Trip Booking Report: LAX-DUS-BCN with AA Miles and MAD-MUC-LAX with UA Miles

(Thanks to Josh for the idea of talking about booking my award tickets).

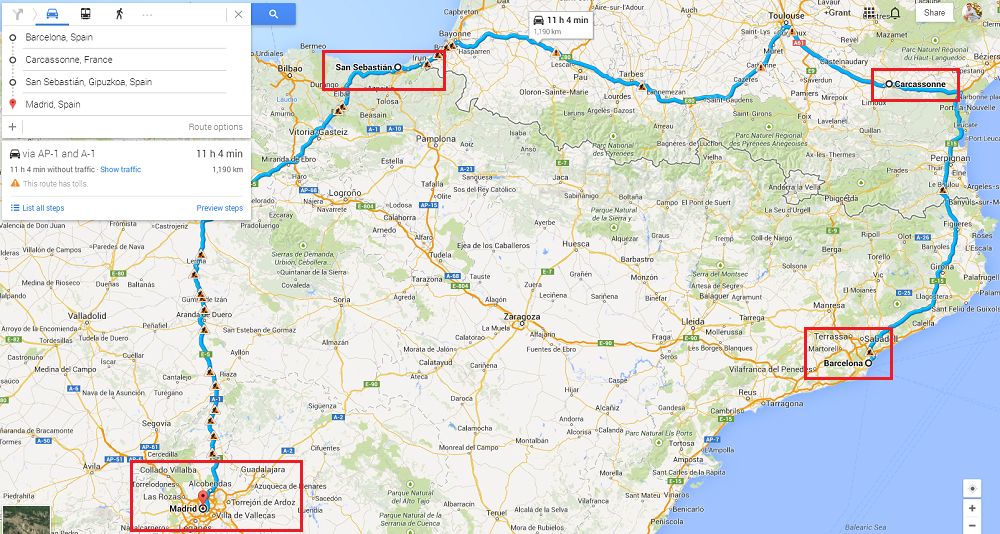

I’m not a huge fan or reading (or writing) trip reports, so I thought I would do a trip booking report – a report on how I used frequent flyer miles to find and book my current trip to Spain. If you guys like this post, I will cover my recent trips to Utah (Delta SkyMiles), Seattle (BA Avios), Hamburg and Copenhagen (Virgin Atlantic economy and Air Berlin business class), Amsterdam (US Airways) or any other award trips. For my current trip, here are my award flights:

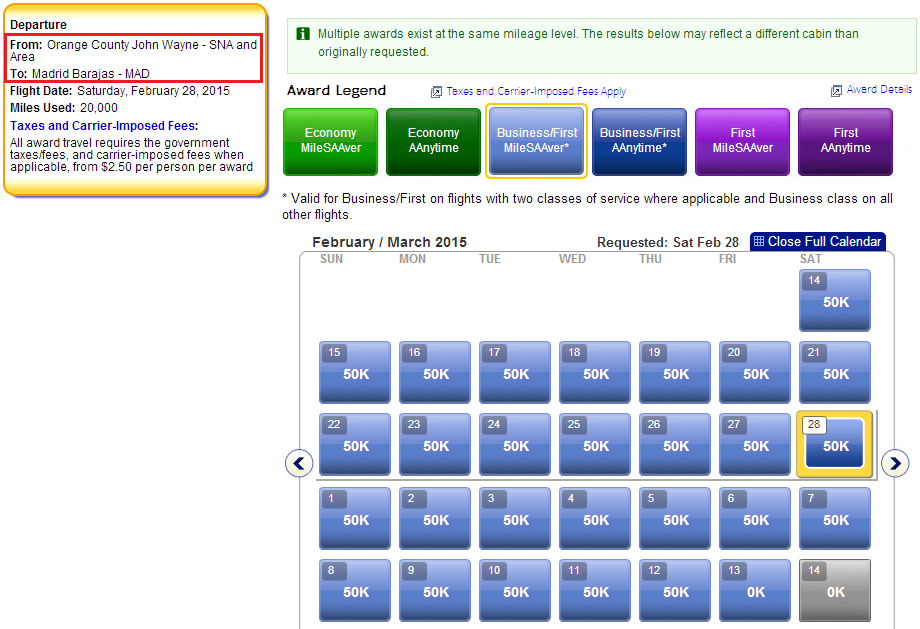

- Los Angeles to Dusseldorf, Germany to Barcelona, Spain (LAX-DUS-BCN) on Air Berlin with American Airlines miles (30,000 miles one way)

- Madrid, Spain to Munich, Germany to Los Angeles (MAD-MUC-LAX) on Lufthansa with United Airlines miles (30,000 miles one way)

Airline Credit Cards and Frequent Flyer Miles

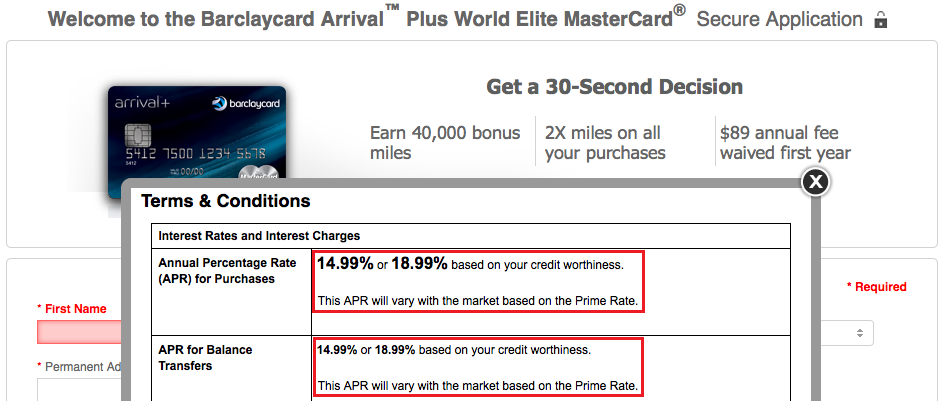

For my current trip, I am traveling with my parents and my younger brother. We used 120,000 American Airlines miles and 120,000 United Airlines miles for 4 round trip economy tickets (I am such a boring travel blogger, I know). My parents used their United Airlines miles that they acquired from their Chase United Airlines MileagePlus Explorer Credit Cards (50,000 mile sign up bonus with a 5,000 mile bonus for adding an authorized user). They both got a Chase Sapphire Preferred Credit Card and topped up their United Airlines account balances to book the award flights. As for the American Airlines miles, my parents have been long time users of the Citi American Airlines Credit Cards, so we redeemed miles from my mom’s account. She recently got her first Citi American Airlines Executive Credit Card to replenish her stash of American Airlines miles.

To find the award flights, my dad was looking 330 days before the start of the trip and booked 4 American Airlines award tickets the day the award seats were released. Then after waiting 2 weeks, he booked 4 United Airlines award tickets as soon as those seats were released. I used the following steps to find the award seats, but the dates below are for future (imaginary) travel and for simplicity, I only searched for 1 award seat. Continue reading →