App-O-Rama Updates: Day 1

5:30AM my alarm goes off. It’s App-O-Rama day!

I turn on my computer and know exactly which cards I am going to apply for and in which order I am going to apply. In case you didn’t read yesterday’s post, here is my strategy list:

- Club Carlson Personal (US Bank) – instant approval! I guess my ARS and IDA credit report freezes might have worked. Learn more here.

- US Airways Personal (Barclays) – denied! Why do you hate my Barclays? I didn’t both calling the reconsideration line, they will tell me that I have too many recent inquires and I have no leverage with them since I have no Barclays credit cards. Good bye US Airways Card. Good bye Arrival Card. Good bye every other Barclays card.

- Alaska Airlines Personal (Bank of America) – pending decision. After a short reconsideration call, I was approved after “sacrificing” my Virgin Atlantic card that had an annual fee coming in a few weeks.

- Platinum Mercedes Benz (AMEX) – pending decision. Called AMEX and was told there was no way to reconsider the app at this time. I would have to wait 2-3 business days for a response. My gut feeling is a denial since I already have 4 personal credit cards, but want to sacrifice my Delta or Hilton HHonors card. Will post an update soon.

- Citi Dividend (Citi equivalent of Chase Freedom and Discover It cash back card) – downgraded. I decided to save a credit inquiry and call Citi and ask them to downgrade/switch my Citi AA AMEX to this card. The rep told me it could take up to 51 days for the switch to take place. WTF?!? Citi, please send me that card soon so I can get the 5% cash back for 4Q 2013.

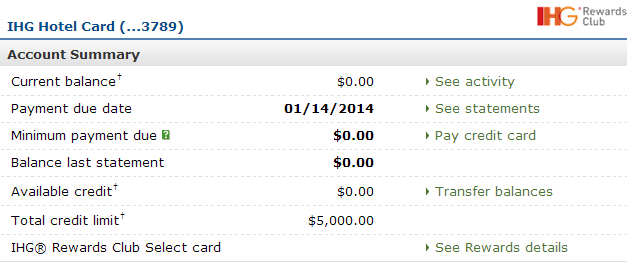

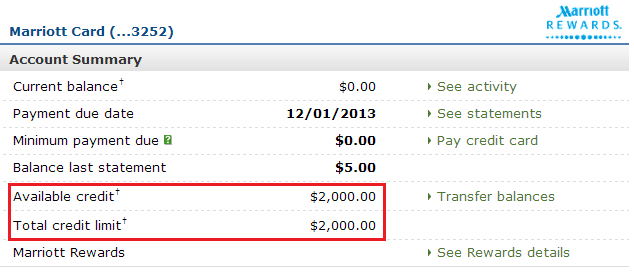

- IHG Hotel Personal (Chase) – pending decision. I called the Chase reconsideration department, was placed on hold for a few minutes and approved with a low $2,000 credit line. After moving credit from my Marriott Card, I got my credit line up to $5,000.

- Hilton HH Surpass (AMEX) – skipped. I am waiting to see what happens to my Platinum Mercedes Benz application before I do anything with this card. I can always upgrade my AMEX Hilton HHonors to the AMEX Hilton HHonors Surpass card for free online (no credit inquiry).

Side note, I was trying to convert my Chase Sapphire card to a Chase Freedom card this morning but the representative was unable to do so over the phone. I believe it was because I had a $585 current balance on the card, even though she told me that shouldn’t be the reason. Later today it turns out that the Chase Freedom card has increased its sign up bonus from 10,000 Ultimate Reward Points to 20,000 Ultimate Reward Points. I wonder if Chase was updating their servers which is why I couldn’t upgrade. It is a mystery…

A friend of mine was able to show me a sign up bonus (through Chase’s site) for the 50,000 Ultimate Reward Points for the Chase Sapphire Preferred. I told him to go for it since the sign up bonus hasn’t been that high in a very long time. Apparently you can get 5,000 bonus Ultimate Reward Points for adding 1 authorized user to your CSP card too.

All in all, I am pretty happy with my results and love how easy it is to work with Chase. I look forward to getting my IHG card soon.

Easy to move credit line from Marriott to IHG card.

I will post an update if anything happens to my US Airways card, Platinum Mercedes Benz card, and which year I get my Citi Dividend card. If you have any app-o-rama questions, let me know.

I’m amazed you got denied for a Barclays card, seeing that you have excellent credit, and you got instantly approved for a US Bank Club Carlson card. That sucks that you’ll never be able to get the US Airways card. What’s annoying about it is that you’ll almost certainly be a good credit risk for them, but they’re too stubborn to approve you for a card. It’s also strange that not having any Barclays cards is a disadvantage, but having 4 personal Amex cards might be a disadvantage. Anyway, earning at least 195K points in one app-o-rama (85 from US Bank Club Carlson, 30 from Bank of America AS, and 80 from Chase IHG) is a huge success.

How do you establish a relationship with Barclays to increase your chances of getting approved for their great credit cards, if they always deny people who apply for a first card from them? How does Barclays profit from this business model?

Barclays believes that people with a lot of credit inquires are more risky. If they take on less risky people, they make more profit. That makes sense, but their assumption that more credit inquires does not mean more risk. I think I am about to give up on Barclays. They do not like me and probably never will. I cannot/will not sit on the sidelines and wait for my credit inquires to drop off my record in order to apply for a Barclay card. I can get any card from any other bank if I want.

I also find that sometimes Barclay will give me a card and sometimes not. I have never been successful when calling reconsideration. As you may know, their relationship with Virgin America is ending and I will be glad to be rid of that card with them. Virgin America says a new card is coming in January. Fingers crossed that it will be Chase.

We will have to wait and see…

It would seem to me that Barclays would want you as a new customer. Giving you a card means that you will be using their competitors cards less. I get that they probably are more sensitive to risk than Citi or Chase.I think this potential denial (along with everything else that I read about Barclays) shows that a person who has a history of churning cards or doing app-o-ramas isn’t the kind of customer Barclays wants.

Exactly, card churners are not for Barclays. :(

Pingback: App-O-Rama Update: Upgrading Hilton HHonors Credit Card to a Hilton HHonors Surpass Credit Card | Travel with Grant

Pingback: App-O-Rama Update: American Express Platinum Mercedes Benz Charge Card Surprise Approval | Travel with Grant

Pingback: What's on my Mind? CES in Las Vegas, Napa Valley, San Francisco, ABC Gift Cards, 2 Free Movie Screenings, SWA Customer Service, Club Carlson Forex Fees, Citi Dividend, and Staples Easy Rebate Headaches | Travel with Grant

Pingback: PSA: Get 16 PointBreaks Hotel Nights with the Chase IHG Rewards Club Visa | Travel with Grant

Pingback: March App-O-Rama Thoughts: Hawaiian Airlines (35,000 Miles), Discover It ($150 Cash Back), Barclays Arrival ($440 Cash Back), Chase Ink Bold Visa (50,000 UR Points), Citi AA Executive (100,000 Miles), and US Bank Olympics Flex Points ($400+ Travel Credit)

Pingback: March App-O-Rama Thoughts: Hawaiian Airlines (35,000 Miles), Discover It ($150 Cash Back), Barclays Arrival ($440 Cash Back), Chase Ink Bold Visa (50,000 UR Points), Citi AA Executive (100,000 Miles), and US Bank Olympics Flex Points ($400+ Travel Credit)

Pingback: 5 Credit Card Applications, 4 Approvals, 3 Reconsideration Calls, 2 Business Cards, and 1 Pending Application | Travel with Grant

Can you downgrade the Citi AA cards to a non AA no fee card?

Yes you can, but that card would probably earn 1 AA mile per $2 spent and not get any cool AA perks like free checked bags or anything.

Pingback: Barclays Sign Up Offers: $400 Barclaycard Arrival, 50,000 Lufthansa Miles, 35,000 Hawaiian Airlines Miles, and 40,000 US Airways Miles | Travel with Grant