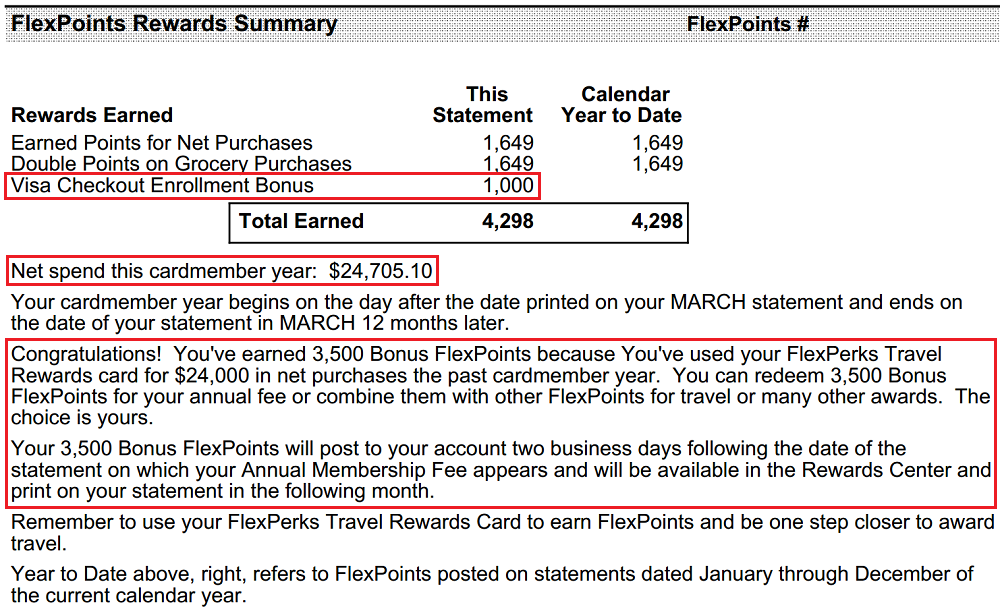

Good morning everyone, just a few quick credit card related pieces of information to pass on. Back in October, I wrote about the US Bank and Visa Checkout promo. It looks like the 1,000 bonus FlexPoints just posted to my account a few days ago. If you signed up for the promo, you should see your bonus points post soon. I also found out that I had spent over $24,000 on my US Bank FlexPerks Credit Card, which earned me 3,500 bonus FlexPoints. Apparently, I can redeem 3,500 FlexPoints to pay for my $49 annual fee. I plan on calling US Bank and asking them to waive the annual fee. I didn’t spend $24,000 on their card to not have to pay the annual fee, that is ridiculous. I will let you know how that call goes in a few months.