Guest Post: 5 Card App-O-Rama (Diners Club, Club Carlson, US Airways, Southwest Airlines Plus, and Citizens Bank)

Good morning everyone, I hope you are having a great holiday season with your friends and family members. Today, I have a guest post from my friend Nigel, where he is sharing his experience with his recent App-O-Rama. Take it away Nigel…

In brief, an App-O-Rama (AOR) is a strategy in the miles/points community where an individual applies for multiple credit cards within a short period of time to maximize their odds of getting approved for multiple credit cards. For me, this typically involves submitting four or more applications within seconds of each other in the hope that the banks don’t denied me for “too many inquires.”

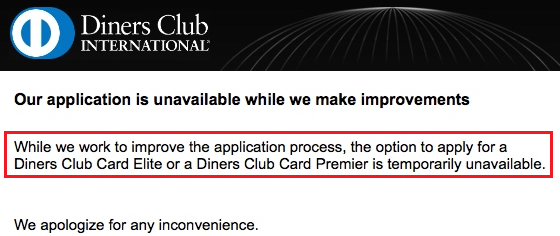

With my Experian inquires starting to pile up from prior AORs, I wanted to limit this AOR to two Experian hits. After doing some research on the Credit Boards credit pull database (link), I discovered that applications for the Diners Club Elite Credit Card have reliably resulted in a Transunion inquiry. I was quite excited at the news, except there was one problem…

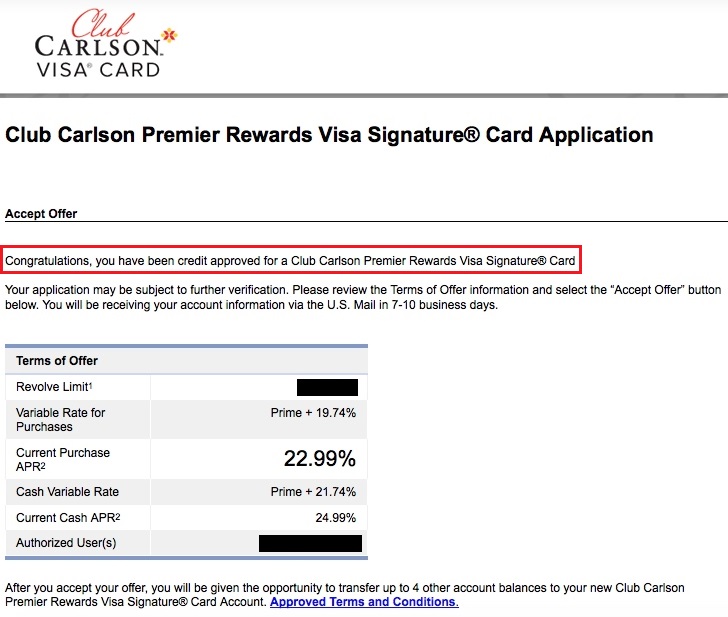

Uh-oh, well I guess I need to rule that out this time around. Instead of waiting for the link to reappear, I decided to continue on with the rest of my AOR. Up next was the US Bank Club Carlson Personal Credit Card, which comes with 50,000 points after first purchase, another 35,000 points after spending $2,500 in 90 days, $75 annual fee, and 40,000 points each card member anniversary.

I’ve wanted this card for quite some time. Even after freezing my ARS/IDA reports (link) and applying for this card toward the beginning of my last two AORs, I kept getting denied due to inquires. Heck, back in June, I even got automatically approved, but I never received the card, just a letter of denial. Many reconsideration attempts were fruitless, as they often are with US Bank. Anyway, I briskly filled out the application, lo and behold another “instant approval” from them, take note on the application that it is subject to further verification so I held my breath.

After a couple of days, the automated line changed from “Still in Process” to “Congratulations”, then the credit card account populated in my US Bank online account, next to the savings account I opened after being rejected back in September to help my future approval odds. I honestly haven’t been this excited for an approval since I overcame three reconsideration attempts to get my Chase Ink Bold approved.

Up next was the Chase Southwest Airlines Plus Credit Card, which offers 50,000 Rapid Rewards points after spending $2,000 in 90 days, with a $69 annual fee. Despite the fact that 50,000 point offers come around quite frequently, I could only locate a standard 25,000 point offer available for the Chase Southwest Airlines Plus Credit Card. After rattling off several emails, Jen at Deals We Like, emailed me back instructions for the 50,000 point offer, which involved applying directly over the phone with a number she provided.

Aside from the fact I was speaking to a rep with a thick accent, submitting my first phone application was actually quite simple, it just took some time since she had to read aloud all of the terms and conditions. After I verified the signup bonus one last time, I gave the rep the okay to submit my application, moments later she informed me Chase would notify me within 10 business days.

A few hours passed, then I decided to call the Chase reconsideration line. I gave the analyst my SSN, after a brief hold she informed me I had been declined due to “too many inquires” and “sufficient credit with Chase.” Unfazed, I asked if she could take a second look at my application and if it would be possible shift some credit from my Chase United Airlines MileagePlus Credit Card. After another brief hold, she returned and asked how much I wanted to move, I said $3,800 from my $13,800 credit line on my United card, she plugged it into her computer and after a small glitch I was approved. I’m now 50,000 points closer to Southwest Airlines Companion Pass qualification for 2015-2016, hopefully I will qualify it in time for spring break, Viva Mexico!

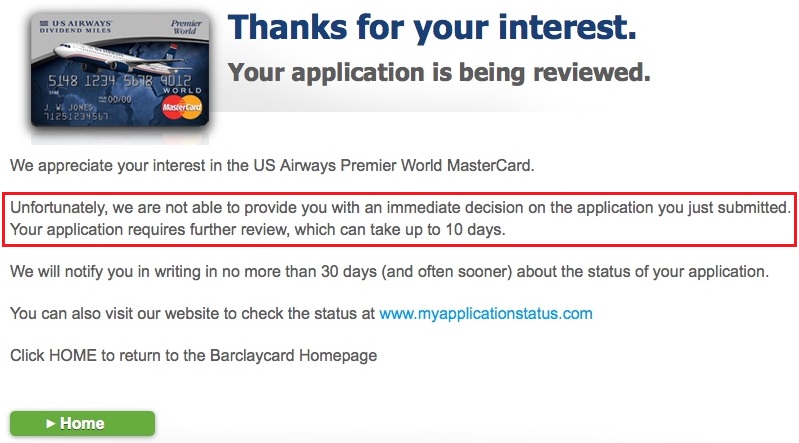

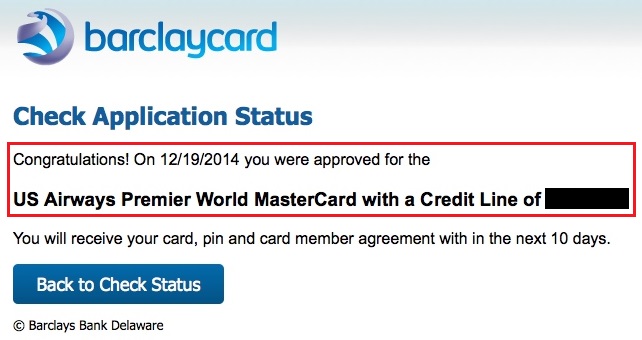

Up next, I wanted to apply for the Barclays US Airways Personal Credit Card, which offers 50,00 Dividend Miles after your first purchase and payment of the $89 annual fee. Since US Airways and American Airlines will merge soon, I figured it was to good time to apply, especially since it had been six months since my last Barclay’s app. After reading about some difficulties people encountered using the preferred link, I chose to apply using the standard offer, then would attempt to match up to the 10,000 anniversary mile offer later. I submitted my application and received a pending screen with instructions on how to check my application status. I immediately typed in my info and was greeted with some bad news.

I sat down for a few minutes, then picked up the phone to ring Barclay’s reconsideration line. The analyst with a strong Jersey accent, GRILLED me about my job description, income, housing, prior three Transunion inquires, to explain the small existing balances that were reporting on two accounts and minimum payments vs full payments. My god, it felt like a police interrogation. During a pause, I mentioned that I have a Barclays Arrival Plus Credit Card that I use as my primary card. From her tone, it sounded like she didn’t initially notice this while reviewing my application. When she returned, she stated she reviewed my Barclays Arrival Plus account and noticed that I make “substantial payments” (some MS) and thanked me for using my card frequently, (~25 charges per month). She approved me for a decent credit line. Not once during the recon call was I asked why I actually wanted the Barclays US Airways Credit Card, after twenty questions this is just utterly shocking, but I’ll take it!

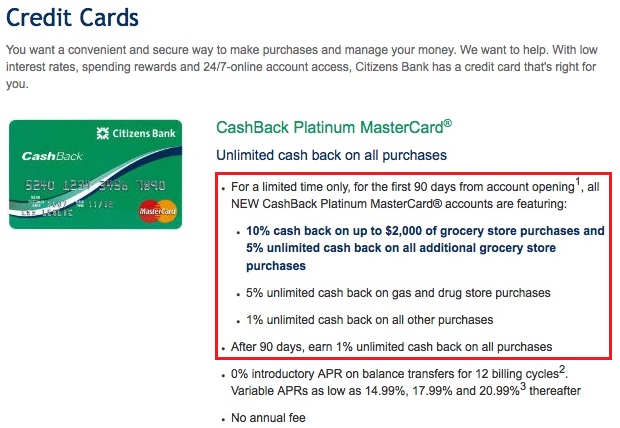

Last but not least, I applied for the Citizens Bank CashBack Platinum Credit Card, which has no signup bonus per se, but does offer 10% cash back on first $2,000 at grocery stores, then 5% cash back at grocery stores, gas stations, and drug stores for 90 days, with no annual fee.

We all know about the recent AMEX Old Blue saga, so I was telling Grant I could probably run tens of thousands of dollars in bonus spend through this card if I were to be approved with a decent credit limit. Although while researching the card, I found reports of people with double my income only getting approved for pitiful lines as small as $500. Aside from that troubling information, I read that Citizens Bank often holds your payment for a week before crediting it to your available credit. Seeing how the Credit Boards database suggested Citizens Bank would pull my Equifax credit report, and since I was unable to apply for the Diners Club Elite Credit Card, I thought what the hell, and submitted an app. Surprise surprise, another pending notification. To their credit, I don’t believe they do instant approvals.

After calling the Citizens Bank application status line daily, which is answered by a human, I was told I was declined due to having more than enough credit accounts (yeah, kind of true). Once the denial letter arrives, I’ll see if it’s possible to call their reconsideration department. Regardless of the outcome of Citizens Bank, I have an easy $4,500 of minimum spend to meet, which will net me almost 200,000 miles/points at a cost of $233 in annual fees which I can easily nullify after a couple trips the grocery store with my AMEX Old Blue.

If you have any questions, please leave a comment below. Nigel or I will be able to answer any questions you may have. Have a great holidays everyone!

Informative post. I never hear of the Citizens Bank offer. A $10K/mo grocery MS action yields $500 in cash back; and if you choose a market with gas points, they can erase any gift card fees – nice!

Navy FCU had a similar 4 pts/$ offer in Nov- Dec, with no limit on all spend. 4 pts/$ = approx 3% Cash back.

Any experience on how sensitive Citizens Bank is to repeat purchases in one day, such as $1500 or 2000 repeat purchases, sometimes needed when “supermarket hopping” :) … to avoid exceeding the daily limits they impose?

I think most banks don’t want to see the same charge at the same business within a short period of time. I think grocery store hopping would be fine.

Hey Grant,

Keep us posted about “match up to the 10,000 anniversary mile offer” for the Barclay card. I tried it by the messaging but it didn’t work. Got the card 2-3 weeks ago. Haven’t tried calling them yet.

Thanks,

Maysam

I’m sure Nigel will update everyone in a few days when he gets his cards and talks to the credit card companies. At least he can get a Barclays card. I’m still trying :)

Nigel, how many inquiries do you have in the past year?

My 2014 inquiries:

Experian: 11

Equifax: 2

Transunion: 4 (Should be 6, but I bumped two off from my June AOR)

Nigel you said you’ve amassed quite a few inquiries. I’m curious approximately what is your avg age of accounts?

Two possible answers for you.

According to Credit Karma, 1.9 years. This is skewed because many years ago my mother added me as an authorized user on her account, that account is currently 14 years old, yet the vast majority of my accounts are under a year and a half in age.

Prior to my Sept AOR, I ordered my FICO report and it said 1 year. I do not believe the latest FICO scoring model takes in to account your oldest AU account. Once you factor in my most recent accounts, I would estimate it around 10 months, surprisingly this alone hasn’t become a limiting factor thus far.

What was the outcome with the Citizens Bank Card. I got denied due to “UNABLE TO VERIFY CREDIT REFERENCES AS PROVIDED”, aka, too many inquiries. Did you call reconsideration, and did you have success?

Nigel was not approved for the Citizens Bank card, due to having too many recent inquiries.

Well the letter officially said “Sufficiently Obligated with Bankcard accounts as the sole reason”. I was telling Grant that I attempted Recon and they said that I have too many accounts, but wanted to help me if I was a banking customer, I am not. I attempted to open a bank account, but I’m out of their service area, so much for that…

Steve, that doesn’t sound like too many inquiries to me, almost like a verification issue, either way I’d ring Recon, if you need the number let me know. Good luck.

Pingback: Giveaway: 4 $450 Chase Checking and Savings Account Sign Up Bonus Coupons | Travel with Grant

Pingback: Guest Post: My Failed 1-800-Flowers Companion Pass Experience | Travel with Grant