Think of Credit Karma and Credit Sesame as peanut butter and jelly – by themselves they are pretty good, but together they are great! I will cover the following topics:

- Which is better, Credit Karma or Credit Sesame?

- How do I Sign Up for Credit Karma?

- How do I use Credit Karma?

- What are these other Scores from Credit Karma?

- How do I Sign Up for Credit Sesame?

- How do I use Credit Sesame?

Which is better, Credit Karma or Credit Sesame?

This is the modern-day Pepsi vs. Coke debate. It all depends on which site reports a higher credit score. Since both sites are free, I use and recommend both sites. You can’t go wrong using both.

How do I Sign Up for Credit Karma?

Go to Credit Karma and sign up now for free! in the upper right corner.

Fill out the entire form and check both boxes at the bottom to be alerted of changes to your credit score. Then click NEXT STEP.

Congratulations, your Credit Karma account is created.

Please complete the rest of the form, including your address, date of birth, and social security number. You may omit your monthly or annual household income, if you wish. Credit Karma uses your social security number to retrieve your TransUnion credit score (the other credit reporting bureaus are Experian and Equifax).

Your information allows us to securely retrieve your credit scores from TransUnion. For the best results, avoid nicknames and use full addresses.

Your information is secure with Credit Karma.

Credit Karma uses bank-level information security.

Credit Karma does not sell, rent, or share your personal information with third parties. Any information shared with partners will be submitted by you with your explicit consent.

Check the box next to the Terms of Use and click NEXT STEP.

Unfortunately since I already have a Credit Karma account, it will not let me use the same social security number twice. You should be able to confirm your identity on the next page. After that page is complete, I will show you how to use Credit Karma.

Log into your Credit Karma account by clicking the link in the upper right corner. After you log in, your account should update with all the credit card and home/auto loans you have attached to your TransUnion score.

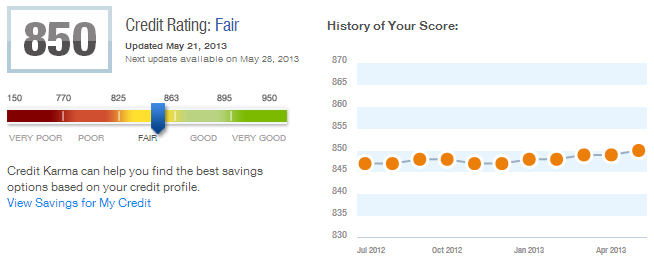

On the left side, it shows my Credit Karma “report card.” The score at the top is not my real credit score, it is what is called a FAKO not a FICO score. Credit Karma uses the data from TransUnion and runs my information through their own algorithms to determine the score above. If I were to request my real credit score from TransUnion, it may be higher or lower by a few points. Credit Karma determined that my score is almost in the excellent range.

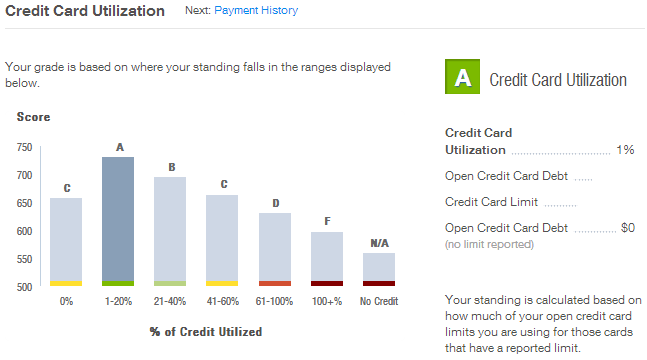

Credit Card Utilization – percentage of your credit limits that you’re using. It’s calculated by dividing your credit card balances by your credit limits. Generally, the higher your utilization (the more credit card debt you have), the lower your credit score. Using between 1-20% of my available credit improves my credit score.

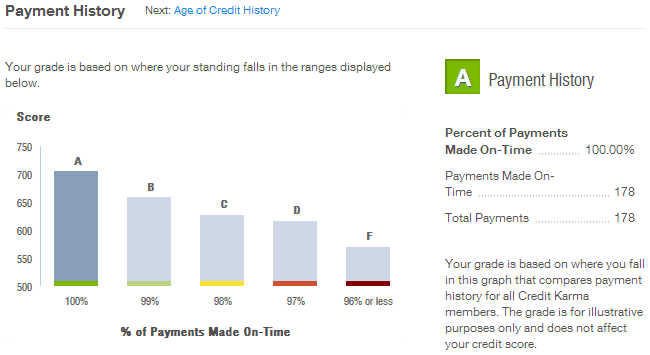

Payment History – percent of payments you have made on-time helps show how reliable you are in meeting your billing obligations. It’s an important component of your credit score. Ensuring that you make all your payments on-time, even if you only pay the minimum amount due, is a great way to build your credit health. Missing or paying late only 1 or 2 times can have a big impact on your credit score.

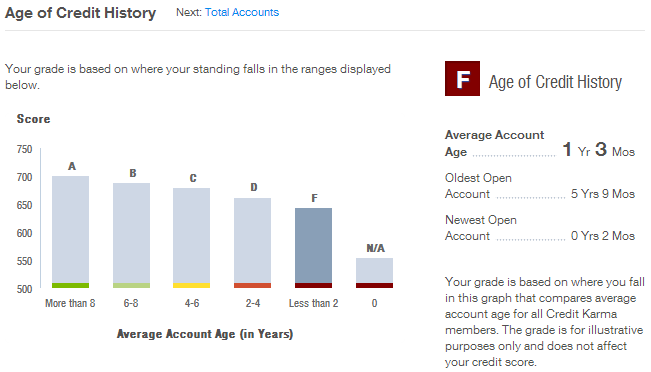

Average Age of Credit History – the length and depth of your credit history is a significant component of your credit score. The amount of time your credit accounts have been open, averaged across all of your accounts, helps measure the length of your credit history. When possible, keep old accounts open and in good standing. This is my worst category because my credit history is only a few years old. Be default, you will start at 0 years old and be able to work your way up.

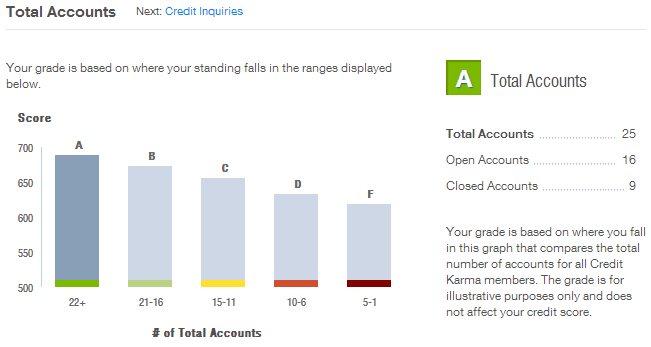

Total Accounts – another measure of your creditworthiness. Consumers with more credit accounts typically have better credit scores because it means more lenders have granted credit. This metric represents the total number of accounts listed on your TransUnion credit report. This is an interesting metric because it includes both open and closed (credit card) accounts. Interestingly enough, having more cards is helping my credit score – contrary to what most people think.

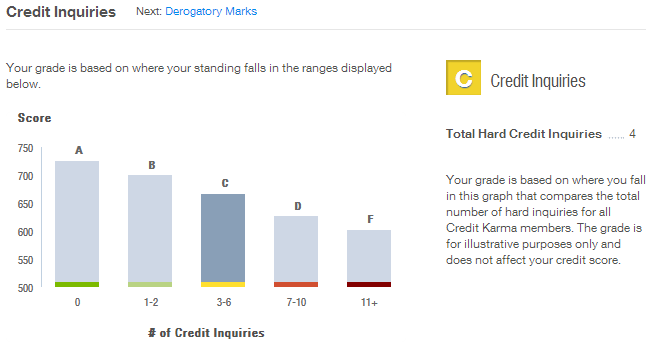

Credit Inquiries – hard credit inquiries are placed on your credit report whenever you apply for credit, like a credit card or loan. This number represents the number of hard inquiries reported on your credit over the last two years. Soft credit inquiries, like the kind used by Credit Karma, do not impact your credit score and are not included in this number. Less recent credit inquiries (hard credit pulls) are better. This has a small impact on your credit score – contrary to what most people think.

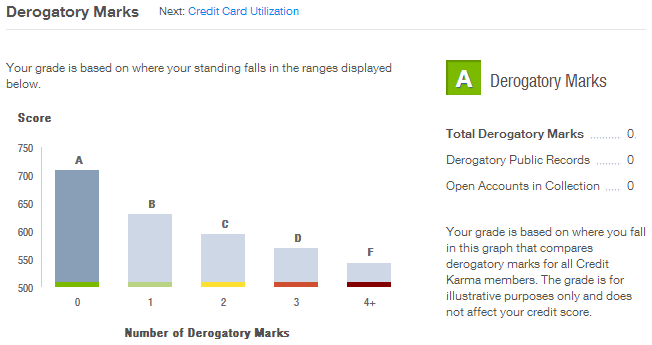

Derogatory Marks – accounts in collections, bankruptcies, civil judgments, and liens are items on your credit report called derogatory marks. To maintain a good credit score you should avoid any derogatory marks on your credit report. It can take from 7-15 years for a derogatory mark to be cleared from your credit history. Having 1 or 2 derogatory marks can really hurt your credit score.

What are these other Scores from Credit Karma?

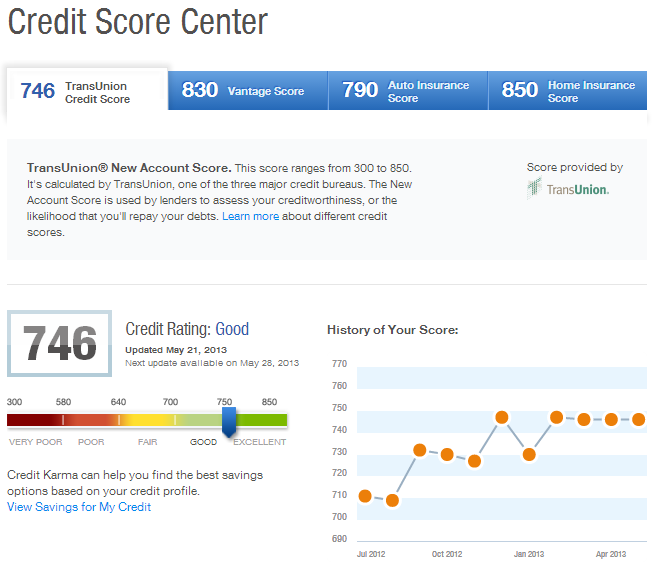

When I click on my 746 Credit Karma score, I will be able to see additional scores.

Credit Karma’s Credit Score Center shows how my TransUnion credit score has changed over the months. Older your Credit Karma accounts will have more dots on the chart.

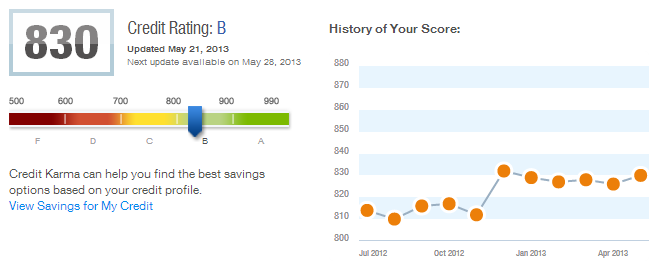

Credit Karma’s Vantage Score was created through a collaboration by the three major credit bureaus: Equifax, Experian and TransUnion. It aims to make credit scoring more consistent and accurate across all the bureaus.

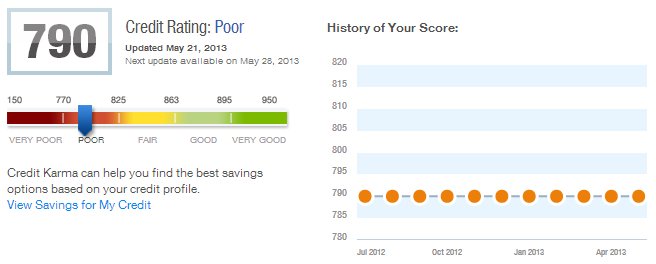

Credit Karma’s Auto Insurance Score is calculated using data from your TransUnion credit report and is used primarily by auto insurance companies to help assess the likelihood that you’ll file an insurance claim. It is not based on your driving record. My parents pay for my auto insurance so it won’t show up on this report.

Credit Karma’s Home Insurance Score is calculated using data from your TransUnion credit report and is used primarily by home insurance companies to help assess the likelihood that you’ll file an insurance claim. I don’t own a home so I ignore this score.

Credit Karma offers many more features at the top of the page that are worth checking out.

How do I Sign Up for Credit Sesame?

Go to www.creditsesame.com and click the sign up button in the upper right corner. (I earn $2.50 commission for each person who signs up with my link. Thank you.)

Completely fill out the form and verify your email address.

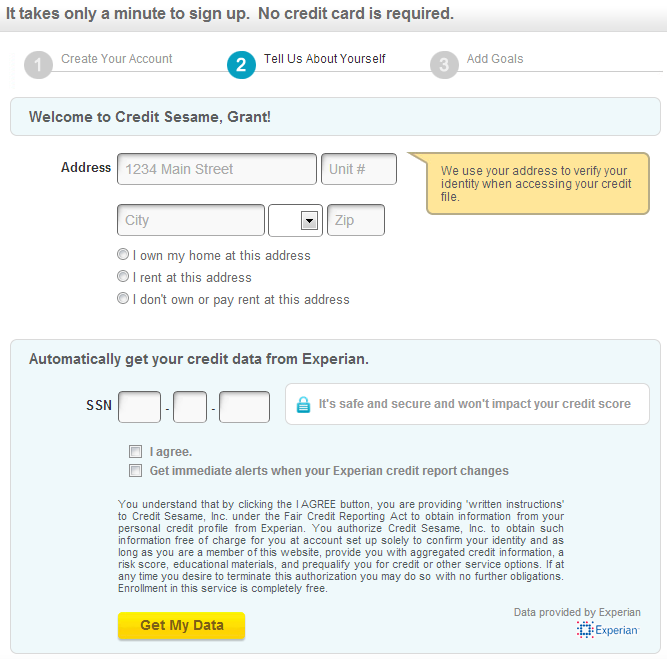

Please enter your address, social security number, and check both boxes. As you can tell by the logo at the bottom of the image, Credit Sesame is using Experian instead of TransUnion. These companies provide very similar services. Congratulations, your Credit Sesame account is ready to go.

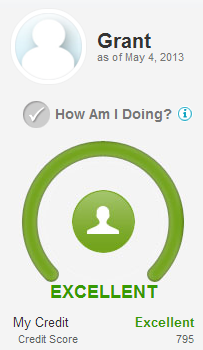

After you log into your account, Credit Sesame will pull your information from Experian, analyse the data using their algorithms and give you a score. My Credit Sesame score is 795 which puts me in the excellent range.

Click the banner below your score to purchase your real FICO score from Experian.

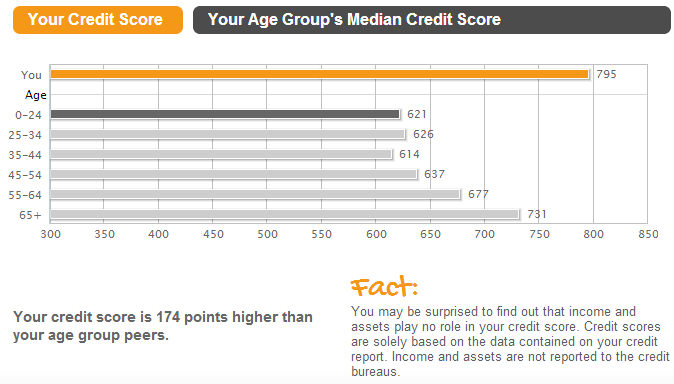

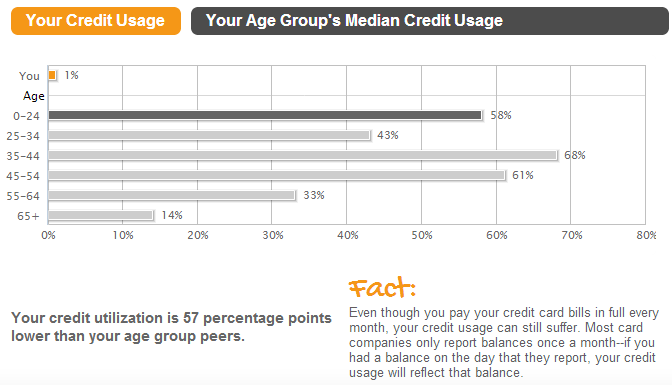

Like Credit Karma, Credit Sesame has a timeline of your credit score. At the bottom, you can compare your score with those of other people your same age. Hopefully your score is higher than theirs.

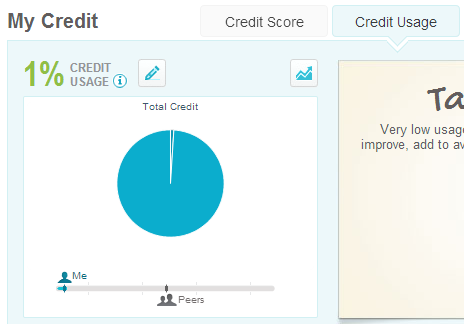

Next to that, they provide a pie chart of your credit utilization ratio. At the bottom, you can see how you compare to other people your same age. Hopefully your credit utilization usage is less than theirs.

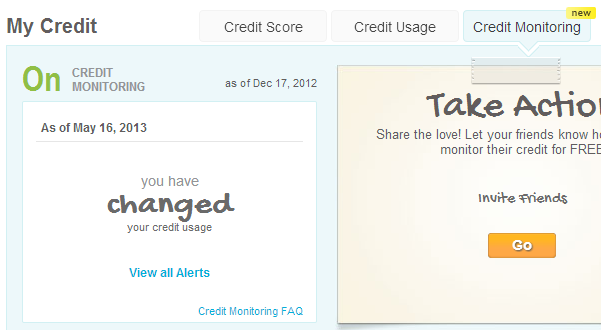

The last tab will let you know if you have had any recent credit inquires.

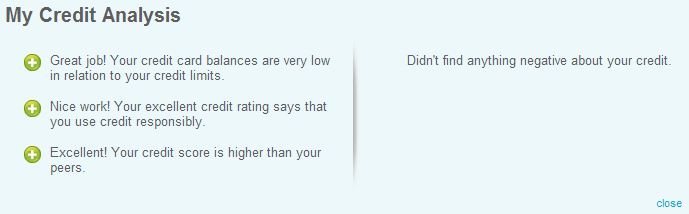

Below that, Credit Sesame will give you their opinion of your credit history.

Click this icon to see how you compare with your peers. ![]() My credit score is 174 points higher than other people in the 0-24 age group.

My credit score is 174 points higher than other people in the 0-24 age group.

My credit utilization ratio is 57% lower than other people in the 0-24 age group.

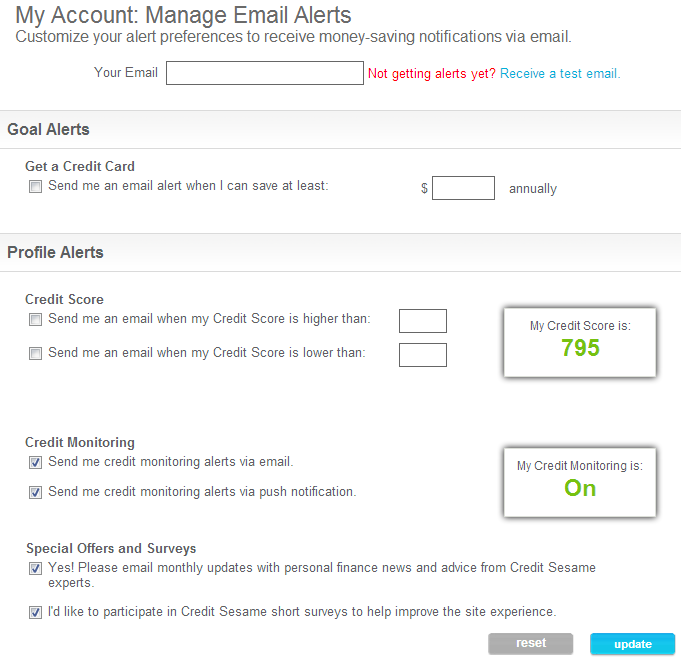

Click the bells icon to set your alerts. ![]() You can set specific alerts to notify you when your credit score changes and whether you want free credit monitoring on or off.

You can set specific alerts to notify you when your credit score changes and whether you want free credit monitoring on or off.

At the top of the page are links to other Credit Sesame services.

If you have any questions, please leave a comment below.

Pingback: Google Wallet Invite? | Travel with Grant

Why no love for Quizzle? At least with Quizzle you get access to a complete Equifax credit report and it uses VantageScore (as does Credit Karma).

I had never heard of Quizzle. I will look into it soon.

Credit sesame now also offers free identity theft insurance and access to a live rep if you’re a victim of identity theft.

Very cool, did you enroll in the service?

when I was signing up for credit seasame, they provided me those security questions about my ssn usage that I’m sure I was never a part of..So I answered none of the above, then they say I answered the question wrong and temporarily blocked my account :(((

similar things happened to Mint and Quizzle..

Hmm. Can you try to sign up after a few day?