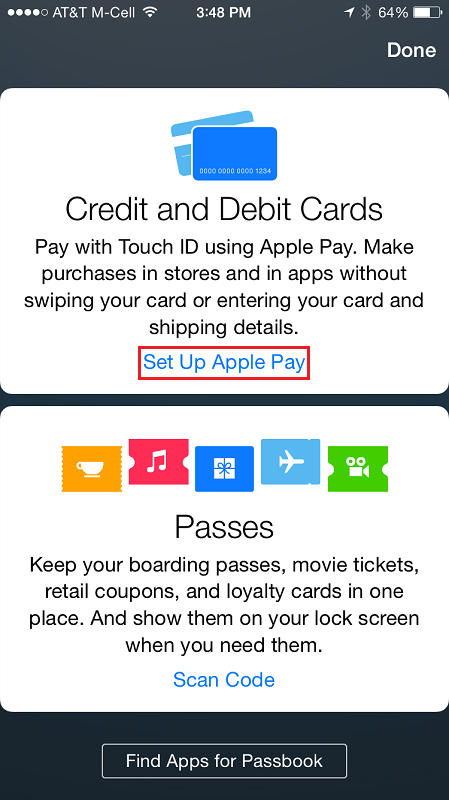

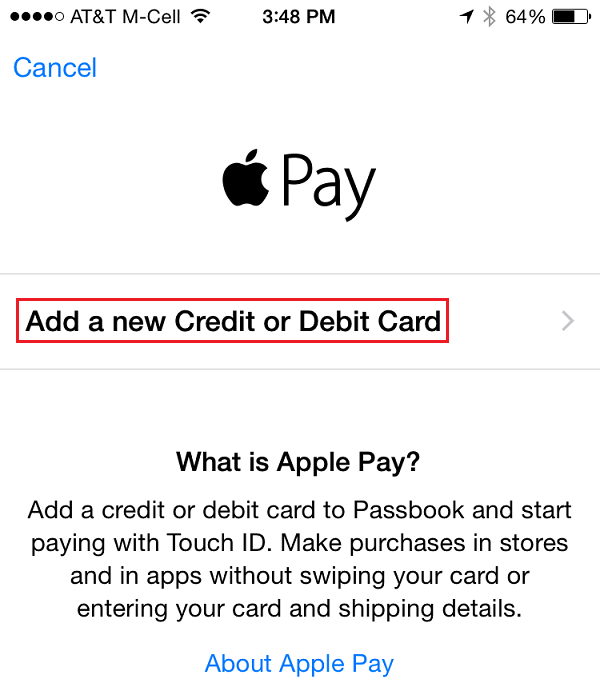

Click Set Up Apple Pay.

Click Add a New Credit or Debit Card.

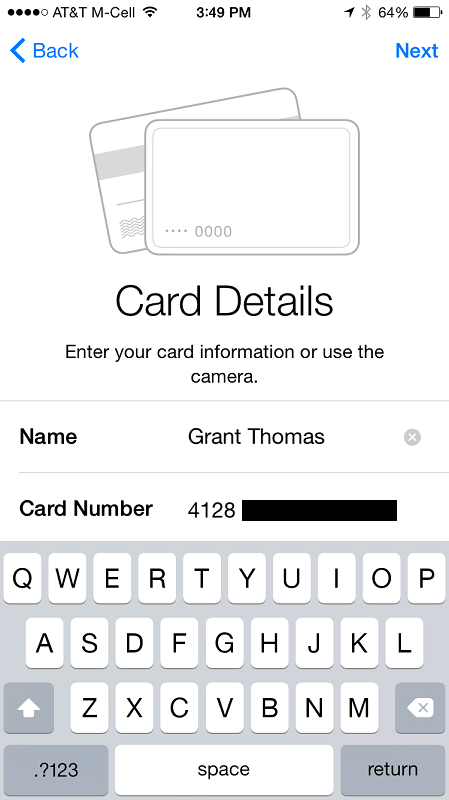

You can add a credit or debit card to your account manually by typing in your name and card information…

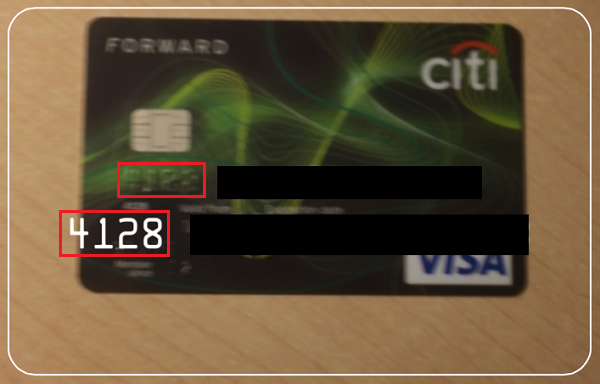

…or you can click the camera icon and take a picture of your card and it will automatically decode you card information.

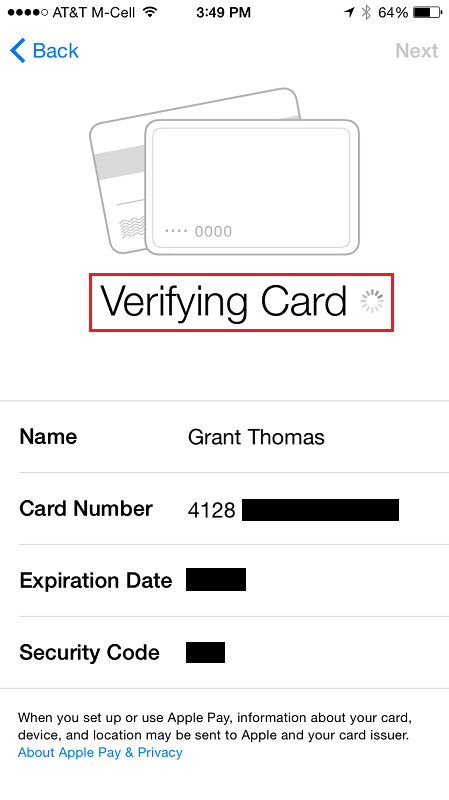

After verifying the details are correct, click Next and Passbook will verify the card with your credit card company.

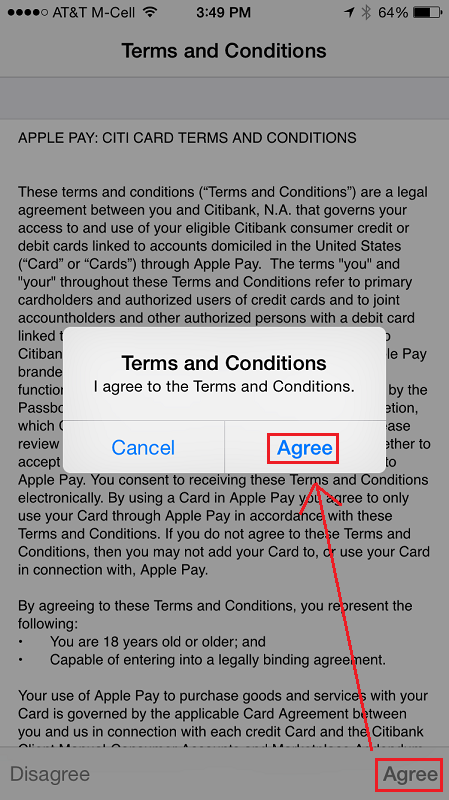

Click on Agree in the lower right corner and then again in the center of the screen to agree to Apple’s terms and conditions.

Passbook will attempt to activate your credit card with your bank. This only takes 5 seconds.

Your credit or debit card is now activated and ready to use with Apple Pay.

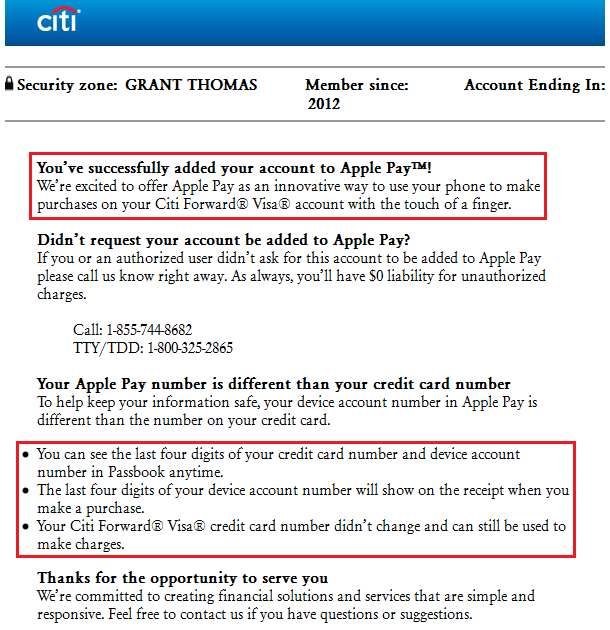

Depending on which credit card you just added, you should receive an email with additional detail on how to use Apple Pay.

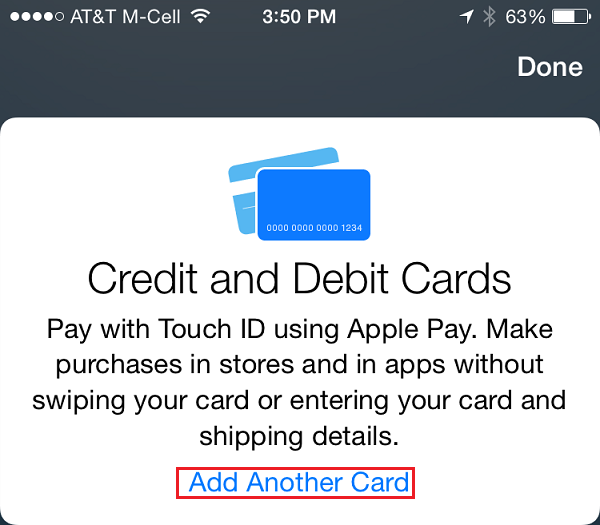

To add other credit and debit cards to your Passbook, scroll to the top of Passbook and press the ‘+’ icon again.

Then click Add Another Card.

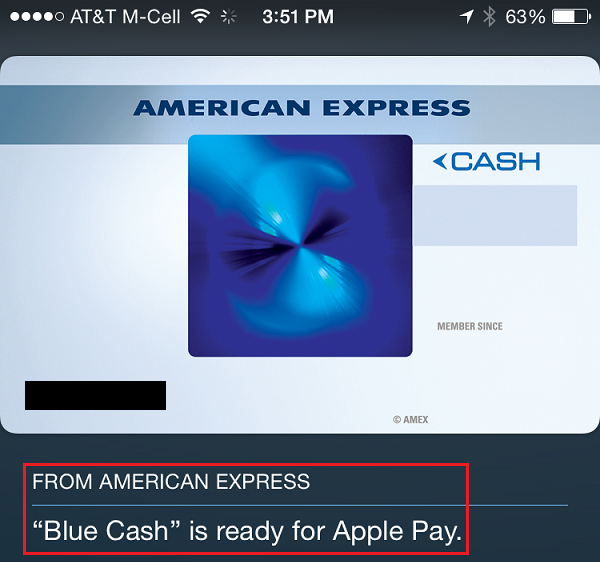

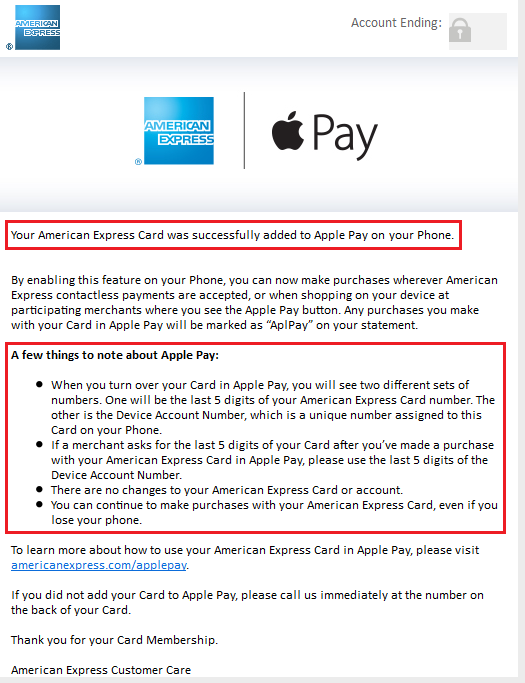

I skipped a few steps but this is what happens when you add an American Express credit card to Passbook.

You will also receive an email from American Express with info on how to use Apple Pay.

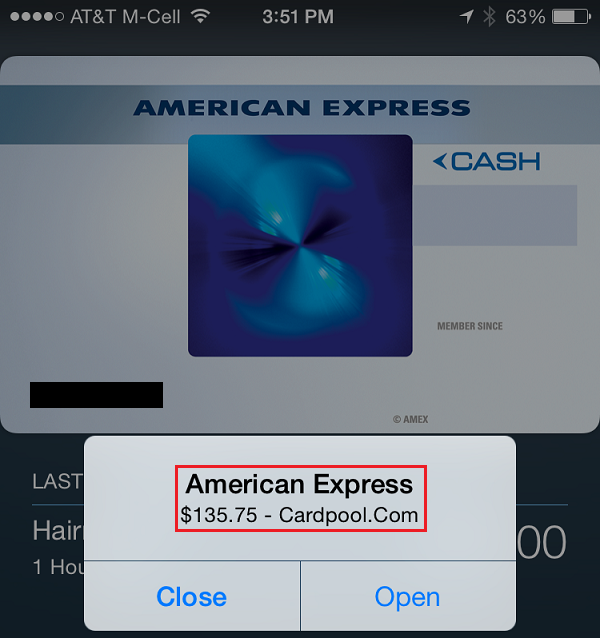

If you used that American Express credit card recently, you may get a few popups regarding recent purchases.

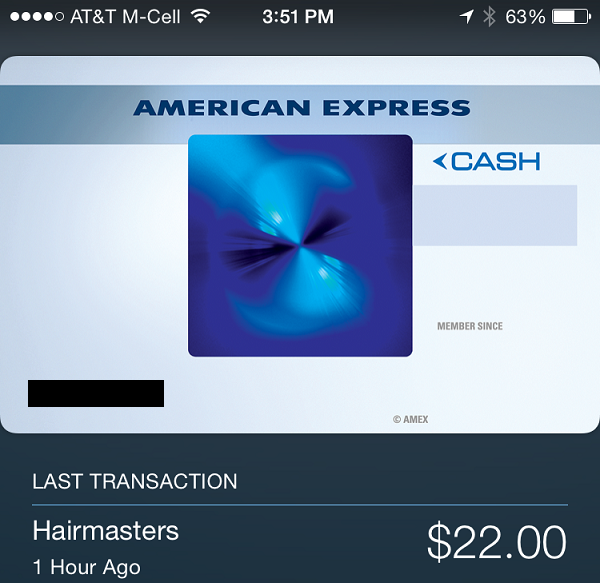

I got a haircut today, so my Passbook shows my recent purchase.

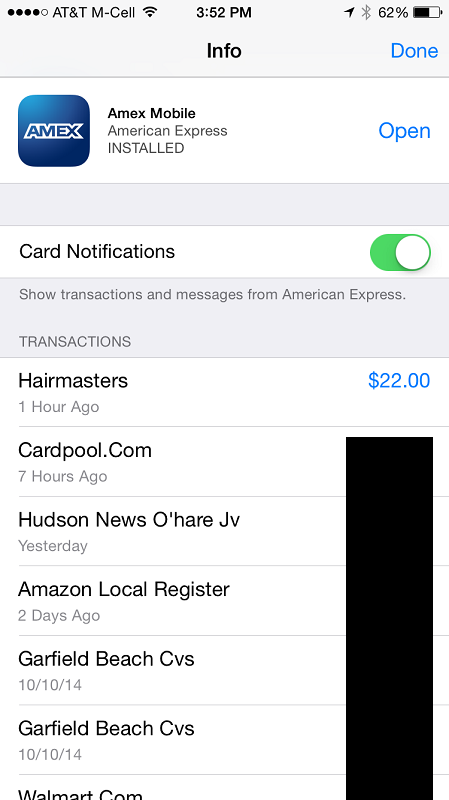

I can also look at other transactions made with the same card over the last few days.

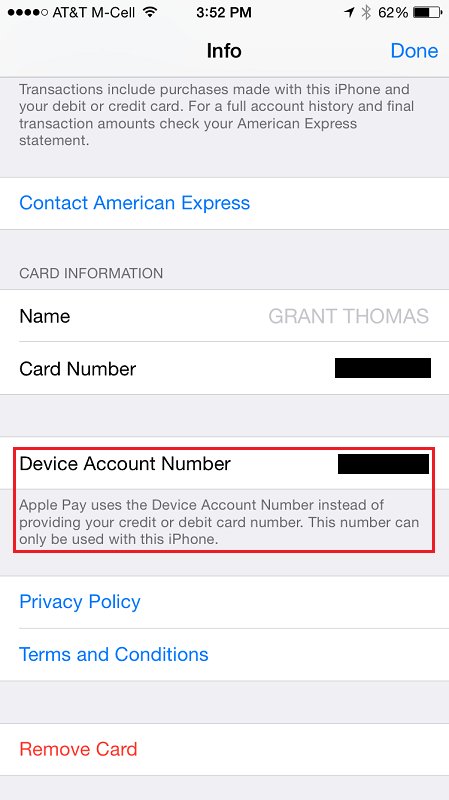

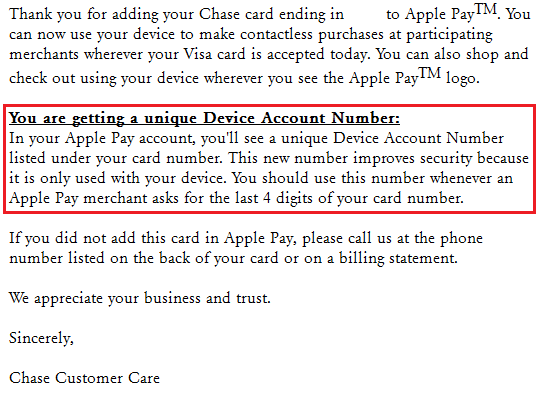

Scrolling to the bottom of that page shows some information regarding the credit card used and the Device Account Number. Apparently, some retailers will ask you for the Device Account Number so they can enter it into their POS system and complete the transaction (similar to entering the CVV code from the back of the credit or debit card).

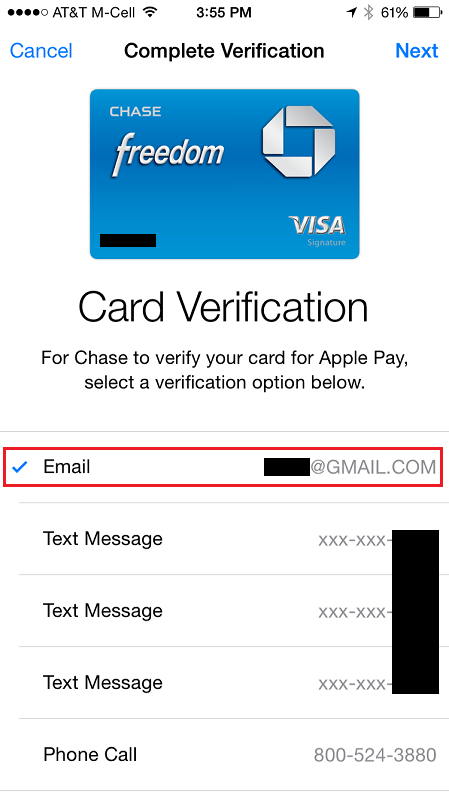

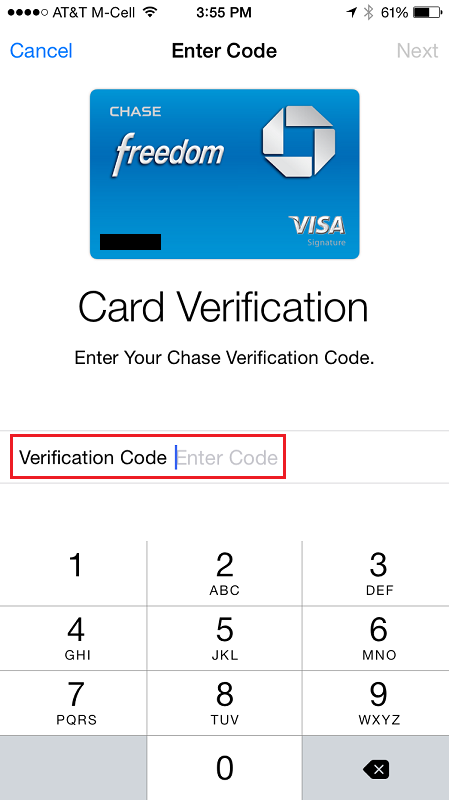

Adding a Chase credit card is a bit tricky, as I found out when adding my Chase Freedom to my Passbook. Like Chase’s website, they have multiple layers of verification and Passbook is no exception. I needed to enter a code to verify the card and my identity with Chase. I selected email verification.

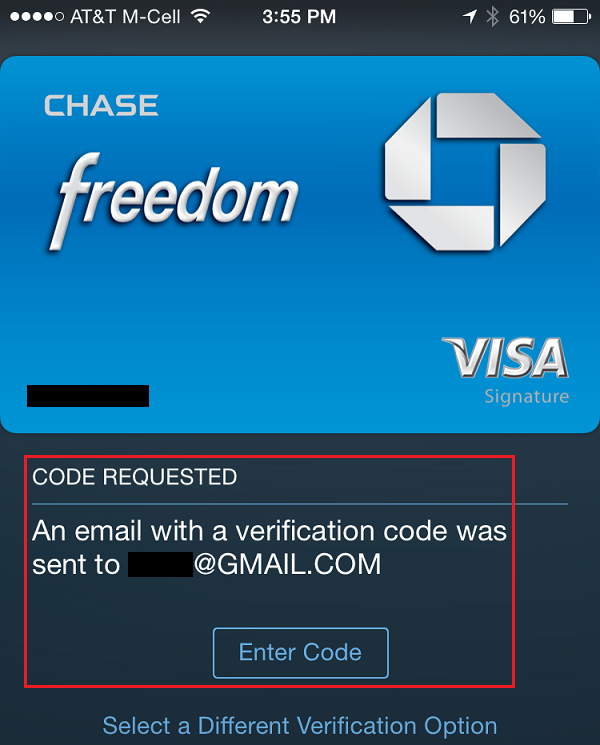

The card is temporarily added to your Passbook but is not activated until the verification code is entered.

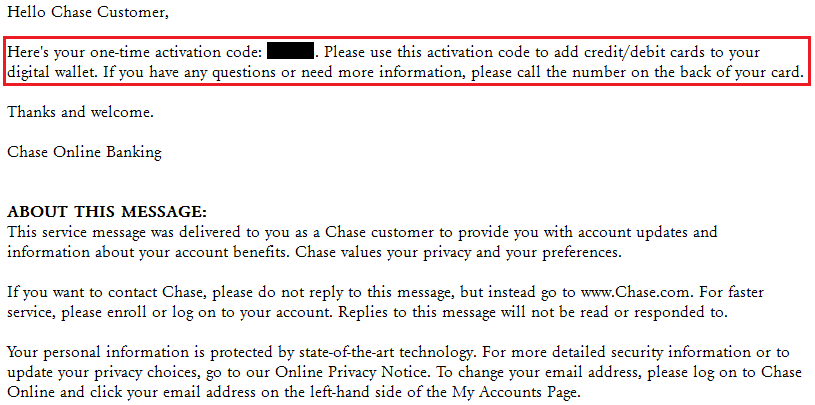

A minute later, I received the verification email with the activation code.

I typed the activation code into Passbook.

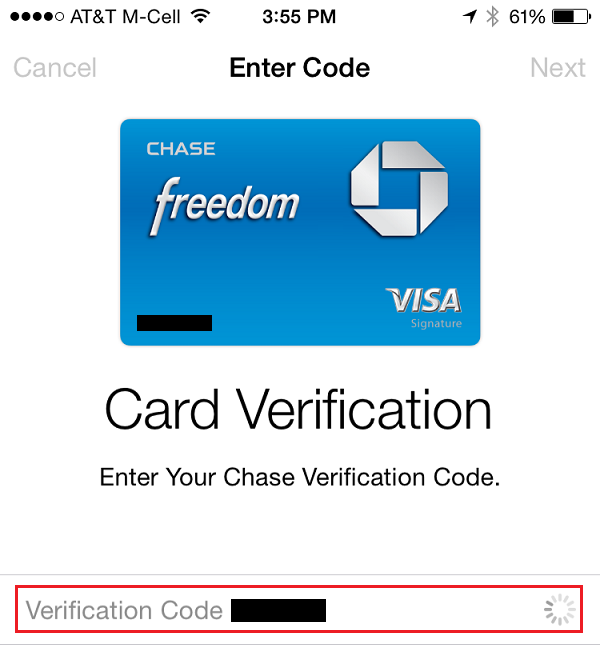

Passbook is verifying the code and my Chase Freedom Credit Card.

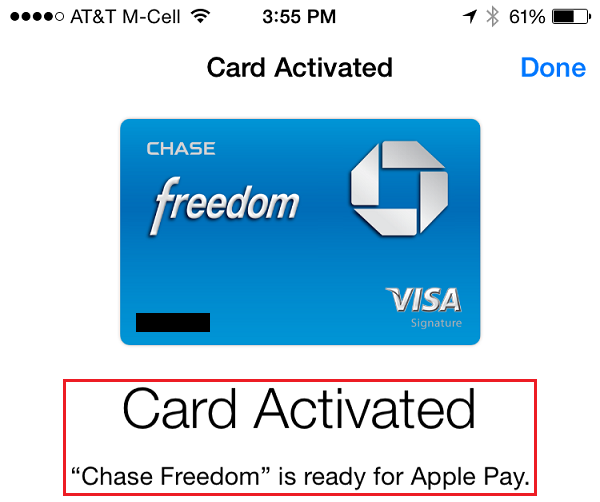

My Chase Freedom Credit Card was successfully verified and activated. I can now use the card with Apple Pay.

You will also receive an email from Chase with info about Apple Pay.

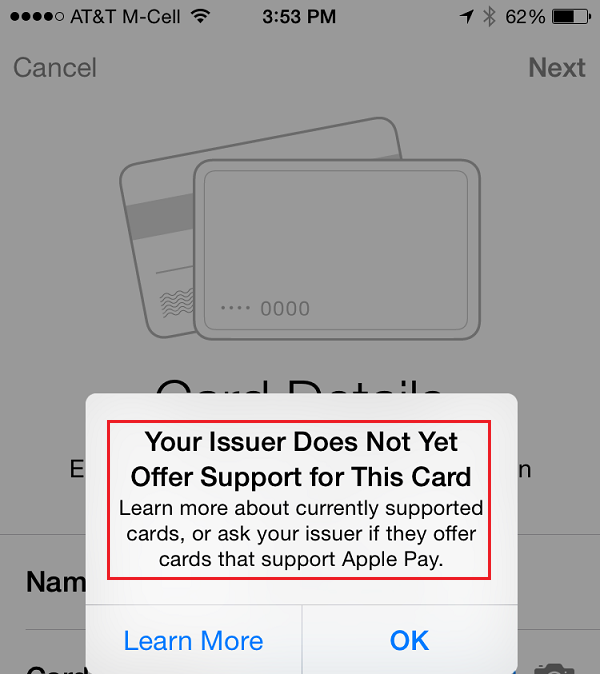

If you try to add a credit or debit card that is not currently supported, you will get the following popup message.

I was unable to add my PayPal Business Debit Card, American Express Serve Card, Chase Ink Plus Visa Business Credit Card, and US Bank Club Carlson Business Credit Card. To refresh your memory, here are the credit/debit card issuers that are currently supported, as of October 20, 2014:

- American Express

- Bank of America

- Capital One

- Chase

- Citi

- MasterCard

- Visa

- Wells Fargo

I am very excited to try out my first Apple Pay purchase. I hope it works as well as I think it will. I will report back as soon as I can.

If you have any questions regarding how to add credit or debit cards to your Passbook, please leave a comment below.

Pingback: Set up Apple Pay in Passbook on your iPhone 6/Plus | Travel with Grant

Grant, the main thing I’m excited about by apple pay is the possibility of using other people’s credit cards without a problem. No, I don’t mean to commit fraud; I mean to help someone with a spend-threshold, or to do an amex offer on a spouse’s card, etc. With NFC, I’m hoping they won’t ID us.

Have you tried adding someone else’s card? And, any idea if I’m right about no ID problems with apple pay?

Lastly, why-in-the-world didn’t they call it iPay? Sounds like such a nice name. I wonder if they’re thinking of expanding beyond iDevices, possibly online (compete with paypal) or some other way, so they didn’t want to tie themselves to the i.

I have not tried adding a card with someone else’s name nor have I had the chance to use Apple Pay yet. I will let you know what it is like. I like iPay, but I also like Apple Pay. I’m sure Apple considered using iPay but voted against it.

Pingback: OC Meetup Reminder, Apple Pay Success, and New Chime Card Promo for Old Navy | Travel with Grant

Grant, American Express has banner notifications for when the physical card is used as well as for Apple Pay. Have you noticed whether this same thing occurs with Citi? Trying to find a Visa (or MC) that similarly notifies (Chase does not).

I think only AMEX does. I also get notifications when I use my credit card online or in-store.

Thank you!