Why Did my Credit Score Tank? Analyzing Credit Karma and Credit Sesame for Answers

Like every good points and miles junkie, I check my credit score with Credit Karma and Credit Sesame at least once a month. My credit score is the magic key to getting hundreds of thousands of points and miles each year from credit card sign up bonuses. Without a good/excellent credit score, I would not be approved for many of the best offers out there, so I try to take very good care of my credit score. If you are unfamiliar with Credit Karma or Credit Sesame, please read my tutorial page.

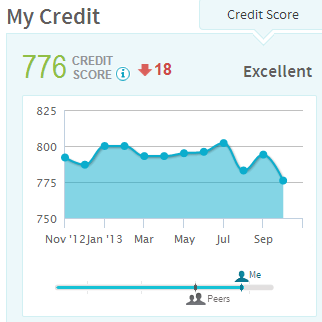

Today, I logged into my Credit Sesame account and saw the above picture. A drop of 18 points is strange since I didn’t do anything to deserve the drop. I didn’t:

- Apply for a new credit card(s)

- Close an existing credit card

- Lower my credit limit

- Forget to pay a credit card bill

- Apply for a car loan or mortgage

I still couldn’t figure out why my score dropped, so I had to do some research.

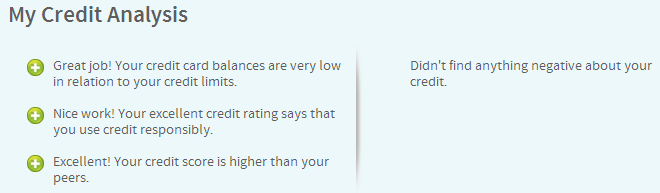

I looked at Credit Sesame’s credit analysis but it did not tell me anything.

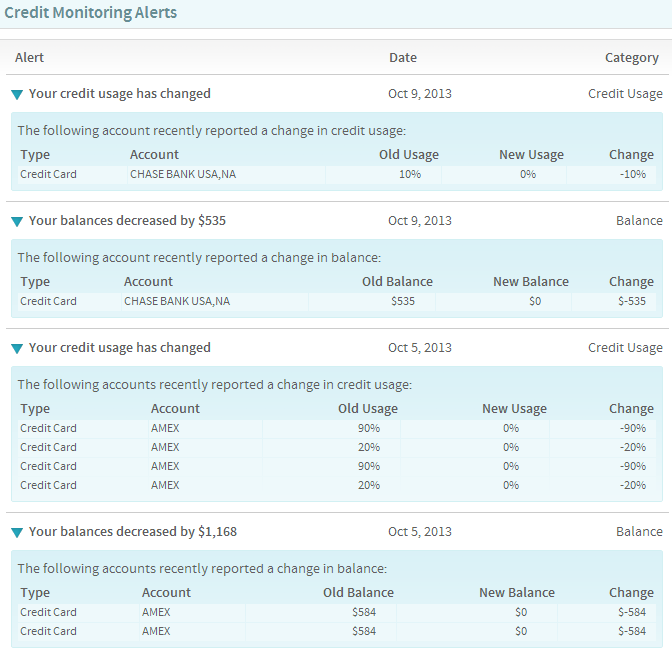

I looked at Credit Sesame’s credit monitoring alerts, but didn’t see anything wrong there.

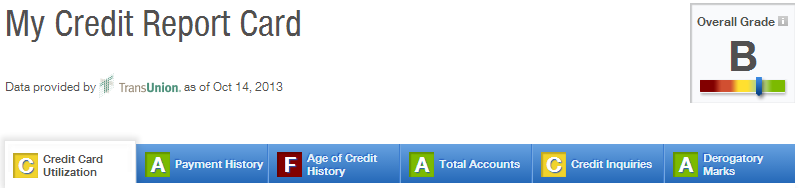

I wanted to get a second opinion, so I logged into my Credit Karma account to see if I could figure out what happened. Here is my Credit Karma credit report card.

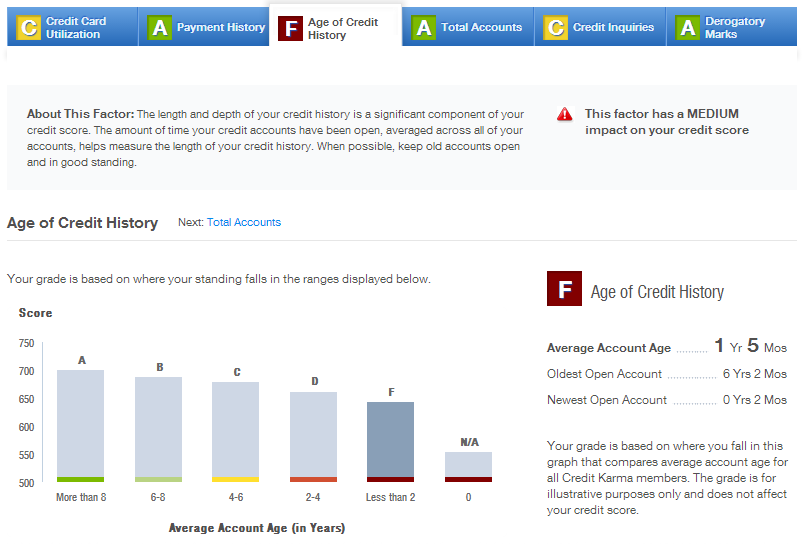

If you read the above Credit Karma and Credit Sesame page, I explain what each category means. Believe it or not, the “F Age of Credit History” has been that score for a very long time, so that didn’t surprise me. Since I apply for a lot of new credit cards, my average age of credit card accounts has always been low. I am working on keeping cards longer, but I think this will take a very long time (many years) to get to an A range.

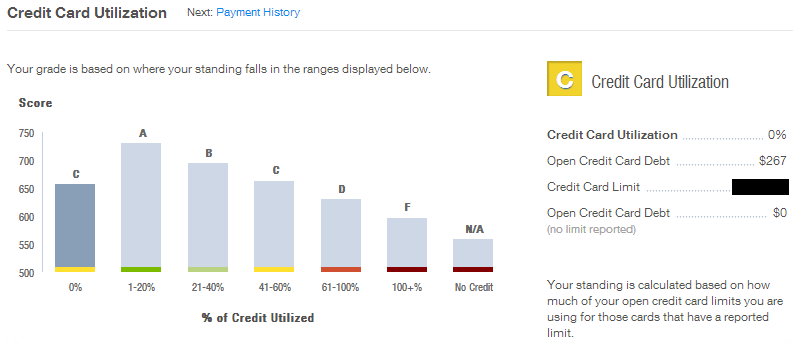

Anyways, this is what I think the problem is. My credit card utilization ratio is too low. In fact, Credit Karma says I am using 0% of my available credit. Some how, 0% is a bad number and subsequently decreases my credit score. I thought I was doing the right thing by paying off my bills early before the statement closes each month. But I guess not.

This line graph illustrates my credit card utilization ratio over the last few months. As you can see, I have an extremely low ratio since I have always paid off my balances before the statement closes.

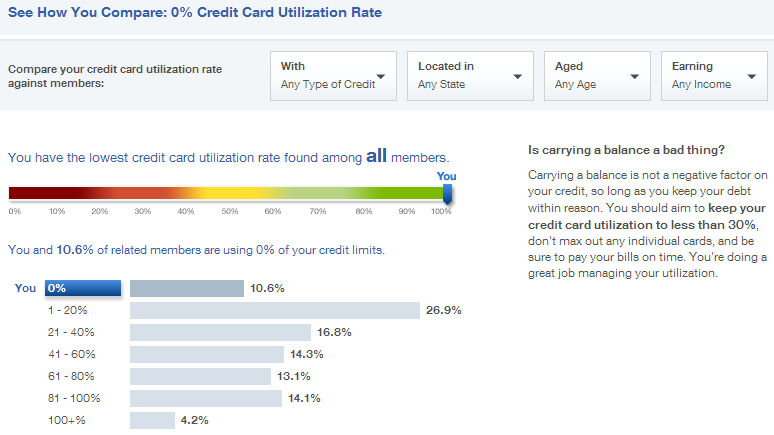

Lastly, this bar graph shows that I am not alone. 10% of Credit Karma users fall into the same category as me.

So, the moral of the story appears to be: do not pay off your entire balance before your statement closes. To test my hypothesis, I will leave around $10 on each of my credit cards so when the statement closes, that small balance will increase my credit utilization ratio. I have quite a few credit cards, so I am curious what this will do to my credit score.

Do you have any suggestions or answers for me? If you have any questions, please leave a comment below.

I’m in the same boat and was just talking to miles/points friends about this tonight. I’m curious to see a follow up post from you on this in a few weeks.

You got it DJ, 90% of my credit card statements close at the beginning of the month, so I hope my score improves in a few weeks. I guess you are in that 10% group with me on Credit Karma :)

Gosh Grant, I sure hope you can get your score up over 790 again because 776 really sucks!!! LOL

Have pitty on me Brant :(

Bad Idea….Most cards will charge you finance charges on your entire next months balance if you carry forward a balance. A better tactic would be to schedule payments automatically after the statement date.

I’m not talking about carry a balance and paying interest, I am talking about paying off my balance AFTER my statement closes, not BEFORE it closes.

Why do you pay before the statement closes? Just wait until you get the statement and pay before the due date.

I’m not like most people, I like logging into my credit card accounts and paying off all my charges as soon as they show up online. I like seeing $0.00 balances on all my cards. It will be tough for me to switch to the “normal” way of paying credit card bills.

Grant, you’re not “normal”. LOL I pay my balance off the same day I receive the statement. I still like to get paper copies. Easier for me to keep track than email notices that are lost in my inbox.

I do all electronic statements. It’s easier for me to keep track of online statements than paper statements.

I noticed the same thing, 0% is a bad thing? So I started letting it wait until the statement posted instead of paying off early. Now I show 1 to 3%.

Thanks for the data point Scott. I will leave $10 on all my cards and wait for the statements to close before paying off the balances.

I’m in the golden A range.. On the balance section anyways i mirror you in almost every other way… my answer 0% interest. I have mine invested in stocks because I want some gains and am earning decent money so could afford the loss. But take out like 5k on a card that has 0% interest for like 18 months put it into a CD earning 1% make 75 bucks and have a higher score…

You are spending too much time in these websites. Wait for the statement to close, pay it off. Keep it simple. I almost never prepay, even with high 5 figures!

I will try my best not to prepay. It will be tough for me.

I also pay early. Iam wondering if having authorized users and /or being AU affects my score. Mine went down 33pts when I started this in June. Luckily, it was 820 to start.

I am keeping $5-$10 on all of my cards until the statements close and will see if my score shoots back up. You have a great credit score, I am jealous.