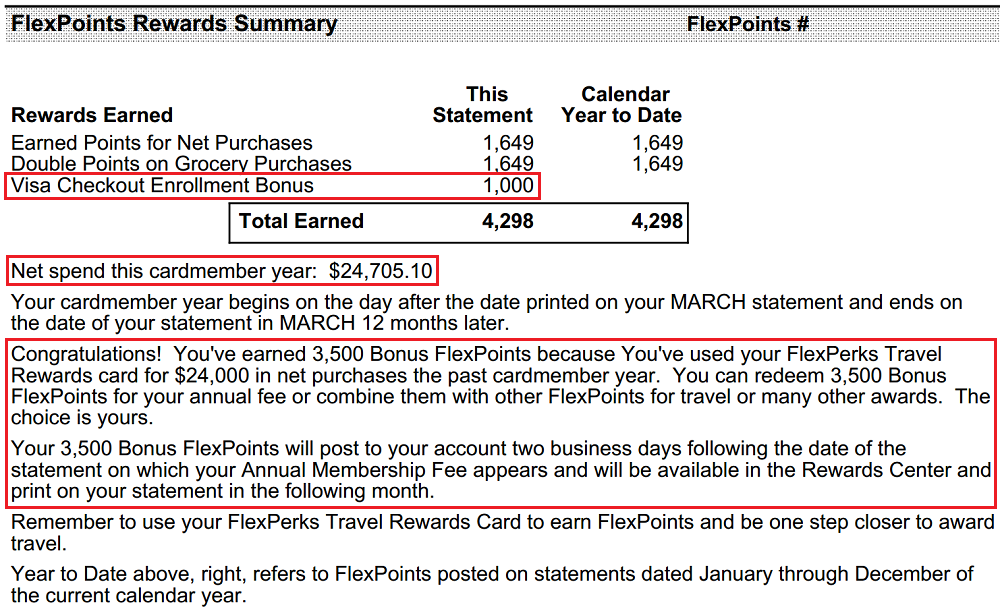

Good morning everyone, just a few quick credit card related pieces of information to pass on. Back in October, I wrote about the US Bank and Visa Checkout promo. It looks like the 1,000 bonus FlexPoints just posted to my account a few days ago. If you signed up for the promo, you should see your bonus points post soon. I also found out that I had spent over $24,000 on my US Bank FlexPerks Credit Card, which earned me 3,500 bonus FlexPoints. Apparently, I can redeem 3,500 FlexPoints to pay for my $49 annual fee. I plan on calling US Bank and asking them to waive the annual fee. I didn’t spend $24,000 on their card to not have to pay the annual fee, that is ridiculous. I will let you know how that call goes in a few months.

Here is a credit card very few people probably have or have heard about: the PayPal Extras MasterCard. This is my oldest, currently open credit card, that I have had since December 2010. I have been an Ebay seller for 10+ years and have had my PayPal Business Debit Card for most of that period. A few years back, I signed up for this credit card since it was a great way to pay for Ebay items and earn additional cash back on my purchase.

Without the PayPal Extras MasterCard: let’s say I have $100 in my PayPal account and I buy an item on Ebay for exactly $100. I would log into my PayPal account and PayPal would use my $100 PayPal balance to pay for the item.

With the PayPal Extras MasterCard: let’s say I have $100 in my PayPal account and I buy an item on Ebay for exactly $100. I would log into my PayPal account and pay for the $100 item using my PayPal Extras MasterCard. Then when the statement closes, my balance is $100. Since the PayPal Extras MasterCard is linked to my PayPal account, I can instantly pay $100 from my PayPal balance to pay off my PayPal Extras MasterCard. In the process, I earn 2 PayPal Points per dollar on all Ebay/PayPal purchases. This $100 purchase earned me 200 PayPal Points.

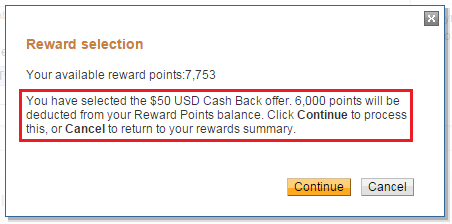

6,000 PayPal Points = $50 statement credit (or $50 gift card for many retailers). Each PayPal Point is worth 0.83 cents x 200 PayPal Points = $1.67 in rewards. If you assume you only use your PayPal Extras MasterCard to pay for Ebay/PayPal purchases, you receive a 1.67% rebate. The rebate percentage doesn’t sound like a lot, but I have my reasons for using this card. Let’s just say it is a great backup credit card.

Currently the best way to pay for Ebay items: I have seen Ebay gift cards at Staples recently. You can buy $50 Ebay gift cards using your Chase Ink Bold/Plus credit card and earn essentially 5% cash back. Much better than the 1.67% cash back I mentioned above. Full disclosure: I don’t use my PayPal Extras MasterCard to pay for Ebay items, I buy Ebay gift cards to pay for Ebay items.

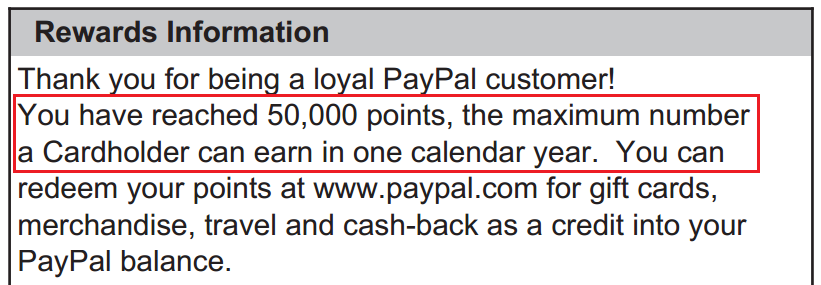

Anyway, my PayPal Extras MasterCard December statement just closed and I saw the message that I had reached my 50,000 point annual cap. Since we are now in January, the annual cap resets to 0. I was surprised PayPal capped all the rewards, not just the 2x or 3x reward categories.

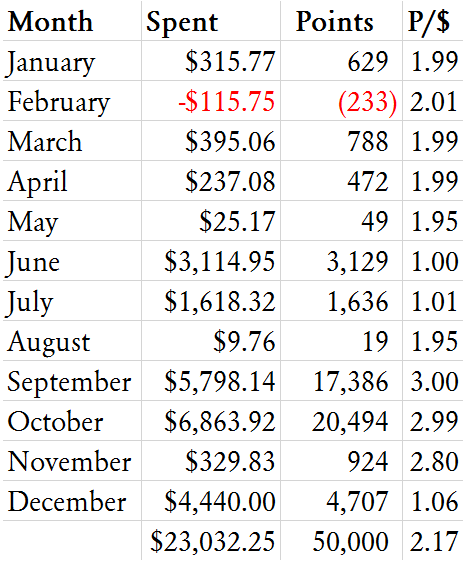

Here is my monthly spend on the PayPal Extras MasterCard and the corresponding points I earned per month. The last column shows how many PayPal Points per dollar I earned, on average. During June and July, I was using my PayPal Extras MasterCard to pay my PayPal Extras MasterCard through Evolve Money. This loophole is now dead, RIP.

I am supposedly speaking at TravelCon OC in Anaheim, CA about some of my PayPal tricks. Tickets are still available here for $129. Here is the list of confirmed speakers:

- Greg, Frequent Miler

- Tahsir (AKA Bengali Miles Guru), Travel Codex

- Omar, Travel Summary

- Fabio, Passageiro de Primeira (Brazil)

- Matt, Saverocity

- Jamison, Points Summary

If you have any questions regarding the US Bank FlexPerks Credit Card or the PayPal Extras MasterCard, please leave a comment below. Have a great day everyone!

After initially balking, I got them to waive my Flexperks annual fee last June.

Excellent to hear, Dave. May I ask how much you spent on your FlexPerks credit card?

Grant, a particular sentence in your post intrigues me. Care to elaborate on “The rebate percentage doesn’t sound like a lot, but I have my reasons for using this card. Let’s just say it is a great backup credit card.” I know I’m missing something but I can’t figure out what it is.

You’re on to something Frank, it has to do with using a PPBDC and a PPEMC together. Do you have both cards?

Came back to look at your reply to my comment from a little bit ago. I have the PPBDC, I don’t have the PPEMC…yet. If theres a good enough reason for me to app for it I will on my next AOR. ;)

It is probably not worth the application. The most you can earn is 50,000 PayPal points per year, which is equal to $400-$420 in cash back per year, but that would require a decent amount of spending.

Maybe I’m missing something but I can’t imagine spending $24k on a Flexperks card. Why not do the spending on a better card? Just wondering.

I believe the first $3,500 was toward the sign up bonus (Winter Olympics Promo) and the rest was just gradually throughout the year (~$2,000 / month). The card earns FlexPoints, so 20,000 FlexPoints = a flight up to $400. The card also earns 2x at grocery stores (and Targets) and 3x at charities (and Kiva Loans). This is not my everyday card, but it is a good card to have when I need to book a $390 flight to ABC for tomorrow.

Pingback: A 3.5% Cashback Anywhere Card Is Debit* – EndPoint