How to Justify / Rationalize / Explain a $475 Annual Fee

The American Express Platinum Mercedes Benz Charge Card has a $475 annual fee, not waived the first year. Let that sink in for a little bit.

Now let me explain why that card is worth the $475…

Sign Up Bonus

- 50,000 Membership Rewards points after you charge $3,000 in purchases in the first three months of Card membership.

Everyday Spending

- 5x points on select Mercedes Benz purchases

- 1x points on all other purchases

Card Perks

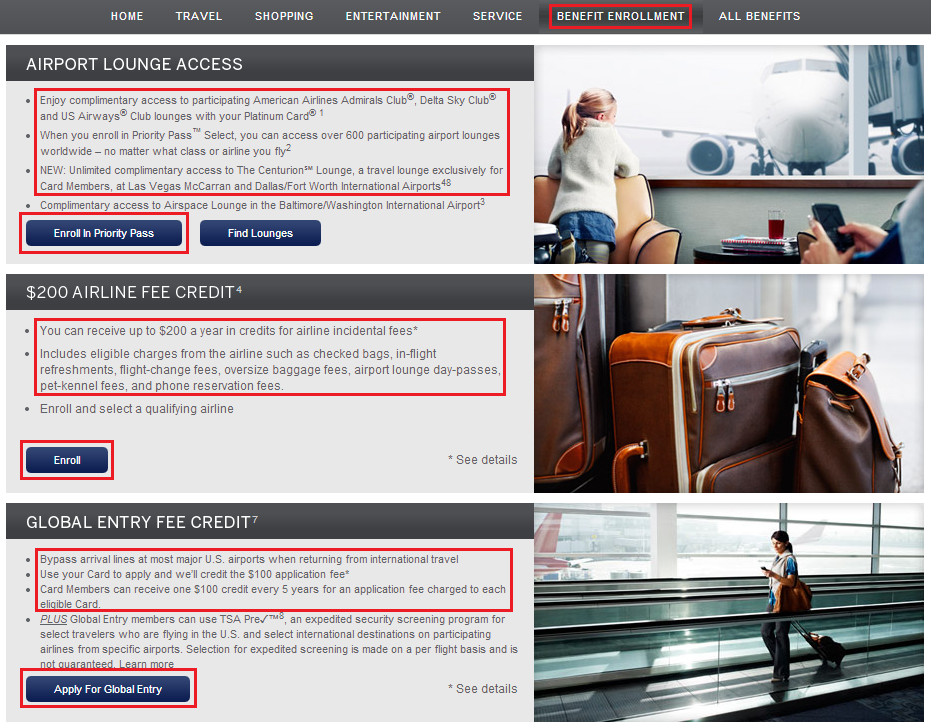

- $200 airline charge reimbursement every calendar year

- Global Entry reimbursement and free TSA PreCheck

- Airport club access to American Airlines, Delta, and US Airways lounges

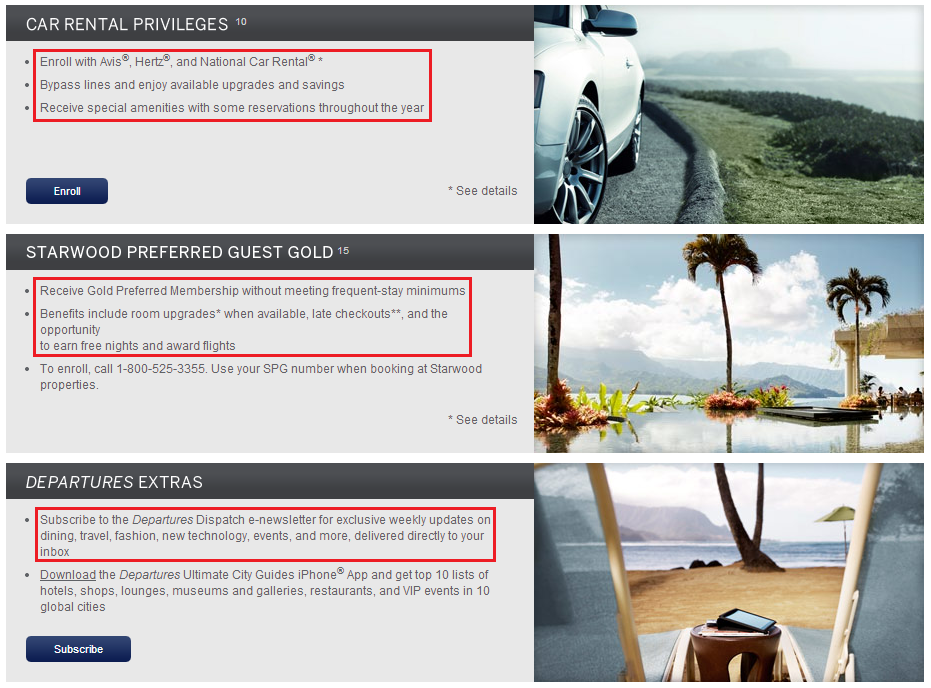

- Avis, Hertz, and Enterprise elite status

- SPG Gold Status

- A $1000 certificate each year you charge $5,000 in purchases, good toward the future purchase or lease of a new Mercedes-Benz

- Up to 2,000 excess miles waived at lease-end on leases through Mercedes-Benz Financial Services

- $100 certificate at renewal of your card account, good toward genuine Mercedes Benz accessories

The Explanation

- Right off the bat, 50,000 Membership Reward Points are worth at least $500 in statement credit or much more if you transfer the Membership Reward Points to one of american Express’s airline travel partners.

- Secondly, every calendar year (Jan 1 – Dec 31), you get $200 in airline fees reimbursed. You can also buy a $200 airline gift card and get that fee reimbursed. I bought a $200 Southwest Airlines gift card a few days ago and plan on buying another $200 Southwest Airlines gift card after January 1. That is worth $400 to me. I will show you how in my next post.

- Global Entry allows you to skip the long US custom lines when travelling back from international destinations and also offers free TSA PreCheck, which allows you to go through TSA screening much faster.

- Free lounge access to American Airline, Delta, and US Airways lounges is great. Free food, a place to sit and relax , and WiFi access. I have only been to a few airport lounges and am looking forward to visiting more in the coming months.

- I don’t rent cars very much but I do like the SPG Gold Status with this card.

- The spending categories (5x on Mercedes Benz purchases and 1x on everything else) are terrible. I don’t plan to use this card much for spending after the $3,000 minimum spending requirement and will only use the card for its perks.

- I don’t need any of the Mercedes Benz free merchandise or lease miles (I drive a Kia Sportage)

Here are all the card benefits (link):

As you can see, all the perks and the sign up bonus overshadow the $475 annual fee. I plan on calling and asking for a retention bonus at the 10-11 month mark. If I don’t get a good offer, I will probably close the card. If you have any questions, please leave a comment below.

I just upgrade my Amex Biz Gold to the Biz Platinum (with no credit pull – woot). Wanted to do it so I could get the $200 credit this year AND next. I’m going to wait and see if a good Platinum personal offer comes out as well this year or next.

Nice move, I heard from Rom’s Deals that you can get the $200 in 2013, in 2014, and early in 2015 (cancel AMEX Platinum card soon after you get the airline reimbursement). Cancel your card will result in a pro-rated refund back to the card.

That won’t exactly work from me since I upgraded from the Biz Gold, which I got in May, which is when it will be time to renew. However, they did prorate the annual fee for me so I only paid $225 instead of the full $450. Also, you have 60 days to decide if you like the card, so theoretically I could upgrade, get the $200 airline credit each year ($400 total), get the global entry fee reimbursed ($100), and then downgrade. But chances are I’ll probably just keep the card and reevaluate in May ;)

Unfortunately, the offer that they gave me is a big joke. 30,000 points for $10k in spend after 5 mos. I’m not even sure if that’s worth it to even try for.

That spending bonus is not very good. I would pass on it.

I’m confused. How do you sign up for the card now; get an airline fee credit for 2013, 2014, and 2015; and only pay 1 annual fee? In order to do that, I would think you would need to pay 2 annual fees.

If you cancel this card with 60 days of when the annual fee posts, you will get a prorated refund on the annual fee. But you can still receive the $200 travel credit before you cancel this card.

Pingback: Planning for Retention Bonuses for a Chase Ink Bold MasterCard and an SPG American Express Credit Card | Travel with Grant