Success: US Bank Club Carlson Business Credit Card Reconsideration Phone Call Bank Visit

What a crazy journey it has been. The US Bank Club Carlson Business Credit Card is finally mine! In case you haven’t been following the journey, here is a recap of events:

App-O-Rama Results – June 12, 2014 (link)

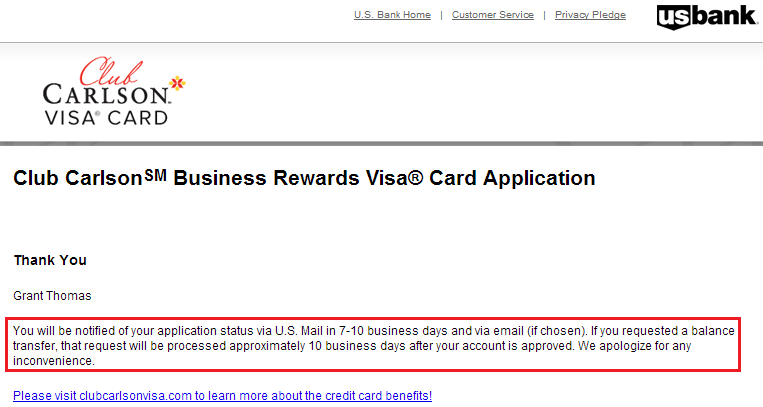

I received a pending application status. I called the automated line and was told it would take 24-48 hours for a decision to be made. I found a number for the credit analyst department and was told the same thing, so I will just have to patiently wait to see what happens.

Random News – June 30, 2014 (link)

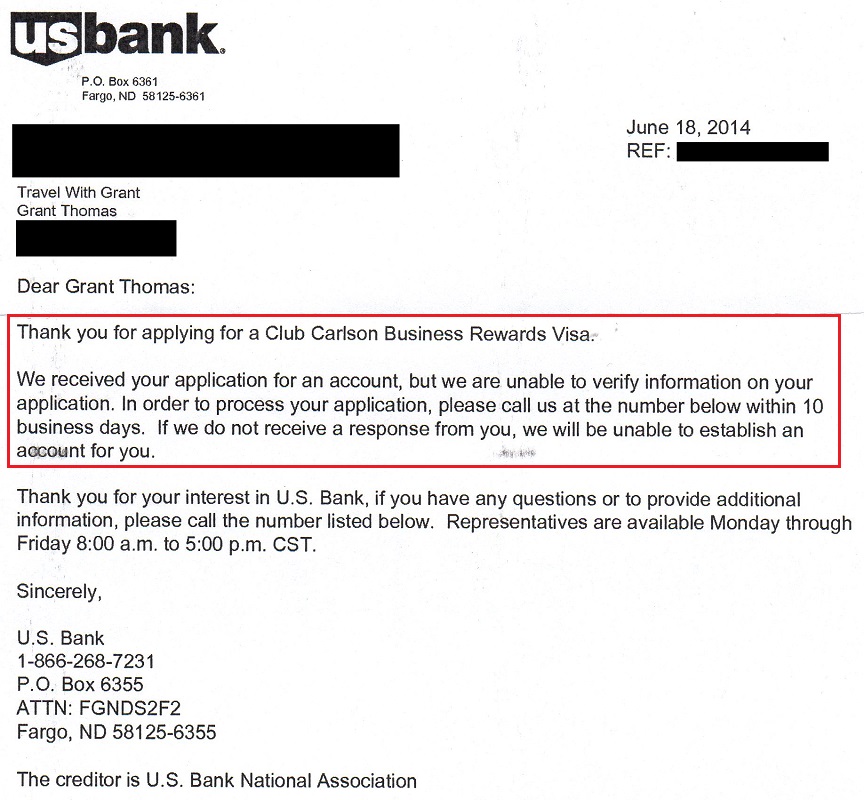

I received the following letter from US Bank regarding my application for a US Bank Club Carlson Business Credit Card. I was instantly approved for the personal version back in November (after freezing my ARS and IDA credit reports) so I was hoping for another instant approval. Unfortunately, that didn’t happen. After calling the number on the letter and speaking with a credit analyst, I was told that I needed to send in documents pertaining to my business license, business lease, and last 3 months of income/expenses. I told him I had a small online business (this blog), but I was told my business was too new and didn’t have the necessary documents. That is a bummer since I have no problem getting business cards with Chase, Bank of America, and American Express. If you had better luck than me, please let me know.

In the comments section of the above post, JW had a good idea:

Grant, you should go to your local US Bank branch. They can grab the application and review with a local underwriter. They did this for me for the CC Biz card and did not ask for any document and approved me. Good luck.

US Bank Visit – July 5, 2014

Shortly after receiving the above letter, I went to my local US Bank location on Saturday morning. After having a hard time locating the application, the personal bank was able to locate the application. I told her I had brought my important business documents (Employer Identification Number, personal tax return for 2013, TWG business revenue for 2013, TWG business expenses for 2013, bank account statement from the previous month, my US Bank Club Carlson Personal Credit Card and US Bank FlexPerks Credit Card, and a few Travel with Grant business cards). I was prepared for anything!

After trying a few different ways to access/review the application, she told me she could not review the application since the application was made online. She said she could help me apply in the bank and make some notes on the file, so I said sure, let’s give it a try. After only requesting to see my EIN document, she started to fill in the application. She didn’t ask many questions about my business, but did ask how much I intended to charge per month. I said between $2,000-$3,000 per month, hoping that would help get approved with a small credit line. After what seemed like 40 minutes to fill out the application (my App-O-Rama times are closer to 1 minute per application), she submitted the application online and told me that I would hear back from underwriting on Monday.

Call from US Bank – July 7, 2014

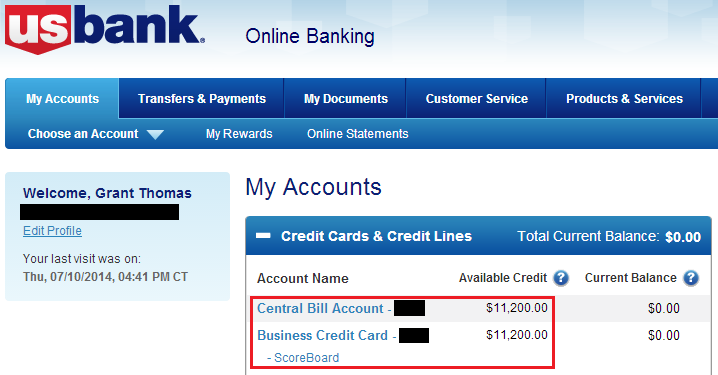

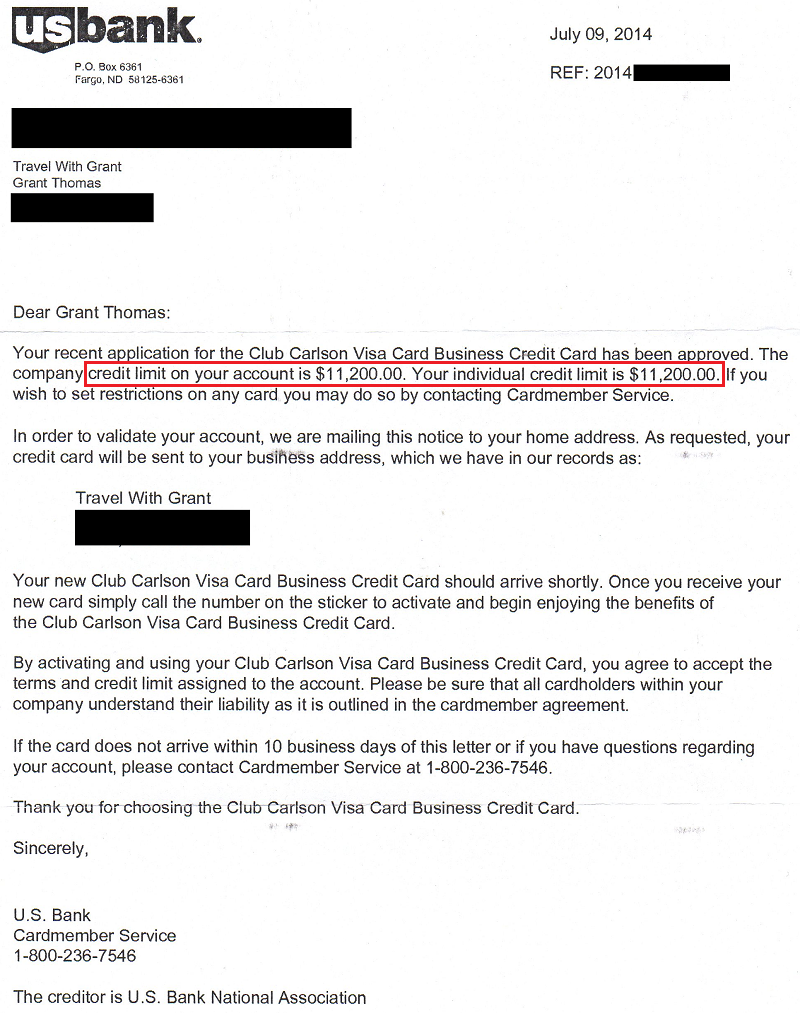

Monday afternoon rolled around and I received a call from the personal bank at US Bank. She had good news for me. I was approved! And it came with an $11,200 credit line! What a double surprise. She told me I would be receiving all the usual documentation in the mail shortly. She also gave me the new username and password for my US Bank Business account log in.

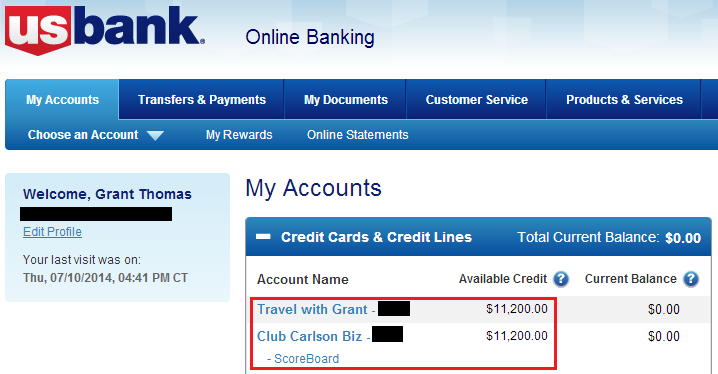

Logging into the US Bank Business account showed two accounts: the TWG business account and the business credit card.

I was able to rename the accounts online so I would remember which account is which.

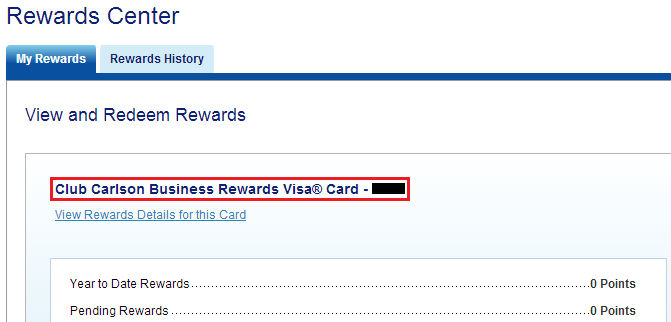

Clicking on the Club Carlson Business Credit Card account showed the full name of the credit card.

The sign up bonus for the business credit card is identical to the sign up bonus on the personal credit card. Plus the annual fee is only $60 for the business credit card compared to the $75 annual fee on the personal credit card.

After I logged out of my US Bank Business account, I logged into my US Bank Personal account and saw the new Club Carlson Business Credit Card had appeared. While on the phone with the US Bank personal banker, she told me that if called US Bank, they could merge all the accounts under one log in (similar to what Chase does for Ink Business Cards). I will call US Bank soon about combining both logins.

Approval Letter from US Bank – July 14, 2014

Here is the approval letter I received today from US Bank. Thanks for the generous credit line!

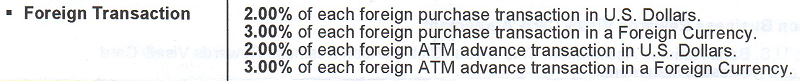

US Bank does charge foreign transaction fees on most of their travel credit cards and the Club Carlson Business Credit Card is no exception. Most other major banks do not charge foreign transaction fees on travel-oriented credit cards. I hope US Bank changes their policy soon.

Receive US Bank Club Carlson Business Credit Card – July 15, 2014 (hopefully!)

Hopefully I receive the new credit card tomorrow (Tuesday) and can start working toward the minimum spending. I’ll keep you posted when I get the credit card in the mail.

So there you have it. Instead of applying for a US Bank Club Carlson Business Credit Card online, you might have a better chance applying inside the bank. As for the US Bank Club Carlson Personal Credit Card, as long as you freeze your ARS and IDA credit reports (link), you should have a good chance of being approved online.

If you have any questions, please leave a comment below.

Do you get a different Club Carlson account with every affiliated US Bank credit card and then combine the points into one account?

I think it is better to have 2 separate Club Carlson accounts so you can use the points to book 2 back to back reservations (4 nights total). When you apply, you can enter a Club Carlson account number or leave it blank and they will create a new account for you.

very cool. do you know if this trick actually works to get 4 consecutive nights for the price of 2?

thanks.

I haven’t tested this myself, but in theory it works.

I know for sure that Carlson won’t let you book back-to-back 2 nights + 2 nights in the same hotel with points to get 2 free nights.. As far as booking with two separate account numbers, (1) the second account would need points and (2) their computer recognizes your name, anyway. For an upcoming trip, I had to book two separate Carlson hotels to get the free nights. Other than having to move between hotels, clubcarlson.com is THE best hotel deal. ihg.com is the second best for many bonus points on credit cards.

so… did you actually try to book 2 nights & 2 nights using 2 diff carlson acct #s? both accts being in your name.

No. I don’t have two different accounts with clubcarlson.com and don’t see how it is possible with the same name, email, etc. Anyway, with no points in a second account, nothing with which to make the booking. I waited a few days and tried to book the other two days but the computer caught me.

I think using 2 separate Club Carlson accounts should work, even if they have the same name (different email and account number).

Anyway, with no points in a second account, nothing with which to make the clubcarlson.com second booking. Please give a fix for that situation.

You need a Club Carlson business credit card to create a second account.

As I wrote before, I had both business and personal credit cards and accounts. When I closed the personal card, they transferred those points into my business account. Since it’s been some time, should I try for a personal credit card again?

Kalboz-I got clubcarlson.com bonus points from both a personal and a business card. When, I cancelled the personal card, they transferred those points into my business account.

Glad my comments helped Grant :)

Keep the good comments coming JW!

No US Bank branch in Texas and in a bunch of states.

That is a bummer. You could always do a nice road trip to CA :)

lovetofly-If, at first, you don’t succeed, sky diving is not for you.

If at first you don’t succeed, try try again. Impressed with how prepared you were for battle :). Nice work!

I don’t give up that easily. Sometimes travel hacking is hard work, but in the end, it is always worth the effort. :)

Grant, do you think US Bank would be more likely to approve an application (I’m looking at the CC Premier -personal not business) if I applied in a local branch versus online? What do you think?

I don’t think it makes much of a difference. I would recommend freezing your ARS and IDA credit reports before doing either option. Applying in a branch is sooooo slow. I would do it online.

Pingback: More Info Regarding Chime Card Loads After October 8 and my App-O-Rama Planning | Travel with Grant

I am running into a very similar situation as you! So after you apply in branch, did you get another hard pull or did they use the same pull? Did you specifically ask them not to pull another one? I dont really have an EIN, would SSN and opening a business account with them be sufficient you think for the “re-apply?”

I don’t remember if US Bank did another hard pull, I wouldn’t be surprised if they did. If you only have a SSN, you should be fine. US Bank will check your personal credit score/history to decide whether to approve you or not for the Club Carlson Business Card.

Did you have to apply for a business checking account with them? Do you have a business checking account prior to the application?

I don’t have any business check accounts with any bank.

No checking account needed. Each spouse to get the personal card AND the business card.

clubcarlson.com is so great. Use points for one night and get the second night free.

So I called the underwriting service after I applied online last Wednesday and I was told by the account verification department that I needed EIN number, proof of last 3 months of income/expense, business lease etc.

I went in to a branch today. They built the business profile for me and did not upsell business account to me unlike another branch. After they resubmited the application from their end, it still went pending because “duplicate application.” I was told to check back in 7-10 business days. I am not sure if you had similar situation, Grant?

I have never had any business cards so I have not built any business credit profile at all. I was instantly approved for Amex Business Plat on the same day I apped for US bank Business Club Carlson last Wednesday though… I really hope it will be a different outcome this time.

I brought some business expenses, personal checking account and a statement from my Chase Ink Bold. I didn’t get the supplicant application warning since it was probably 2 weeks between applications. You should be fine, it might take a few extra days due to the holidays.

Just got approved! :) Thank you grant and others for advising that I should apply in branch!

Btw, kind of off topic here, I see that you have Amex plat as well (business and personal?). I have the business for 100k bonus and wondering if you have any advise on preventing FR? I plan to use about 3.5k in PPMC each month to satisfy the spend. If I have other charges, it should not be suspicious right? or should I try to buy PPMC from different places each month? Amex card is hard to MS and I am just looking to get the bonus. Any tips? I think it might be a great topic for another blog post! :)

Good morning Rick, I only have the personal AMEX Platinum (Mercedes Benz version). I got a FR when I used my AMEX PRG to buy VRCs at CVS, back in the day. I would say that AMEX has a much shorter fuse for business cards than personal cards when it comes to MS. I would tread lightly at the beginning and slowly ramp up your spending. Congrats on the US Bank Club Carlson Business Card! Do you have the personal card as well?

No I do not have US Bank CC personal card but I do have cash+ with them and a personal checking account.

Do you dont mind telling me… how much did you spend on VRC at CVS each month and for how long did you do that to get FR? I have $10k spend to meet in 3 months, so I am not sure how to tread lightly :( Any tips?

I was working on the $5000 minimum spend when I got hit with the financial review. I probably spent about $2000 at CVS which was a red flag in their system. I would definitely mix in a lot of non-manufactured spending purchases.

Can you still apply for the US Bank Club Carlson personal and business at the same time? I successfully did so 12+ months ago, but it seems most people don’t apply for both anymore. Is there an active forum somewhere talking about the current situation?

There might be a forum on FlyerTalk or on the smaller Saverocity/Travel Codex. I haven’t heard of anyone applying for both the personal and business cards on the same day, but I guess it is possible.

I applied for the business card and was approved I did not put in a club Carlson number a few days latter I was looking at my personal card and the business card was there I went to the rewards on the business card and it showed my personal account did they put the two accounts together? and if so can I do anything to separate them?

That is strange. I have never heard of them doing that. To be safe, I created a second Club Carlson account before applying for the business version. You can try calling US Bank and seeing what is possible.