Random News: Last Day for AMEX $10 Statement Credit, iPhone 6/Plus Cases, Friday’s App-O-Rama Results, and Hang-Up-Call-Again Success Story

Good afternoon everyone, I hope your weekend is off to a great start. I had the pleasure of meeting a blog reader (and hopefully a future blog reader) for coffee in Oceanside this morning to talk miles and points.

Let’s get to the random news, shall we?

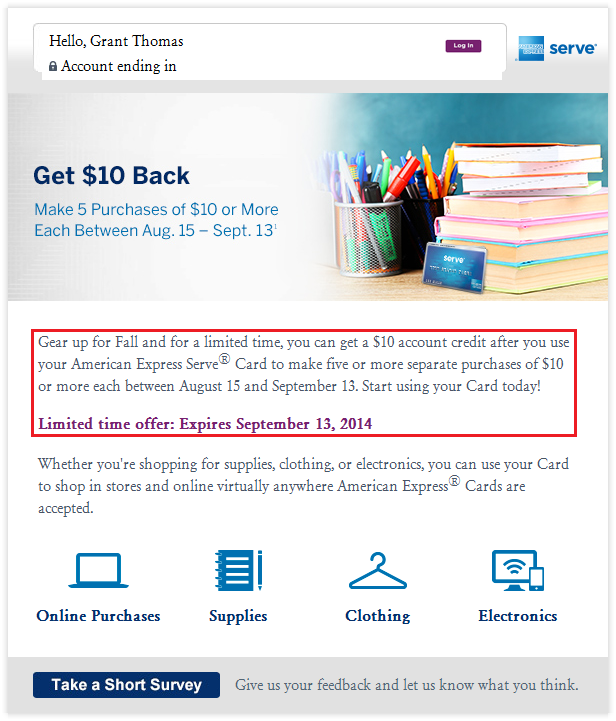

Sorry for the late notice, but today is the last day to take advantage of the $10 AMEX Serve Statement Credit After Making 5 $10+ Purchases. You must make 5 purchases of $10 or more with your Serve Card between August 15 and today. The statement credit posts after a few days of making the qualifying purchases.

Click here to read the full article.

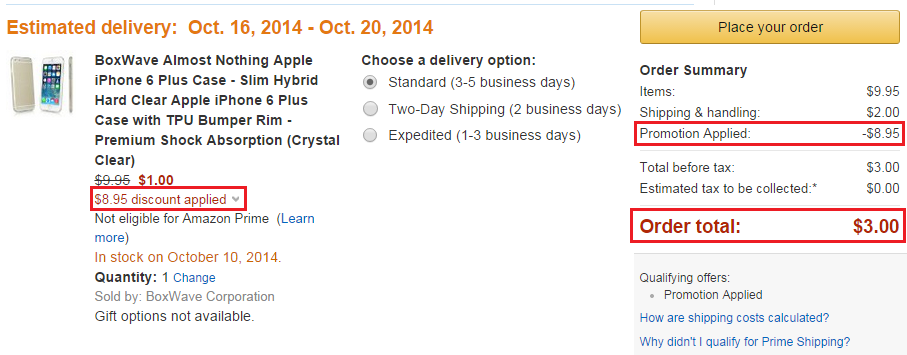

A reader of mine (thanks Alex!) reminded me to to look into buying an iPhone 6 or iPhone 6 Plus case on Amazon. He was able to get an iPhone 6 Plus case for $3 shipped. Nice find Alex!

He bought this case (link) and used promo code PGF7ZMXI. The shipping date is slated for next month, which might be a problem for some people, but they could always change the shipping date and ship the case much sooner than that.

If you are wondering, I bought this case (link) so I could hold my drivers license and 1-2 credit cards (not sure I need them with Apple Pay though). Looks cool, should work well, and comes with Amazon Prime shipping for quick delivery.

If you want to browse all iPhone 6/Plus cases, I would search for all Amazon Prime-eligible cases (link).

On Friday morning, I did a mini 4 card App-O-Rama. I will go into more detail next week when the cards arrive, but here are my results:

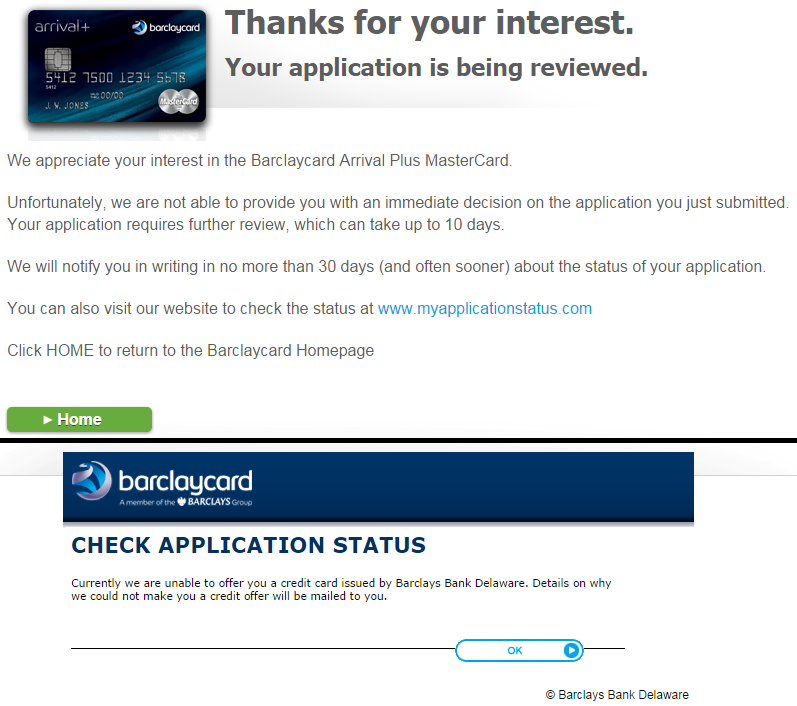

- Barclays Arrival Plus Credit Card – automatically decline (4th time in a row I think). I don’t bother doing recon calls for Barclays since I have no leverage/relationship with them. I will keep trying, maybe one of these days I will get approved…

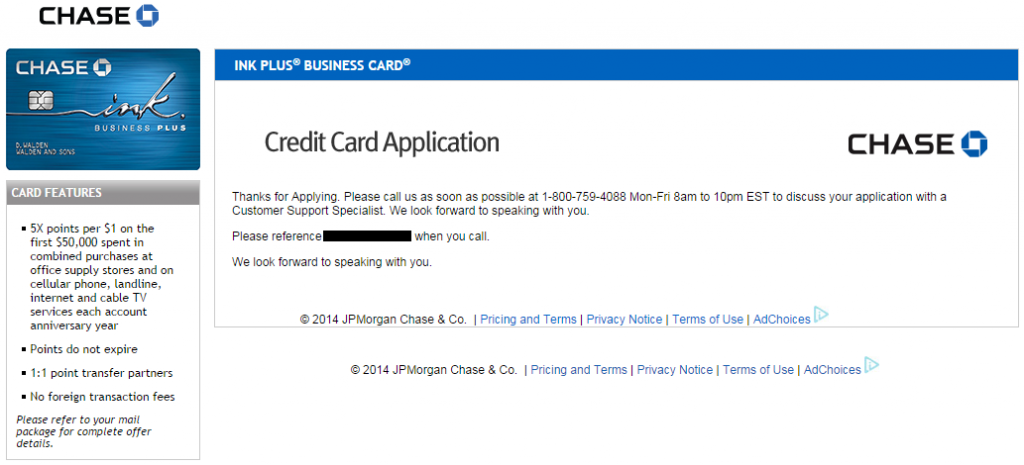

- Chase Ink Plus Business Credit Card – pending decision, called in and had to explain why I wanted another Ink card (I already have a Chase Ink Bold MasterCard and a Chase Ink Bold Visa). After answering a few questions about 2012, 2013, and 2014 business revenue and profits, I was approved!

- Chase United Airlines MileagePlus Credit Card – even though the public 50,000 mile offer expired a few days ago, there is a working targeted offer posted on Fat Wallet (link). It turns out my United account was targeted for the 50,000 mile offer. After applying for the offer, I received a pending decision. After calling the recon number (888-245-0625) and verifying some information, I was approved for a $5,000 credit line, no credit line moves or card closures necessary.

- Old American Express Blue Cash Credit Card – I used the zombie link and was instantly approved! I still have my American Express Blue Cash Preferred Credit Card open, so I guess it is possible to have both at the same time.

Last but not least, I can’t stress how important Hang-Up-Call-Again (HUCA) is. I was trying to make modifications to a few 1 night stays with SPG. I was trying to get 5th night free and cancel my individual reservations, but I was past the 3 day cancellation period (I always get screwed by the longer than normal cancellation/change window). After the first rep was unable to help, I called back and somehow reached the SPG Elite reservations department and had a very nice rep help me. She was unable to change/cancel the reservations, but told me that there were cash and points rates available on the days I wanted to stay. I was originally paying with 7,000 SPG points per night. The cash and points rates for 3,500 SPG Points and $55 were available. But there was a slight problem. She could not change from all points to points and cash and she could not cancel the all points reservation. She put me on hold for a few minutes and called the hotel directly. She came back with good news and said they were able to change the reservation to cash and points without cancelling the original reservation. I was extremely grateful for her help. She told me to ask if there were any upgrades when I checked in, which surprised me. I have never asked for an upgrade as a Gold SPG member (have I been missing out for years?). Instead, I like to be pleasantly surprised at check-in if there is an unexpected upgrade available. We shall see, I still don’t feel comfortable asking for an upgrade, but I may drop the line, “the nice SPG rep who helped me make these reservations said you might have an upgraded room available.” We will see if that leads to anything…

If you have any questions, please leave a comment below. Have a great weekend!

Grant, did you buy iPhone 6? If so which one u bought, 6 or 6+ and how many GB?

How to maximize earning points and miles on buying iPhone 6? Please share or maybe you can write a post on it, means a lot for us newbie.

Thanks so much and appreciate it

I bought an iPhone 6 64GB from AT&T’s website. I used my Chase ink bold business credit card to earn 5% cashback on the purchase.

The Ink’s terms say that the 5x does not apply for devices. Do you pay the iPhone fee in full by Chase Ink or by installment every month into your phone bill?

I paid for the whole iPhone at once. Sometimes the TOC are not 100% accurate. I will let you know whether I earn 5x or not.

Thanks, please let m know.

Also I have question about you booking SPG hotel. I’ve heard the best use of SPG starpoints is redeeming it for airline miles. Since you get an additional 5k bonus for every 20k that you transferred. And redeeming it for hotel is not as good as transferring to miles. As starpoints is hardest to earn because the SPG card does not have category bonus like Ink or CSP or Freedom, don’t you agree?

In your case, you mentioned that besides the 7,000 points per night option, the cash and points option is available with 3,500 and $55, so you essentially buy 3,500 starpoints with $55 ….. Do you think it’s worth it? Also if use cash and points option will the stay earn you double SPG points as the SPG card say you earn 2x at SPG hotels and will the stay count toward elite status?

I have same situation like you, have upcoming trip and I see some category 3 SPG hotel at 7,000/night but the hotel website doesn’t list the cash and point option. Very tempting but I am hesitate to burn my SPG points for hotel stays due to reasons I mentioned above. I see in the area that I will be going also has some IHG, Hyatt, Marriott hotels too….does the place that you will go have those hotels too, have you search and considering them instead of SPG and if so what makes you still go with SPG and burn those painstakingly earned starpoints?

Very good questions Adam. I’m staying at the Sheraton Anaheim across the street from the Anaheim Convention Center. There is a Hilton a little closer, where I am staying for 1 night for 40k points. Being really close to the Anaheim Convention Center is extremely important, so there were not many viable options.

I don’t transfer SPG points to airline miles, or in the rate cases that I do, it is probably in 2,000-4,000 point increments. I have plenty of miles in various programs so I don’t have a need to convert SPG Points to miles.

I currently have 60,000+ SPG Points. My parents signed up for each SPG card and I work on the minimum spend for them and then transfer all the SPG Points to my account. I have SPG Gold, so we get better treatment as a gold member.

There may not be any cash and points prices available now, but they may release some space close to the check-in date. Book with all points and you may be able to change to cash and points. Enjoy your points now and don’t let them hold you hostage. Earn -> Burn -> Earn some more.

Wait grant don’t u live close by? Why staying in hotel in Anaheim? Are u at a conference or something?

Thanks for the shoutout re the case! I ended up buying 2… Got one w prime shipping that should arrive sooner just in case my phone gets here earlier than expected. Will use the 2nd as backup ….

Also one other tip I heard about re screen protectors in case anyone is looking is the Zagg tempered glass w lifetime warranty. Heard that is one of the best although a little more $$$

I probably live 15 miles away from the hotel, but I want to be close to the Convention Center so I don’t have to worry about going there in the morning. Plus, lots of parties and drinking after hours and I don’t want to drive home :)

The Amex Blue is a great card. I’m also in Socal, it’s a great way to rack up cash back.

I’m well aware of how awesome the old AMEX Blue Cash card is :)

I’m going to work on the spending after I do my other minimum spends.

What link did you use to apply to AMEX Blue Cash?

Check out this post for more info on the card and fro the card link: http://freequentflyerbook.com/blog/2014/1/3/5-cash-back-is-back-for-now

Grant – for some reason I couldn’t get a retention bonus with my Amex BCP. Did you have any success with it? I try by saying, I use this card a lot and put in a lot of spending and wondering if there are any offers to negate the annual fee.’ The reps never buy this.

On Barclays arrival, I assume you already applied for other barclays cards. Also, do you already have Capital one venture? Almost same as Arrival Plus.

I applied for a US Airways card last year but got the same results :/

I haven’t had a capital one card in a long time. I might have to go back to them. The big problem is that they pull your credit report from all three credit bureaus. :/

I don’t think I got a retention offer on BCP either :/

Mine was pending review as well but when i called, they say my application was declined due to the number of high credit cards balances that i have, so they cannot open another credit line. I asked them if they could take some of my credit line from US Airways card and they agreed. However they wanted me to explain why do i have high balances on my credit cards. Only then i was approved. Pretty tough.

Do you mean high credit balances or high credit lines/limits? I’m glad you were approved for the Barclays Arrival Plus credit card.

I meant high credit balances…thanks

I see, yes, I think Barclays wants to see lower credit balances on their cards.

Not so sure if the three credit pull thing is true anymore….

Is it just one credit pull now? That would be great news.

I got my cap 1 venture card 3 months ago today and they hit all 3 credit bureaus. Dont know if thats changed in the last three months.

Thank you for the data point Raul.

I got my $25 (not $10) AMEX Serve Statement Credit within 5 days qfter making 5 $10+ Purchases.

Excellent. I wish I had the $25 offer. You are lucky.

Grant, how did u receive 5% cash back with your ink card at AT&T ?

Whenever I pay my family’s AT&T bill I always get 5x with my Chase Ink Bold. There are mixed results as to whether buying an iPhone will count, but I’ll let you know what happens.

I have the old barclay arrival card design (without chip), can I reapply for chip one & get 40k bonus? Are they considered same product? Thanks

I believe they are considered the same product, just with a new card design/feature. Therefore no additional sign up bonus, I’m afraid.

Another alternative to the Arrival + and Venture card is the new Citi Double Cash card. You get 1% on purchases and another 1% when up make a payment. Not as good as the Arrival plus but way easier to get and doesn’t hit all 3 credit bereaus like Venture. There is also a targeted $200 bonus for this card after hitting $1000 spend in 3 months. I was planning to downgrade my Citi Thank U until i read on myFICO site that if you send Citi a secure message saying you heard of the $200 offer and ask to be enrolled in it they will give it to you.

I won’t apply for the Citi Double Cash Card, but I’ll try to downgrade one of my Citi AA Exec Card when my annual fee comes due.

Hey grant I have an off the topic question. I know your not supposed to apply for a lot of CC when looking to buy a house since it looks bad and lowers the average age of credit line but what about MSing. Should one not MS if looking to buy a home?

I don’t think the banks will know if you are MSing or not. The only thing that could hurt you is if your MSing leads to high credit card balances, late payments, etc. Those would lower your credit score. If you MS responsibly and keep on track of your credit cards, you should be fine. For the record, I still live at home with my parents so I don’t know anything about buying a house and applying for mortgages.

If your MSing results in a lot of cash or money order deposits, you will have to provide detailed documentation for where the funds all came from. If you keep all of your receipts, you should be okay.

Good to know. Thank you Chris.

Hey Grant, don’t feel too bad about the Barclays’ denial. I was also denied last week either for my third or 4th time. I also don’t even bother for reconsideration any more. I just keep using my Fidelity and Old Blue. Like you, I will also try to get the new Citi card the next time I receive a renewal notice on one of my many Citi cards. Too bad about Amazon Payments. It was always good to have it as a reliable backup when a gift card was giving me problems elsewhere. Oh well, as you have said many times…something else will turn up.

I hope that something comes soon :)