Updated 12/12/17 at 9pm PT: I changed all references of IDA to SageStream, per Eric Lindeen, VP of Marketing at ID Analytics, a Symantec company.

(Hat Tip to Amol from Hack My Trip and to this FlyerTalk thread)

Why would you want to freeze these credit reports? Good question. US Bank uses these two credit bureaus to check your credit score if you apply for any of their credit cards. The only credit card that might interest you is the Club Carlson Personal Credit Card from US Bank. In order to freeze both of your credit reports, you will need to contact each bureau.

ARS’s contact information:

Advanced Resolution Services, Inc.

5005 Rockside Rd

Ste 600

Independence, OH 44131

Phone: 800-392-8911 (Opens at 8AM EST)

Fax: 216-615-7642

SageStream’s contact information:

SageStream

PO Box 503793

San Diego, CA 92150

Phone: 866-248-7344 (Opens at 8AM PST)

Fax: 858-312-6275

They will both ask you to mail or fax the following document and required items of proof. Depending on your state, you may need to mail the documents via USPS Certified Mail.

Here is the form letter that I used for ARS (ARS Form.docx):

Advanced Resolution Service, INC

5005 Rockside Road, Suite 600

Independence, OH 44131To Whom It May Concern:

I would like to place a security freeze on the Advanced Resolution Service (ARS) files associated with my Social Security Number.

My information is as follows:

Full name: FIRST MIDDLE LAST

Social Security Number: 123-45-6789

Address: 123 Fake St, Springfield, IL 12345

Telephone Number: (555) 555-1234Proof of Identity (CHOOSE ONE):

( ) COPY OF DRIVER’S LICENSE/STATE-ISSUED IDENTIFICATION CARD

( ) COPY OF MEDICARE HEALTH INSURANCE CARD

( ) NUMI FORM, SIGNED AND DATED BY LOCAL SOCIAL SECURITY ADMIN OFFICERegards,

FIRST MIDDLE LASTSIGNATURE: X___________________________________

DATE: MM/DD/YYYY

Here is the form letter that I used for SageStream (SageStream Form.docx):

SageStream

PO BOX 503793

San Diego, CA 92150-2833To Whom It May Concern:

I would like to place a security freeze on the SageStream account associated with my Social Security Number.

My information is as follows:

Full name: FIRST MIDDLE LAST

Social Security Number: 123-45-6789

Street Address: 123 Fake St., Springfield, IL 12345

Date of Birth: MM/DD/YYYY

Phone Number: 555-555-1234Identity Verification (Choose TWO):

( ) COPY OF DRIVER’S LICENSE/STATE-ISSUED IDENTIFICATION CARD

( ) COPY OF SOCIAL SECURITY CARD

( ) COPY OF US PASSPORT (PICTURE PAGE)

( ) COPY OF UTILITY BILL WITHIN PAST 60 DAYS

( ) COPY OF VOIDED CONSUMER CHECK

( ) COPY OF ALIEN REGISTRATION CARD

( ) COPY OF BIRTH CERTIFICATERegards,

FIRST MIDDLE LASTSIGNATURE: X____________________________

DATE: MM/DD/YYYY

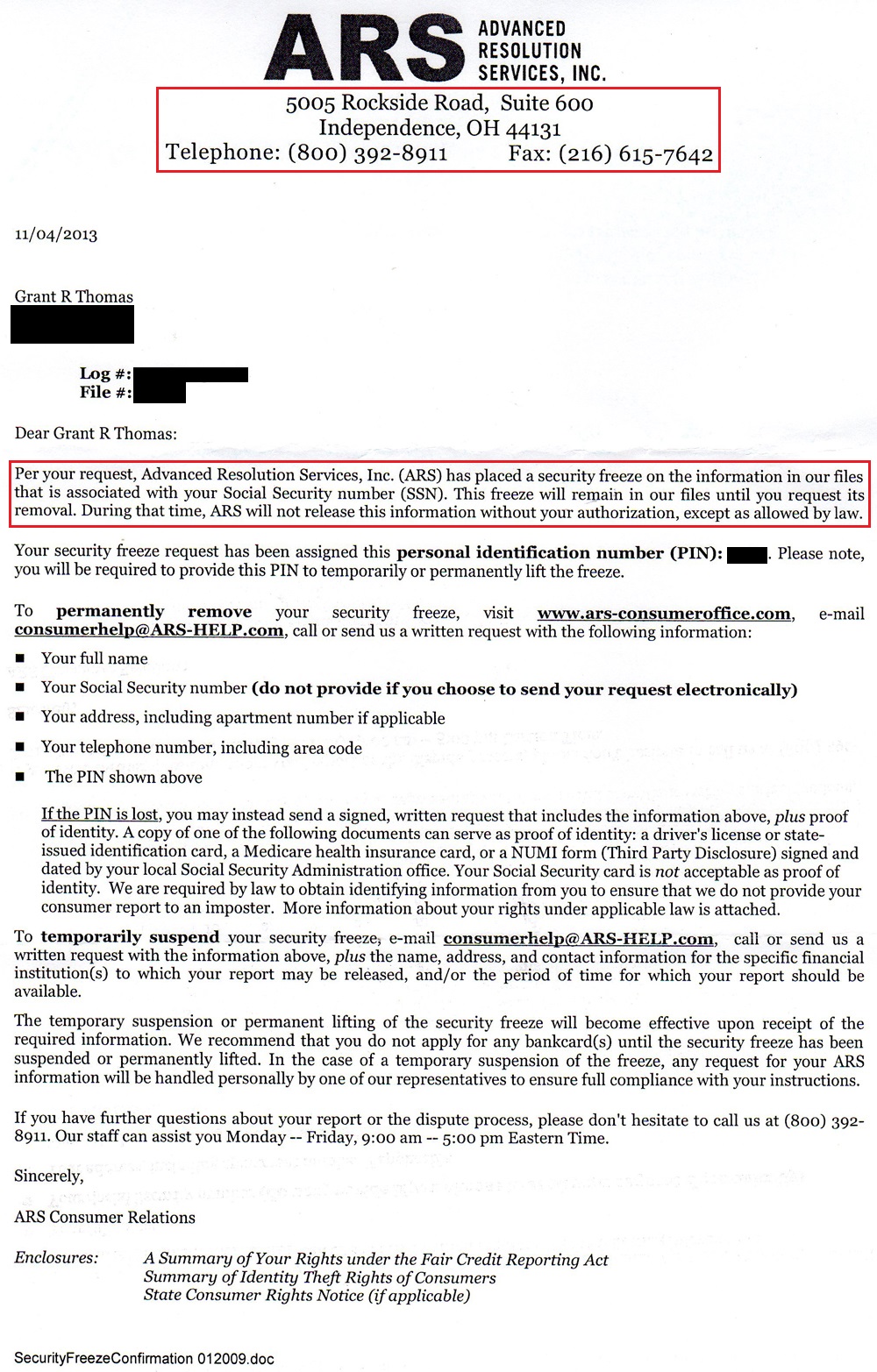

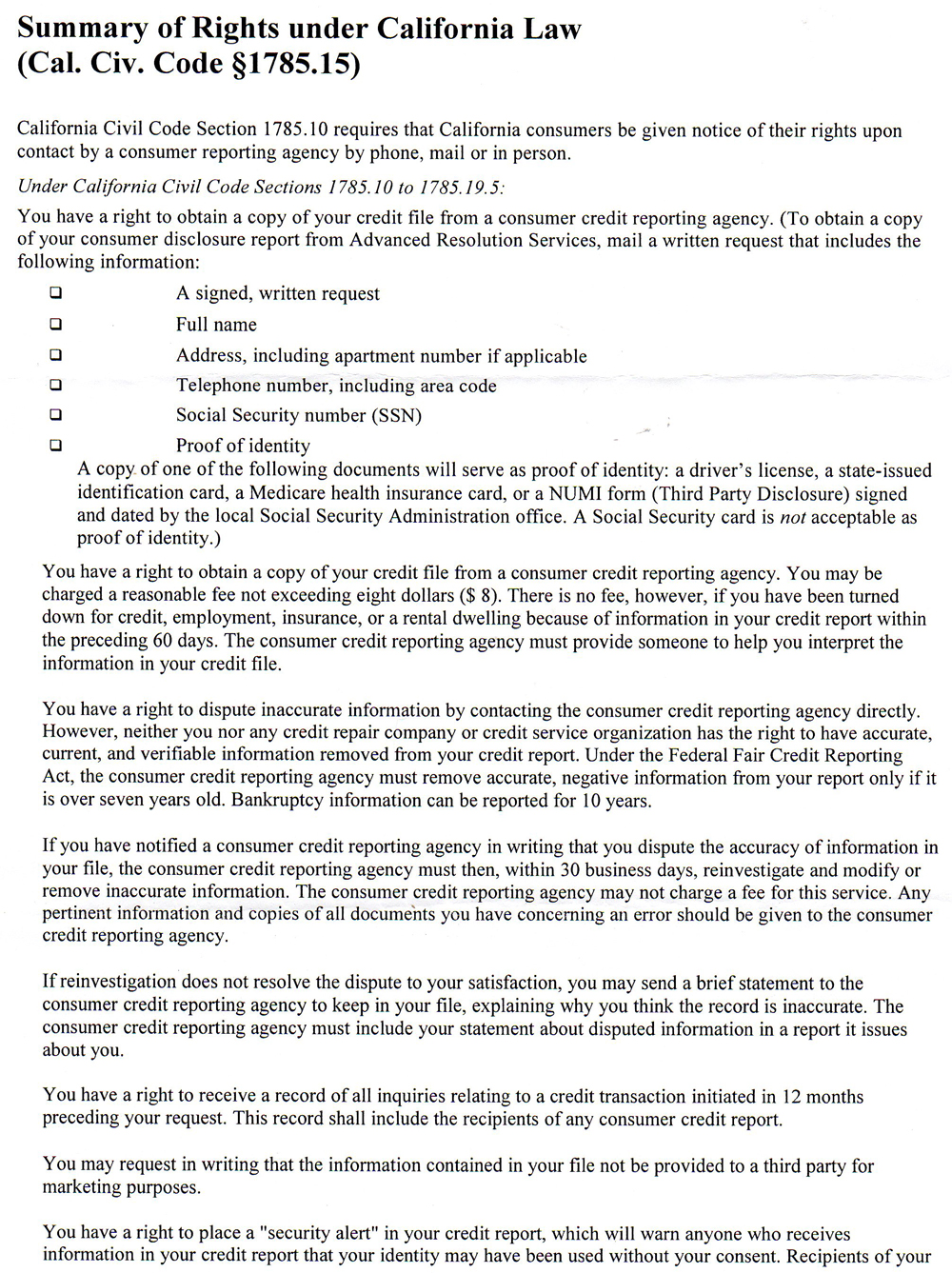

After a few days, I received letter from both bureaus. Here are the documents I received from ARS. My ARS credit report is officially frozen. If I ever need to unfreeze it, I must call them and use the PIN below.

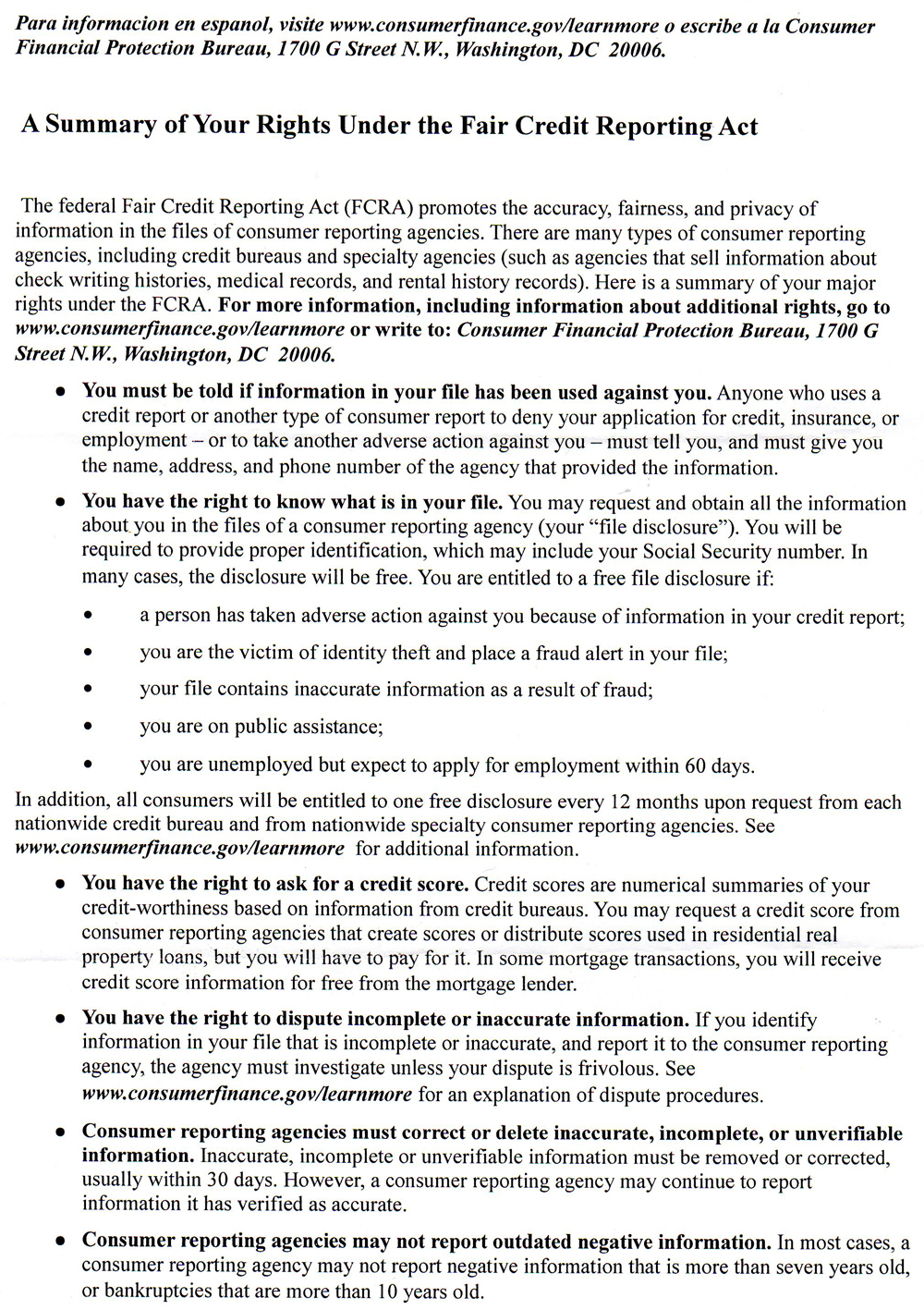

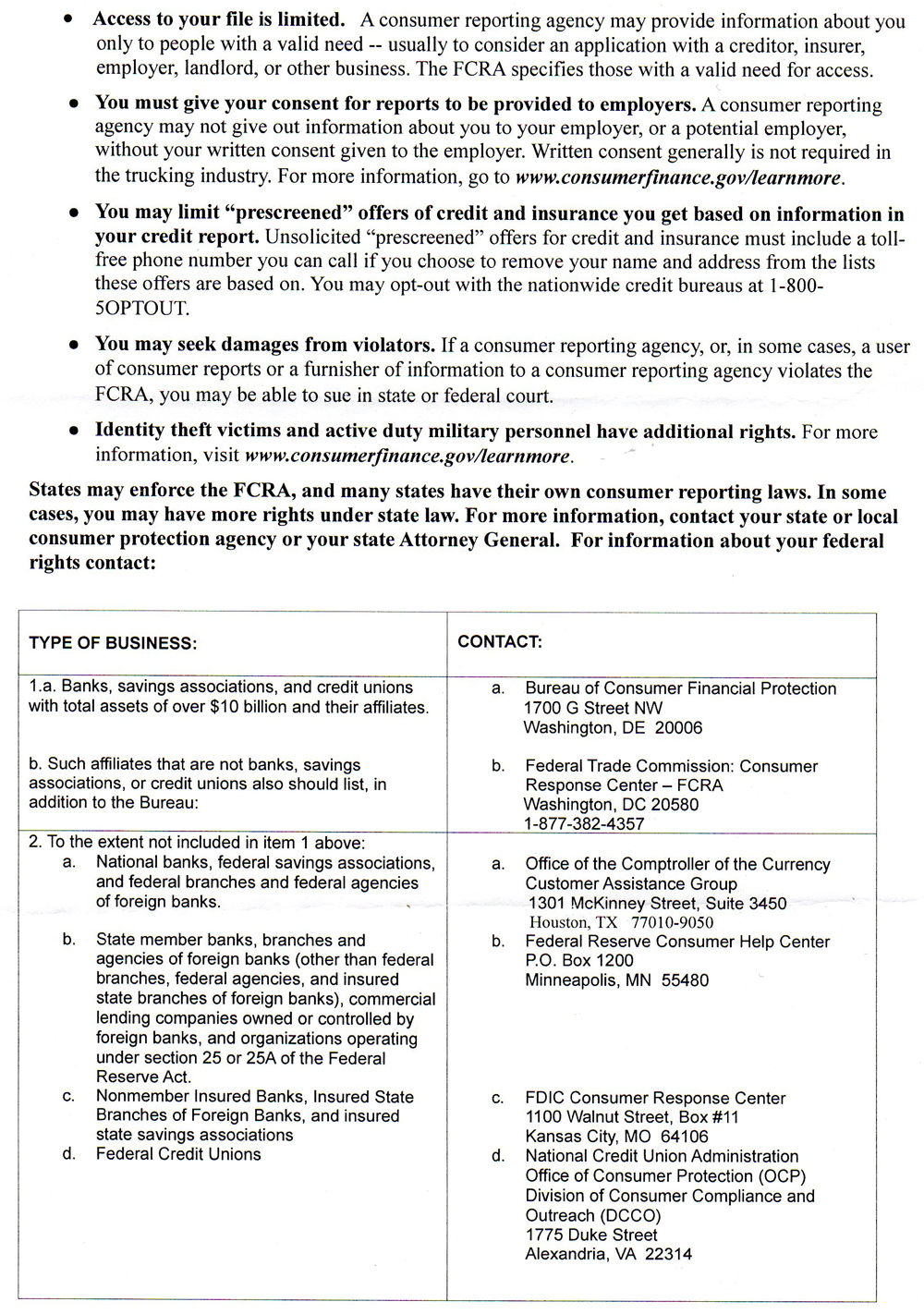

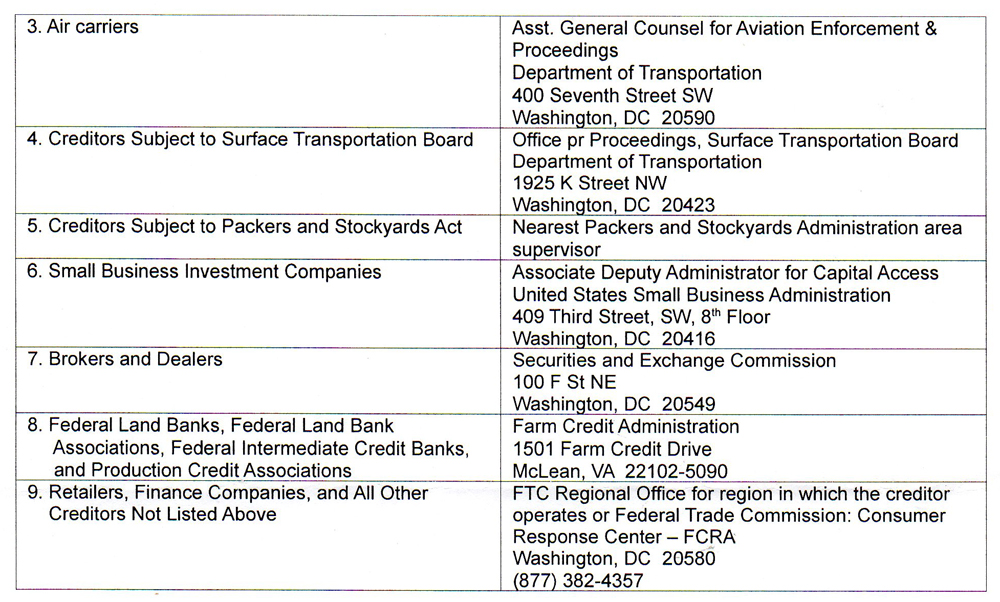

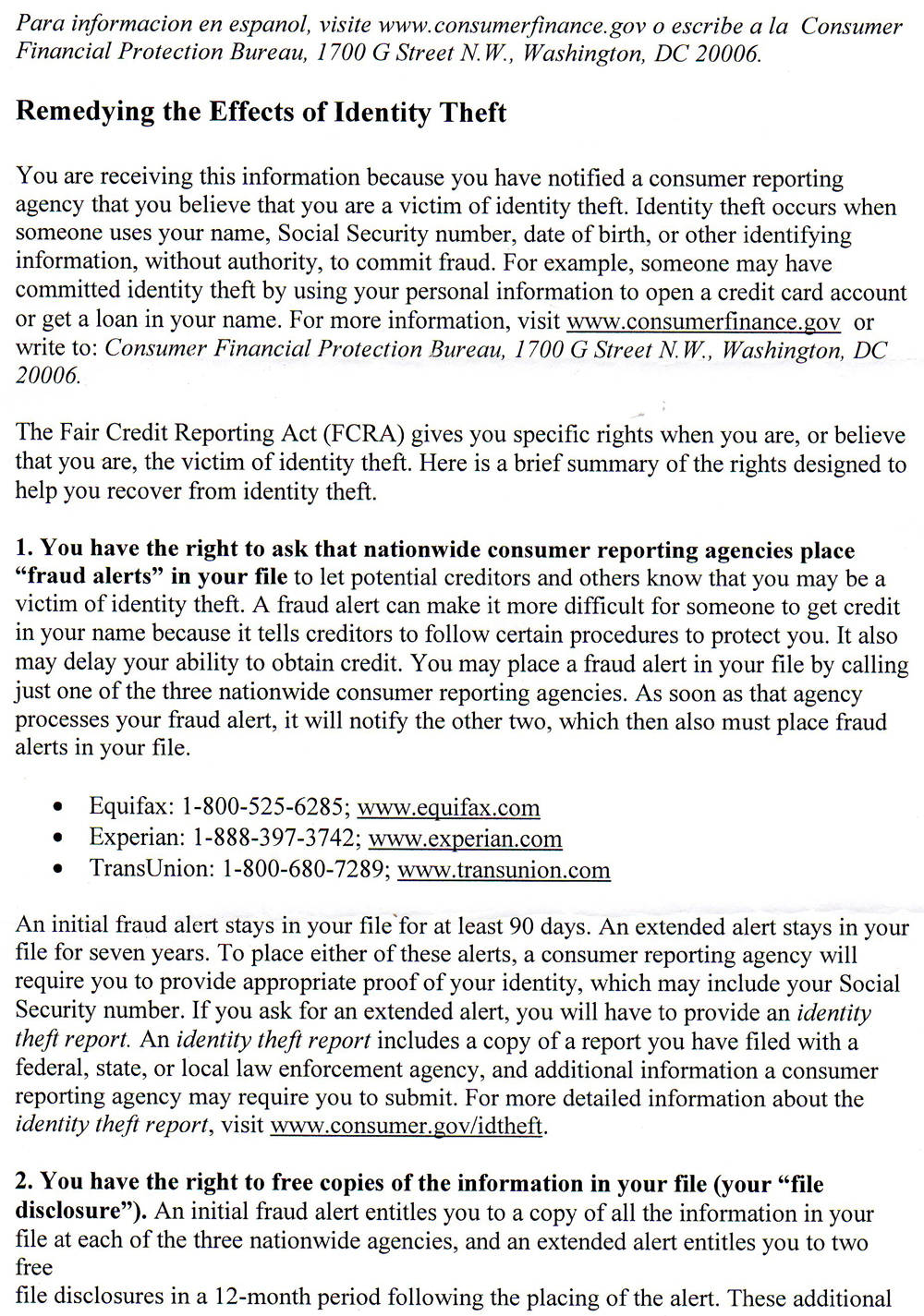

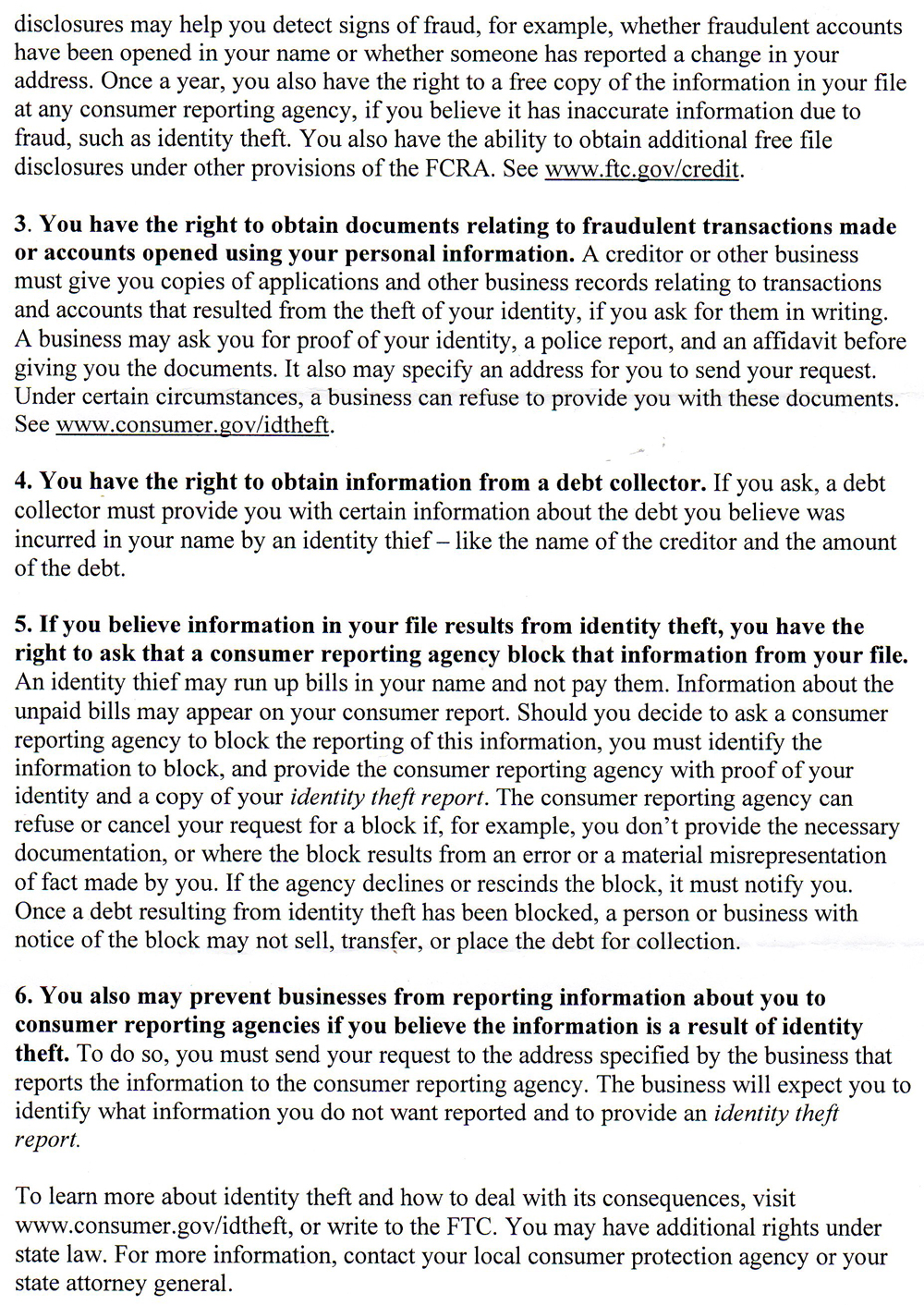

The following 8 pages were included about the Fair Credit Report Act:

Page 2:

Page 3:

Page 4:

Page 5:

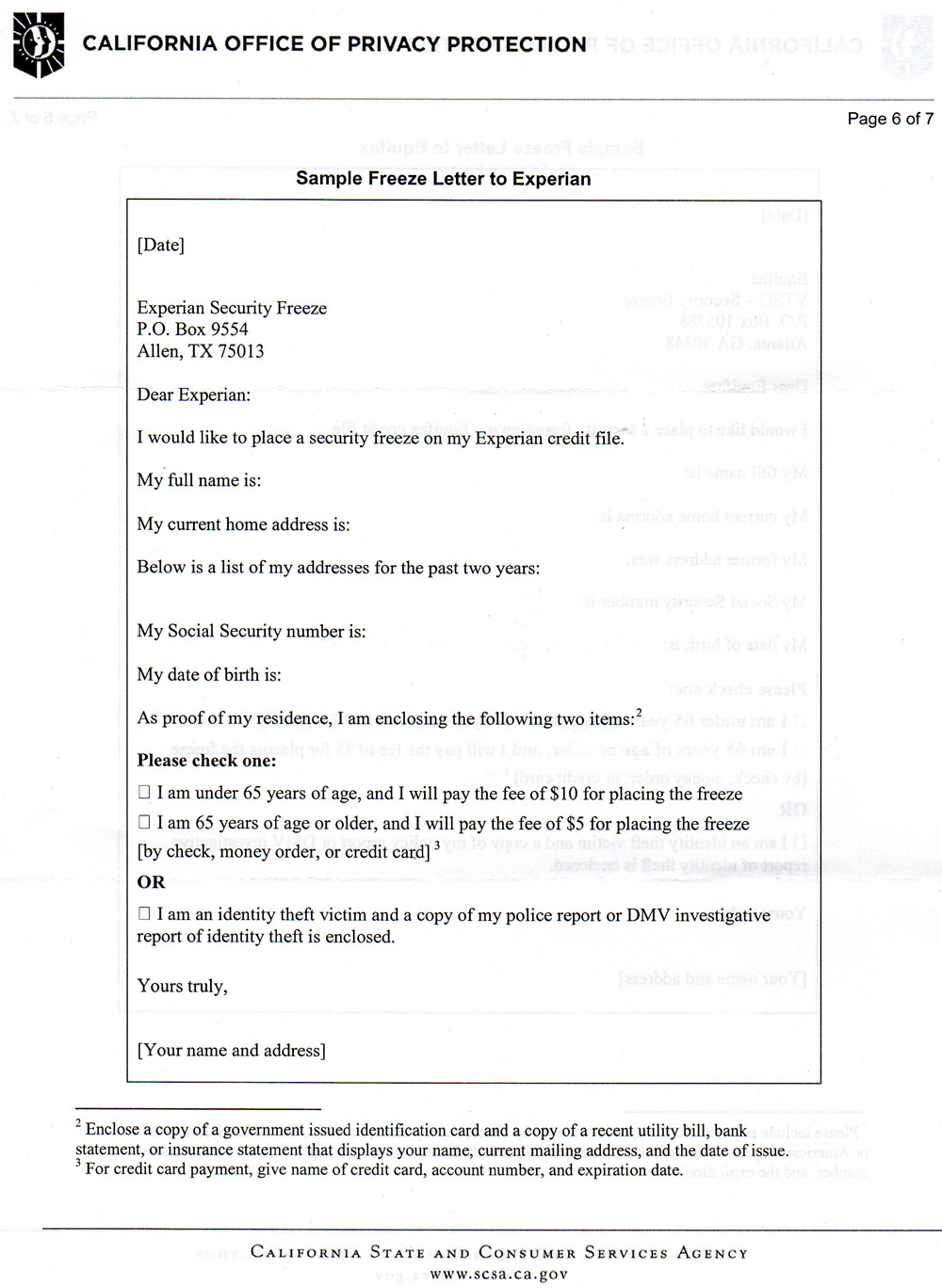

Page 6:

Page 7:

Page 8:

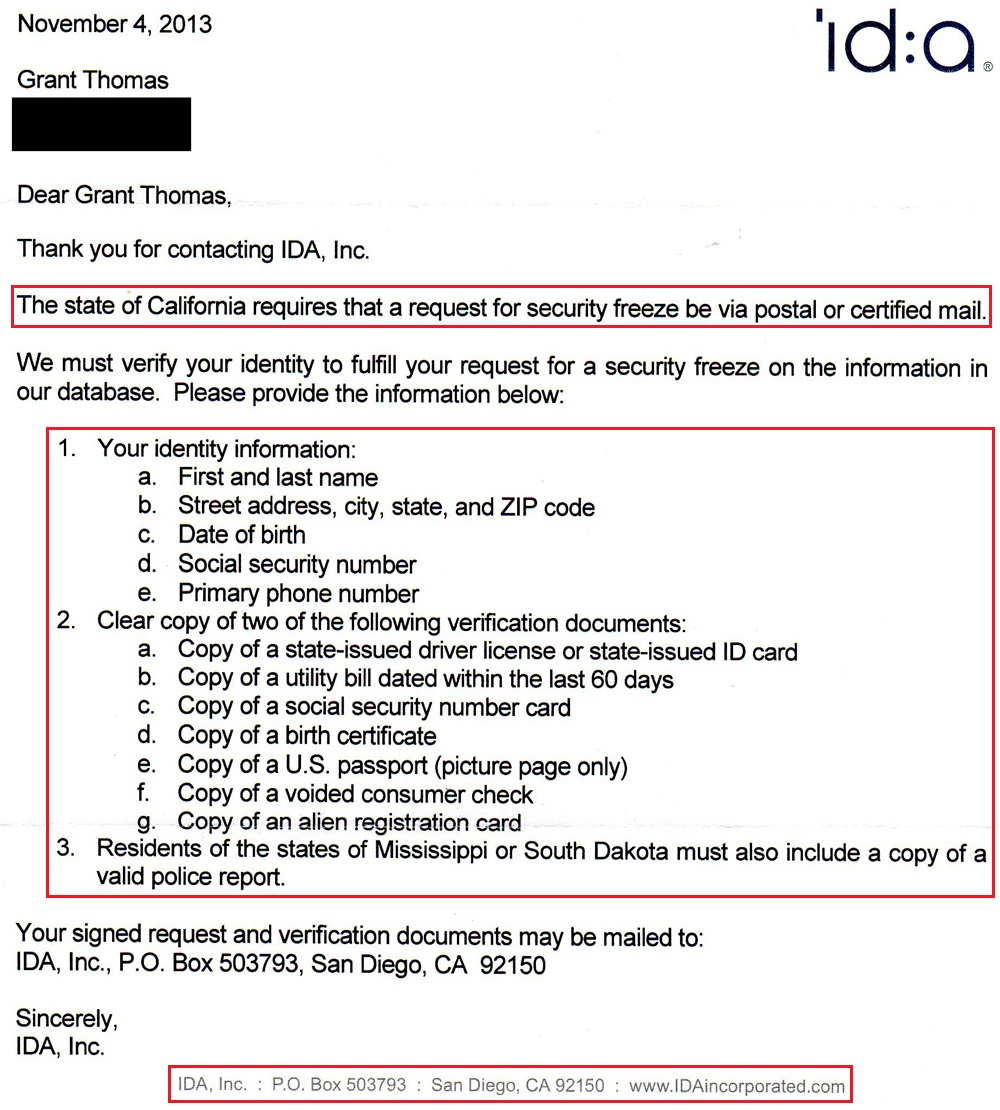

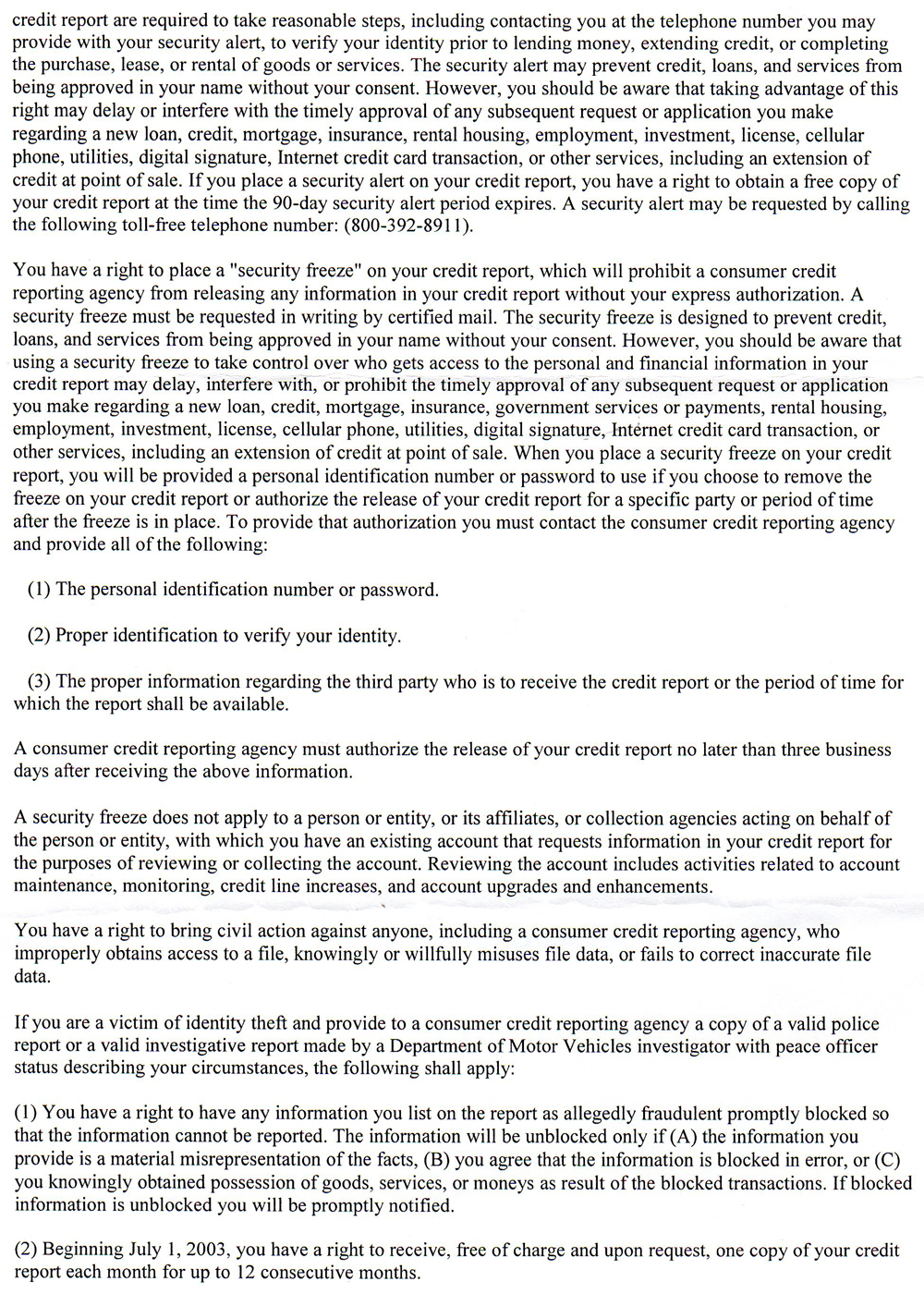

Here are the documents I received from SageStream, previously called IDA. Here is the official form you get from them (same info as above).

My SageStream credit report is officially frozen. If I ever need to unfreeze it, I must call them and use the PIN below.

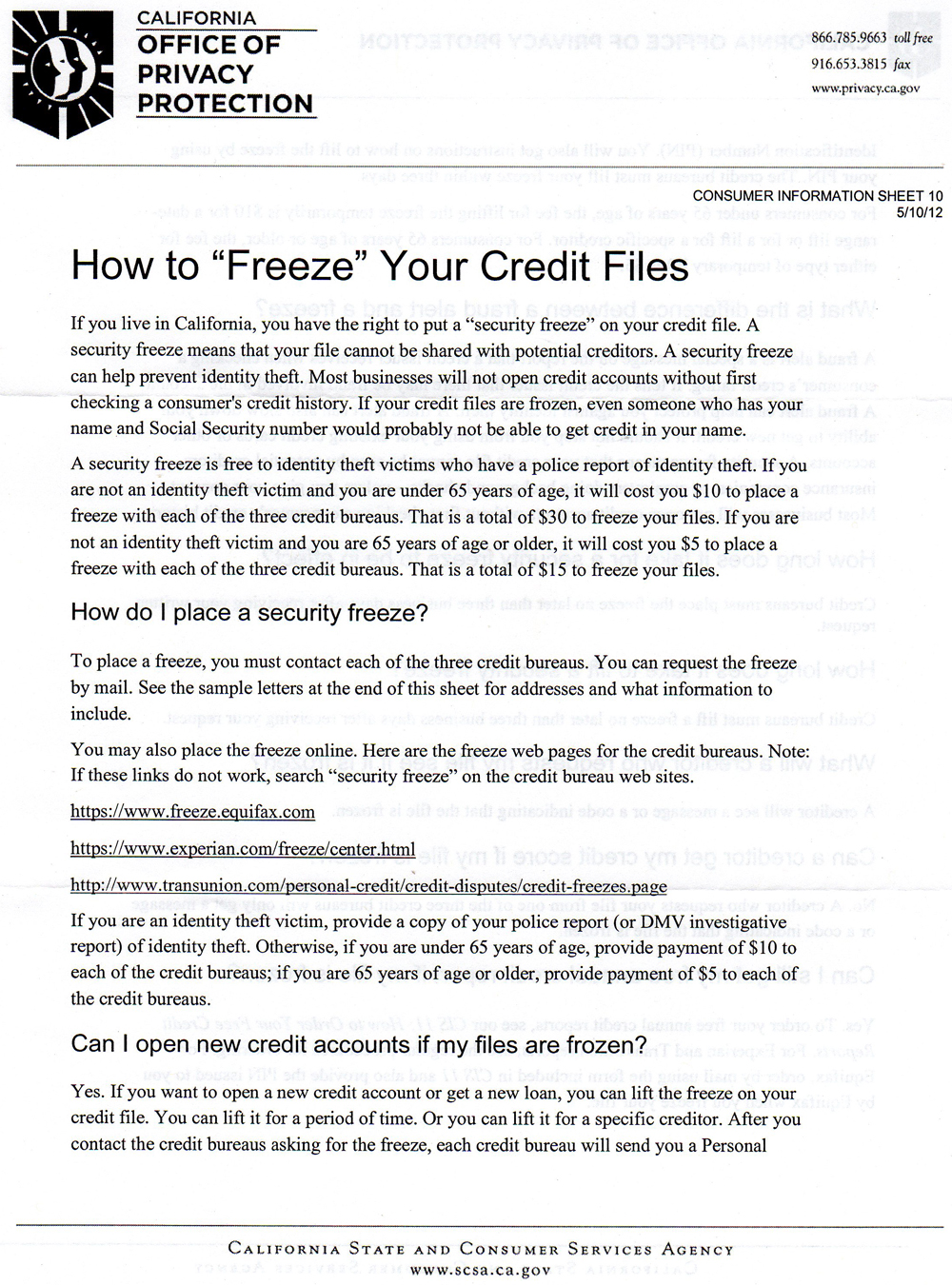

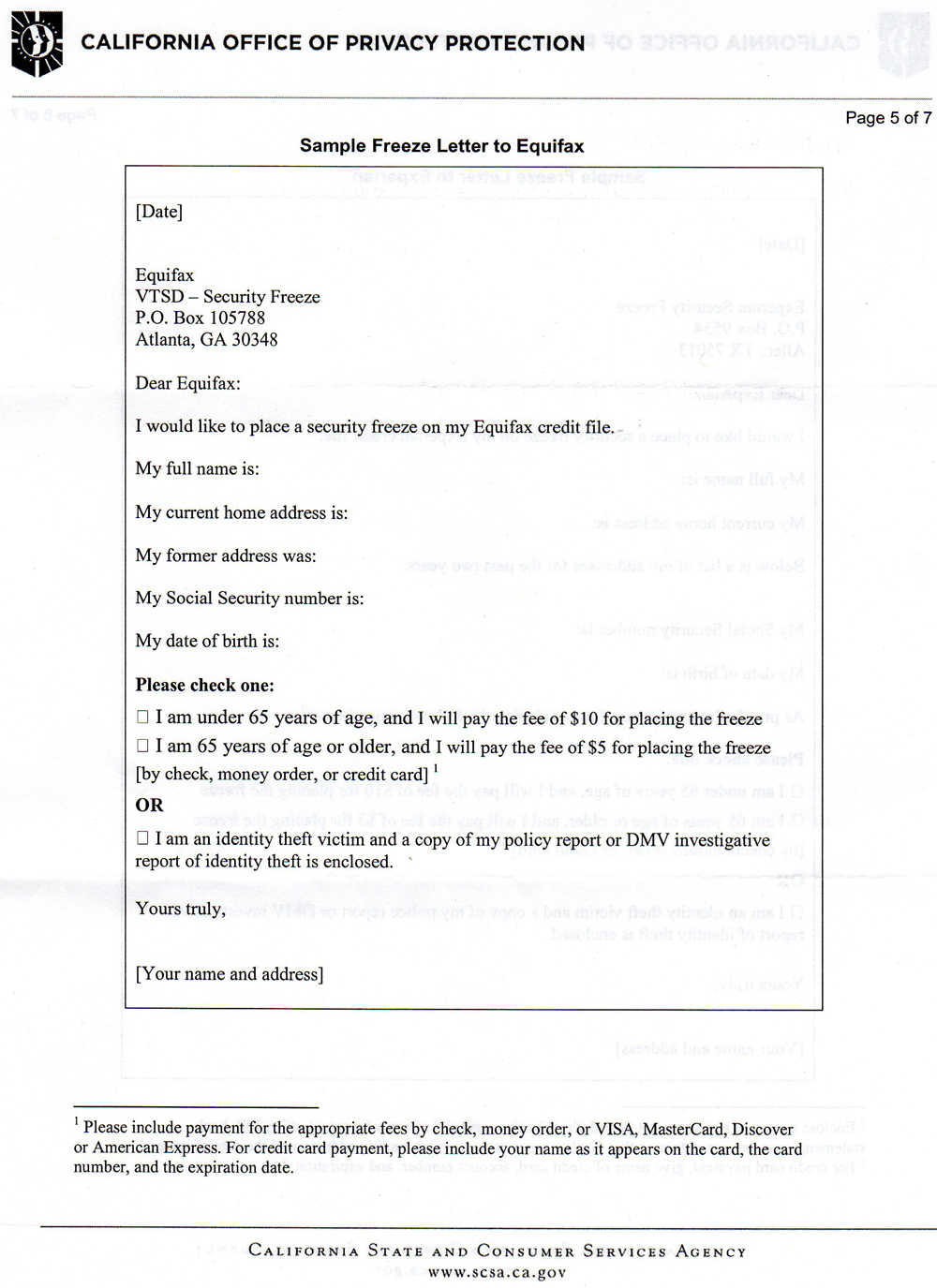

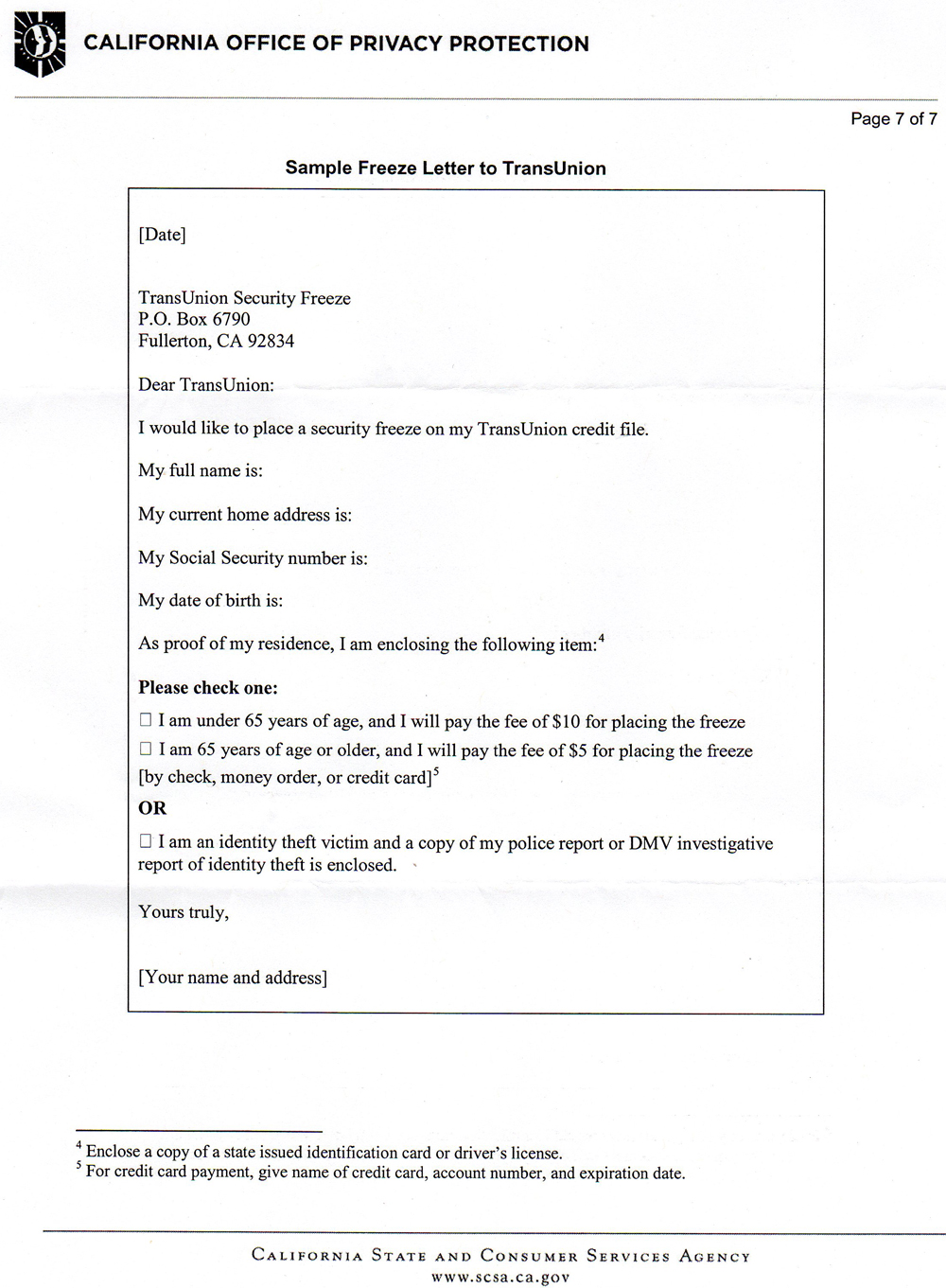

The following 7 pages are specific to California credit reports.

Page 2:

Page 3:

Page 4:

Page 5:

Page 6:

Page 7:

If you have any questions, please leave a comment below. If you are interested in applying for the Club Carlson credit card, please click on the credit cards tab above.

Pingback: Credit Card App-O-Rama Preparation: Freezing your ARS and IDA Credit Reports | Travel with Grant

if you freeze both, what choices do they have to check your credit ?

One of the big three bureaus I believe. Not sure which one though.

Is there a way to get a copy of the own file from ARS and IDA. Since I did not even know about their existence I never checked my reports and would love to do that before placing a freeze.

Call the phone numbers listed by each company and ask if they can send you your report.

How much total does it cost to freeze both?

It doesn’t cost anything other than the cost of stamps to mail the forms to the company. It takes about a week for them to freeze your reports.

So is it better/highly advised to have both frozen BEFORE applying Club Carlson cards? Do I have to unfreeze them again if I want to sign up for other cards (Chase, AMEX, etc) or just leave it as it is? In what point it would be necessary to unfreeze them again (e.g. applying for house loan, car loan, etc.)?

Good morning David, if you are really serious about getting approved for the Club Carlson card, I would freeze both credit bureaus. These are two very small credit bureaus and all the other major banks do not pull your credit from these locations. I would leave them frozen forever probably.

Thanks Grant! by the way do you got a working link for current best sign up promo for Club Carlson card?

No, I only have a few cards from Barclays. I applied through the link on FlyerTalk: http://www.flyertalk.com/forum/credit-card-programs/1177334-special-credit-card-offers-master-thread-subscription.html

Ok got it. What kind of shipping method did you use to mail both of the forms (USPS Express/Priority with certified/signature confirmation, etc. or FedEx, DHL) ? Since this is highly sensitive documents which contain SS# listed on it……

Since I live in CA, I was able to fax one document and mail the other to San Diego. If I remember correctly, each bureau has their own requirements that depend on what state you live in. I think I just sent it First Class with a single stamp. Not very secure, but you have to trust the Post Office to do their job.

Grant, I also live in CA too (NorCal). Did you call ARS first before you fax it?

Yes, make sure to call both companies before you send them any documents.

I am also CA, thanks for the blog!

I don’t see why a person would need to call before sending in the documents. The faxed/mailed documents would be sufficient on their own

Something could have changed since I wrote the blog post (maybe they have a new fax number or new address), so I would still call to make sure everything is still the same.

Thanks, quick question here: I have a car loan with Pentagon Federal (PenFed) Credit Union and I want to try to pay my monthly car loan payment via BlueBird, but when I look up the business by keyword “Penfed” or “Pentagon Federal” it won’t show up any result. Can I still pay the auto loan via BlueBird?

Yes, you just need to enter their mailing address and Bluebird will mail them a check. Make sure to enter your account number.

THANK YOU!:)

Hi Grant, I got a question : I remember you said that if applying for cc (for ex: Barclay) we can apply as much as we can until we get denied as long as it’s from same company that issue the cards, since it will be counted as one hard credit pull inquiry. Will this work on any credit card company? how about with Chase and AMEX? Can I apply for as many as AMEX or Chase cards until I get denied/pending approval in same day?

Generally yes, with AMEX and Chase, they will probably instantly approve the first card then you will get a pending message on the second.

I see, why CHASE and AMEX is so hard to get a second card approved in same day?

So do you think is it worth trying to apply second card or not (with AMEX and CHASE)? (I won’t do if it’s not worth trying, e.g.: will leave bad impression with them and they will put it on the note in their database to make it hard for me to apply for card in the future).

Usually you can get 1 personal and 1 business card on the same day.

Thanks, I am thinking of applying Chase British Airways since they have promotion of 50 bonus points now before they’re gone (actually I confuse between this card and Sapphire Preferred, but I think I can apply Sapphire Pref anytime since the promotion always run all the time and the British Airways card can be ended anytime). What do you think?

Also I want to apply for AMEX HHonors Surpass since the promo of 40k bonus will ended in Feb.

Can you please recommend a good business card to start with, for each of Chase and AMEX? thank you.

That’s a good strategy if you plan on needing BA Avios. Go for it!

Thanks! but can you please recommend a good business card to start with, for each of Chase and AMEX? thank you.

Sure, I would look at the Chase Ink Bold or Plus and the SPG business cards.

Thanks Grant.

By the way, do you think it’s ok if I buy 4 VR cards and loaded it with $500 each to fulfill my minimum spending of $2k for SW RR cards in one month? This month is the last month I could meet the minimum spending and I waited until january since I want the rewards to be posted in 2014.

Sure, go for it. I would probably purchase 1 or 2 VRCs per week.

Cool, it’s ok as long as I also use the card to buy something else, isn’t it? If I continuously buy 4 VR cards every months to manufacture spending, will it trigger an alert to Chase?

It might, it is best to start small and slowly ramp up your spending so it doesn’t look suspicious.

Got it…..by the way just came back from my local CVS stores, I went to 3 of them in my area and a bit out of my area…….all of them sold out their VR cards and NetSpend cards, no more of that cards! oh my …..I am panicked…..how do I meet the minimum spending now? they only have “MyVanilla Visa”(the black color card) and Vanilla Visa gift card……

From what I know, we can only reload amount to BB account if the card has a pin #., like debit card…….. is there any other prepaid credit cards that can be reloadable to BB account as VR card? Help please……depressed one here….running out of time….:(

Just relax, most CVS stores restock every week, so just try again in a few days. You can call the stores and ask the cashiers if they have the VRCs in stock before driving around town. You can buy Visa and MasterCard gift cards and then load them to your Bluebird Card at Walmart.

Thanks, will check and let you know…..

yes I did call them and the cashier said they had it, when I got there I didn’t find it in the gift card section so I asked him and he showed me the wrong one, he thought it was MyVanilla (since a lot of vanilla credit cards) when I asked for “vanilla prepaid reload card” on the phone….bummer…cannot rely on the person who picked up the phone….

So for last resort I can buy Visa and Mastercard gift cards and load them at Walmart? Is it ok if the card doesn’t have pin#? because I thought only prepaid card with pin # can be loaded into BB.

All Visa and MasterCard gift cards can have a PIN added. You may need to call or go online to set the PIN.

Why freeze the files at these 2 credit bureaus? If we apply for the Club Carlson credit card from US Bank and they only pull your credit from these two obscure credit bureaus, that is a good thing because then they will not bother to pull from the big three (Equifax, Experian, TransU) and your credit files will not have a hard pull on them from the big three, only hard pulls from the 2 obscure unknown bureaus. Am I missing something?

From what I’ve read online (FT mainly), these bureaus get information from the other big 3 bureaus and tie credit card accounts and inquiries to a phone number. The only thing I can tell you is that I applied for this card several months ago and got declined. Then I froze both credit reports and I got instantly approved. That doesn’t mean anything, but it seemed like it helped me. I’m not saying that you have to 100% freeze those credit reports, but it doesn’t hurt your chances.

I just spoke with IDA and they said that 858-312-6275 is their secure fax line and the listed fax line is unsecure. Heads Up!

Thanks John, I just updated the post with the correct phone number. Good catch!

Do I need to freeze my ARS and IDA reports if I apply for the Club Carlson biz card?

I believe both the personal and business Club Carlson credit cards use both of those credit bureaus. Don’t apply just yet, I have some more info about the biz card that may make it harder to be approved for.

Ok. I am just requesting my free reports from both ARS and IDA right now.

Btw, when I called IDA, Inc. earlier, their Consumer Office Dept told me to go to http://www.idainc.com for instructions on how to request my free Consumer Report (she would not call it “credit report”). Useful link and not sure if you want to add it to your “IDA’s Contact Information” section above.

Thanks for the info. I will add it to the main blog post.

You don’t need to request the reports, just freeze them so US Bank cannot view the reports.

So I just saw this post about freezing these but already applied and just got an email saying they were unable to approve me. The funny thing is I called US Bank yesterday and the guy on the phone check my app and said I was good to go. Did something change? Any suggestions on changing their mind at this point? Thank!

US Bank is strange. If the screen doesn’t say approved, you might be approved or denied. Calling them is not very helpful either. They will tell you that you are approved over the phone, but you may receive an email or letter saying your were denied. The only way to know if you were approved is to wait a few days and get the new credit card in the mail. US Bank is unlike all other credit card companies.

I have 10 live inquiries and Barclay’s approved me yesterday for the US Airways card, five weeks after I froze IDA and ARS. I can’t remember which, but one of them included an informative package about consumer rights in its letter acknowledging the freeze.

Did the packet you received from ARS or IDA look like any of the documents I uploaded?

Hi Grant,

Do you think Barclay’s uses ARS or IDA?

Hey, congratulations on the beautiful new website. Of course, I loved your original site also.

Cheers :)

Barclays doesn’t use ARS or IDA, only US Bank uses those smaller credit bureaus. Depending on what state you are in, Barclays will use either Experian, TransUnion or Equifax.

Thanks Grant. I know you said the major 3 on’t pull these. I was just fishing around trying to find out why Barclays keeps denying me for “too many inquiries”, when I only had 4 Transunion pulls during 2014.

Barclays is super strict in terms of recent application and credit inquiries. The only thing that you can do is not apply for any credit cards for 5 to 6 months, and then apply for a new Barclays credit card.

I’ve been successfully getting the Barclays Arrival card with 40k bonus twice per family member (4 of them). Most recently, I cancelled my sister Arrival last October and she was approved for a new one this month. I put a lot of MS spend on them so it seems that as long as those card get usage, they don’t mind approving the apps. I only get them the Barclays Arrival card and I have not tried having 2 active cards with them at the same time.

Thanks for the data point, Bob. You have a good system going right now.

So if I freeze these reports from where will US Bank pull my credit report from?

It depends which state you live in, but they will pull your credit report from Experian, TransUnion, or Equifax.

Good info!

Thank you, glad you enjoyed the post.