PSA: Chase Ink Card Annual Spending Limit

A few readers have asked me some good questions, so I thought I would answer them for everyone. Since I am sure most of you have at least one Chase Ink Business Credit Card, you are probably aware of the $50,000 annual spending limit for 5x categories (office supply stores and on cellular phone, landline, internet and cable services).

The terms of the card state that your spending limits apply annually and Chase defined annual as:

“Annually” means the year beginning with your enrollment date through the first statement after the anniversary of your enrollment date, and each twelve billing cycles thereafter.) There is no maximum number of points that can be earned on net purchases earning 1 base point, or the additional 1 point on chase.com/ultimaterewards bookings.”

So to clarify, you have 12 months (12 billing periods) before your annual spending limit is reset. $50,000 / 12 months = $4,167 per month at 5x categories and 2x categories. If you have a Chase Ink Cash or Ink Classic, $25,000 / 12 months = $2,083 per month at 5x categories and 2x categories.

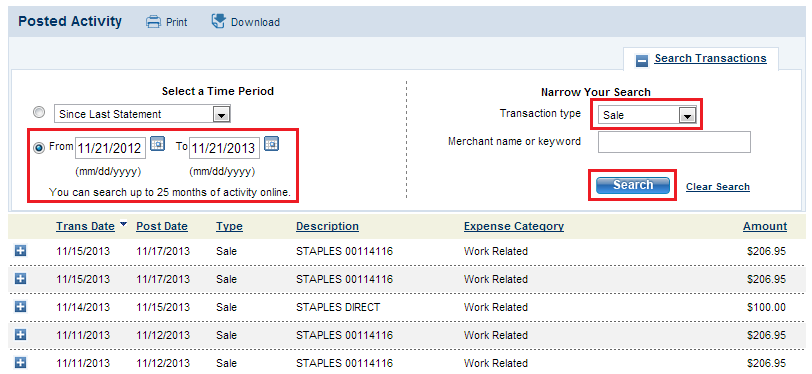

To view how much you have spent in the last year, log into your Chase account, and look at your account activity. Change the time period to be today and one year from today (in this case, 11/21/2012 – 11/21/2013). Change the Transaction Type drop down menu to Sale and click search. Then click the download link at the top of the page and download a CSV (Excel) file. Add up all your transactions and see how much you spend. I use my Ink Bold 99% of the time at 5x categories, and my yearly total was $29,410. Yikes! 5x Chase Ultimate Reward Points per dollar is 147,054 Chase Ultimate Reward points. Double yikes!

In conclusion, if you spend less than $4,000 per month at 5x categories, you will never spend more than $50,000 per year at 5x categories. However, if you find yourself constantly spending more than $4,000 per month at 5x categories, you may want to calculate when you have reached your $50,000 yearly limit. In that case, you may want to get another Chase Ink card (there are several to chose from).

PSA: PayPal Debit Card

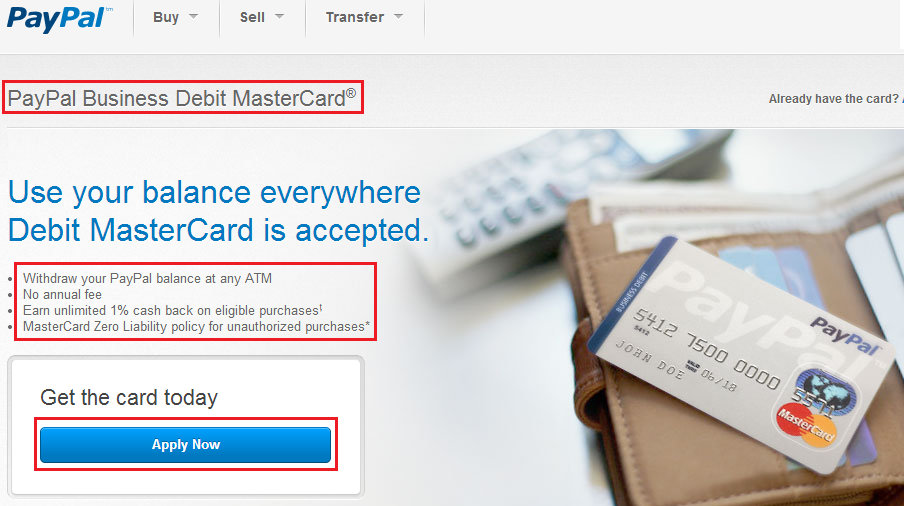

A reader told me he applied for a PayPal Debit Card to take advantage of free cash back from loading his Bluebird Card online (read Cash Back Loading Bluebird). Unfortunately he ordered the wrong PayPal card.

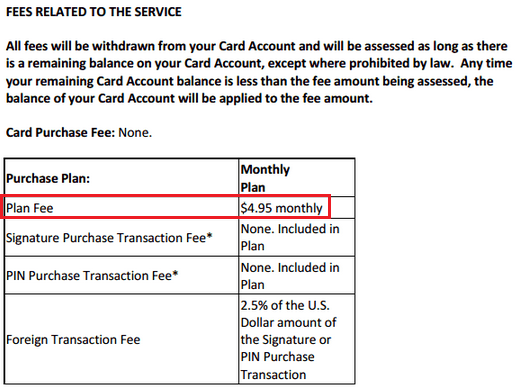

To clarify, you need the PayPal Debit Card (uses your current PayPal balance for purchases), not a PayPal Prepaid Card (essentially a prepaid reloadable debit card).

The PayPal Debit Card has no monthly or annual fees, but the Paypal Prepaid Card charges $4.95 per month. Yikes!

You can probably sign up for the Paypal Debit Card through your PayPal account or directly at this page. You will probably need to upgrade your PayPal account to a business or premier account. You can also create a separate business PayPal account. Business only means you have the ability to accept credit card payments, in which case, you will be charged a 2.75% fee. If you do not anticipate accepting credit cards, you will not be charged any fees to use your PayPal Debit Card.

As always, if you have any questions, please leave a comment below.

Can you use the Paypal debit card for something similar to Square Cash, or is that type of opportunity with Paypal now gone?

That used to work but Square Cash blocked PayPal Debit Cards from being used. Was a great way to generate free money.

Hey grant, Not sure if this is in the right post but:

I applied for a Chase Bold card and didn’t get instantly approved. It says they will let me know in 30 days or less if I am approved or send a denial letter in the mail with an explanation. Would it be better to call them at the reconsideration line right now?

I forgot to mention I do have a small business with $10k revenue but it is a sole proprietorship in my name, not registered business yet. I have been in business 2 years but most of the revenue came from 2013, with just $2k last year.

Good afternoon Bob, yes, call the reconsideration department now. Chase just needs to verify some income information and you should be approved over the phone. Let me know if you have any questions.