$20 Staples Gift Card After Purchasing $300+ of MasterCard Gift Cards at Staples

(Hat Tip to Frequent Miler (link) – he is on vacation and still has time to find great deals)

This is similar to other Staples Easy Rebates, but this time, you will get a Staples Gift Card as a rebate, instead of a prepaid Visa/MasterCard gift card. The terms of the offer say you can only get the rebate once per household (think out side the box neighborhood). Offer valid from July 13th – 19th.

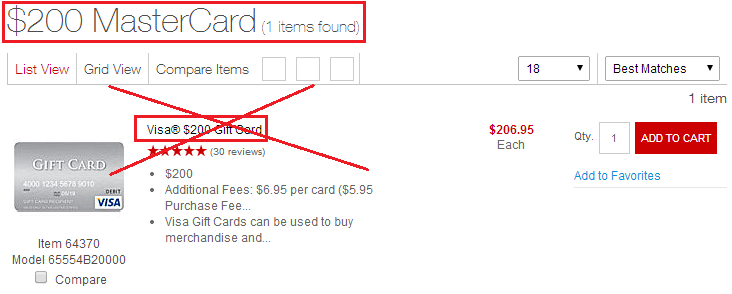

Since you have to buy MasterCard gift cards, you will have to go to a Staples store. Staples.com only sells Visa Gift Cards. You must buy MasterCard gift cards to qualify for the Easy Rebate. If you have never completed an Easy Rebate, they are really easy (link).