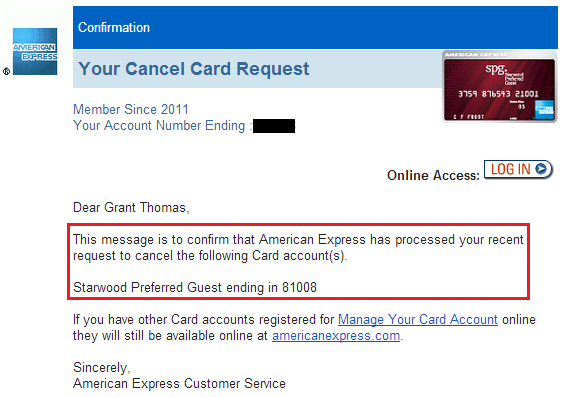

Update 7AM: I just called Chase and got a $95 statement credit on my Chase Ink Bold MasterCard and I moved my credit line from my SPG American Express Credit Card to my Blue Cash Preferred Credit Card. See tonight’s post for more information.

Planning for Retention Bonuses for a Chase Ink Bold MasterCard and an SPG American Express Credit Card

There comes a time in every credit card’s life when you have to make a very important decision – do you pay the annual fee and keep the credit card another year or do you cancel the credit card to avoid paying the annual fee? Like most things in life, there is a secret third option, which I like to call Door 3, aka the Retention Bonus. Behind Door 3, you get the best of both worlds – keep the credit card for another year and avoid paying the annual fee.

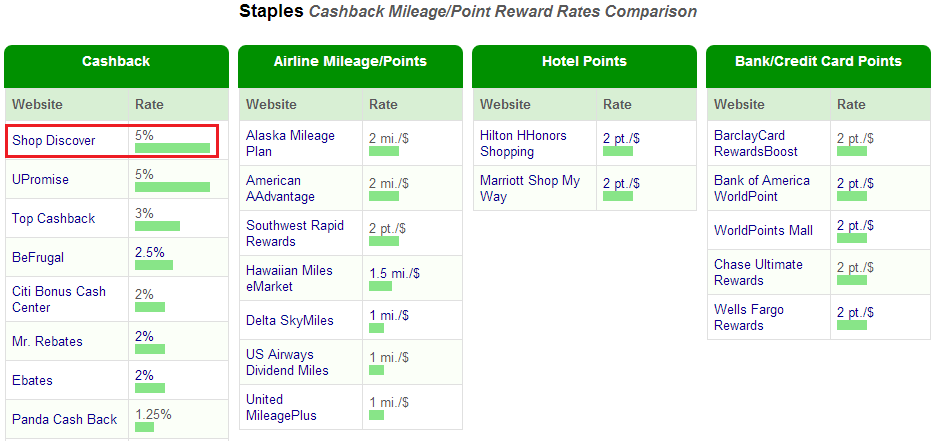

I’ve had pretty good success in the past regarding the Chase Ink Bold MasterCard (5,000 Chase Ultimate Rewards Points or $47.50 statement credit) and the Chase United MileagePlus Credit Card (2 more United Club Passes and 10,000 United miles). Ideally you want to call 10, 11, or 12 months from the day you were approved for the credit card, right before the annual fee posts to your account.

The term retention bonus means waiving the annual fee, providing a statement credit that offsets the annual fee, or bonus miles/points that offset the annual fee. Some credit card companies will make you spend a certain amount of money every month to get the retention bonus. To ensure the highest possibility of a retention bonus, here are my tips:

- Make sure your credit card is paid off and has a $0 balance.

- Make sure all transferable points have been spent/redeemed/transferred already.

- Have 1 or 2 good reasons why you want to cancel the credit card.

Continue reading →