Good morning everyone, I hope you all had a great weekend (with the exception of the recent AMEX Membership Rewards Changes). My girlfriend and I are going to Greece and Malta this Summer, so we are busy booking flights, making hotel reservations, and researching things to see / eat / do in those countries. During the airfare booking process, we have been using my girlfriend’s Capital One Venture Rewards “miles.”

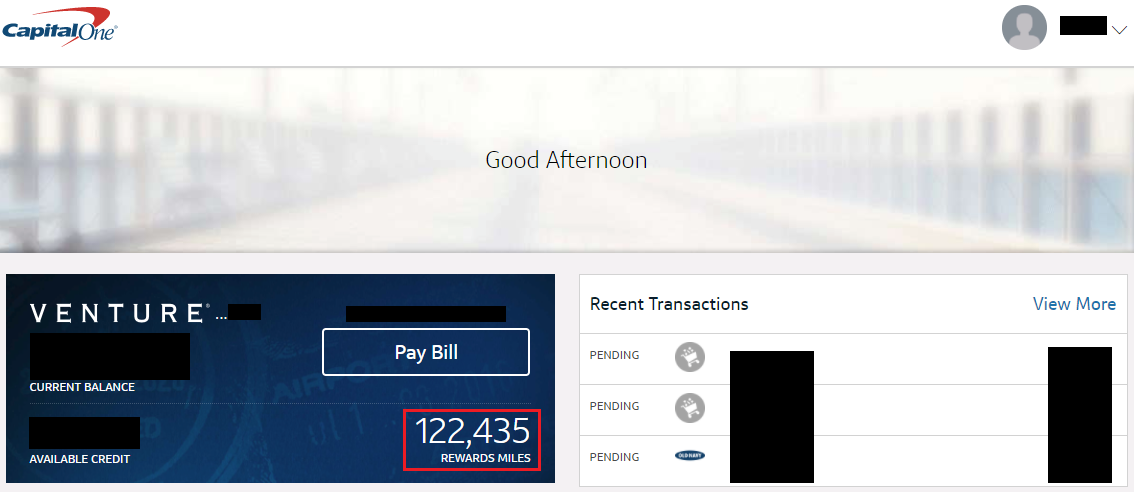

Before we started redeeming the “miles” for this trip, she had 122,435 “miles”, which is equivalent to $1,224.35 in travel. In this post, I will show you how to redeem Capital One Venture Rewards “miles” for travel purchases. In tomorrow’s post, I will show you how to book airfare directly through the Capital One travel portal and how to pay with Capital One Venture Rewards “miles.” Without further ado, log into your Capital One account and click on your “miles” balance.