How to Convert from a Bluebird Card to an American Express Serve Card

Now you have to chose – Bluebird or Serve? There are pros and cons to each card, but at the end of the day, you can only have one.

Bluebird Card Pros:

- You can load up to $1,000 per day with a $5,000 monthly limit

- You can load funds from a Vanilla Reload Card or at Walmart with a debit/gift card

- You can load an additional $100 online with a debit card with a $1,000 monthly limit

Serve Card Pros:

- You can load up to $1,000 per day with a $5,000 monthly limit

- You can load funds at CVS or 7-11 with cash only (no debit/credit cards accepted)

- You can load up to $200 online with a credit card with a $1,000 monthly limit

- You can load up to $200 online with a debit card with a $1,000 monthly limit

Bluebird and Serve Cons:

You can no longer buy Vanilla Reload Cards with a credit card or load Serve with a credit card, it really comes down to this: how close is your nearest Walmart? If you have a Walmart nearby, you should keep your Bluebird Card, since you can easily load up to $5,000 per month in debit/gift cards in-store and an additional $1,000 online with a debit card. If you do not have a Walmart nearby, you should go with Serve. You can load up to $1,000 per month online with a credit card and another $1,000 online with a debit/gift card. You can do all this without ever stepping inside Walmart (which might be a dream for some of you).

If you do decide to switch from Bluebird to Serve, you will have to call the number on the back of your Bluebird Card (1-877-486-5990) and tell them you want to close your Bluebird Card because you want to open a Serve Card. Make sure your Bluebird Card has a $0 balance before calling to close.

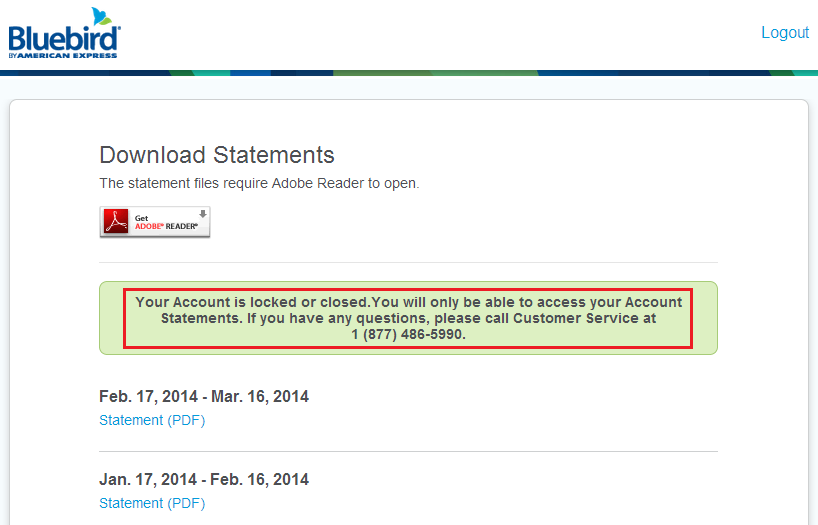

Once you get off the phone, your Bluebird Card will be officially closed, but you will still be able to log into your Bluebird account and view previous monthly statements, but that is it.

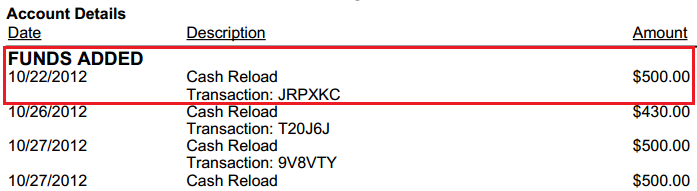

I saw my first Bluebird transactions from October 2012, such a long time with my good friend Bluebird.

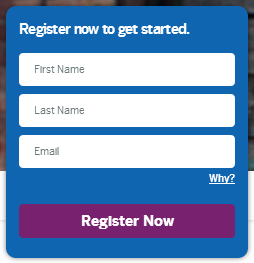

Anyways go over to Serve’s website (www.serve.com) and register for your new Serve Card.

Complete all the necessary information and submit your application. If you just closed your Bluebird Card a few minutes ago, you will probably get this screen. It just means that the phone number you entered matches an existing phone number from Bluebird. To resolve this problem, call the Serve customer service department (1-800-555-4318) and they should be able to approve your new Serve Card.

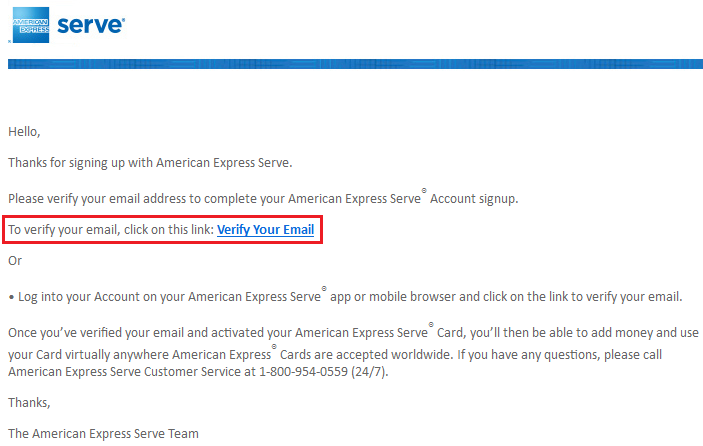

If everything goes well, they will approve your Serve Card and send you a welcome email to verify your email address.

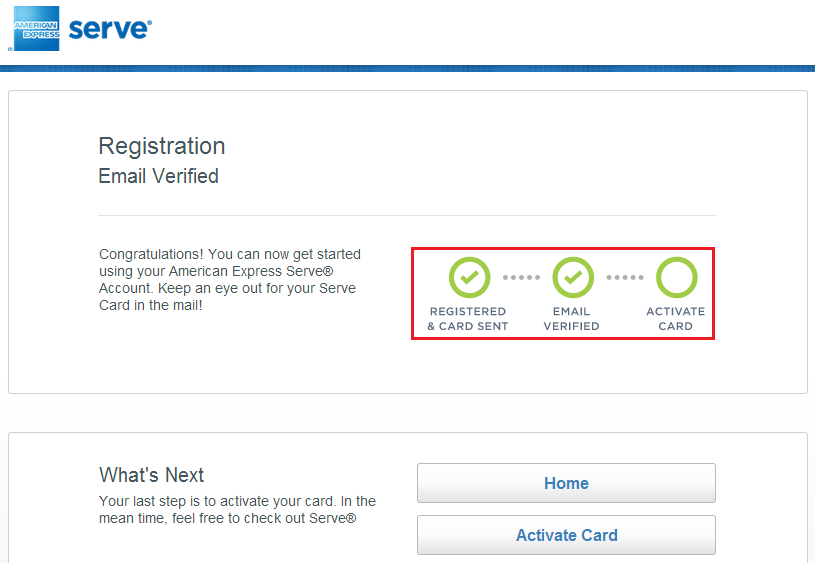

Congratulations, you just verified your email address. Now you will have to wait a few days for your new Serve Card to arrive in the mail.

You should receive this email in a few days stating that your Serve Card has shipped to you.

A few days later, you will get an email from American Express asking you to activate your new Serve Card. Hold onto that email until you receive your Serve Card in the mail, then you can follow the instructions to activating your Serve Card.

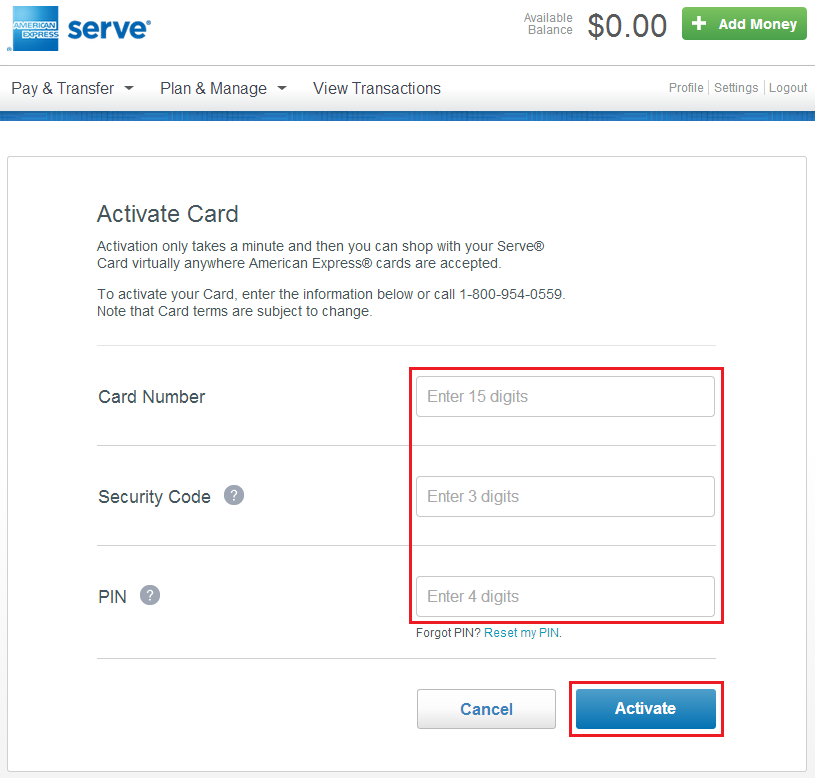

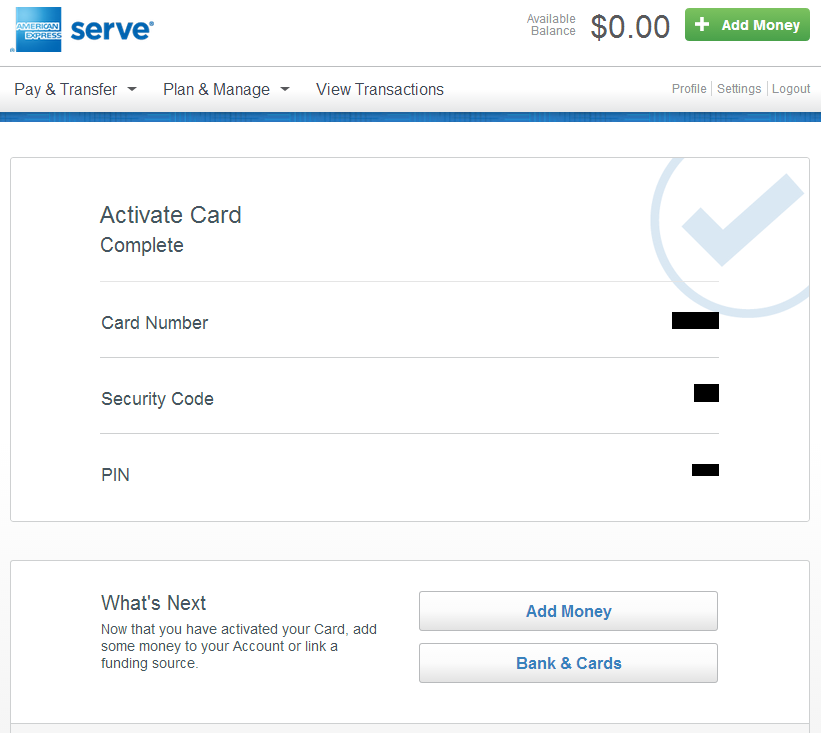

With your new Serve Card, fill in the card information and create a 4 digit PIN. This PIN will be used to add funds to your Serve Card and to withdraw funds from an ATM.

Congratulations, your Serve Card has been activated!

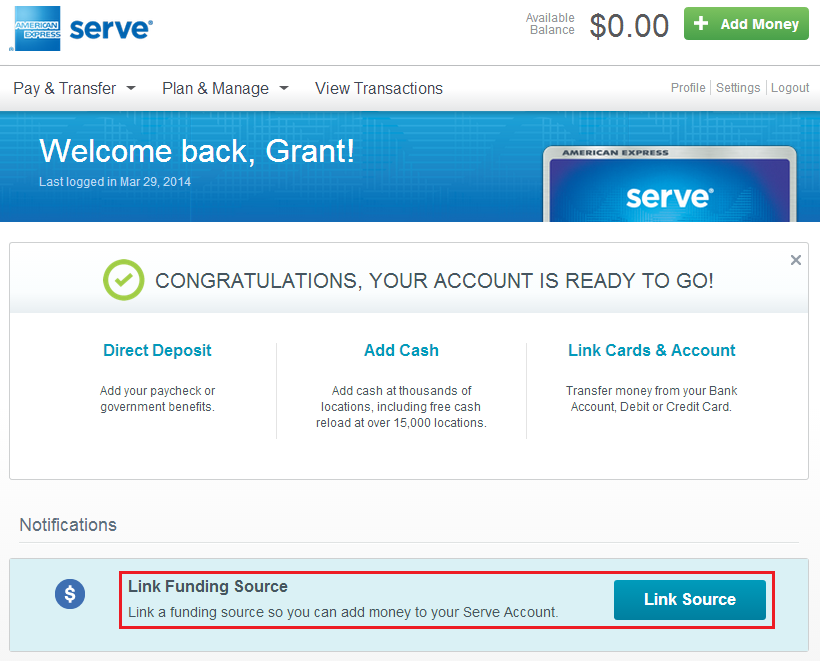

Now from the home page, you will need to start linking funding sources to your Serve account. You can link a bank account (checking or savings), a debit card, and a credit card.

Here is a welcome email from American Express Serve.

If you have any questions about closing your Bluebird Card, opening up a Serve Card, or verifying your new Serve Card, please leave a comment below.

The bottom comments about credit cards and Serve contradict each other:

Serve Card Pros:

You can load up to $1,000 per day with a $5,000 monthly limit

You can load funds at CVS or 7-11 with cash only (no debit/credit cards accepted)

You can load up to $200 online with a credit card with a $1,000 monthly limit

You can load up to $200 online with a debit card with a $1,000 monthly limit

Bluebird and Serve Cons:

You can no longer buy Vanilla Reload Cards with a credit card or load Serve with a credit card, it really comes down to this: how close is your nearest Walmart?

Seems to me, we need a post on switching from Serve back to BB.

Haha just do the steps in reverse.

I’m confused by what you are asking.

This is interesting: I didn’t know you could load Bluebird online up to $1K/month ($100/day) with a debit card. That’s in addition to the $5K at Walmart. However, the first time I tried it, Bluebird declined because the $500 variable Visa gift card (the ones I load at Walmart), cannot have an address assigned to them. Does anyone know the brand of MasterCard and Visa debit cards (variable load up to $500) that can be bought in drug stores and grocery stores (all mine locally let c cards be used for purchase) and have an address assigned? And if you can assign an address, how is this done? In the store? When you take the card home and do it online?

Any help would be appreciated.

The PayPal Debit Card is perfect for this situation. You earn cash back on every reload.

Grant,

This is very helpful information. And Serve is definitely starting to appeal to me because the schlepp out to my nearest Walmart is already getting old, and we’re just one billing cycle in since the big Vanilla Reload crisis! Looks like I’d still have to go to Walmart, but the $1K credit card load per month would save me two trips each month. We have two BB cards, one is in my husband’s name, and our goal is just 5K MS miles per card, per month.

Here are my questions about Serve:

1. Could I load $200 per day with a maximum of $1K per month DIRECTLY and ONLINE from my Delta SkyMiles Amex and/or US Airways Dividend Miles Mastercard?

2. How does that work? Do you need a PIN? I’m not sure I ever assigned a PIN to those cards, but I guess that’s as simple as calling customer service and getting one.

3. Also, do you know if the credit card companies treat this transaction as a cash advance?

Meanwhile, I continue to encounter inconsistencies with the “new” CVS policy for One Vanilla pre-paid debit cards and gift cards. I was denied yesterday at a CVS in Arleta (yes, it’s part of LA proper in the Valley; never heard of it before I started schlepping out to the nearby Walmart) where I had successfully purchased the cards several times since the big policy change. Cashier wouldn’t even try. Last time I was at this same store, I had to persuade the cashier to give it a try, therefore I should have known that store wasn’t going to work for me much longer. Then I bought two $500 One Vanilla Gift Cards as a CVS closer to my house without any issues. Thing is, if I have to make 3 or 4 stops per 1K miles, including the Walmart reload, this is starting not to be worth it to me. I’m hoping that the CVS inconsistencies will subside soon.

Anyone else having similar issues?

Thank you,

Nora

For your Delta and US Airways credit card, you can only use them for credit card loading, not for debit card loading. They will go through as a purchase, not a cash advance. I would use the US Airways credit card instead of the Delta credit card.

Grant – This is my big concern in no longer having access to CC purchased VRs. Is there a guide somewhere as to which credit cards can be used to purchase OneVanilla or other gift cards will register as a purchase vs cash advance?

All credit cards can be used to buy One Vanilla gift cards. None of the banks/credit card companies will charge you a cash advance fee, so use whatever credit card you want.

Many have reported that you won’t get points for loading Serve from an AMEX account.

I’ve not had that issue. However, does anyone know which Mastercard or Visa debit gift card allows for the assigning of an address so that you can transfer that money from the debit card to BB online ($100/day, $1K/month limit)? Neither my $500 variable Visa gift card or Vanilla Visa gift card allows for the assigning of an address which is required for the linking of the debit card as a funding source within the Bluebird account. Does this require a My Vanilla card or something like that? What works?

I’m not sure which gift cards work, but I think the cards that say My Gift Card Site will let you register an address. They have those at Ralph’s grocery stores.

To the earlier point, you say a pro of Serve is that you can load it with a credit card and then in the next paragraph you say you can no longer load Serve with a credit card.

To the other comment, is there anyway to load a Paypal debit card with a credit card. Paypal and Reloadit (among others) seem not to be purchasable via credit card in ANY store I’ve ever been in. Any thoughts?

The good news for me is that my RiteAid’s, Fred Meyers, and local markets allow for buying variable gift cards with credit cards.

I’m not sure where you can get PayPal MyCash Card with a credit card. For Serve, credit cards can be used online to load, but not inside CVS stores.

So, there’s effectively no way to use a credit card to take advantage of the $1K/month debit card online load to BB, right?

The PayPal Debit Card will work. I wrote a post under the Bluebird header about it.

Is it true that you can only have one credit card active with Serve at a time? I think I’ve read that it is a bit of a hassle to change credit cards with Serve. I can foresee changing up between three different credit cards, but I’m wondering if this causes any problems with Serve.

If they are credit cards in your name, and not an authorized user, you should be fine. Don’t change the credit card frequently, maybe once a month or less and you should be fine.

Discover has a promotion to spend $3K month for six months, make $680 in cash back. Nothing to sneeze at, but I’ve got a Chase SP that I need to squeeze in $3K total spend to get 45K UR points. Nothing to sneeze at either. And once all of this is over, I’ll probably just use Fido Amex for Serve. Right now I have Discover set up, but probably should have set up Sapphire to finish off the $3K spend. And then, of course, change back to Discover. All within 13 days. Probably not a good idea. Clearly evident that I’m not a MS heavy hitter, but I’m content with my scraps.

That should be “spend $3K EACH MONTH for six months”.

What are the consequences of linking an authorized user card? Do you know if the same applies to debit card funding on a Bluebird card? I would like to try to liquidate Paypal funds on a BB card that is not in my name. I know I can create an authorized user card for the BB acct holder, but will linking and funding with that card get me shut down?

Probably not shut down but Bluebird won’t let you load with that card until it verifies that you are the primary card holder.

What’s the Discover promotion? Do you have a URL?

It started April 1st, and I’ve seen it mentioned by several others that it is a targeted offer. I didn’t use the card much at all, so I may be targeted to people to stimulate usage. It was a link on my opening account page over on the right side.

What’s the card and URL?

Discover IT (recently converted from Discover Motiva). The promotion is for $500 cash back, but I had it confirmed that 5% rotating categories and 1% every thing else is still in play, so the cash back will actually be at least $680, probably a good bit more.

I found this offer on FatWallet: http://www.fatwallet.com/forums/finance/1339107/

Update: I called Discover but they cannot add targeted promotions onto your account. They send out targeted promotions via mail and you have to receive the letter to be eligible for the promo. Bummer, hopefully I get a special offer soon.

They aren’t letting me get a Serve account for 31 days…talked to 2 different people. First one said all I have to do is change my email address and phone number and I could have both accounts (didn’t work) second person I talked to told me basically too bad, I have to wait.

That’s lame. I was able to do it the same day. What will you do, keep Bluebird or close it and wait 31 days?

Hey Ryan, are you still waiting or did you somehow work it out so that you didnt have to wait 30 days? It seems pretty arbitrary who has to wait 30 days and who gets a pass by a CSR.

Nope, I got thru! I made an accidental error while filling in my SSN, and got the ‘review’ screen instead of denial. I called in and they emailed me a link to upload a picture of my DL and SSN card and poof, I was approved. Although it did take 2.5 weeks to get my card in the mail….

Good work Ryan. Glad you got your new card.

Funny, I made the same mistake ;) Dyslexic travel hackers unite! Approved. Though people calling and saying “I made a mistake with my ssn” (instead of calling to “verify whatever I need to for approval”) is surely going to rouse suspicions in no time. Glad I got in before they caught on.

Congrats Jonathan!

People that call and say they messed it up are not gonna get accelerated thru, the ones who call and ask why will be given some ‘slack’

I’m sure they will help you regardless of what your excuse is.

I cancelled it. I’ll keep trying

Good luck, hopefully they can help you get your Serve Card approved.

Can you load bb to the max. Clear your account to 0 and cancel. Then get serve and load another $5k to serve in the same month?

Yes, but I think you have to wait 30 or 31 days between closing one account and opening the other account.

Rep told me if you cancel BB, wait 24 hours to apply for Serve. If you are denied, you’ll have to wait 30 days to reapply and then another 10 or so to get the card. I’m guessing most people have to wait 30 days due to the multiple month loading issues.

It seems to vary from person to person.

I am recently thinking about getting a serve via ISIS. Just a little concern: suppose I use my chase freedom to load $1000 to my serve, then my freedom is gonna have at $1000 bill. If I use serve to pay back this $1000, would this cycling trigger review? If I use serve only pay a portion of it, would this be safer?

You should be fine doing the full bill payment of $1,000. I wouldn’t load and unload your Serve card on the same day. Just let the money sit for a few days.

As mentioned in Glycine comment If i were to get serve could i load it with $1000 from my amx everyday card (CC). Wait and then pay it back to my amx even though it is the same company? Thanks

Would my cc company card me for cash adv. by using this?

No, all online Serve loads are processed as normal purchases.

Yes that should work. There are some reports that AMEX cards don’t earn points for online Serve reloads, but I haven’t tested that out yet.

same thing happened to me. Reports on FT say this is becoming more common

I have my temp card and I tried adding $50 to my account using a Visa Amazon card to see if this works and it didn’t allow me to add money? Do I need to wait for my actual card to start loading money into it? Thanks,

I think you have to wait until your permanent Serve Card arrives.

Thanks Grant, Found your site recently and I think your a great help! When will you raffle a free plane ticket? lol jk

Maybe by the year 2020 I will have enough Amazon profit for an airplane ticket. I’m currently sitting on $3.68 for May :/

So for the Serve ‘debit card’ online loads does anyone know for sure on the following if they work or not…

PayPal regular prepaid re loadable debit- I think I saw that it does on here

PayPal Business re loadable debit-Grant mentioned it does, with cash back

Account Now?

Visa Rush?

Any VGC purchased at grocery stores, then registered online with name address etc

The only PayPal card that works is the PayPal Business Debit Card. You can only get it if you have a business or premier PayPal account.

Somehow I ended up with a Premier account…I clicked a few links and got an email saying I have a business card on the way….I thought I was clicking the regular card link…hopefully it wont confuse me too much. I did figure out that I can buy a paypal my cash card, load it to my regular PayPal, then pull it into the prepaid card which is a bank account from Bancorp, and then have bills come out of that. It comes with a routing number and bank account number…

But now with the Business card I am not sure I need all of that…What do you think Grant? Hope I didn’t lose you….

A premier or business PayPal account is great for eBay sellers since you can accept credit and debit cards from buyers.

What are Visa Rush and Account Now?

Other prepaid debit cards that load with Money Packs

Grant, I am a newcomer to all of this Serve, Vanilla, Bluebird info and don’t really understand how it all works for procuring points or miles. Is there an initial blog discussioor something that would help explain it all to me?

Good morning Leslie, I don’t have an initial blog post, but maybe this post will help explain: http://travelwithgrant.com/2014/06/07/my-favorite-credit-cards-for-manufactured-spend/

Basically, the purpose of use Bluebird, Serve, or Go Bank is to generate miles and points on a credit card for a cheaper price than the value you get out of them by redeeming the miles and points.

For example, if you buy a $500 gift card at CVS, some cards offer 5% cash back, so you are essentially getting $25 cash back by purchasing a $500 with a $5 activation fee. Then you use Bluebird, Serve, or Go Bank to convert that gift card back into cash. Let me know if you have any other questions I can help answer for you. Thank you.

Can we reload american serve with money pack if so why we need blue bird?

I don’t think you can load AMEX Serve with MoneyPak cards.

The easiest way is to send me an email directly: grant at travel with grant dot com. I’ll send you an email soon. Thank you Leslie.

I canceled my bluebird yesterday morning, and signed up for Serve with ISIS later the same day using the ISIS mobile app. I was approved without issues (and without using a fake SSN). I was told I’ll get the serve card in 7-10 days, but I can already load my account with a cc, $200/day.

Now that you can also load Serve at Walmart, I really don’t see any good reason to stick with Bluebird (unless you really need those paper checks).

I’m glad it was easy to cancel Bluebird and get a Serve Card. I guess the SSN trick is not necessary for some people.

how do you sign up for serve through isis please?

Good evening Gene, I have no idea. I wouldn’t worry about ISIS, Serve is good enough by itself. Maybe someone can share their experience with you.

As I understand you are no longer could load gift cards in wallmart into blue bird. I need help, I procrastinate and am stuck with metabank visa gift cards. I do have a bluebird. I also need to hit spend of 3000 for ink fast. Any help, please?

Metabank gift cards will still work to load to your Bluebird Card.

Wait a second, so “You can no longer buy Vanilla Reload Cards with a credit card or load Serve with a credit card…” but “you should go with Serve. You can load up to $1,000 per month online with a credit card and another $1,000 online with a debit/gift card.” ??? Are not those 2 statements contradictory? Correct me if I am wrong but if one cannot load Serve with CC why would he/she go with Serve?

Hi Grant. Do you know anything about Balance Financial, available through Walgreens? The fees aren’t a real issue for me -I just have to meet some min. spends and am willing to pay a little more. I was told by a Walgreens manager they can be funded with a CC, then one can simply withdraw cash. I have no data points to confirm this. Anyone have experience with Balance Financial? Thanks!

Interesting, I will ask my friend Will about this and report back my findings.

Hi Grant…Just got my Bluebird account last week at Walmart, but then noticed yesterday they offer the Serve card as well…I’ve been looking everywhere for the differences between the two and basically all it comes down to is the amount of money you can load on a BB vs a Serve, paper checks, and Serve can earn points and also be attached to an Amex Isis account?

Unfortunately, I am a sprint customer so I guess I can’t get Isis…So since I can’t get Isis, should I go through the trouble of closing my BB account to go with Serve or not? And you don’t need to use a real SSN when applying for your real BB or Serve cards???

Thanks!

B.J.

The only real different between Serve and Bluebird is Serve has the ability to load $1,000 to your Serve Card with a credit card. Bluebird does not have this feature. If that is a big deal for you, then you might want to switch. But Bluebird is really good, so you might want to hold on to that card for a few weeks and see how you like using it.

Thanks for the helpful info! Switching from Bluebird to Serve was a pretty smooth transaction.

Good to hear. You will like Serve, I think it is better than Bluebird.

Hi Grant,

Do you know if you can use Serve to buy a money order at WalMart?

I’m not sure if you can/cannot, but I would definitely no recommend that. Serve is just like an online bank account, the money is already in your account. If you buy a money order, you will have to pay a fee and then deposit the money order at your bank. If you have money on your Serve Card, you should just do bill pay or withdraw the funds to your bank account. That is free and easy.

Agreed, I have always used bill pay for my CC bills, but in an upcoming one-time payment to someone, I have to hand deliver a check, so the online bill pay is just not gonna work. You recommend just withdrawing the cash and writing a check out of my personal? Money orders at WM are only 70 cents, so it seemed like an easy solution.

I would just write a check from your personal checking account and saving the funds in Serve for another bill. I am not sure if you can use an AMEX card at Walmart to buy a money order, but I suppose you can try.

Hi Grant,

Great forum.

Do you think now SERVE is even better because One Vanilla GCs can no longer be loaded at Walmart? Also do you know any of the major credit cards (Chase, Citi, BofA, Discover) take online loading at SERVE as Cash Advances?

Thanks much.

Actually OVGCs are working again. I have loaded 3 already this weekend. It is an unpublished MS opportunity. With that said, no issuer charges cash advance fees, but AMEX will not give points/miles for funding Serve online.

Great, thanks again!

I would not try with AMEX anyway, it is not exactly normal purchases:-)

OVGCs are working again? Is this with the work around or can I I load without workaround like other non vanilla visa GCs? I wasn’t able to get work around to work for me when Walmart updated systems couple months back so been using GCs from FoodCo (raulphs) ever since but OVGC are easier for me to purchase. Also too bad Amex doesn’t give points for loading Serve, this would have been perfect for my Old Blue Cash CC. Still I think I’ll dump BB for Serve. Hope I don’t have to wait the 31 days

OVGCs are working but require the change payment workaround. Good luck!

Are there any current bonuses/referrals for opening(switching) to Serve ? Tx

No bonuses or referrals for switching, but they have promo every so often. Last month they had a $50 bonus if you had 2 qualifying direct deposits of $250 or more. I got the bonus on all 3 of my Serve Cards (mine, mom, and dad).

Yeah, 50,000 MR points. Oye!

Haha, I wish!

Closed two BB accounts last week and received the 1st Serve card today. Linked bank & CC and made initial deposit of $200 which posted in seconds. I used Club Carlson card, $.06 value per point x 5 = 3 cents per $. Now have Amex 4 Target (4 accounts) which I use for AGC’s, Amazon Payment (2 accounts) & Serve (2 accounts) so I can MS $6K each month. I use Evolve to pay misc. bills w/ GC’s. Have the TD go x 2 but that is dead. Looking for other options. Do you have any suggestions, Grant?

You seem to have everything covered, but I think your statement “MS $6K each month” is a bit off. You can always do money orders to increase MS. I do about $20k per month across 3 Serve Cards, a Go Bank card, an AMEX Target, and Amazon Payments. That takes about 2-3 hours per week, so it is a decent trade off.

If the additional MS has anything to do w/ Walmart, I’ve had zero luck here in NJ.

Hmm, can you buy money orders anywhere else? Many grocery stores sell them. I’m not an expert on money orders, but that is what I have heard from several people.

I think Serve ISIS (now called Softcard, I think?), allows for $1500 a month funding via CC. I could be mistaken, but thought Id mention there may be a difference between the two.

Yes, you are right. Softcard (what FM calls SoftServe) allows $1,500/month with online debit card reloads and $1,500/month with online credit card reloads. It is just a pain to get Softcard if you do not have the right smarty phone to begin with.

Hi Grant,

Do you know if loading One Vanilla at Walmart with the workaround still working? Thanks much.

I haven’t tried the workaround in many weeks, so I’m not sure if it still works. If you have any OVGCs, test out your local Walmart and see if the workaround still works. You may want to test at the Kiosk, the Money Center, and at a checkout lane.