My Credit Score Jumped 32 Points this Month (Credit Sesame)

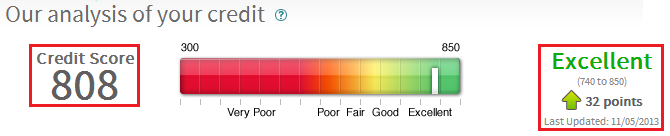

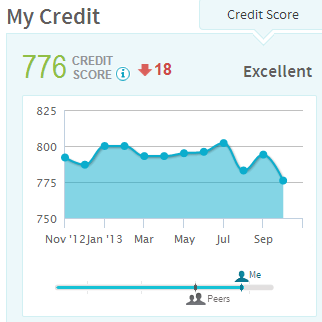

This is pretty good news considering my credit score fell 18 points last month for no apparent reason. If you didn’t read my post from last month, I highly recommend that you read it now (link).

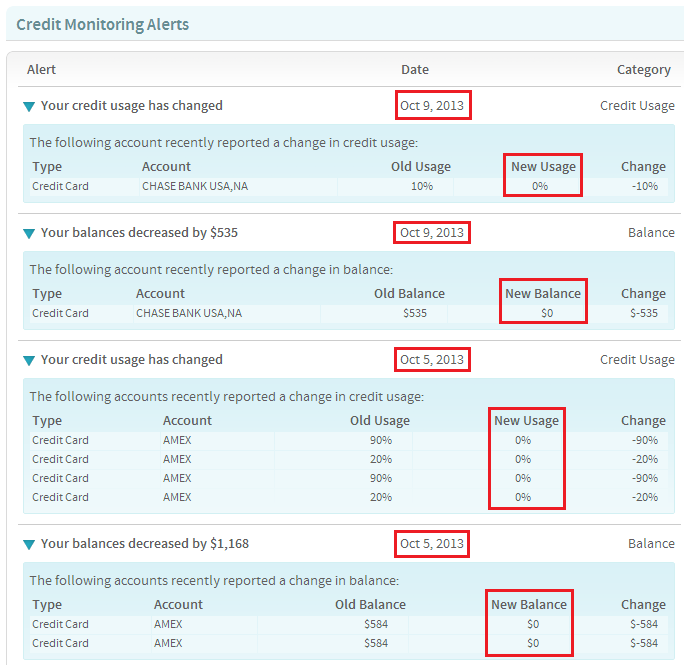

Based on the information Credit Sesame and Credit Karma were showing me, it appeared that my credit utilization ratio was too low, like 0%. Credit utilization is how much you spend on your card divided by your total credit limit, so $1,000 in spend on a $10,00 credit limit represents a 10% credit utilization ratio. Apparently paying all your credit card bills before the statement closes and having the banks report $0 balance on all your credit cards is a bad thing. All those $0 and 0% are bad for my credit score.

Anyways, to fix this problem, I decided I would charge $5-$10 on all 17 of my credit cards this month and see if that would change (hopefully improve) my credit score. Some of my credit cards are used several times a month, but others sit comfortably in my desk drawer. I decided to take all my active cards out and make a small charge on each one.

- $5 BofA HA Card – paid $5 10/24/2013

- $5 BofA VA Card – paid $5 11/4/2013

- $5 Citi AA MC Card – paid $5 11/6/2013

- $5 Citi AA AM Card – paid $5 11/6/2013

- $5 Citi Forward Card – paid $5 11/6/2013

- $5 Chase UA Card – paid $5 11/4/2013

- $5 Chase Marriott Card – paid $5 11/4/2013

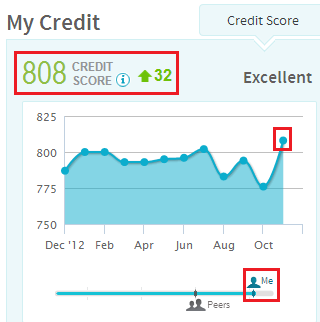

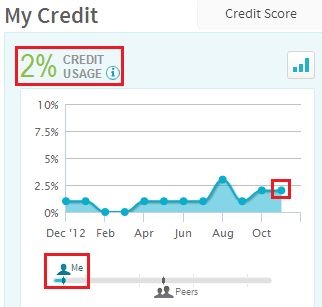

Now that almost all of my credit card statements have closed for October, the banks are reporting my credit utilization ratio (approximately 1-2% per card). It is still early in November, so I don’t have much info from Credit Sesame or Credit Karma but I do have some pretty graphs. My credit score is at a new all time high :)

I’m not sure this is entirely accurate, but I am not complaining about a 2% credit utilization ratio.

Credit Karma still shows my score from last month so I don’t have any visuals from them. So there you have it folks. Don’t pay off your entire credit card bill before the statement closes. Try to use less than 30% of your available credit limit, with a sweet spot of 1-10% per card. If you have any questions, please leave a comment below.

About your older post about when your credit score dropped 18 points, does that mean you can spend to your credit limit, pay it off before the statement closes, and it still wouldn’t affect your utilization ratio? If so, then you might be able to spend more than, or even several times, your credit limit. Also, when they determine the utilization ratio, do they look at the utilization for your credit card collection as a whole, or for each card? If it’s as a whole, then that would allow you to max out 1 card and spend $5 per month on 7 other cards, and still have a good overall utilization ratio.

Another question, sorry if I asked this before. I have a friend who has a Membership Rewards business card with no credit limit. Do you or people you know have any business cards with no credit limit?

Some banks report each card separately and other report all credit cards as 1 lump sum. Also, some bank share your credit utilization ratio before the statement closes, but it is definitely possible to spend more than your credit limit if you pay it off during the month.

Most business credit cards don’t have a “credit limit” but I know the Chase Ink Bold card has a “present spending limit”. I believe mine is at around $13,000. Meaning that if I need to spend more, they can increase it temporarily. I think almost all cards have an upper limit. You can’t spend million on a business card. It just depends what the bank sets as your “preset spending limit”. If your friend were to call AMEX and ask, I’m sure they could tell him a number. But that might trigger a financial review, which is bad, very bad.

Specifically, which banks report each card separately, which banks report all credit cards as 1 lump sum, and which banks share your utilization ratio before the statement closes?

I really don’t know. I currently have 17 open credit cards spread across several banks and they all report something to CS and CK who use an algorithm to determine your “credit score”.

If you have several cards, you shouldn’t worry to much about having a high credit utilization ratio on one of them.

The Barclay’s Arrival card now gives you on demand and free your TRUE FICO score based on Transunion data. This is clearly superior to the CK and CS estimates. It’s right there under tools when you log into your account.

You are right Mike. I read about that on other travel blogs. I wish I had a Barclays credit card.

Grant, from my understanding, to boost the credit score more quickly, we should keep the overall debt to credit ratio low, 1%-10% is best, not 0%, since 0% indicates you are not using the revolving credit you should use.

In the meantime, keep the number of cards with balance to be minimum, I mean, if you have, say 10 cards, and you need to spend $1000 this month, it’s better if you split the $1000 to 2-4 cards, not $100 on each card to get all the cards with a balance.

Credit Karma, Credit Sesame and Credit.com are good tools to keep track of your credit changes, but I don’t care too much of the score, I think they are more useful for keeping updated of the credit alert, for example, usage, hard inquiry.

Agreed, those services are better credit monitoring services than credit score reporting services.

Hi Grant, which website are you using to track your credit score?

I use Credit Karma and Credit Sesame. Check out the links on that post to learn more.